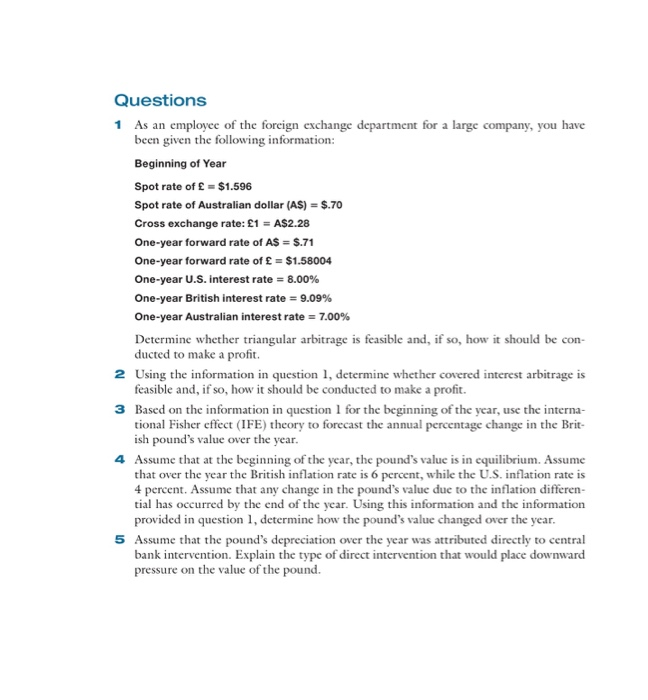

Questions As an employee of the foreign exchange department for a large company, you have been given the following information: Beginning of Year Spot rate of = $1.596 Spot rate of Australian dollar (A$) = $.70 Cross exchange rate: 1 = A$2.28 One-year forward rate of A$ = $.71 One-year forward rate of = $1.58004 One-year U.S. interest rate = 8.00% One-year British interest rate = 9.09% One-year Australian interest rate = 7.00% Determine whether triangular arbitrage is feasible and, if so, how it should be con- ducted to make a profit. 2 Using the information in question 1, determine whether covered interest arbitrage is feasible and, if so, how it should be conducted to make a profit. 3 Based on the information in question 1 for the beginning of the year, use the interna- tional Fisher effect (IFE) theory to forecast the annual percentage change in the Brit- ish pound's value over the year. Assume that at the beginning of the year, the pound's value is in equilibrium. Assume that over the year the British inflation rate is 6 percent, while the U.S. inflation rate is 4 percent. Assume that any change in the pound's value due to the inflation differen- tial has occurred by the end of the year. Using this information and the information provided in question 1, determine how the pound's value changed over the year. Assume that the pound's depreciation over the year was attributed directly to central bank intervention. Explain the type of direct intervention that would place downward pressure on the value of the pound. Questions As an employee of the foreign exchange department for a large company, you have been given the following information: Beginning of Year Spot rate of = $1.596 Spot rate of Australian dollar (A$) = $.70 Cross exchange rate: 1 = A$2.28 One-year forward rate of A$ = $.71 One-year forward rate of = $1.58004 One-year U.S. interest rate = 8.00% One-year British interest rate = 9.09% One-year Australian interest rate = 7.00% Determine whether triangular arbitrage is feasible and, if so, how it should be con- ducted to make a profit. 2 Using the information in question 1, determine whether covered interest arbitrage is feasible and, if so, how it should be conducted to make a profit. 3 Based on the information in question 1 for the beginning of the year, use the interna- tional Fisher effect (IFE) theory to forecast the annual percentage change in the Brit- ish pound's value over the year. Assume that at the beginning of the year, the pound's value is in equilibrium. Assume that over the year the British inflation rate is 6 percent, while the U.S. inflation rate is 4 percent. Assume that any change in the pound's value due to the inflation differen- tial has occurred by the end of the year. Using this information and the information provided in question 1, determine how the pound's value changed over the year. Assume that the pound's depreciation over the year was attributed directly to central bank intervention. Explain the type of direct intervention that would place downward pressure on the value of the pound