Questions A & B:

Information:

Tables:

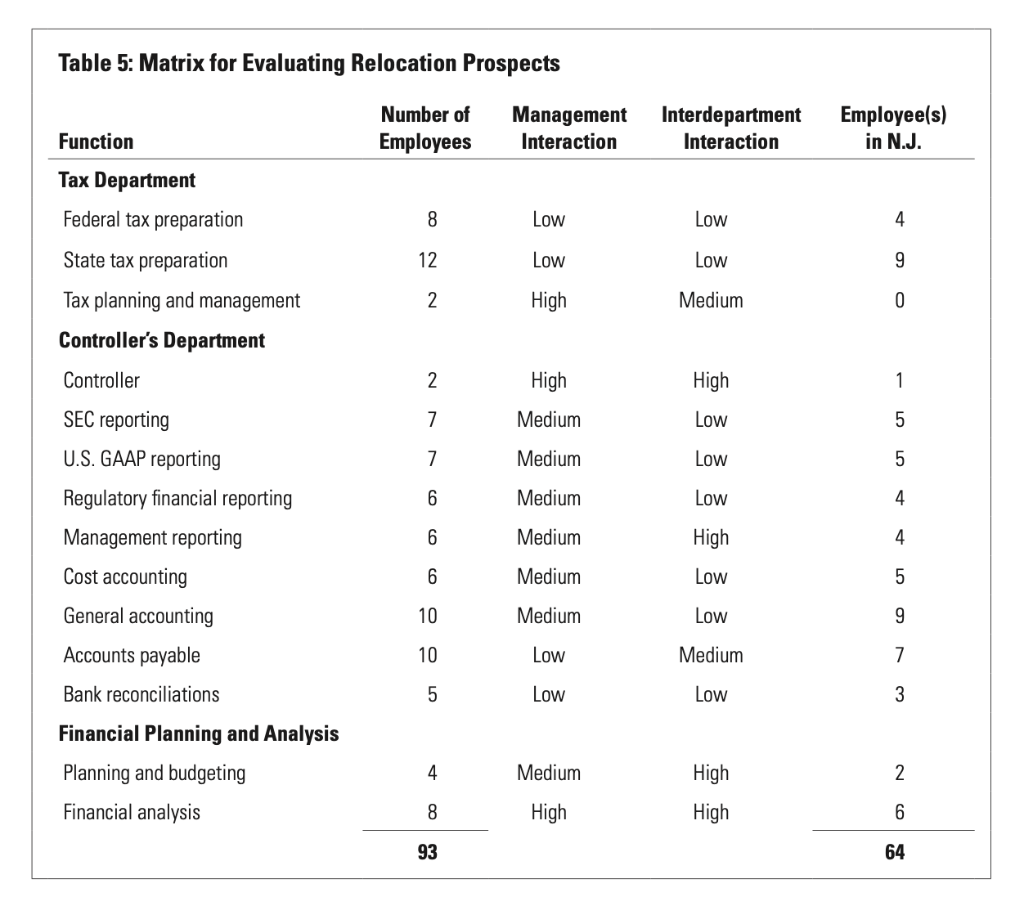

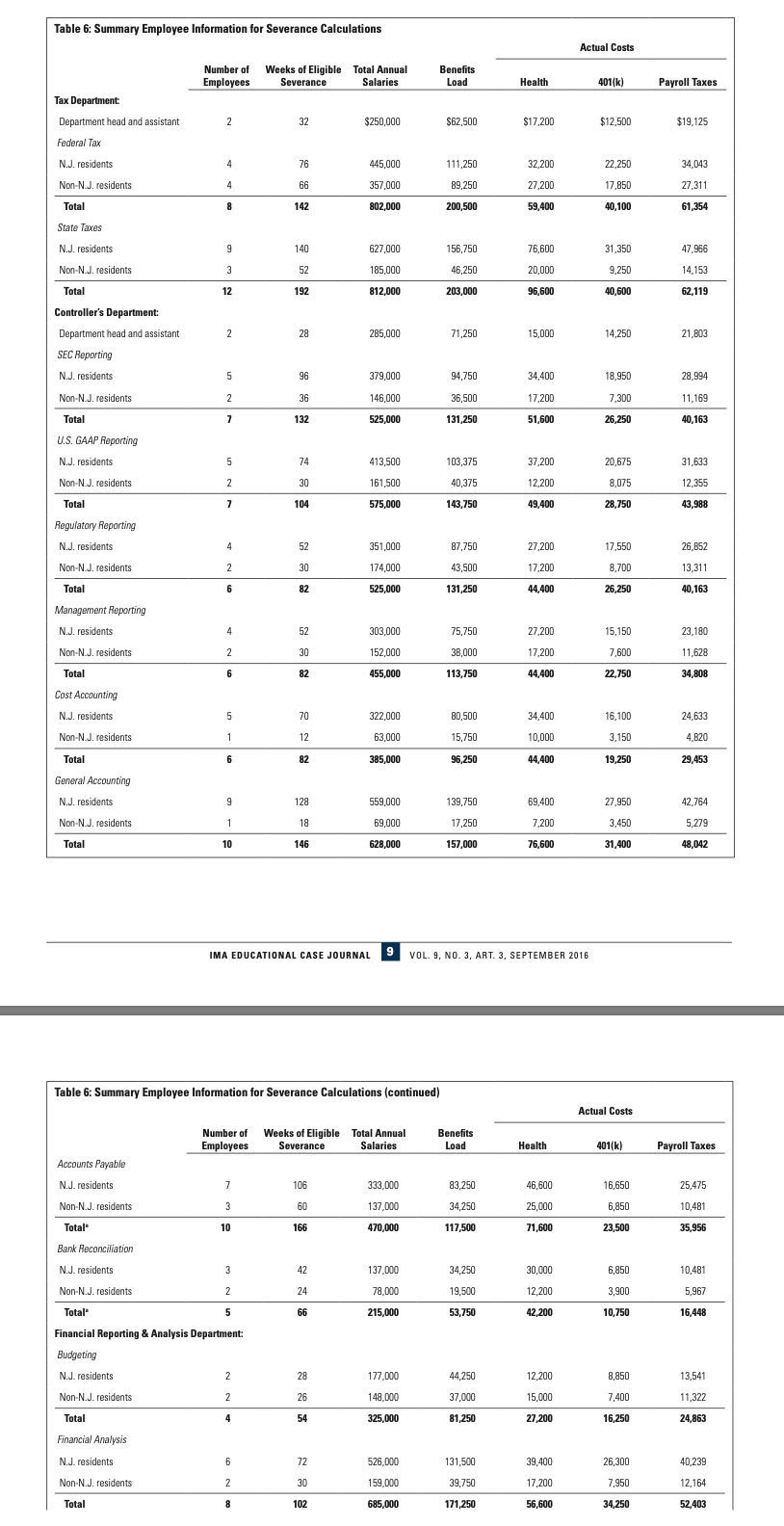

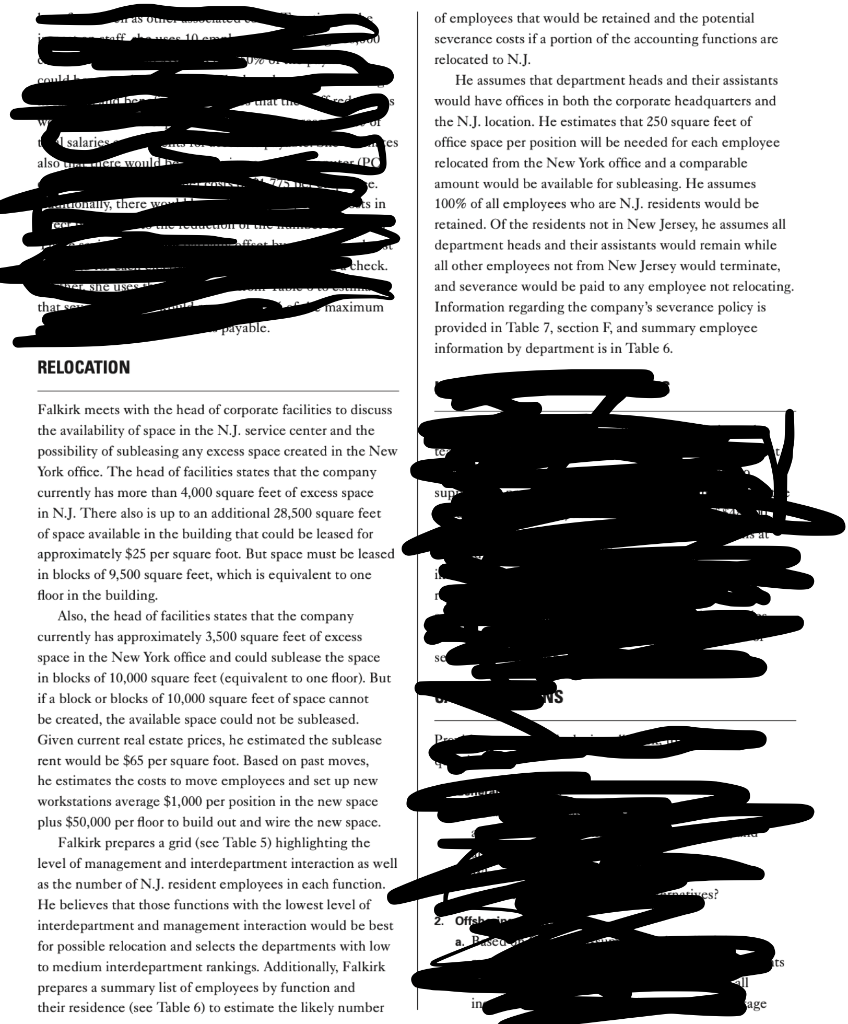

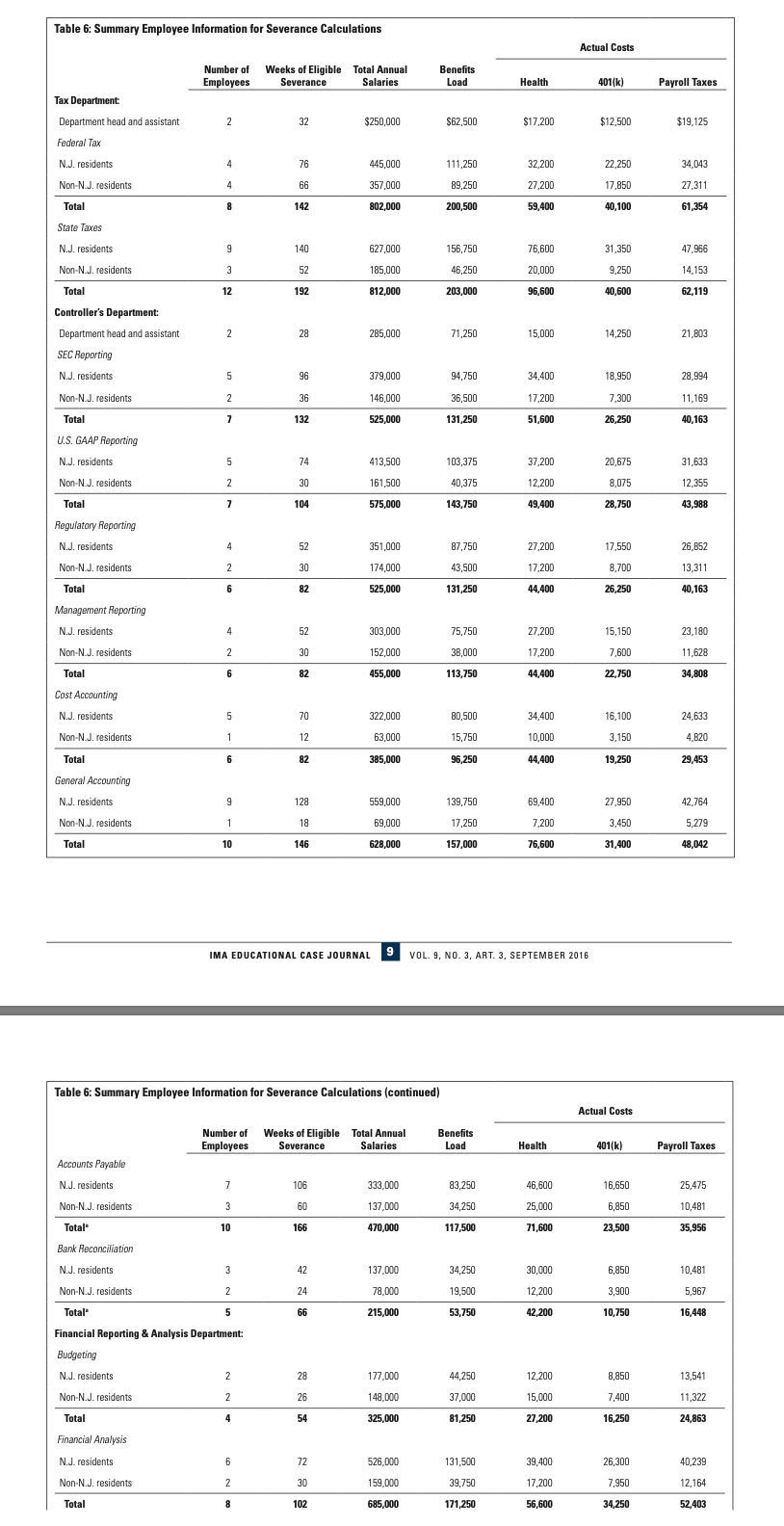

4. Relocation: a. Using the information that Falkirk gathered on potential real estate savings through relocation, estimate the annual cost savings available through relocating some or all of the accounting functions to New Jersey. b. What are the impacts on AC-US's costs over the next three years, including the one-time costs? (Be sure to include severance costs, using information from Table 6, in the one-time costs). Otec f. 10 comid ber win SUN salaries also cines (PC e. of employees that would be retained and the potential severance costs if a portion of the accounting functions are relocated to N.J. He assumes that department heads and their assistants would have offices in both the corporate headquarters and the N.J. location. He estimates that 250 square feet of office space per position will be needed for each employee relocated from the New York office and a comparable amount would be available for subleasing. He assumes 100% of all employees who are N.J. residents would be retained. Of the residents not in New Jersey, he assumes all department heads and their assistants would remain while all other employees not from New Jersey would terminate, and severance would be paid to any employee not relocating. Information regarding the company's severance policy is provided in Table 7, section F, and summary employee information by department is in Table 6. CONlly, there wa is in WIN check. TA SIT that maximum payable RELOCATION sup sa Falkirk meets with the head of corporate facilities to discuss the availability of space in the N.J. service center and the possibility of subleasing any excess space created in the New York office. The head of facilities states that the company currently has more than 4,000 square feet of excess