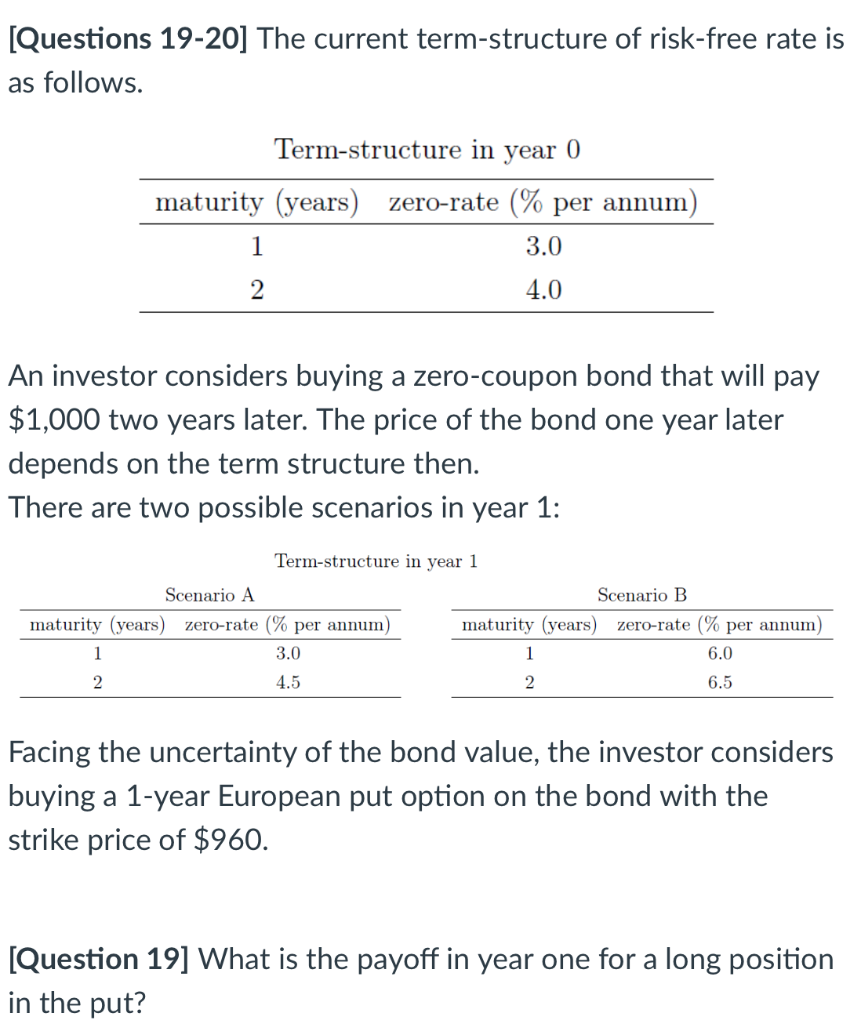

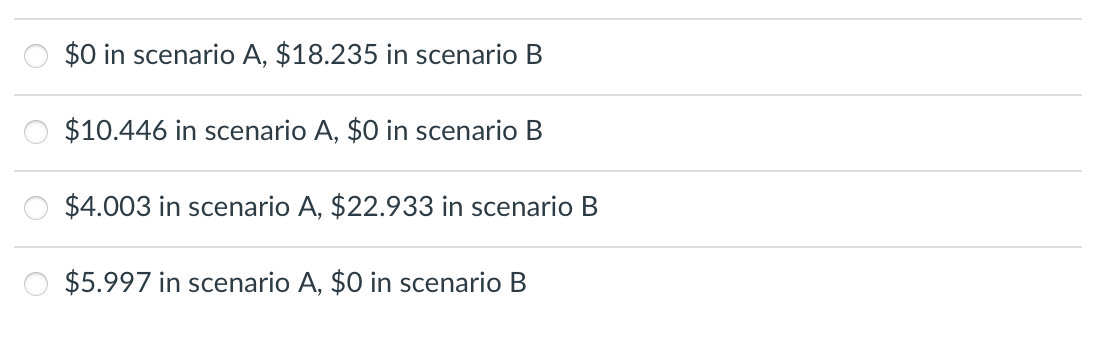

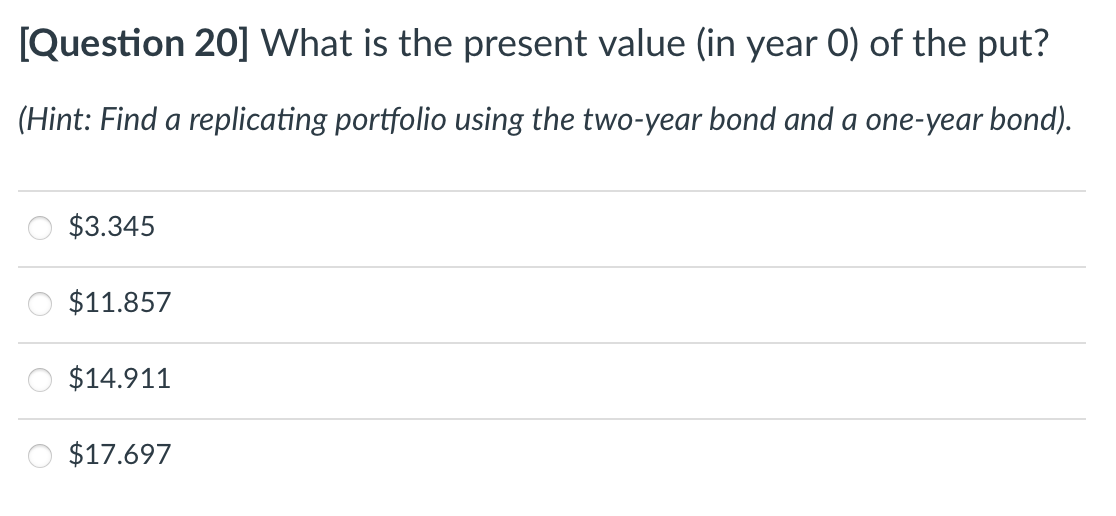

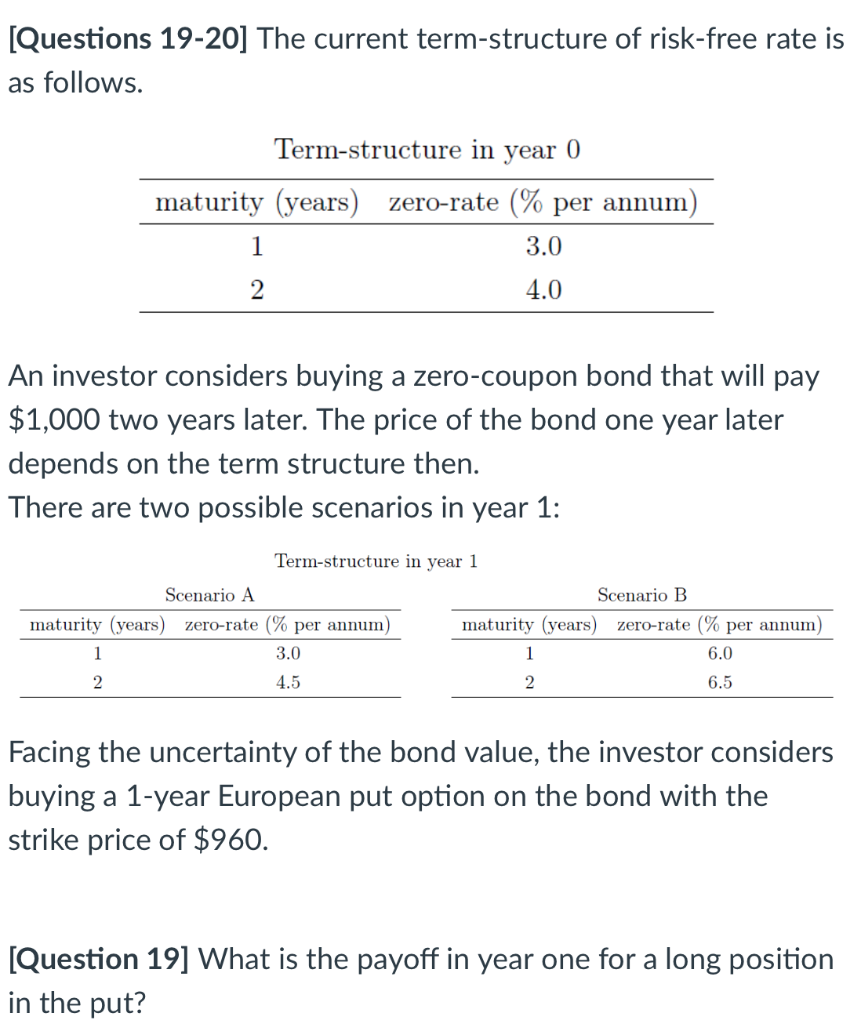

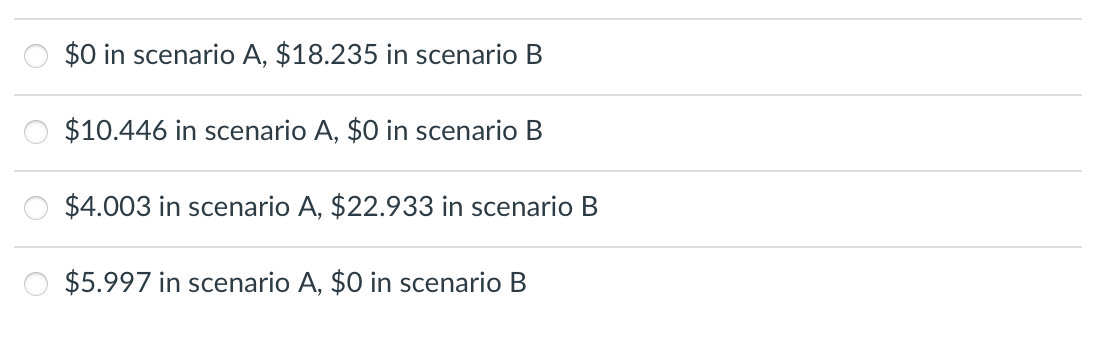

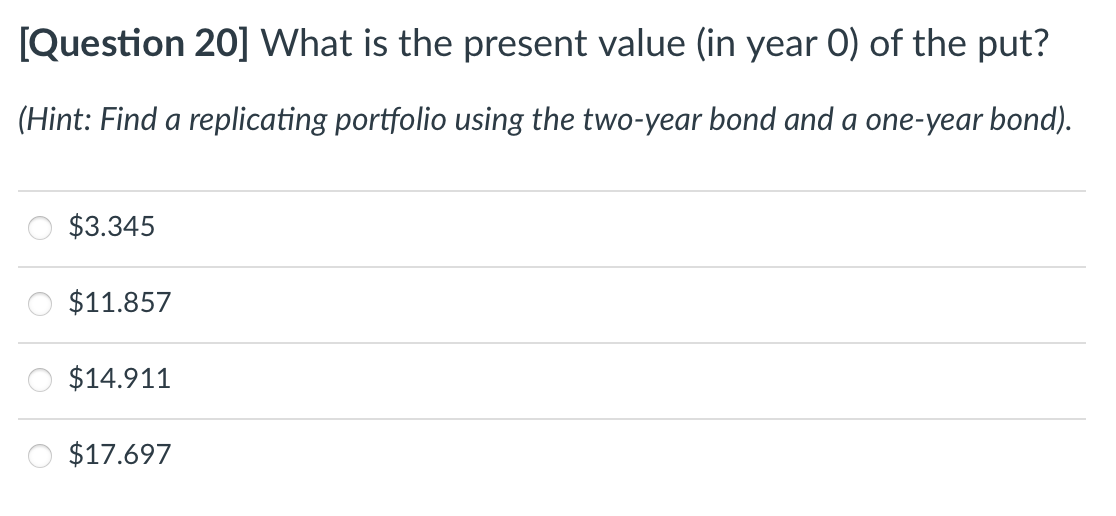

[Questions 19-20] The current term-structure of risk-free rate is as follows. Term-structure in year 0 maturity (years) zero-rate (% per annum) 1 3.0 2 4.0 An investor considers buying a zero-coupon bond that will pay $1,000 two years later. The price of the bond one year later depends on the term structure then. There are two possible scenarios in year 1: Term-structure in year 1 Scenario A Scenario B maturity (years) zero-rate (% per annum) maturity (years) zero-rate (% per annum) 1 3.0 1 6.0 2 4.5 2 6.5 Facing the uncertainty of the bond