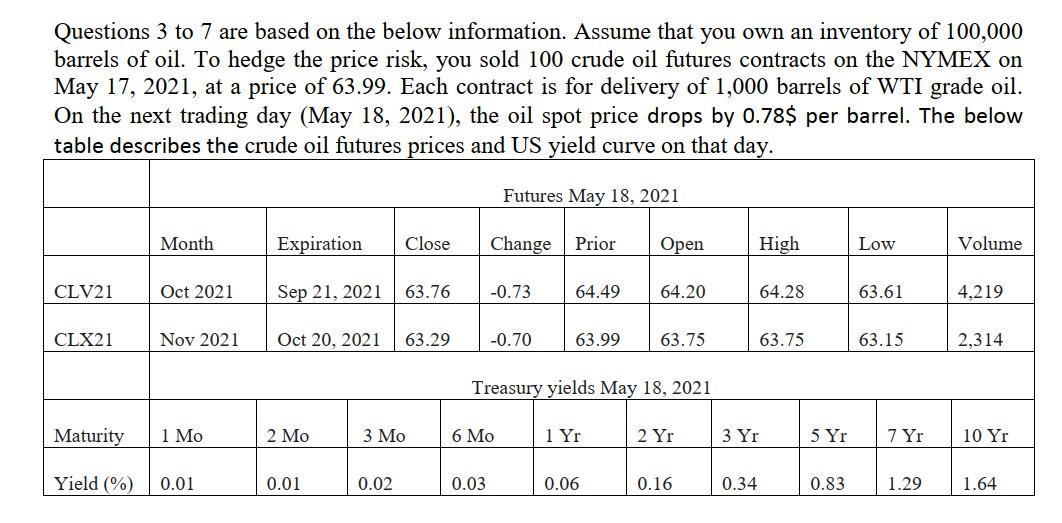

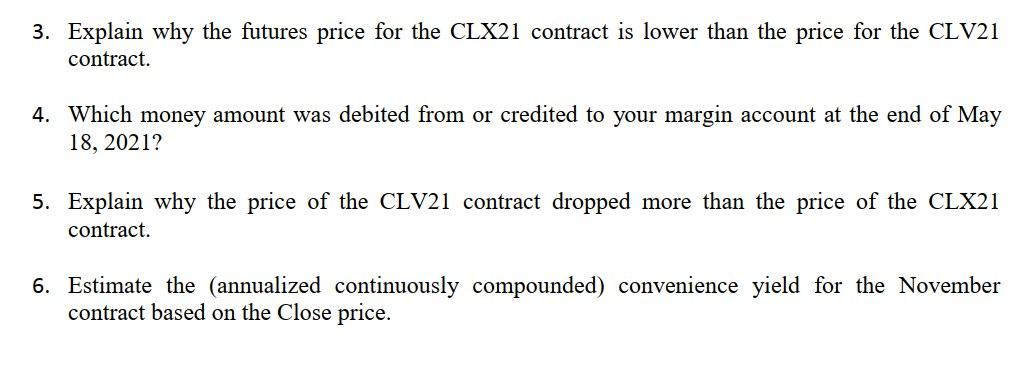

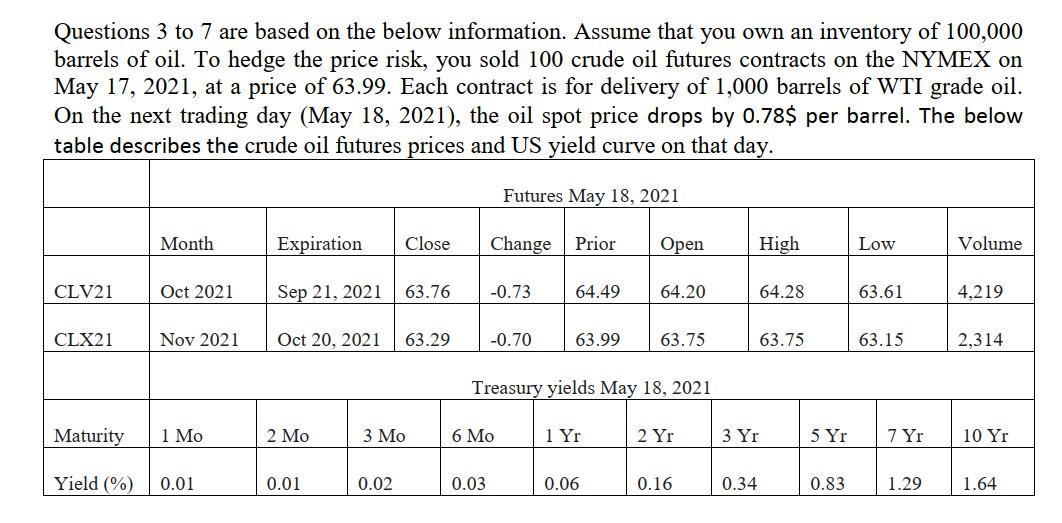

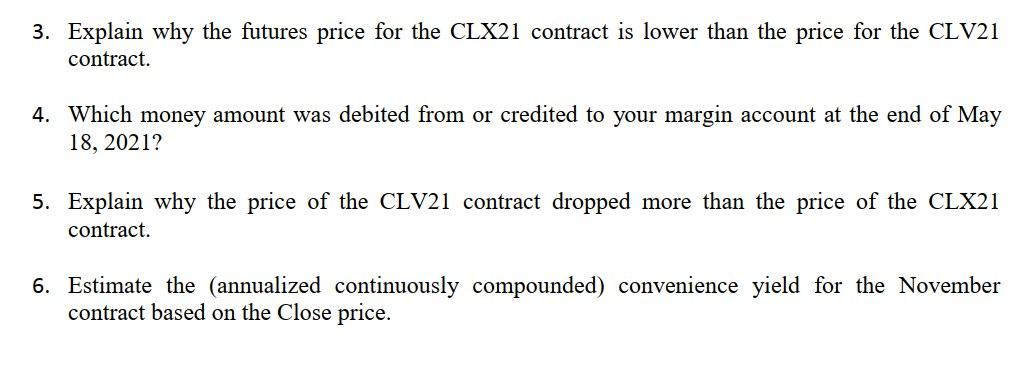

Questions 3 to 7 are based on the below information. Assume that you own an inventory of 100,000 barrels of oil. To hedge the price risk, you sold 100 crude oil futures contracts on the NYMEX on May 17, 2021, at a price of 63.99. Each contract is for delivery of 1,000 barrels of WTI grade oil. On the next trading day (May 18, 2021), the oil spot price drops by 0.78$ per barrel. The below table describes the crude oil futures prices and US yield curve on that day. Futures May 18, 2021 Month Expiration Close Change Prior Open High Low Volume CLV21 Oct 2021 Sep 21, 2021 63.76 -0.73 64.49 64.20 64.28 63.61 4,219 CLX21 Nov 2021 Oct 20, 2021 63.29 -0.70 63.99 63.75 63.75 63.15 2,314 Treasury yields May 18, 2021 Maturity 1 Mo 2 Mo 3 Mo 6 Mo 1 Yr 2 Yr 3 Yr 5 Yr 7 Yr 10 Yr Yield (%) 0.01 0.01 0.02 0.03 0.06 0.16 0.34 0.83 1.29 1.64 3. Explain why the futures price for the CLX21 contract is lower than the price for the CLV21 contract. 4. Which money amount was debited from or credited to your margin account at the end of May 18, 2021? 5. Explain why the price of the CLV21 contract dropped more than the price of the CLX21 contract. 