space in N.J. There also is up to an additional 28,500 square feet of space available in the building that could be leased for approximately $25 per square foot. But space must be leased in blocks of 9,500 square feet, which is equivalent to one floor in the building Also, the head of facilities states that the company currently has approximately 3,500 square feet of excess space in the New York office and could sublease the space in blocks of 10,000 square feet (equivalent to one floor). But if a block or blocks of 10,000 square feet of space cannot be created, the available space could not be subleased. Given current real estate prices, he estimated the sublease rent would be $65 per square foot. Based on past moves, he estimates the costs to move employees and set up new workstations average $1,000 per position in the new space plus $50,000 per floor to build out and wire the new space. Falkirk prepares a grid (see Table 5) highlighting the level of management and interdepartment interaction as well as the number of N.J. resident employees in each function. He believes that those functions with the lowest level of interdepartment and management interaction would be best for possible relocation and selects the departments with low to medium interdepartment rankings. Additionally, Falkirk prepares a summary list of employees by function and their residence (see Table 6) to estimate the likely number ies? 2. Offsb Ba age Table 5: Matrix for Evaluating Relocation Prospects Number of Employees Management Interaction Interdepartment Interaction Employee(s) in N.J. Function Tax Department Federal tax preparation 8 Low Low 4 State tax preparation 12 Low Low 9 Tax planning and management 2 High Medium 0 Controller's Department Controller 2 High High 1 7 Medium Low 5 SEC reporting U.S. GAAP reporting 7 Medium Low 5 6 Medium Low 4 Regulatory financial reporting Management reporting Cost accounting 6 Medium High 4 6 Medium Low 5 General accounting 