Questions

As an international marketing consultant, you are

asked to give an independent assessment of Guin

-

ness's opportunities in the world beer market. You are

specifically asked the following questions:

1.

How would you explain the Guinness pricing strat

-

egy and the underlying assumptions about con

-

sumer behaviour when Diageo reports for 2013 to

2018 that in the UK and Ireland Guinness sales vol

-

ume fell by 5 per cent, but a value growth of 3 per

cent was achieved in both markets, mainly due to

price increases?

2.

Motivated by the success of this pricing strategy,

should Diageo continue to increase the price of

Guinness?

3.

In Choueke (2006), an anonymous beer retail buyer

comments on Guinness's decreasing sales volume:

Guinness has an older profile of drinker and with

an ever-increasing availability of continental lagers and a fast-growing range of alcopops, the younger

generation of drinkers simply haven't bought into

it. Innovation - widgets and gadgets - will keep

the brand alive for a while but where else can Dia

-

geo go? Flavoured Guinness? No thanks. It is in

decline and Diageo's best minds can't do much

about it. The brand may have only a couple of

decades' worth of life in it and I would milk it for

everything before getting rid of it and concentrat

-

ing on spirits.

Do you agree with this statement? Explain your

reasons.

4.

What elements of the Guinness international

marketing strategy would you focus on in order

to increase both global sales volume, value and

profits?

5.

What do you think about the '1759' marketing idea?

Should Guinness introduce more special edition

beer brands with a limited lifetime for special occa

-

sions or as a gift product?

