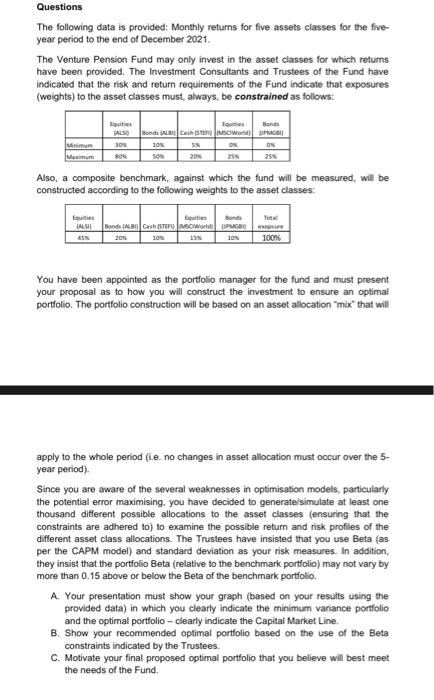

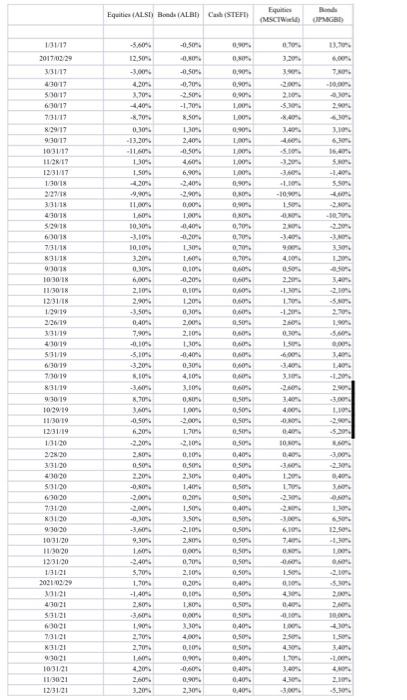

Questions The following data is provided: Monthly returns for five assets classes for the five- year period to the end of December 2021. The Venture Pension Fund may only invest in the asset classes for which returns have been provided. The Investment Consultants and Trustees of the Fund have indicated that the risk and return requirements of the Fund indicate that exposures (weights) to the asset classes must always, be constrained as follows: Equities Bonde ALSO sends. ChuCWMGO 10% ON 80 20 Minimum Mesum Also, a composite benchmark, against which the fund will be measured, will be constructed according to the following weights to the asset classes Equities Bond Total FALSE) Bonds BO Cash (SEFU World UPMGBEN 108 19 10 100% 2015 You have been appointed as the portfolio manager for the fund and must present your proposal as to how you will construct the investment to ensure an optimal portfolio. The portfolio construction will be based on an asset allocation "mix" that will apply to the whole period (.e. no changes in asset allocation must occur over the 5- year period) Since you are aware of the several weaknesses in optimisation models, particularly the potential error maximising, you have decided to generate simulate at least one thousand different possible allocations to the asset classes (ensuring that the constraints are adhered to) to examine the possible return and risk profiles of the different asset class allocations. The Trustees have insisted that you use Beta (as per the CAPM model) and standard deviation as your risk measures. In addition, they insist that the portfolio Beta (relative to the benchmark portfolio) may not vary by more than 0.15 above or below the Beta of the benchmark portfolio A. Your presentation must show your graph (based on your results using the provided data) in which you clearly indicate the minimum variance portfolio and the optimal portfolio - clearly indicate the Capital Market Line. B. Show your recommended optimal portfolio based on the use of the Beta constraints indicated by the Trustees. C. Motivate your final proposed optimal portfolio that you believe will best meet the needs of the Fund. Equities (ALSI) Bande (ALRD) Cash (STEF Equites (MSCW -560 90% 0,90 0.90 0.0 1.00 100 0.90 La -0.50 -0, -6.50% -0.70 -2.50 -1.30 X.Son 1.30 2.400 -0.50% 4.60 6,90 2.00 2.0 -S. .. 140 20 12,50 -3,00 4209 2,70 -4.40 -2.70 010 -13.20% 11.40 1.30 1.Son. 2004 9,90 11.00 1.60 10.10 -1.10%. 10,10 3.20 0.30 60 16. SON 1.00 1.00 SS -10: 1.50 . -300 20 -) 3030 0,70 0.70 0,70 0.70 060 0.6 0,00 100 so -0,40 -0.2014 1.30 1.60 0,109 -0.20% 0,10 1.20 0,30 2.000 2.10 1.10 -0.409 3.0 -1.30 170 -1. 2.0 2 -5 101/12 2017/02/29 30/12 4/3017 5:30:17 630/17 73117 :29/17 9:30/17 1031/17 112/17 12/31/17 1/30/18 327/18 3311 4/30/18 52918 630/18 73118 311 101 10:30/1 11/30/1 12/31/IN 19:19 2019 31/19 4/10/19 5:31/19 6/30/19 73019 831/19 9:30-19 102019 11/30/10 12/31/19 1/31/20 22820 33120 20:30 53120 6/10 20 73120 3120 9/30/20 10/31/20 11/3020 12/31/20 1/3121 2021 02/29 1121 4/30 21 53121 3021 73121 X3121 9:30:21 10/31/21 11/3021 12/31:21 06 _500 0.00 0.00 DAN 060 1 0,10 J. L. - 20 2.10 2.00% -3.50 0:40 7.90% - 10 -5.10 3.2013 10% -360 70 30 -0.50% 209 2.2014 2.0 0.50 220 -0, -2.00 2.00 -0.0 4,10 3,10 0,50 1.00 1.00 GON -0. L -3.00 1.30 . . 50 -3.0 9.30 1.0 0.00 . 0.50 0:50 . 0.50 0,40" 0.50 0.40 0.50 0.50 0:40 3.50 0.50% 0.0 .. 0.50 0,50 0.40 0.50 0,50 0.5 0,40% 0.50 0.50 0.40 0,40% 0.40 0.40% un 7 0,109 0.son 2.30 1.40 0,21 1.50 3.50 -2.10 2. 0.00 0,70 2,10 0209 0,10 1.NO 0.00 30 4,00 0,10 0,90 -0,60 0,19 2,30 - 1.50 5,701 1.70 -1.40% 20. -3/ 1.00 2.70 2,70 1.00 4.20 200 3.2015 4. . 2 40 17 3 3. -2.00 3.00 -3.0