10 Medium Low 9 Accounts payable 10 Low Medium 7 Bank reconciliations 5 Low Low 3 Financial Planning and Analysis Planning and budgeting Financial analysis 4 Medium 2 High High 8 High 6 93 64 Table 6: Summary Employee Information for Severance Calculations Actual Costs Number of Employees Weeks of Eligible Total Annual Severance Salaries Benefits Load Health 401(k) Payroll Taxes 2 32 $250,000 $ $62,500 $17,200 $12.500 $19,125 Tax Department Department head and assistant Federal Tax NJ, residents 4 76 445,000 111,250 32,200 22,250 34,043 4 66 357.000 89,250 27,200 17,850 27,311 Non-N.J. residents Total 8 142 802.000 200,500 59,400 40,100 61,354 State Taxes 9 140 627,000 156,750 76,600 31,350 47,956 N.J. residents Non-N.J. residents 3 52 46,250 20,000 14,153 185.000 812,000 9,250 40,600 Total 12 192 203,000 96,600 62,119 Controller's Department: Department head and assistant SEC Reporting 2 28 285,000 71,250 15,000 14,250 21,803 N.J. residents 5 96 379,000 94,750 34,400 18,950 28,994 2 36 146,000 36,500 17,200 7,300 11,169 Non-N.J. residents Total 7 132 525,000 131,250 51,600 26,250 40,163 U.S. GAAP Reporting N.J. residents Non-N.J. residents 5 74 413,500 103,375 37,200 20,675 31,633 2 30 161,500 40,375 12,200 8,075 12,355 Total 7 104 575,000 143,750 49,400 28,750 43.988 Regulatory Reporting N.J. residents 4 52 351,000 87,750 27,200 17,550 26,852 2 30 174,000 43,500 17,200 8,700 13,311 Non-N.J. residents Total 6 82 525,000 131,250 44,400 26,250 40,163 Management Reporting N.J. residents Non-N.J. residents 4 52 303,000 75,750 27,200 15,150 23,180 2 30 152,000 38,000 17,200 7,600 11,628 Total 6 82 455,000 113,750 44,400 22,750 34,808 Cost Accounting N.J. residents 5 70 322,000 80,500 34,400 16,100 24,633 Non-N.J. residents 1 1 12 15,750 10,000 3,150 4,820 63,000 385,000 Total 6 82 96,250 44,400 19,250 29,453 g 128 559,000 139,750 69,400 27,950 42,764 General Accounting N.J. residents Non-N.J. residents Total 1 18 69,000 17,250 7,200 