Question

Questions The income statement that has been prepared by Recon Ltd.s accountant for the current year ending July 30 is as follows: Sales Revenue 750,000

Questions

The income statement that has been prepared by Recon Ltd.s accountant for the current year ending July 30 is as follows:

| Sales Revenue | 750,000 | ||

| Cost of Goods Sold | 270,000 | ||

| Gross Profit | 480,000 | ||

| Operating Expenses: | |||

| Salaries and Wages | 118,000 | ||

| Interest and Property taxes | 22,000 | ||

| Amortization expense (see Note 1) | 56,000 | ||

| Charitable donations | 2,700 | ||

| Life Insurance (see Note 2) | 6,600 | ||

| Meals and Entertainment (see Note 3) | 31,000 | ||

| Repairs and Maintenance (see Note 4) | 62,000 | ||

| Other operating expenses | 62,000 | 360,300 | |

| Operating income | 119,700 | ||

| Other revenue and expenses | |||

| Loss on sale of delivery vans | -56,000 | ||

| Interest revenue | 3,300 | ||

| Gain on sale of shares (Note 5) | 10,800 | ||

| Dividends from taxable Canadian corporations | 7,200 | -34,700 | |

| Income before taxes | 85,000 | ||

| Income tax expense | 6,750 | ||

| Income after taxes | 78,250 |

Note 1: Recons assets include:

| Cost | NBV | UCC | |

| Land | 350,000 | 375,000 | |

| Building | 560,000 | 380,000 | 340,000 |

| Furniture and equipment | 325,000 | 117,000 | 97,150 |

| Delivery vans | 320,000 | 186,000 | 115,280 |

During the year, Recon decided it would most cost effective to rent delivery vans as necessary than own the vehicles. Proceeds of $123,500 were received on the sale of the vans. New equipment and furniture was purchased for $50,500.

Note 2: Recon carries a life insurance policy on the major shareholder to ensure the company can survive until personnel can be replaced or redeployed in the event of his death.

Note 3: Meals and Entertainment expense included $5,000 to sponsor local childrens sports teams. The remainder was spent while entertaining clients.

Note 4: $23,000 was spent to replace leaking windows. The balance was spent to install a sky light above the employee breakroom.

Note 5: Recon sold shares for proceeds of $22,000. The shares had an original cost of $13,500.

Note 6: Recon has $4,800 (from 1997) in their net capital loss pool, and a $12,700 (from 2007) balance in their non-capital loss carryover pool.

REQUIRED: Ignore the temporary provision allowing immediate expensing of assets on pages 276 to 278 of your textbook.

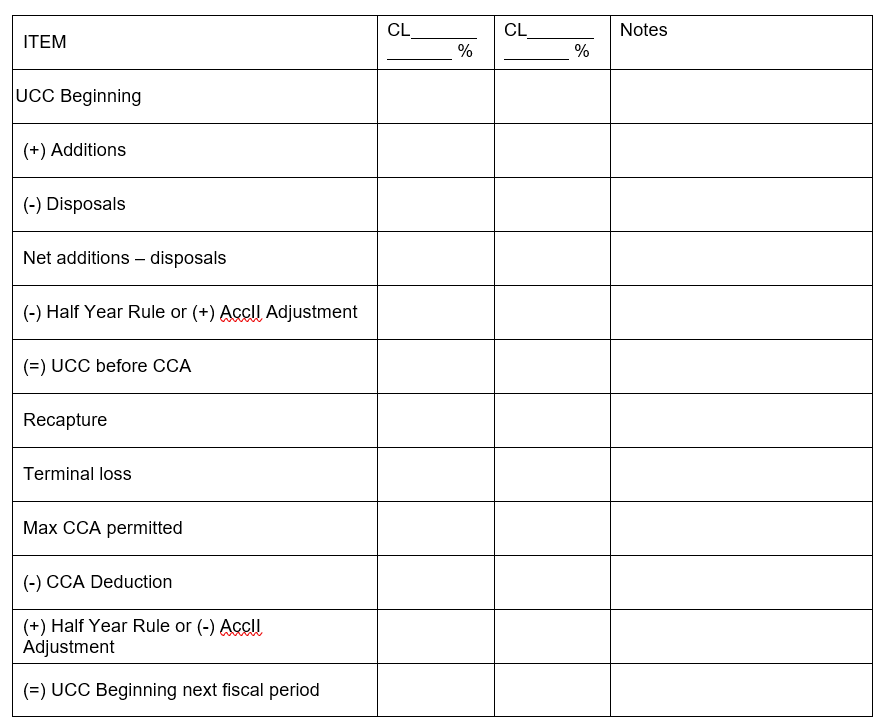

Assignment 1 Capital Cost Allowance Schedule (CCA):

Using an Excel workbook, prepare the CCA schedule in good form for Recon Ltd. You may use the vertical format as in the textbook:

CCA Schedule (Alternative to Schedule 8)

\begin{tabular}{|c|c|c|c|} \hline ITEM & CL% & CL_% & Notes \\ \hline \multicolumn{4}{|l|}{ UCC Beginning } \\ \hline \multicolumn{4}{|l|}{ (+) Additions } \\ \hline \multicolumn{4}{|l|}{ (-) Disposals } \\ \hline \multicolumn{4}{|l|}{ Net additions - disposals } \\ \hline \multicolumn{4}{|c|}{ (-) Half Year Rule or (+) Accll Adjustment } \\ \hline \multicolumn{4}{|l|}{ (=) UCC before CCA } \\ \hline \multicolumn{4}{|l|}{ Recapture } \\ \hline \multicolumn{4}{|l|}{ Terminal loss } \\ \hline \multicolumn{4}{|l|}{ Max CCA permitted } \\ \hline \multicolumn{4}{|l|}{ (-) CCA Deduction } \\ \hline \multicolumn{4}{|l|}{\begin{tabular}{l} (+) Half Year Rule or (-) Accll \\ Adjustment \end{tabular}} \\ \hline (=) UCC Beginning next fiscal period & & & \\ \hline \end{tabular}

\begin{tabular}{|c|c|c|c|} \hline ITEM & CL% & CL_% & Notes \\ \hline \multicolumn{4}{|l|}{ UCC Beginning } \\ \hline \multicolumn{4}{|l|}{ (+) Additions } \\ \hline \multicolumn{4}{|l|}{ (-) Disposals } \\ \hline \multicolumn{4}{|l|}{ Net additions - disposals } \\ \hline \multicolumn{4}{|c|}{ (-) Half Year Rule or (+) Accll Adjustment } \\ \hline \multicolumn{4}{|l|}{ (=) UCC before CCA } \\ \hline \multicolumn{4}{|l|}{ Recapture } \\ \hline \multicolumn{4}{|l|}{ Terminal loss } \\ \hline \multicolumn{4}{|l|}{ Max CCA permitted } \\ \hline \multicolumn{4}{|l|}{ (-) CCA Deduction } \\ \hline \multicolumn{4}{|l|}{\begin{tabular}{l} (+) Half Year Rule or (-) Accll \\ Adjustment \end{tabular}} \\ \hline (=) UCC Beginning next fiscal period & & & \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started