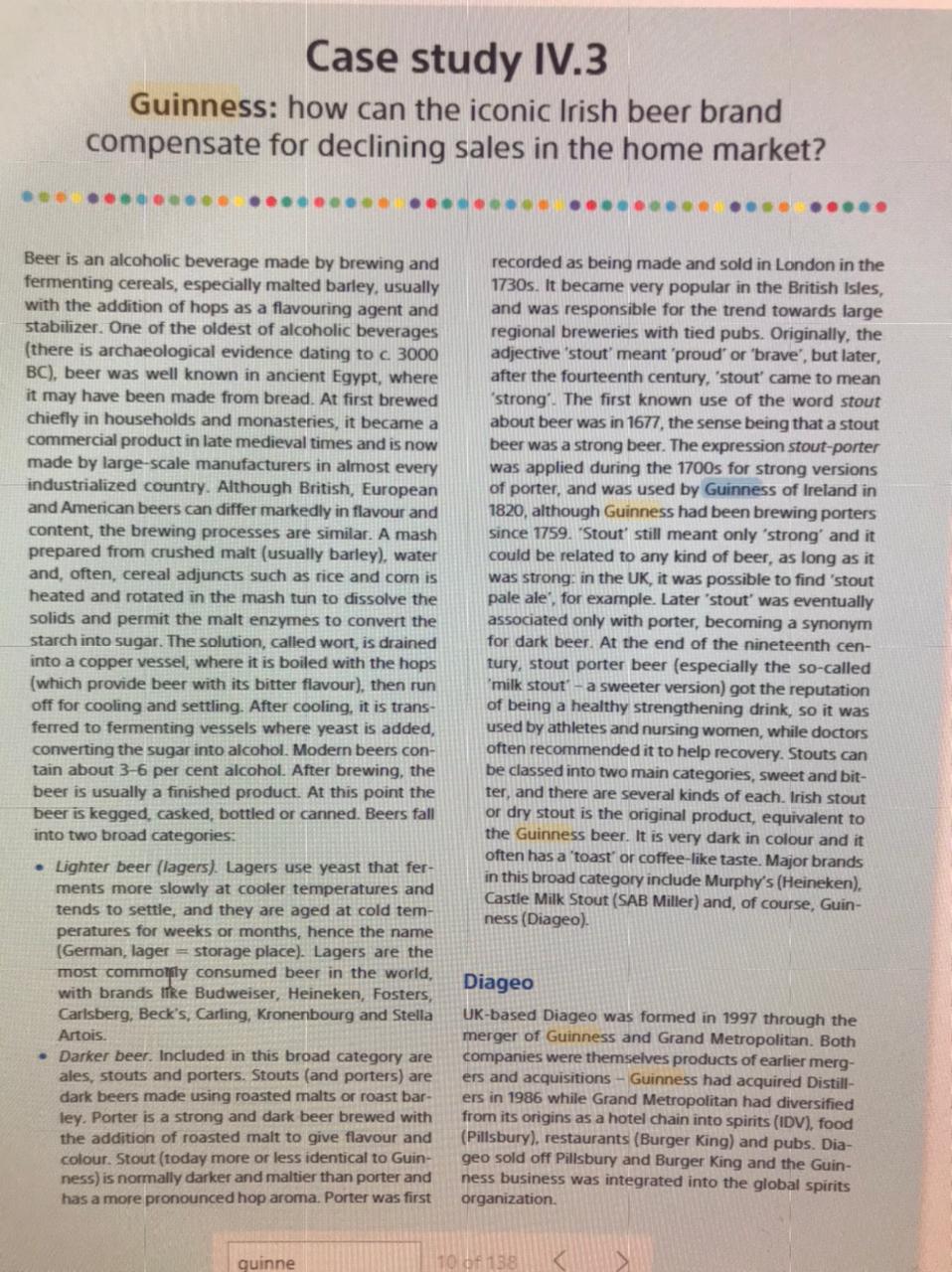

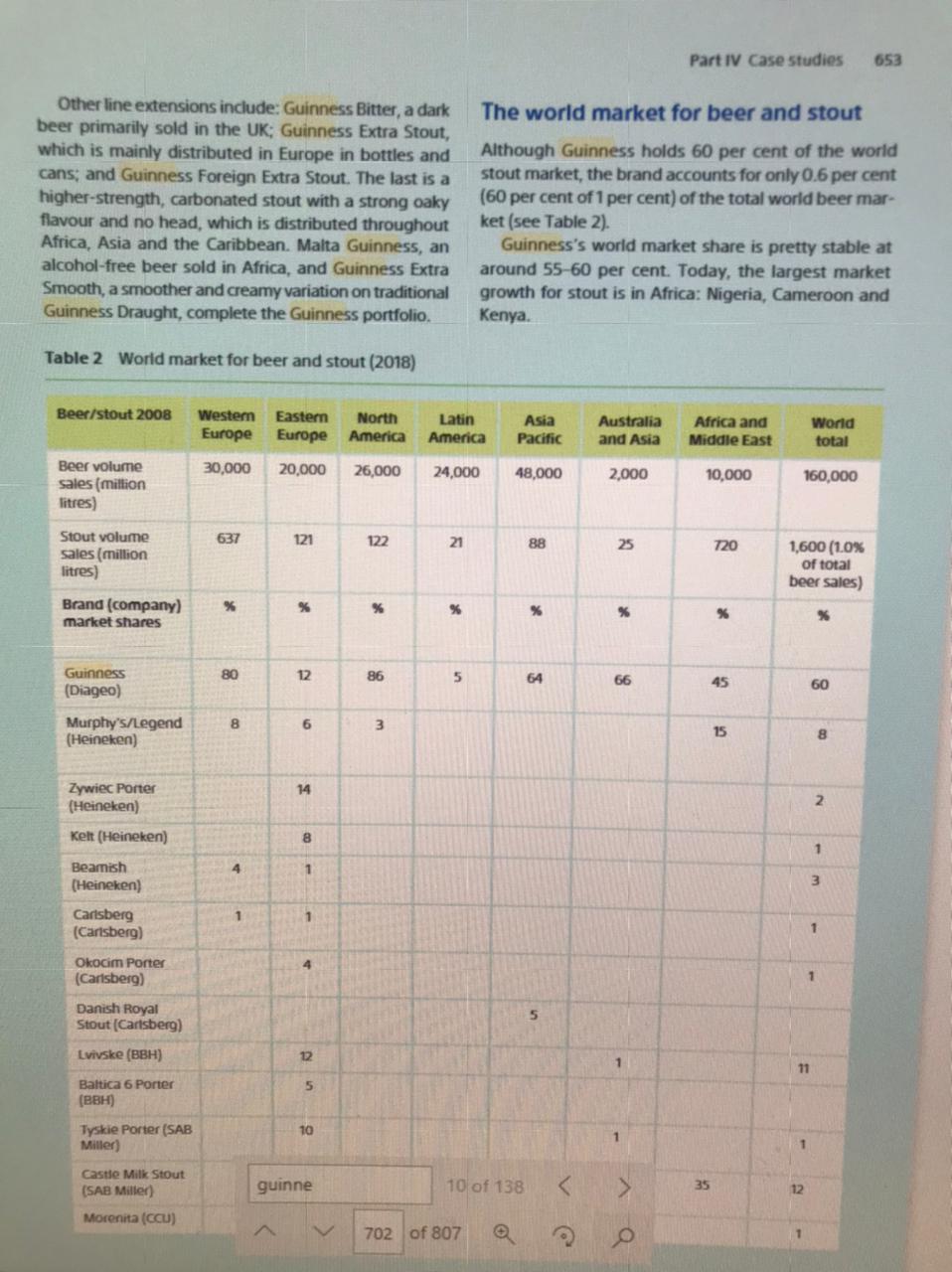

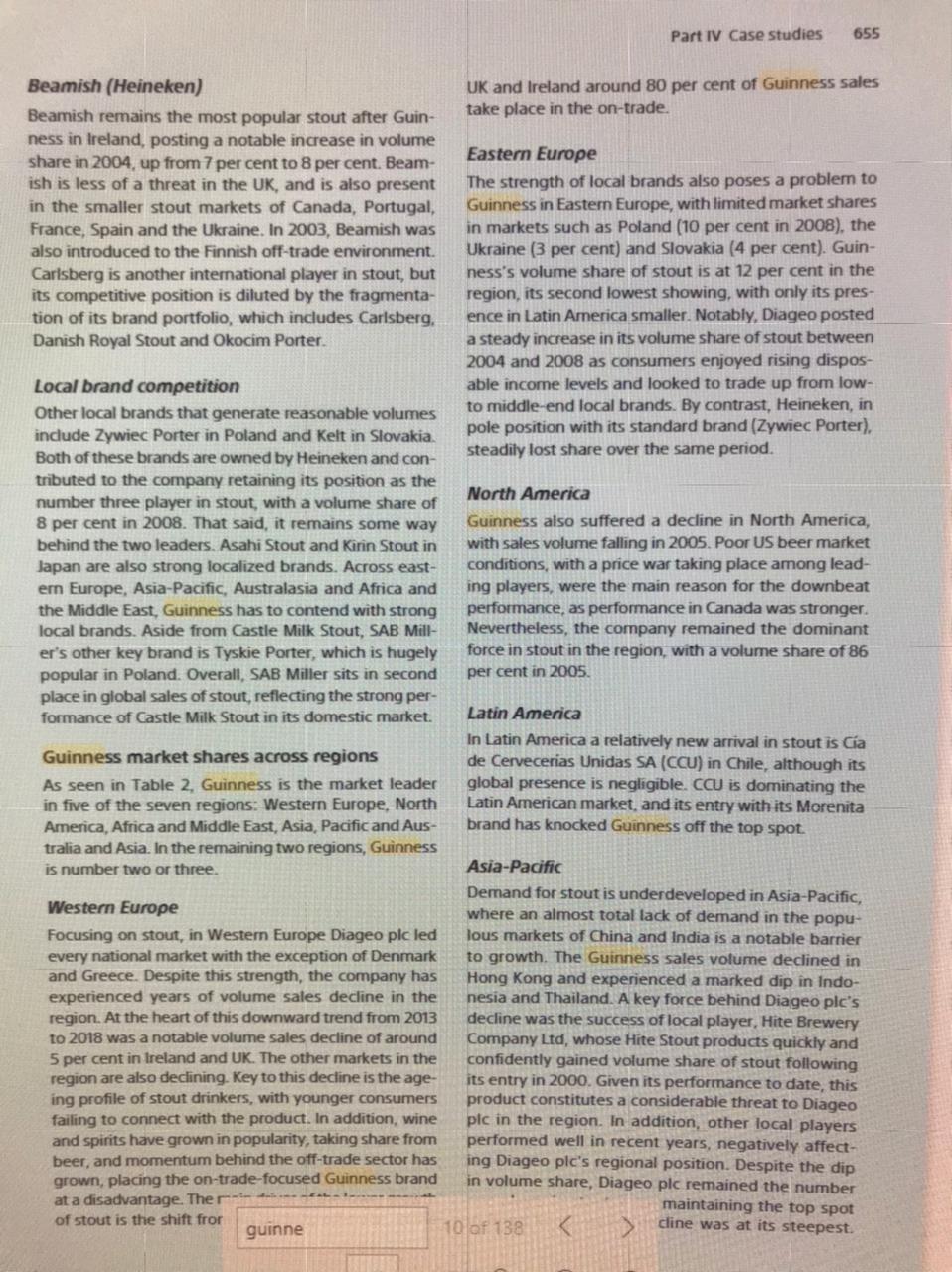

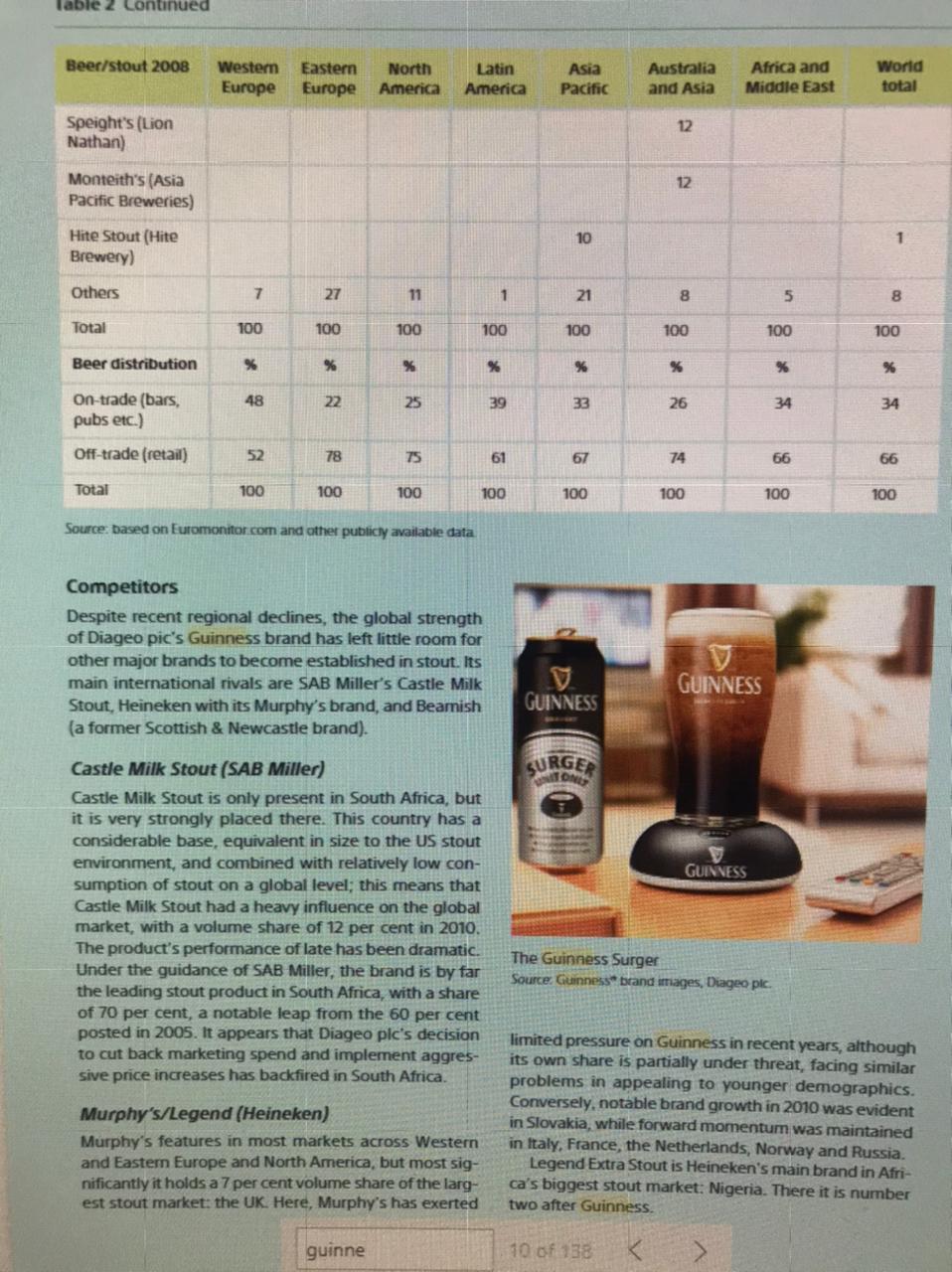

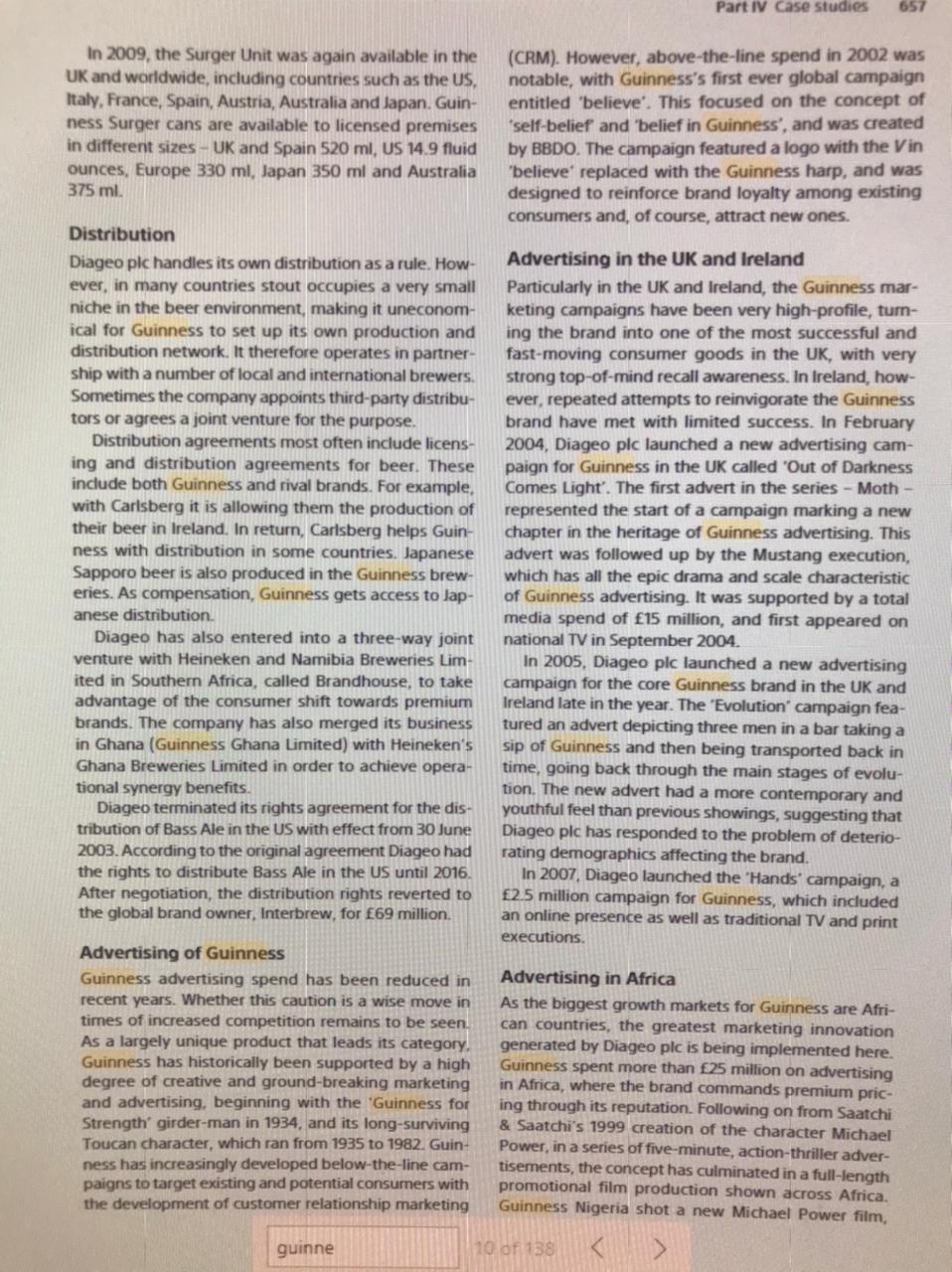

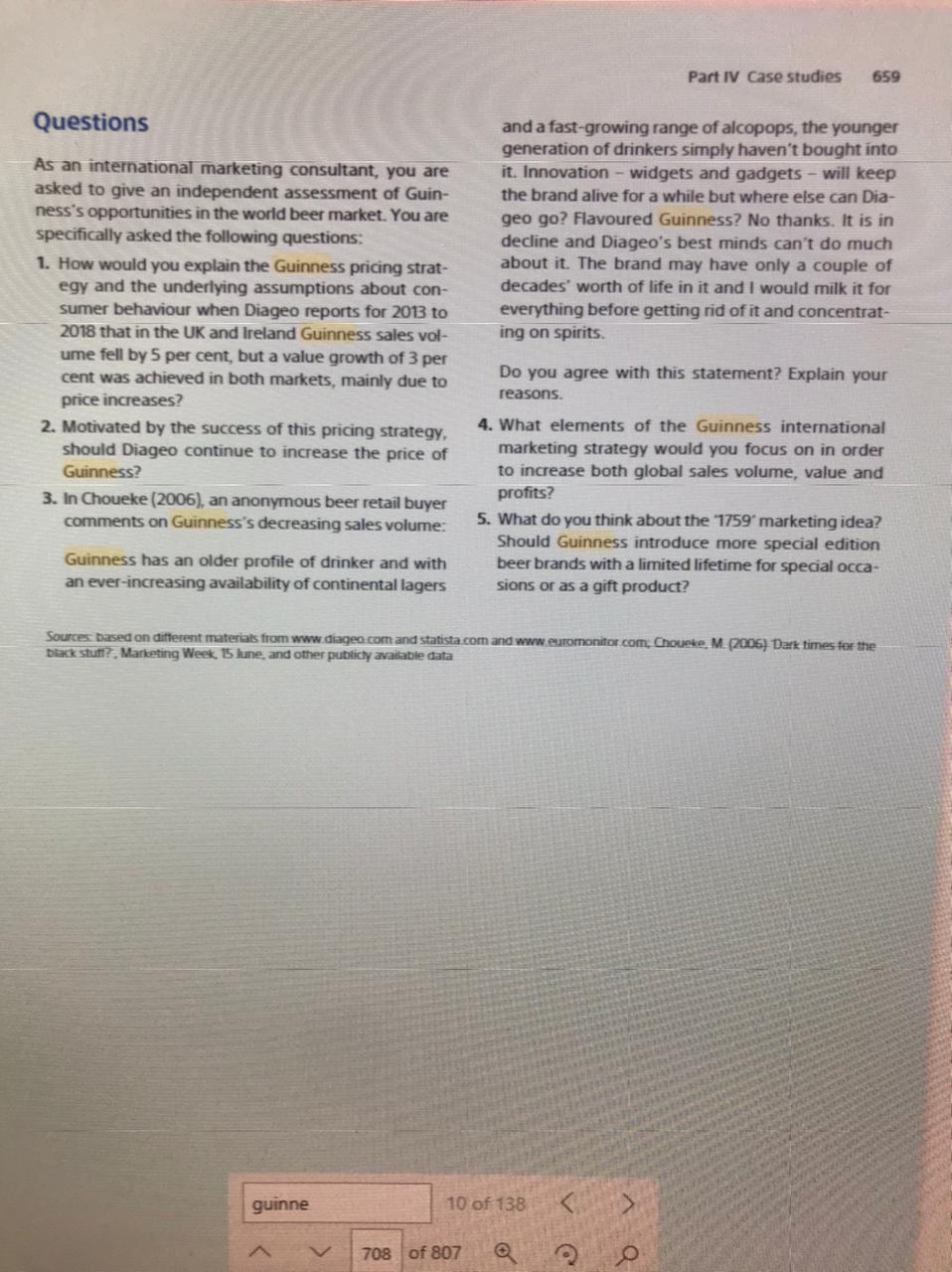

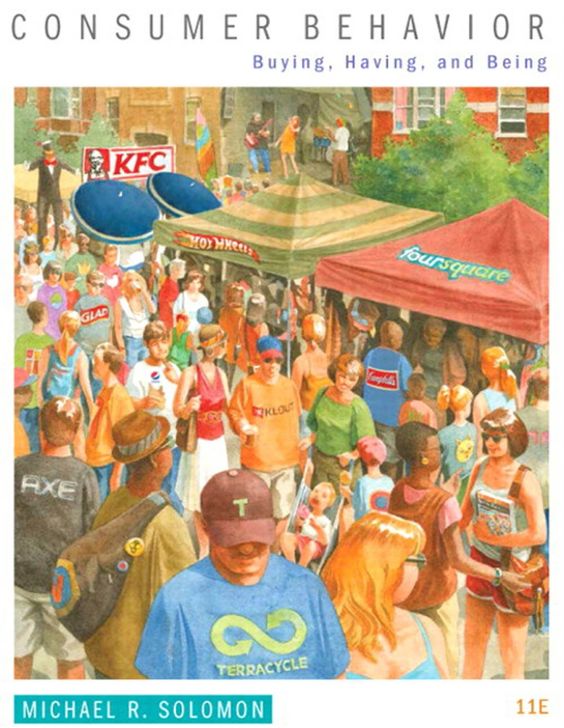

Case study IV.3 Guinness: how can the iconic Irish beer brand compensate for declining sales in the home market? .......... Beer is an alcoholic beverage made by brewing and recorded as being made and sold in London in the fermenting cereals, especially malted barley, usually 1730s. It became very popular in the British Isles, with the addition of hops as a flavouring agent and and was responsible for the trend towards large stabilizer. One of the oldest of alcoholic beverages regional breweries with tied pubs. Originally, the (there is archaeological evidence dating to c. 3000 adjective 'stout meant 'proud" or 'brave', but later, BC), beer was well known in ancient Egypt, where after the fourteenth century, 'stout' came to mean it may have been made from bread. At first brewed 'strong'. The first known use of the word stout chiefly in households and monasteries, it became a about beer was in 1677, the sense being that a stout commercial product in late medieval times and is now beer was a strong beer. The expression stout-porter made by large-scale manufacturers in almost every was applied during the 1700s for strong versions industrialized country. Although British, European of porter, and was used by Guinness of Ireland in and American beers can differ markedly in flavour and 1820, although Guinness had been brewing porters content, the brewing processes are similar. A mash since 1759. "Stout' still meant only 'strong' and it prepared from crushed malt (usually barley), water could be related to any kind of beer, as long as it and, often, cereal adjuncts such as rice and corn is was strong: in the UK, it was possible to find 'stout heated and rotated in the mash tun to dissolve the pale ale', for example. Later 'stout' was eventually solids and permit the malt enzymes to convert the associated only with porter, becoming a synonym starch into sugar. The solution, called wort, is drained for dark beer. At the end of the nineteenth cen- into a copper vessel, where it is boiled with the hops tury, stout porter beer (especially the so-called (which provide beer with its bitter flavour), then run 'milk stout" -a sweeter version) got the reputation off for cooling and settling. After cooling, it is trans- of being a healthy strengthening drink, so it was ferred to fermenting vessels where yeast is added, used by athletes and nursing women, while doctors converting the sugar into alcohol. Modern beers con- often recommended it to help recovery. Stouts can tain about 3-6 per cent alcohol. After brewing, the be classed into two main categories, sweet and bit- beer is usually a finished product. At this point the ter, and there are several kinds of each. Irish stout beer is kegged, casked, bottled or canned. Beers fall or dry stout is the original product, equivalent to into two broad categories: the Guinness beer. It is very dark in colour and it often has a 'toast' or coffee-like taste. Major brands . Lighter beer (lagers). Lagers use yeast that fer- in this broad category include Murphy's (Heineken), ments more slowly at cooler temperatures and Castle Milk Stout (SAB Miller) and, of course, Guin- tends to settle, and they are aged at cold tem- ness (Diageo) peratures for weeks or months, hence the name (German, lager = storage place). Lagers are the most commonly consumed beer in the world, Diageo with brands like Budweiser, Heineken, Fosters, Carlsberg, Beck's, Carling, Kronerbourg and Stella UK-based Diageo was formed in 1997 through the Artois. merger of Guinness and Grand Metropolitan. Both Darker beer. Included in this broad category are companies were themselves products of earlier merg- ales, stouts and porters, Stouts (and porters) are ers and acquisitions - Guinness had acquired Distill- dark beers made using roasted malts or roast bar- ers in 1986 while Grand Metropolitan had diversified ley. Porter is a strong and dark beer brewed with from its origins as a hotel chain into spirits (IDV), food the addition of roasted malt to give flavour and (Pillsbury). restaurants (Burger King) and pubs. Dia- colour. Stout (today more or less identical to Guin- geo sold off Pillsbury and Burger King and the Guin- ness) is normally darker and maltier than porter and ness business was integrated into the global spirits has a more pronounced hop aroma. Porter was first organization.Part IV Case studies ES9 Other line extensions include: Guinness Bitter, a dark The world market for beer and stout beer primarily sold in the UK; Guinness Extra Stout, which is mainly distributed in Europe in bottles and