3,450 5.279 10 146 628,000 157,000 76,600 31,400 48,042 IMA EDUCATIONAL CASE JOURNAL 9 VOL. 9, NO. 3, ART. 3, SEPTEMBER 2016 Table 6: Summary Employee Information for Severance Calculations (continued) Actual Costs Weeks of Eligible Total Annual Severance Salaries Benefits Load Health 401(k) k) Payroll Taxes 106 83,250 46,600 16,650 25,475 333,000 137,000 60 34,250 25,000 6,850 10,481 166 470,000 117,500 71,600 23,500 35,956 Number of Employees Accounts Payable N.J. residents 7 Non-N.J. residents 3 Total" 10 Bank Reconciliation N.J. residents 3 Non-N.J. residents 2 Total 5 Financial Reporting & Analysis Department: Budgeting N.J. residents 2 Non-N.J. residents 2 42 34,250 30,000 6,850 10,481 137,000 78,000 24 19,500 12,200 3,900 5,967 66 215,000 53,750 42,200 10,750 16,448 28 177,000 44,250 12,200 8,850 13,541 26 148.000 37,000 15.000 7,400 11,322 Total 4 54 325,000 81,250 27,200 16,250 24,863 Financial Analysis 6 72 526,000 131,500 39,400 26,300 40,239 N.J. residents Non-N.J. residents 2 30 159,000 39,750 17,200 7,950 12,164 Total 8 102 685,000 171,250 56,600 34,250 52,403 4. Relocation: a. Using the information that Falkirk gathered on potential real estate savings through relocation, estimate the annual cost savings available through relocating some or all of the accounting functions to New Jersey. b. What are the impacts on AC-US's costs over the next three years, including the one-time costs? (Be sure to include severance costs, using information from Table 6, in the one-time costs). Otec f. 10 comid ber win SUN salaries also cines (PC e. of employees that would be retained and the potential severance costs if a portion of the accounting functions are relocated to N.J. He assumes that department heads and their assistants would have offices in both the corporate headquarters and the N.J. location. He estimates that 250 square feet of office space per position will be needed for each employee relocated from the New York office and a