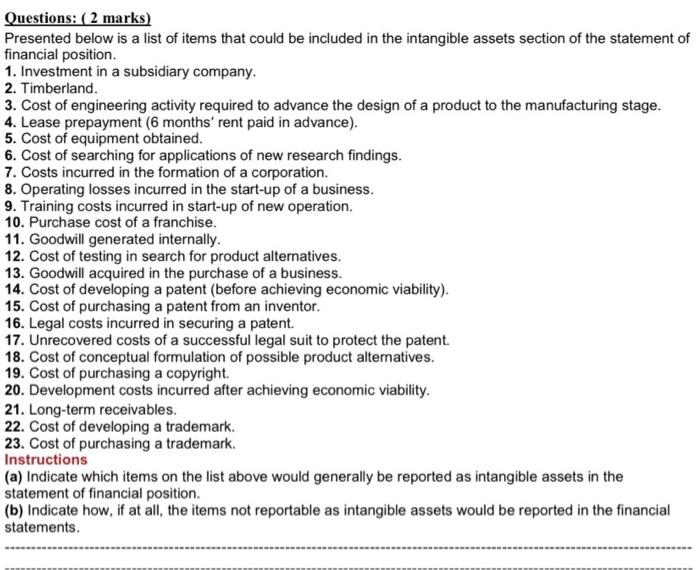

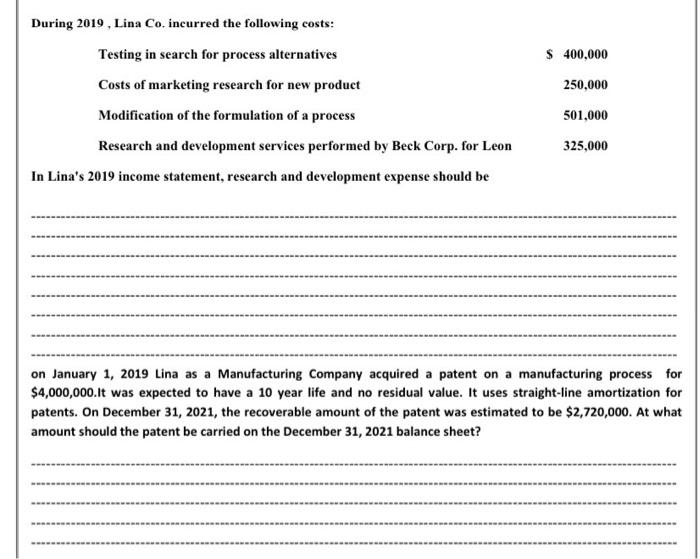

Questions: (2 marks) Presented below is a list of items that could be included in the intangible assets section of the statement of financial position. 1. Investment in a subsidiary company. 2. Timberland. 3. Cost of engineering activity required to advance the design of a product to the manufacturing stage. 4. Lease prepayment (6 months' rent paid in advance). 5. Cost of equipment obtained. 6. Cost of searching for applications of new research findings. 7. Costs incurred in the formation of a corporation. 8. Operating losses incurred in the start-up of a business. 9. Training costs incurred in start-up of new operation. 10. Purchase cost of a franchise. 11. Goodwill generated internally. 12. Cost of testing in search for product alternatives. 13. Goodwill acquired in the purchase of a business. 14. Cost of developing a patent (before achieving economic viability). 15. Cost of purchasing a patent from an inventor. 16. Legal costs incurred in securing a patent. 17. Unrecovered costs of a successful legal suit to protect the patent. 18. Cost of conceptual formulation of possible product alternatives. 19. Cost of purchasing a copyright 20. Development costs incurred after achieving economic viability. 21. Long-term receivables. 22. Cost of developing a trademark. 23. Cost of purchasing a trademark. Instructions (a) Indicate which items on the list above would generally be reported as intangible assets in the statement of financial position. (b) Indicate how, if at all, the items not reportable as intangible assets would be reported in the financial statements. $ 400,000 250,000 During 2019, Lina Co. incurred the following costs: Testing in search for process alternatives Costs of marketing research for new product Modification of the formulation of a process Research and development services performed by Beck Corp. for Leon In Lina's 2019 income statement, research and development expense should be 501,000 325,000 on January 1, 2019 Lina as a Manufacturing Company acquired a patent on a manufacturing process for $4,000,000.it was expected to have a 10 year life and no residual value. It uses straight-line amortization for patents. On December 31, 2021, the recoverable amount of the patent was estimated to be $2,720,000. At what amount should the patent be carried on the December 31, 2021 balance sheet