Questions are divided into questions ai, bii, and biii.

Help urgent!

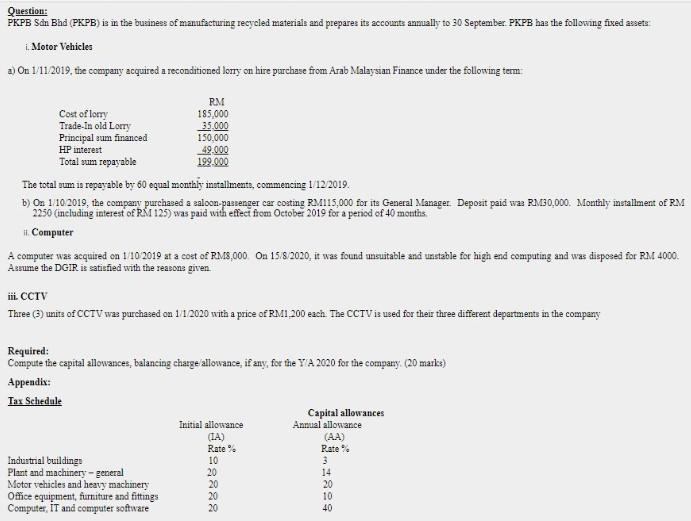

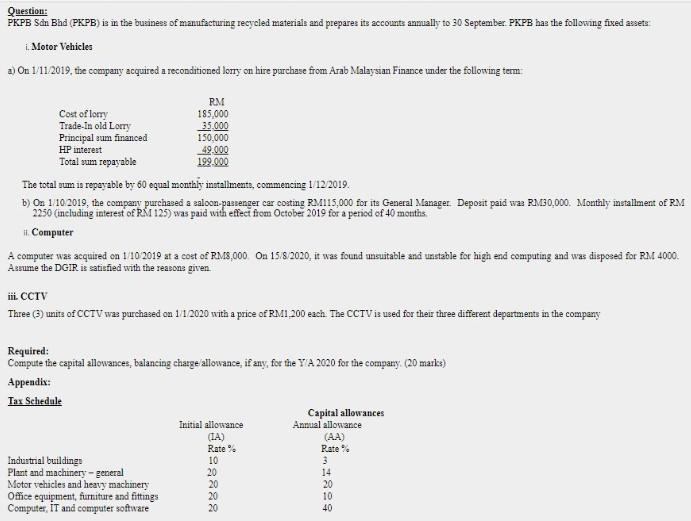

Question: PKPB Sdn Bhd (PKPB) is in the business of manufacturing recycled materials and prepares its accounts ammually to 30 September PKPB has the following fixed assets 1. Motor Vehicles a) On 1/11/2019, tire company acquired a reconditioned lorry on hire purchase from Arab Malaysian Finance under the following term PM Cost of lorry 185.000 Trade-In old Lorry 35.000 Principal eum financed 150.000 HP interest 49.000 Total sum repayable 199.000 The total num. 1n reparable by 60 equal monthly installments, commencing 1/12/2019. b) Os 1/10/2019, the company purchased a saloon passenger car costing RM115,000 for its General Manager. Depozit paid wa RM30,000. Monthly installment of PM 2250 (including interest of RI 125) was paid with effect from October 2010 for a period of 40 motiths it Computer A computer was acquired on 1/10 2019 at a cost of RM8,000 On 15/8/2020, it was found unsuitable and unstable for high end computing and was disposed for RM 4000 Assume the DGIR it satisfied with the reasons given iii. CCTV Three (9) units of CCTV was purchased on 1/1 2020 with a price of RM1.200 each The CCTV is used for their three different departments in the company Required: Compute the capital allowances, balancing charge allowance if any, for the YA 2000 for the company (20 marks) Appendix: Tax Schedule Capital allowances Initial allowance Annual allowance (IA) (AA) Rate. Rates Industrial buildings 10 3 Plant and machinery - general 20 14 Motor vehicles and heavy machinery 20 20 Office equipment, furniture and fittings 20 10 Computer IT and computer software 20 40 Question: PKPB Sdn Bhd (PKPB) is in the business of manufacturing recycled materials and prepares its accounts ammually to 30 September PKPB has the following fixed assets 1. Motor Vehicles a) On 1/11/2019, tire company acquired a reconditioned lorry on hire purchase from Arab Malaysian Finance under the following term PM Cost of lorry 185.000 Trade-In old Lorry 35.000 Principal eum financed 150.000 HP interest 49.000 Total sum repayable 199.000 The total num. 1n reparable by 60 equal monthly installments, commencing 1/12/2019. b) Os 1/10/2019, the company purchased a saloon passenger car costing RM115,000 for its General Manager. Depozit paid wa RM30,000. Monthly installment of PM 2250 (including interest of RI 125) was paid with effect from October 2010 for a period of 40 motiths it Computer A computer was acquired on 1/10 2019 at a cost of RM8,000 On 15/8/2020, it was found unsuitable and unstable for high end computing and was disposed for RM 4000 Assume the DGIR it satisfied with the reasons given iii. CCTV Three (9) units of CCTV was purchased on 1/1 2020 with a price of RM1.200 each The CCTV is used for their three different departments in the company Required: Compute the capital allowances, balancing charge allowance if any, for the YA 2000 for the company (20 marks) Appendix: Tax Schedule Capital allowances Initial allowance Annual allowance (IA) (AA) Rate. Rates Industrial buildings 10 3 Plant and machinery - general 20 14 Motor vehicles and heavy machinery 20 20 Office equipment, furniture and fittings 20 10 Computer IT and computer software 20 40