comparable amount would be available for subleasing. He assumes 100% of all employees who are N.J. residents would be retained. Of the residents not in New Jersey, he assumes all department heads and their assistants would remain while all other employees not from New Jersey would terminate, and severance would be paid to any employee not relocating. Information regarding the company's severance policy is provided in Table 7, section F, and summary employee information by department is in Table 6. CONlly, there wa is in WIN check. TA SIT that maximum payable RELOCATION sup sa Falkirk meets with the head of corporate facilities to discuss the availability of space in the N.J. service center and the possibility of subleasing any excess space created in the New York office. The head of facilities states that the company currently has more than 4,000 square feet of excess space in N.J. There also is up to an additional 28,500 square feet of space available in the building that could be leased for approximately $25 per square foot. But space must be leased in blocks of 9,500 square feet, which is equivalent to one floor in the building Also, the head of facilities states that the company currently has approximately 3,500 square feet of excess space in the New York office and could sublease the space in blocks of 10,000 square feet (equivalent to one floor). But if a block or blocks of 10,000 square feet of space cannot be created, the available space could not be subleased. Given current real estate prices, he estimated the sublease rent would be $65 per square foot. Based on past moves, he estimates the costs to move employees and set up new workstations average $1,000 per position in the new space plus $50,000 per floor to build out and wire the new space. Falkirk prepares a grid (see Table 5) highlighting the level of management and interdepartment interaction as well as the number of N.J. resident employees in each function. He believes