Although Guinness holds 60 per cent of the world cans; and Guinness Foreign Extra Stout. The last is a stout market, the brand accounts for only 0.6 per cent higher-strength, carbonated stout with a strong oaky (60 per cent of 1 per cent) of the total world beer mar- flavour and no head, which is distributed throughout ket (see Table 2). Africa, Asia and the Caribbean. Malta Guinness, an Guinness's world market share is pretty stable at alcohol-free beer sold in Africa, and Guinness Extra around 55-60 per cent. Today, the largest market Smooth, a smoother and creamy variation on traditional growth for stout is in Africa: Nigeria, Cameroon and Guinness Draught, complete the Guinness portfolio. Kenya. Table 2 World market for beer and stout (2018) Beer/stout 2008 Western Eastern North Latin Asia Australia Africa and World Europe Europe America America Pacific and Asia Middle East total Beer volume 30,000 20,000 26,000 24,000 48,000 2,000 10,000 160,000 sales (million litres) Stout volume 637 121 122 21 88 25 720 1,600 (1.0% sales (million of total litres) beer sales) Brand (company) market shares Guinness 80 12 86 5 64 66 45 60 (Diageo) Murphy's/Legend 8 3 15 (Heineken) Zywiec Porter 14 N (Heineken) Kelt (Heineken) Beamish w (Heineken) Carlsberg (Carlsberg) Okocim Porter (Carlsberg) Danish Royal Stout (Carlsberg) Lvivske (BBH) Baltica 6 Porter 5 (BBH) Tyskie Porter (SAB 10 Miller) Castle Milk Stout 12 (SAB Miller) guinne 10 of 138 35 Morenita (CCU) 702 of 807652 Part IV Designing the global marketing programme Table 1 Key financial figures of Diageo (2016-18) which puts the on-trade (pubs and bars) Guinness at a distinct disadvantage. 2016 (Em) 2017 (Em) 2018 (Em) One of the reasons for this shift away from tradi- tional pub consumption towards home drinking is the Total net sales 10,485 12,050 12,163 banning of smoking in public places, both in the UK Operating profit 2,841 3.559 and in Ireland. Nowhere have these trends been more 3.691 evident than in these key markets. In general, Diageo Source. based on www.diageo.com pic in 2010 reported a 2 per cent decline in Guinness worldwide volume sales, while in the UK and Ireland the fall was steeper, at 3 per cent. Nevertheless, on the Today, Diageo is a Fortune 500 company listed on back of notable price rises, value growth of 4 per cent both the New York and London stock exchanges. The was achieved in both markets. firm is the world's leading premium drinks enterprise, with a broad selection of brands, It currently occupies a Guinness - an iconic Irish brand 30 per cent share of the global market, and owns nine of the world's top 20 spirit brands, including Smirnoff As an adopted Irish national icon (although it is not vodka, Bushmills Irish whiskey, Johnnie Walker Scotch Irish-owned), the Guinness brand is readily recognizable whisky, Captain Morgan rum, Gordon's dry gin, J&B throughout the world, even by non-consumers. Indeed, it Scotch whisky. Crown Royal whiskey and Baileys is one of only a few truly global beer brands, possessing a cream liqueur. The portfolio also includes Guinness geographic coverage that spans all international regions. stout. In 2019 the company had over 20,000 employ- Brewed in over 50 countries, the Guinness recipe is mod- ees, and traded in over 180 markets around the world. ified to suit different market tastes in type and strength, Its annual turnover in the fiscal year 2018 reached with around 20 different variants sold worldwide. Its more than f12 billion, of which Guinness accounts for prime line is Guinness Draught, launched in 1959 and around 12%. Diageo has a total market capitalization of marketed in over 70 countries. This sub-brand accounts over f25 billion. The financial development of Diageo for around 55 per cent of all Guinness sold worldwide. during 2016-18 is illustrated in Table 1. Widget technology saw Guinness Draught move Diageo pic has one major beer brand, Guinness, into cans in 1989, and into bottles in 1999. To entice which is the world's leading stout brand. However, in younger lager drinkers to stout, Guinness Draught the world beer market the stout only accounts for 1.0 Extra Cold was added to its range in its core markets per cent of world beer sales (see Table 2). As a result of the UK and Ireland in 1998. The sub-brand actu- of Guinness' status, Diageo pic's beer performance is ally comes from the same barrel as Guinness draught heavily reliant on the fortunes of the Guinness brand. but goes through a super cooler on the way to the However, cracks have started to appear in the brand glass, and is served at a temperature around one-third as an aggressive price increase policy was employed lower than regular Guinness. This product is generally to mask volume declines in key markets. Diageo pic served in more modern outlets, where people prefer fails to disclose operating