Answered step by step

Verified Expert Solution

Question

1 Approved Answer

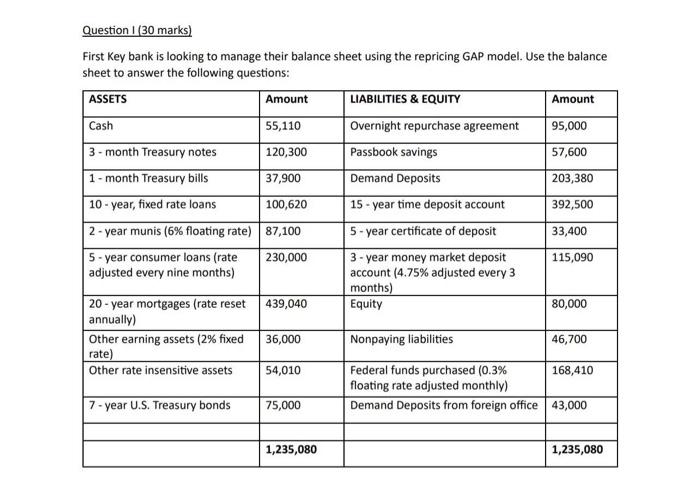

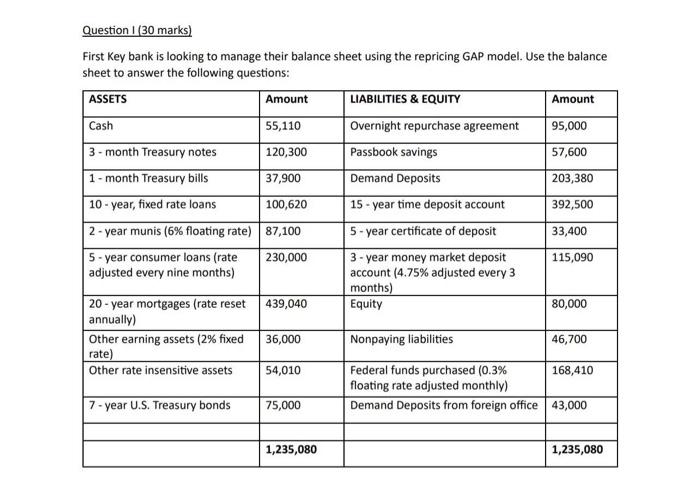

Questions please and thank you! First Key bank is looking to manage their balance sheet using the repricing GAP model. Use the balance sheet to

Questions please and thank you!

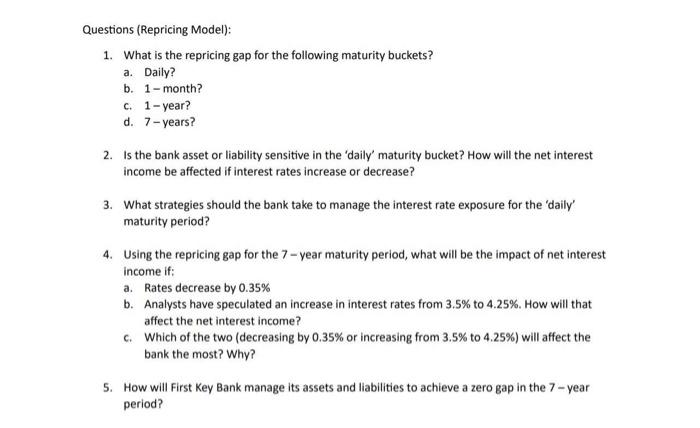

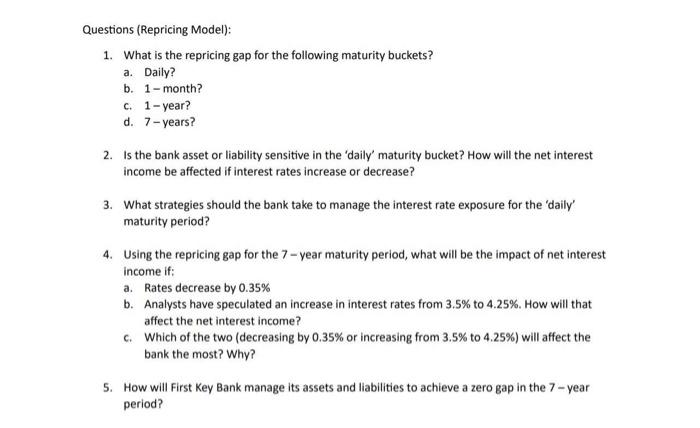

First Key bank is looking to manage their balance sheet using the repricing GAP model. Use the balance sheet to answer the following questions: 1. What is the repricing gap for the following maturity buckets? a. Daily? b. 1-month? c. 1-year? d. 7-years? 2. Is the bank asset or liability sensitive in the 'daily' maturity bucket? How will the net interest income be affected if interest rates increase or decrease? 3. What strategies should the bank take to manage the interest rate exposure for the 'daily' maturity period? 4. Using the repricing gap for the 7-year maturity period, what will be the impact of net interest income if: a. Rates decrease by 0.35% b. Analysts have speculated an increase in interest rates from 3.5% to 4.25%. How will that affect the net interest income? c. Which of the two (decreasing by 0.35% or increasing from 3.5% to 4.25% ) will affect the bank the most? Why? 5. How will First Key Bank manage its assets and liabilities to achieve a zero gap in the 7-year period

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started