that those functions with the lowest level of interdepartment and management interaction would be best for possible relocation and selects the departments with low to medium interdepartment rankings. Additionally, Falkirk prepares a summary list of employees by function and their residence (see Table 6) to estimate the likely number ies? 2. Offsb Ba age Table 5: Matrix for Evaluating Relocation Prospects Number of Employees Management Interaction Interdepartment Interaction Employee(s) in N.J. Function Tax Department Federal tax preparation 8 Low Low 4 State tax preparation 12 Low Low 9 Tax planning and management 2 High Medium 0 Controller's Department Controller 2 High High 1 7 Medium Low 5 SEC reporting U.S. GAAP reporting 7 Medium Low 5 6 Medium Low 4 Regulatory financial reporting Management reporting Cost accounting 6 Medium High 4 6 Medium Low 5 General accounting 10 Medium Low 9 Accounts payable 10 Low Medium 7 Bank reconciliations 5 Low Low 3 Financial Planning and Analysis Planning and budgeting Financial analysis 4 Medium 2 High High 8 High 6 93 64 Table 6: Summary Employee Information for Severance Calculations Actual Costs Number of Employees Weeks of Eligible Total Annual Severance Salaries Benefits Load Health 401(k) Payroll Taxes 2 32 $250,000 $ $62,500 $17,200 $12.500 $19,125 Tax Department Department head and assistant Federal Tax NJ, residents 4 76 445,000 111,250 32,200 22,250 34,043 4 66 357.000 89,250 27,200 17,850 27,311 Non-N.J. residents Total 8 142 802.000 200,500 59,400 40,100 61,354 State Taxes 9 140 627,000 156,750 76,600 31,350 47,956 N.J. residents Non-N.J. residents 3 52 46,250 20,000 14,153 185.000 812,000 9,250 40,600 Total 12 192 203,000 96,600 62,119 Controller's Department: Department head and assistant SEC Reporting 2 28 285,000 71,250 15,000 14,250 21,803 N.J. residents 5 96 379,000 94,750 34,400 18,950 28,994 2 36 146,000 36,500 17,200 7,300 11,169 Non-N.J. residents Total 7 132 525,000 131,250 