profit figures for its beer their beer gooler than standard. sector or for the flagship Guinness stout brand. How- ever, it is estimated that beer accounts for 20 per cent GUEVNESS of company sales, while its contribution to profits is thought to be smaller, at around 15 per cent. Diageo's top management has growing concern over the company's principal beer brand, Guinness. The company reported a volume sales decline of 2 per cent for the brand in 2010, with value sales growth of 5 per cent only being achieved as a result of aggressive price increases in its main markets. The adoption of such a strategy has raised doubts over the sustainabil ity of brand profitability. The Guinness brand has suf- fered on a number of levels, being hit by deteriorating Si Purick's Day Fashion demographics, with younger drinkers turning away from stout in general, a growing preference for wine and spirits, and a shift towards off-trade consumption Guinness 'St. Patrick's Day' promotion (buying beers in the shop guinne 10 of 138 O picPart IV Case studies 655 Beamish (Heineken) UK and Ireland around 80 per cent of Guinness sales Beamish remains the most popular stout after Guin- take place in the on-trade. ness in Ireland, posting a notable increase in volume share in 2004, up from 7 per cent to 8 per cent. Beam- Eastern Europe ish is less of a threat in the UK, and is also present The strength of local brands also poses a problem to in the smaller stout markets of Canada, Portugal, Guinness in Eastern Europe, with limited market shares France, Spain and the Ukraine. In 2003, Beamish was in markets such as Poland (10 per cent in 2008), the also introduced to the Finnish off-trade environment. Ukraine (3 per cent) and Slovakia (4 per cent). Guin- Carlsberg is another international player in stout, but ness's volume share of stout is at 12 per cent in the its competitive position is diluted by the fragmenta- region, its second lowest showing, with only its pres- tion of its brand portfolio, which includes Carlsberg, ence in Latin America smaller, Notably, Diageo posted Danish Royal Stout and Okocim Porter. a steady increase in its volume share of stout between 2004 and 2008 as consumers enjoyed rising dispos- Local brand competition able income levels and looked to trade up from low- Other local brands that generate reasonable volumes to middle-end local brands. By contrast, Heineken, in include Zywiec Porter in Poland and Kelt in Slovakia. pole position with its standard brand (Zywiec Porter), Both of these brands are owned by Heineken and con- steadily lost share over the same period. tributed to the company retaining its position as the number three player in stout, with a volume share of North America 8 per cent in 2008. That said, it remains some way Guinness also suffered a decline in North America, behind the two leaders. Asahi Stout and Kirin Stout in with sales volume falling in 2005. Poor US beer market Japan are also strong localized brands. Across east- conditions, with a price war taking place among lead- er Europe, Asia-Pacific, Australasia and Africa and ing players, were the main reason for the downbeat the Middle East, Guinness has to contend with strong performance, as performance in Canada was stronger. local brands. Aside from Castle Milk Stout, SAB Mill- Nevertheless, the company remained the dominant er's other key brand is Tyskie Porter, which is hugely force in stout in the region, with a volume share of 86 popular in Poland. Overall, SAB Miller sits in second per cent in 2005. place in global sales of stout, reflecting the strong per- formance of Castle Milk Stout in its domestic market. Latin America In Latin America a relatively new arrival in stout is Cia Guinness market shares across regions de Cervecerias Unidas SA (CCU) in Chile, although its As seen in Table 2, Guinness is the market leader global presence is negligible. CCU is dominating the in five of the seven regions: Western Europe, North Latin American market, and its entry with its Morenita America, Africa and Middle East, Asia, Pacific and Aus- brand has knocked Guinness off the top spot. tralia and Asia. In the remaining two regions, Guinness is number two or three. Asia-Pacific Demand for stout is underdeveloped in Asia-Pacific, Western Europe where an almost total lack of demand in the popu Focusing on stout, in Western Europe Diageo pic led lous markets of China and India is a notable barrier every national market with the exception of Denmark to growth. The Guinness sales volume declined in and Greece. Despite this strength, the company has Hong Kong and experienced a marked dip in Indo- experienced years of volume sales decline in the nesia and Thailand. A key force behind Diageo pic's region. At the heart of this downward trend from 2013 decline was the success of local player, Hite Brewery to 2018 was