Answered step by step

Verified Expert Solution

Question

1 Approved Answer

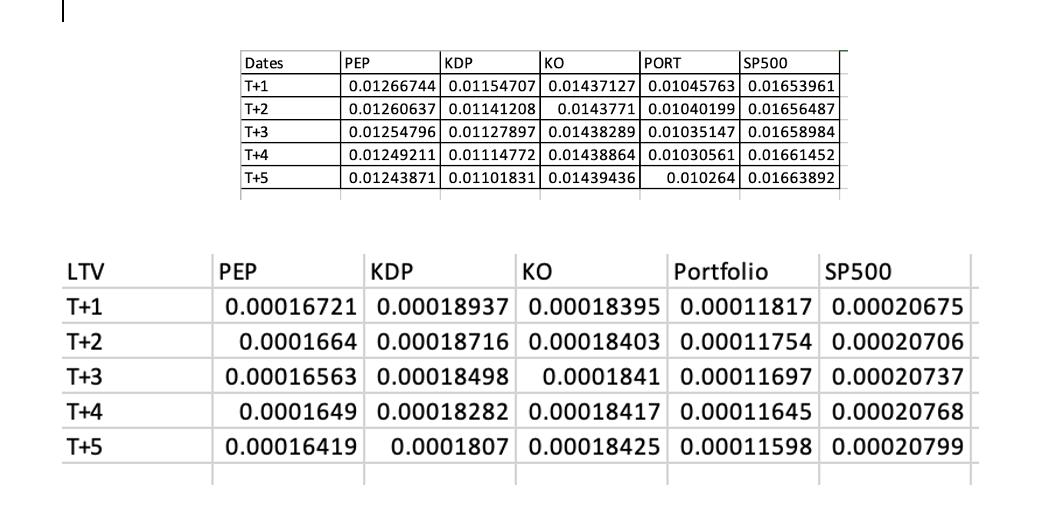

a. Calculate the long-term volatility estimate for each of the three companies. LTV T+1 T+2 T+3 T+4 T+5 Dates T+1 T+2 T+3 T+4 T+5 PEP

a. Calculate the long-term volatility estimate for each of the three companies.

LTV T+1 T+2 T+3 T+4 T+5 Dates T+1 T+2 T+3 T+4 T+5 PEP PEP KDP KDP KO PORT 0.01266744 0.01154707 0.01437127 0.01045763 0.01653961 0.01260637 0.01141208 0.0143771 0.01040199 0.01656487 0.01254796 0.01127897 0.01438289 0.01035147 0.01658984 0.01249211 0.01114772 0.01438864 0.01030561 0.01661452 0.01243871 0.01101831 0.01439436 0.010264 0.01663892 KO SP500 Portfolio SP500 0.00016721 0.00018937 0.00018395 0.00011817 0.00020675 0.0001664 0.00018716 0.00018403 0.00011754 0.00020706 0.00016563 0.00018498 0.0001841 0.00011697 0.00020737 0.0001649 0.00018282 0.00018417 0.00011645 0.00020768 0.00016419 0.0001807 0.00018425 0.00011598 0.00020799

Step by Step Solution

There are 3 Steps involved in it

Step: 1

ANSWER To calculate the longterm volatility estimate for each of the three companies we need to calculate the standard deviation of their returns over the given time period Heres how you can do it 1 C...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started