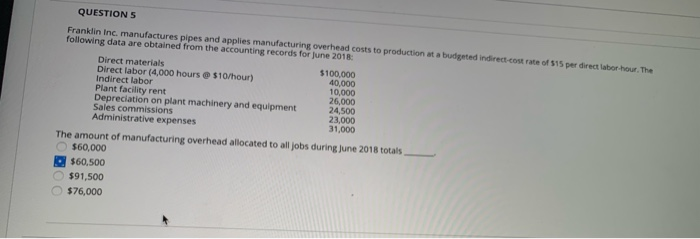

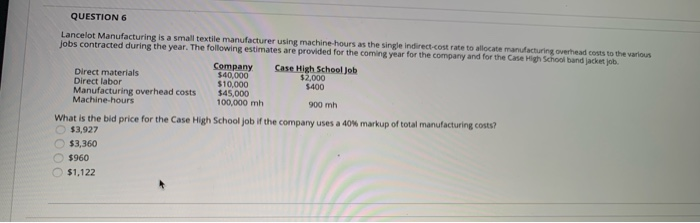

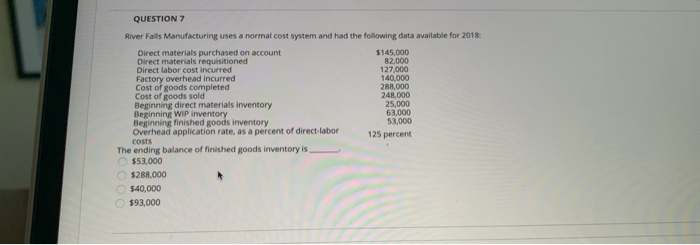

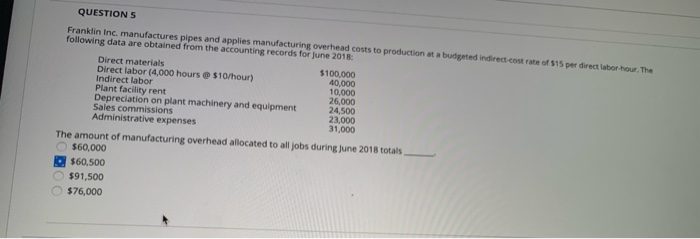

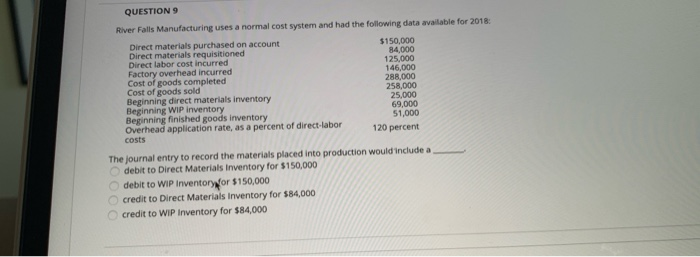

QUESTIONS Franklin Inc, manufactures pipes and applies manufacturing overhead costs to production at a budgeted indirect cost rate of 515 per direct labor hour. The following data are obtained from the accounting records for June 2018: Direct materials $100,000 Direct labor (4,000 hours $10/hour) 40,000 Indirect labor 10,000 Plant facility rent 26,000 Depreciation on plant machinery and equipment 24,500 Sales commissions 23,000 Administrative expenses 31,000 The amount of manufacturing overhead allocated to all jobs during June 2018 totals $60,000 $60,500 $91,500 $76,000 QUESTION 6 Lancelot Manufacturing is a small textile manufacturer using machine hours as the single indirect.cost rate to allocate manufacturing overhead costs to the various jobs contracted during the year. The following estimates are provided for the coming year for the company and for the Case High School band jacket job Company Case High School Job Direct materials $40,000 $2,000 Direct labor $10,000 $400 Manufacturing overhead costs $45,000 Machine-hours 100,000 m 900 m What is the bid price for the Case High School job if the company uses a 40% markup of total manufacturing costs? $3,927 $3,360 $960 $1,122 QUESTION 7 River Falls Manufacturing uses a normal cost system and had the following data available for 2018: Direct materials purchased on account $145,000 Direct materials requisitioned 82,000 Direct labor cost incurred 127,000 Factory overhead incurred 140,000 Cost of goods completed 288,000 Cost of goods sold 24,000 Beginning direct materials inventory 25,000 Beginning WIP inventory 63,000 Beginning finished goods inventory 53,000 Overhead application rate, as a percent of direct labor costs 125 percent The ending balance of finished goods inventory is $53,000 $288,000 $40,000 $93.000 QUESTIONS Franklin Inc, manufactures pipes and applies manufacturing overhead costs to production at a budgeted indirect.cost rate of 515 per direct labor hour. The following data are obtained from the accounting records for June 2018: Direct materials $100,000 Direct labor (4,000 hours $10/hour) 40,000 Indirect labor 10,000 Plant facility rent 26,000 Depreciation on plant machinery and equipment 24,500 Sales commissions 23,000 Administrative expenses 31,000 The amount of manufacturing overhead allocated to all jobs during June 2018 totals $60,000 $60,500 $91,500 $76,000 QUESTION 9 River Falls Manufacturing uses a normal cost system and had the following data available for 2018: Direct materials purchased on account $150,000 Direct materials requisitioned 84,000 Direct labor cost incurred 125,000 Factory overhead incurred 146,000 Cost of goods completed 288,000 Cost of goods sold 258,000 Beginning direct materials inventory 25,000 Beginning WIP Inventory 69,000 Beginning finished goods inventory 51,000 Overhead application rate, as a percent of direct labor 120 percent costs The journal entry to record the materials placed into production would include a debit to Direct Materials Inventory for $150,000 debit to WIP Inventory or $150,000 credit to Direct Materials Inventory for $84,000 credit to WIP Inventory for $84,000