6. Estimate the annualized continuously compounded) convenience yield for the November contract based on the Close price. Questions 3 to 7 are based on the below information. Assume that you own an inventory of 100,000 barrels of oil. To hedge the price risk, you sold 100 crude oil futures contracts on the NYMEX on May 17, 2021, at a price of 63.99. Each contract is for delivery of 1,000 barrels of WTI grade oil. On the next trading day (May 18, 2021), the oil spot price drops by 0.78$ per barrel. The below table describes the crude oil futures prices and US yield curve on that day. Futures May 18, 2021 Month Expiration Close Change Prior Open High Low Volume CLV21 Oct 2021 Sep 21, 2021 63.76 -0.73 64.49 64.20 64.28 63.61 4,219 CLX21 Nov 2021 Oct 20, 2021 63.29 -0.70 63.99 63.75 63.75 63.15 2,314 Treasury yields May 18, 2021 Maturity 1 Mo 2 Mo 3 Mo 6 Mo 1 Yr 2 Yr 3 Yr 5 Yr 7 Yr 10 Yr Yield (%) 0.01 0.01 0.02 0.03 0.06 0.16 0.34 0.83 1.29 1.64 3. Explain why the futures price for the CLX21 contract is lower than the price for the CLV21 contract. 4. Which money amount was debited from or credited to your margin account at the end of May 18, 2021? 5. Explain why the price of the CLV21 contract dropped more than the price of the CLX21 contract. 6. Estimate the annualized continuously compounded) convenience yield for the November contract based on the Close price