Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. What is the pricing problem present in the case? 2. What is the appropriate pricing model which could have helped Abercrombie & Fitch avoid

1. What is the pricing problem present in the case?

2. What is the appropriate pricing model which could have helped Abercrombie & Fitch avoid the given pricing problem?

3. What is/are the indicator/s of crisis present in the case?

4. What is the appropriate course of action should Abercrombie & Fitch undertake based on the concept of pricing in crisis?

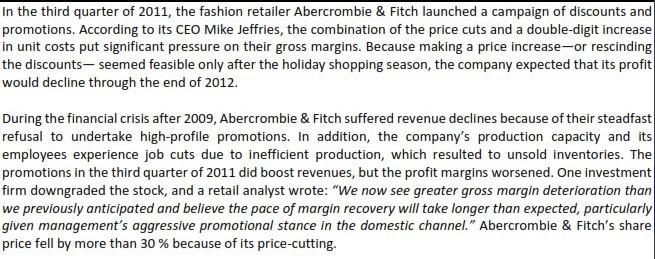

In the third quarter of 2011, the fashion retailer Abercrombie & Fitch launched a campaign of discounts and promotions. According to its CEO Mike Jeffries, the combination of the price cuts and a double-digit increase in unit costs put significant pressure on their gross margins. Because making a price increase-or rescinding the discounts- seemed feasible only after the holiday shopping season, the company expected that its profit would decline through the end of 2012. During the financial crisis after 2009, Abercrombie & Fitch suffered revenue declines because of their steadfast refusal to undertake high-profile promotions. In addition, the company's production capacity and its employees experience job cuts due to inefficient production, which resulted to unsold inventories. The promotions in the third quarter of 2011 did boost revenues, but the profit margins worsened. One investment firm downgraded the stock, and a retail analyst wrote: "We now see greater gross margin deterioration than we previously anticipated and believe the pace of margin recovery will take longer than expected, particularly given management's aggressive promotional stance in the domestic channel." Abercrombie & Fitch's share price fell by more than 30 % because of its price-cutting.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 The pricing problem present in the case is that Abercrombie Fitch launched a campaign of discounts and promotions which put significant pressure on their gross margins This resulted in a decrease in ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started