Answered step by step

Verified Expert Solution

Question

1 Approved Answer

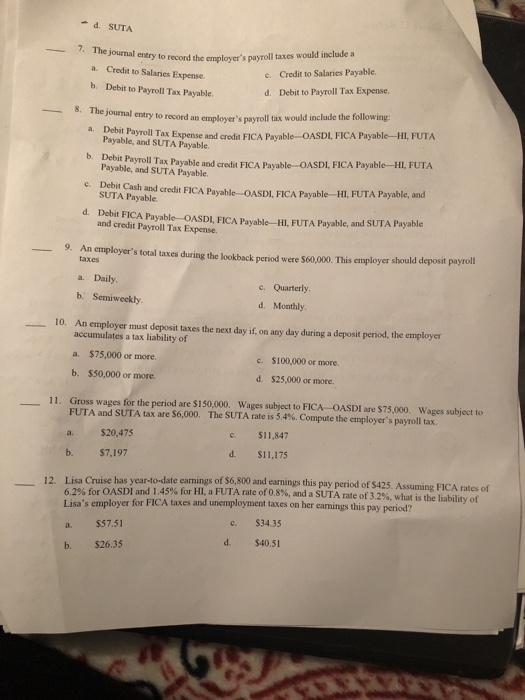

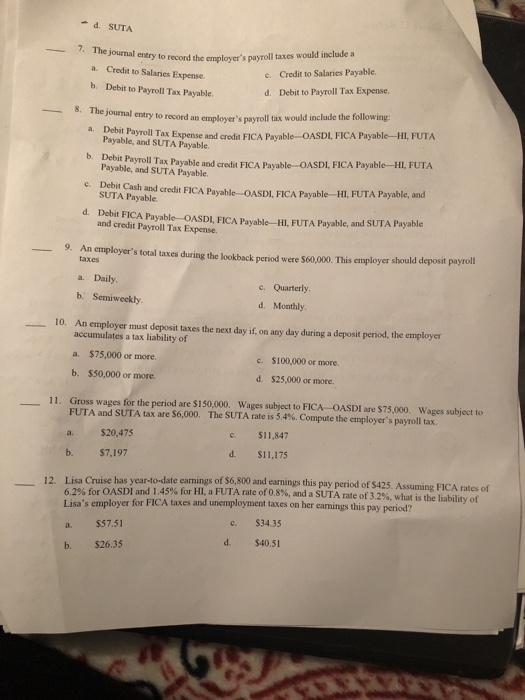

Questions 7-12 d SUTA 7 The journal entry to record the employer's payroll taxes a. Credit to Salaries Expense. b. Debit to Payroll Tax Payable

Questions 7-12

d SUTA 7 The journal entry to record the employer's payroll taxes a. Credit to Salaries Expense. b. Debit to Payroll Tax Payable c. Credit to Salaries Payable d. Debit to Payroll Tax Expense. 8. The journal entry to record an employer's payroll tax would include the following: Debit Payroll Tax Expense and credit FICA Payable OASDI, FICA Payable- HI, FUTA b. Debit Payrol Tax Payable and e. Debit Cash and credit FICA Payable OASDI, FICA Payable-HI, FUTA Payable, and d. Debit FICA Payable- OASDI, FICA Payable- -HI, FUTA Payable, and SUTA Payable Payable, and SUTA Payable Paab de nd S ayalble and crodit FICA Payable-OASDL FICA Payable-IHIL FUTA SUTA Payable and credit Payroll Tax Expense. 9. An employer's total taxes during the looktack period were $60,000. This employer should deposit payol taxes a. Daily b. Semiweekly c. Quarterly d. Monthly 10. An employer must deposit taxes the next day if, on any day during a deposit period, the employer accumulates a tax liability of a. $75,000 or more. b. $50,000 or more. c. $100,000 or more d. $25,000 or more. 11. Gross wages for the period are $150,000. Wages subject to FICA-OASDI are $75,000. Wages subject to The SUTA rate is 54%. Compute the employer's payroll ta. FUTA and SUTA tax are S6,000. a. $20,475 b. $7,197 $11,847 d. $11,175 earnings this pay period of $425. Assuming FICA rates of Lisa Cruise has year-to-date earmings of S6,800 and 6.2% for OASDI and 1.45% for HI, a FUTA rate of 0.8%, and Lisa's employer fo 12. a SUTA rate of 32%, what is the liability of r FICA taxes and unemployment taxes on her earnings this pay period? c. $34.35 a. $57.51 b. $26.35 d. $40.51

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started