a notable volume sales decline of around Company Lid, whose Hite Stout products quickly and 5 per cent in Ireland and UK. The other markets in the confidently gained volume share of stout following region are also declining. Key to this decline is the age- its entry in 2000. Given its performance to date, this ing profile of stout drinkers, with younger consumers product constitutes a considerable threat to Diageo failing to connect with the product. In addition, wine pic in the region. In addition, other local players and spirits have grown in popularity, taking share from performed well in recent years, negatively affect- beer, and momentum behind the off-trade sector has ing Diageo pic's regional position. Despite the dip grown, placing the on-trade-focused Guinness brand in volume share, Diageo pic remained the number at a disadvantage. The r maintaining the top spot of stout is the shift from guinne 10 of 138 cline was at its steepest.Beer/stout 2008 Western Eastern North Latin Asia Australia Africa and World Europe Europe America America Pacific and Asia Middle East total Speight's (Lion 12 Nathan) Monteith's (Asia 12 Pacific Breweries) Hite Stout (Hite 10 Brewery) Others 27 21 8 8 Total 100 100 100 100 100 100 100 100 Beer distribution % On-trade (bars, 22 25 26 34 34 pubs etc.) Off-trade (retail) 52 78 75 61 67 74 66 66 Total 100 100 100 100 100 100 100 100 Source: based on Euromonitor com and other publicly available data Competitors Despite recent regional declines, the global strength of Diageo pic's Guinness brand has left little room for other major brands to become established in stout. Its V main international rivals are SAB Miller's Castle Milk V GUINNESS Stout, Heineken with its Murphy's brand, and Beamish GUINNESS (a former Scottish & Newcastle brand). Castle Milk Stout (SAB Miller) BURGER Castle Milk Stout is only present in South Africa, but it is very strongly placed there. This country has a considerable base, equivalent in size to the US stout environment, and combined with relatively low con- GUINNESS sumption of stout on a global level; this means that Castle Milk Stout had a heavy influence on the global market, with a volume share of 12 per cent in 2010. The product's performance of late has been dramatic. The Guinness Surger Under the guidance of SAB Miller, the brand is by far Source. Guinness* brand images, Diageo pic the leading stout product in South Africa, with a share of 70 per cent, a notable leap from the 60 per cent posted in 2005. It appears that Diageo pic's decision limited pressure on Guinness in recent years, although to cut back marketing spend and implement aggres- its own share is partially under threat, facing similar sive price increases has backfired in South Africa. problems in appealing to younger demographics. Murphy's/Legend (Heineken) Conversely, notable brand growth in 2010 was evident in Slovakia, while forward momentum was maintained Murphy's features in most markets across Western in Italy, France, the Netherlands, Norway and Russia. and Eastern Europe and North America, but most sig- Legend Extra Stout is Heineken's main brand in Afri- nificantly it holds a 7 per cent volume share of the larg- ca's biggest stout market: Nigeria. There it is number est stout market: the UK. Here, Murphy's has exerted two after Guinness. guinne 10 of 158In 2009, the Surger Unit was again available in the (CRM). However, above-the-line spend in 2002 was UK and worldwide, including countries such as the US, notable, with Guinness's first ever global campaign Italy, France, Spain, Austria, Australia and Japan. Guin- entitled 'believe'. This focused on the concept of ness Surger cans are available to licensed premises self-belief and 'belief in Guinness', and was created in different sizes - UK and Spain 520 ml, US 14.9 fluid by BBDO. The campaign featured a logo with the Vin ounces, Europe 330 ml, Japan 350 ml and Australia "believe replaced with the Guinness harp, and was 375 ml. designed to reinforce brand loyalty among existing consumers and, of course, attract new ones. Distribution Diageo pic handles its own distribution as a rule. How- Advertising in the UK and Ireland ever, in many countries stout occupies a very small Particularly in the UK and Ireland, the Guinness mar- niche in the beer environment, making it uneconom- keting campaigns have been very high-profile, turn- ical for Guinness to set up its own production and ing the brand into one of the most successful and distribution network. It therefore operates in partner- fast-moving consumer goods in the UK, with very ship with a number of local and international brewers. strong top-of-mind recall awareness. In Ireland, how- Sometimes the company appoints third-party distribu- ever, repeated attempts to reinvigorate the Guinness tors or agrees a joint venture for the purpose. brand