51,600 26,250 40,163 U.S. GAAP Reporting N.J. residents Non-N.J. residents 5 74 413,500 103,375 37,200 20,675 31,633 2 30 161,500 40,375 12,200 8,075 12,355 Total 7 104 575,000 143,750 49,400 28,750 43.988 Regulatory Reporting N.J. residents 4 52 351,000 87,750 27,200 17,550 26,852 2 30 174,000 43,500 17,200 8,700 13,311 Non-N.J. residents Total 6 82 525,000 131,250 44,400 26,250 40,163 Management Reporting N.J. residents Non-N.J. residents 4 52 303,000 75,750 27,200 15,150 23,180 2 30 152,000 38,000 17,200 7,600 11,628 Total 6 82 455,000 113,750 44,400 22,750 34,808 Cost Accounting N.J. residents 5 70 322,000 80,500 34,400 16,100 24,633 Non-N.J. residents 1 1 12 15,750 10,000 3,150 4,820 63,000 385,000 Total 6 82 96,250 44,400 19,250 29,453 g 128 559,000 139,750 69,400 27,950 42,764 General Accounting N.J. residents Non-N.J. residents Total 1 18 69,000 17,250 7,200 3,450 5.279 10 146 628,000 157,000 76,600 31,400 48,042 IMA EDUCATIONAL CASE JOURNAL 9 VOL. 9, NO. 3, ART. 3, SEPTEMBER 2016 Table 6: Summary Employee Information for Severance Calculations (continued) Actual Costs Weeks of Eligible Total Annual Severance Salaries Benefits Load Health 401(k) k) Payroll Taxes 106 83,250 46,600 16,650 25,475 333,000 137,000 60 34,250 25,000 6,850 10,481 166 470,000 117,500 71,600 23,500 35,956 Number of Employees Accounts Payable N.J. residents 7 Non-N.J. residents 3 Total" 10 Bank Reconciliation N.J. residents 3 Non-N.J. residents 2 Total 5 Financial Reporting & Analysis Department: Budgeting N.J. residents 2 Non-N.J. residents 2 42 34,250 30,000 6,850 10,481 137,000 78,000 24 19,500 12,200 3,900 5,967 66 215,000 53,750 42,200 10,750 16,448 28 177,000 44,250 12,200 8,850 13,541 26 148.000 37,000 15.000 7,400 11,322 Total 4 54 325,000 81,250 27,200 16,250 24,863 Financial Analysis 6 72 526,000 131,500 39,400 26,300 40,239 N.J. residents Non-N.J. residents 2 30 159,000 39,750 17,200 7,950 12,164 Total 8 102 685,000 171,250 56,600 34,250 52,403