value, the investor considers buying a 1-year European put option on the bond with the strike price of $960. [Question 19] What is the payoff in year one for a long position in the put? $0 in scenario A, $18.235 in scenario B $10.446 in scenario A, $0 in scenario B $4.003 in scenario A, $22.933 in scenario B $5.997 in scenario A, $0 in scenario B [Question 20] What is the present value (in year 0) of the put? (Hint: Find a replicating portfolio using the two-year bond and a one-year bond). $3.345 $11.857 $14.911 $17.697 [Questions 19-20] The current term-structure of risk-free rate is as follows. Term-structure in year 0 maturity (years) zero-rate (% per annum) 1 3.0 2 4.0 An investor considers buying a zero-coupon bond that will pay $1,000 two years later. The price of the bond one year later depends on the term structure then. There are two possible scenarios in year 1: Term-structure in year 1 Scenario A Scenario B maturity (years) zero-rate (% per annum) maturity (years) zero-rate (% per annum) 1 3.0 1 6.0 2 4.5 2 6.5 Facing the uncertainty of the bond value, the investor considers buying a 1-year European put option on the bond with the strike price of $960. [Question 19] What is the payoff in year one for a long position in the put? $0 in scenario A, $18.235 in scenario B $10.446 in scenario A, $0 in scenario B $4.003 in scenario A, $22.933 in scenario B $5.997 in scenario A, $0 in scenario B [Question 20] What is the present value (in year 0) of the put? (Hint: Find a replicating portfolio using the two-year bond and a one-year bond). $3.345 $11.857 $14.911 $17.697