have met with limited success. In February Distribution agreements most often include licens- 2004, Diageo pic launched a new advertising cam- ing and distribution agreements for beer. These paign for Guinness in the UK called 'Out of Darkness include both Guinness and rival brands. For example, Comes Light'. The first advert in the series - Moth - with Carlsberg it is allowing them the production of represented the start of a campaign marking a new their beer in Ireland. In return, Carlsberg helps Guin- chapter in the heritage of Guinness advertising. This ness with distribution in some countries. Japanese advert was followed up by the Mustang execution, Sapporo beer is also produced in the Guinness brew- which has all the epic drama and scale characteristic eries. As compensation, Guinness gets access to Jap- of Guinness advertising. It was supported by a total anese distribution. media spend of f15 million, and first appeared on Diageo has also entered into a three-way joint national TV in September 2004. venture with Heineken and Namibia Breweries Lim- In 2005, Diageo pic launched a new advertising ited in Southern Africa, called Brandhouse, to take campaign for the core Guinness brand in the UK and advantage of the consumer shift towards premium Ireland late in the year. The "Evolution" campaign fea- brands. The company has also merged its business tured an advert depicting three men in a bar taking a in Ghana (Guinness Ghana Limited) with Heineken's sip of Guinness and then being transported back in Ghana Breweries Limited in order to achieve opera- time, going back through the main stages of evolu- tional synergy benefits. tion. The new advert had a more contemporary and Diageo terminated its rights agreement for the dis- youthful feel than previous showings, suggesting that tribution of Bass Ale in the US with effect from 30 June Diageo pic has responded to the problem of deterio- 2003. According to the original agreement Diageo had rating demographics affecting the brand. the rights to distribute Bass Ale in the US until 2016. In 2007, Diageo launched the 'Hands' campaign, a After negotiation, the distribution rights reverted to 12.5 million campaign for Guinness, which included the global brand owner, Interbrew, for 169 million. an online presence as well as traditional TV and print executions. Advertising of Guinness Guinness advertising spend has been reduced in Advertising in Africa recent years. Whether this caution is a wise move in As the biggest growth markets for Guinness are Afri- times of increased competition remains to be seen can countries, the greatest marketing innovation As a largely unique product that leads it's category. generated by Diageo pic is being implemented here. Guinness has historically been supported by a high Guinness spent more than f25 million on advertising degree of creative and ground-breaking marketing in Africa, where the brand commands premium pric- and advertising, beginning with the 'Guinness for ing through its reputation. Following on from Saatchi Strength' girder-man in 1934, and its long-surviving & Saatchi's 1999 creation of the character Michael Toucan character, which ran from 1935 to 1982. Guin- Power, in a series of five-minute, action-thriller adver- ness has increasingly developed below-the-line cam- tisements, the concept has culminated in a full-length paigns to target existing and potential consumers with promotional film production shown across Africa. the development of customer relationship marketing Guinness Nigeria shot a new Michael Power film, guinne 10 of 158656 Part IV Designing the global marketing programme Another source of positive momentum in 2004 was on its dominance (70 per cent market share) in South Japan, where the company took its volume share to Africa with its Castle Milk Stout. Heineken is espe- over 40 per cent. cially strong in Nigeria and Cameroon. Consequently, This growth was a notable achievement, given the company performances are very reliant on local geo- extent of local competition from Asahi and Kirin, which graphic conditions. Diageo has started to develop its both have rival products to Guinness (Asahi Stout and presence outside the core markets in Africa, such as Kirin Stout) and both enjoy significant price advan- Nigeria and Kenya. The company started to do that tages. In Asia-Pacific, the introduction of ginseng- in 2010, by acquiring a majority stake in Tanzania'a flavoured stout brands signalled repositioning of second-ranked brewer, Serengeti Brewery. stout. Examples of ginseng stout brands are Danish Royal Stout Ginseng (Carlsberg), Partner Stout Gin- The international marketing strategy seng (Bali Hai Brewery) and ABC Extra Stout Ginseng (Asia Pacific Breweries). These new ginseng stout In the ensuing paragraphs, Guinness's initiatives within brands were developed for fans who seek a full-bod- the international marketing mix will be explained. ied stout with additional benefits. The key end target market for this product segment is the middle-income New product innovation/packaging male consumer. Diageo pic moved its Guinness Draught into bottles in Australia and Asia late 1999 following the development of a new 'rocket widget', which enabled Guinness to retain its dis- This region is one of the strongest markets for Guin- tinctive foamy white head when consumed from its ness, which enjoys a market share of 66 per cent in the packaging. Presented in long-neck bottles, this line region as a whole. positioned Guinness alongside premium lagers and flavoured alcoholic beverages (FABs), such as Diageo Africa and the Middle East pic's popular Smirnoff Ice. Africans have been drinking Guinness since the The beer market in the UK is seeing a dynamic slave-trading days of the 1820s, company documents shift away from traditional pub consumption towards say. European merchant sailors preferred to load up home drinking experiences, partially due to the ban- with Guinness rather than other beers because a ning of smoking in public places. The impact of ban- higher concentration of alcohol, at 7.5 per cent, gave ning smoking in pubs in Ireland and the UK has been the stout a longer shelf life. By 1827, Guinness was a switch from on-trade (pubs, bars) into off-trade as exporting its stout, from its brewery on the banks of more people opted to smoke and drink at home. Dublin's Liffey River to Sierra Leone. In February 2006, the 'Guinness Surger' was In 2013, Guinness employed 5,000 people in Africa launched. It is a plug-in unit promising to deliver the in breweries. African countries - Nigeria, Kenya, Cam- perfect pint at home by sending ultrasonic sound eroon, Ivory Coast and South Africa-accounted for five waves through the special Guinness Draught Surger of the 10 largest markets by volume in the world for beer. By releasing this new product, Diageo aimed Guinness and about 50 per cent of worldwide profit. to recreate the 'pub experience' in consumers' own This region is one of the most important for the homes. Consumers purchasing drinks for at-home company in terms of growth potential, as the level of occasions want to mimic the on-trade experience as stout consumption is among the highest in the world, much as possible, particularly in terms of presentation and much growth is expected in the short term. The and quality. The new Surger gadget delivered exactly majority of Diageo's worldwide brewing facilities are in this, as well as having a shareability" factor to enhance Africa, where its majority-owned brewing operations. consumers' at home drinking experience through the such as in Kenya, Nigeria, Cameroon, Ghana and the novelty of using the ultrasound device. The price in Seychelles, brew both Guinness and local brands. Guin- the UK was f17 for the starter kit, which included one ness is also produced by third-party brewers in other Surger, a pint glass and two cans of Surger beer. African countries where volumes are not so strong. Diageo thought the Guinness Draught Surger Overall, Guinness is a stout market leader in Africa would help to capitalize on the growing movement and Middle East. Guinness's strongest markets are the towards the off-trade. The product had already been markets in East Africa (Kenva Ilnanda and Tanzania) released with success in lanan and Singapore, and although the majority of vi which is the brand's secor guinne 10 of 138. marketing campaign in For example, Guinness ha: s Surger Unit was with- cent in Kenya, while SAB April 2008 and sales of 705 of 807 O i Tesco stores.Part IV Case studies 659 Questions and a fast-growing range of alcopops, the younger generation of drinkers simply haven't bought into As an international marketing consultant, you are it. Innovation - widgets and gadgets - will keep asked to give an independent assessment of Guin- the brand alive for a while but where else can Dia- ness's opportunities in the world beer market. You are geo go? Flavoured Guinness? No thanks. It is in specifically asked the following questions: decline and Diageo's best minds can't do much 1. How would you explain the Guinness pricing strat- about it. The brand may have only a couple of egy and the underlying assumptions about con- decades' worth of life in it and I would milk it for sumer behaviour when Diageo reports for 2013 to everything before getting rid of it and concentrat- 2018 that in the UK and Ireland Guinness sales vol- ing on spirits. ume fell by 5 per cent, but a value growth of 3 per cent was achieved in both markets, mainly due to Do you agree with this statement? Explain your price increases? reasons. 2. Motivated by the success of this pricing strategy, 4. What elements of the Guinness international should Diageo continue to increase the price of marketing strategy would you focus on in order Guinness? to increase both global sales volume, value and 3. In Choueke (2006), an anonymous beer retail buyer profits? comments on Guinness's decreasing sales volume: 5. What do you think about the '1759" marketing idea? Should Guinness introduce more special edition Guinness has an older profile of drinker and with beer brands with a limited lifetime for special occa- an ever-increasing availability of continental lagers sions or as a gift product? Sources based on different materials from www.diageo.com and statista.com and www.euromonitor.com; Choueke, M. (2006) Dark times for the black stuff?. Marketing Week, 15 June, and other publicly available data guinne 10 of 138 A 708 of 807 Q 2 0658 Part IV Designing the global marketing programme which was screened in 2004. In a further display of also put a stronger focus on spirits rather than draught commitment to this growth region, Guinness Nigeria beer, thereby signalling that Diageo pic saw its spir- has worked with local communities to provide them its brands driving future revenue growth rather than with clean, safe water. Royalties from the Guinness- Guinness beer. sponsored feature film Critical Assignment, which The top management in Diageo is in doubt as to highlights the need for clean drinking water, have what to do about Guinness in the future. Should it helped fund a Water of Life project. continue the 'milking strategy' by withdrawing mar- keting resources (lowering costs) and increasing reve- How to attract the young consumer nues (by increasing the end-consumer prices)? At least Despite its previous marketing successes, Guinness that would maximize profits over a shorter term, and is suffering from a lack of take up among younger Diageo could use the financial resources in acquiring consumers in preference for more fashionable lagers other beer brands. Or should Diageo instead make and FABs. An interesting trend in Diageo pic's mar- a long-term investment in developing the brand, by keting strategy was a further change in the way the implementing new global marketing initiatives? company marketed it's flagship Guinness brand. For a time, on its Guinness.com website, the company Later Guinness initiatives actively encouraged consumers to mix Guinness with According to Diageo's 2018 annual report, sales of other products to produce various 'cocktails'. This was Guinness fell by 5 per cent globally from 2013 to 2018. clearly a further effort to appeal to the youth seg- In order to reverse the negative sales development ment, given that many consumers in this age group (especially happening, on the UK market), Guinness find the taste of Guinness too bitter. Examples of mix- has come up with new marketing ideas. ers suggested by the company included champagne, Guinness launched the '1759' limited edition with a blackcurrant juice, lime juice or curacao, cacao and run of 90,000 bottles, but at a price of f22 per bottle - Dubonnet. about five times what you would normally pay for a Sponsorships traditional Guinness at the local pub. However, '1759 is not an Irish dry stout. It is an amber ale with peated The positioning of Guinness has been centred on the malt, the same smoky stuff that goes into certain brand's traditional associations with sports. In 2005, types of Scotch whisky. The reason it is called '1759 Guinness made a notable investment in sports spon- is that it is the year when Arthur Guinness set up his sorship, putting its name to the 2005 tour of the British shop in Dublin. and Irish Lions rugby union team to New Zealand and Guinness '1759' is meant to be a gift product. Also paying $20 million to sponsor the 2005-06 season of the packaging is a bit special - it is topped off with a top domestic rugby union league in the UK. In addi- cork. Guinness suggest serving it in a champagne-like tion, the brand was the sponsor of the G-8 Summit in glass (preferably stemless - see picture). Gleneagles, Scotland. In 2008, Diageo announced that Guinness would be the title sponsor for Singapore Rugby. The three- year deal saw Guinness sponsoring the Guinness Pre- miership in the UK and Ireland, the Irish national rugby team and the club Hong Kong Sevens. In Singapore. A Guinness sponsored three divisions, as well as the elite knock-out competition, the Singapore Cup. 1759 Investments in a new Irish-theme pub concept Guinness consumption rose partly because of the development of the Irish-theme pub. In the UK, Dia- V geo pic invested $13 million in 2001 in developing a new bar concept that it encouraged independent owners of Irish-theme pubs to adopt. The idea was to make traditional pubs less clut- tered and more contemporan lighter and cleaner and The Guinness '1759" brand thereby more appealing to grand guinne 10 of 138