Answered step by step

Verified Expert Solution

Question

1 Approved Answer

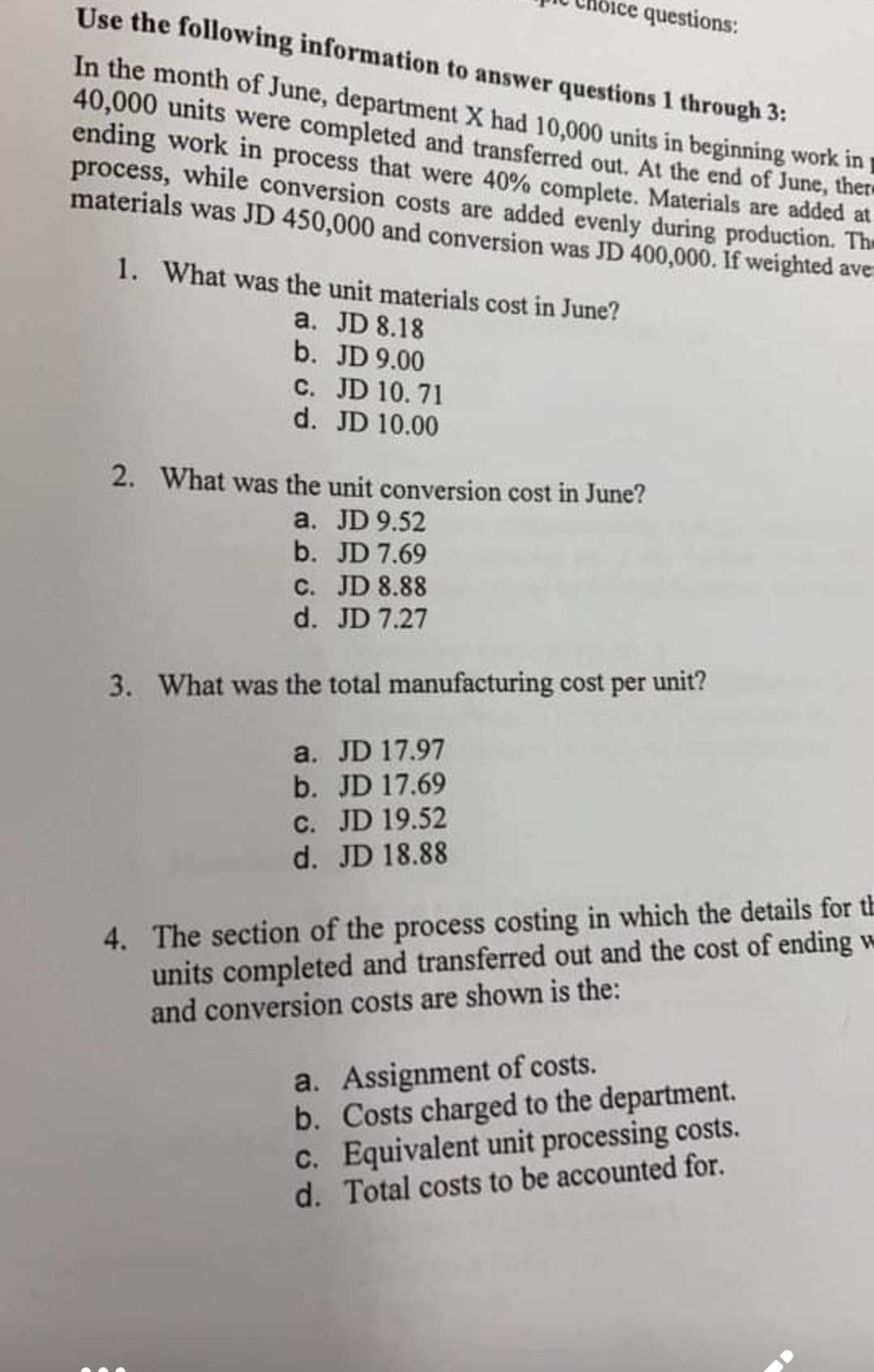

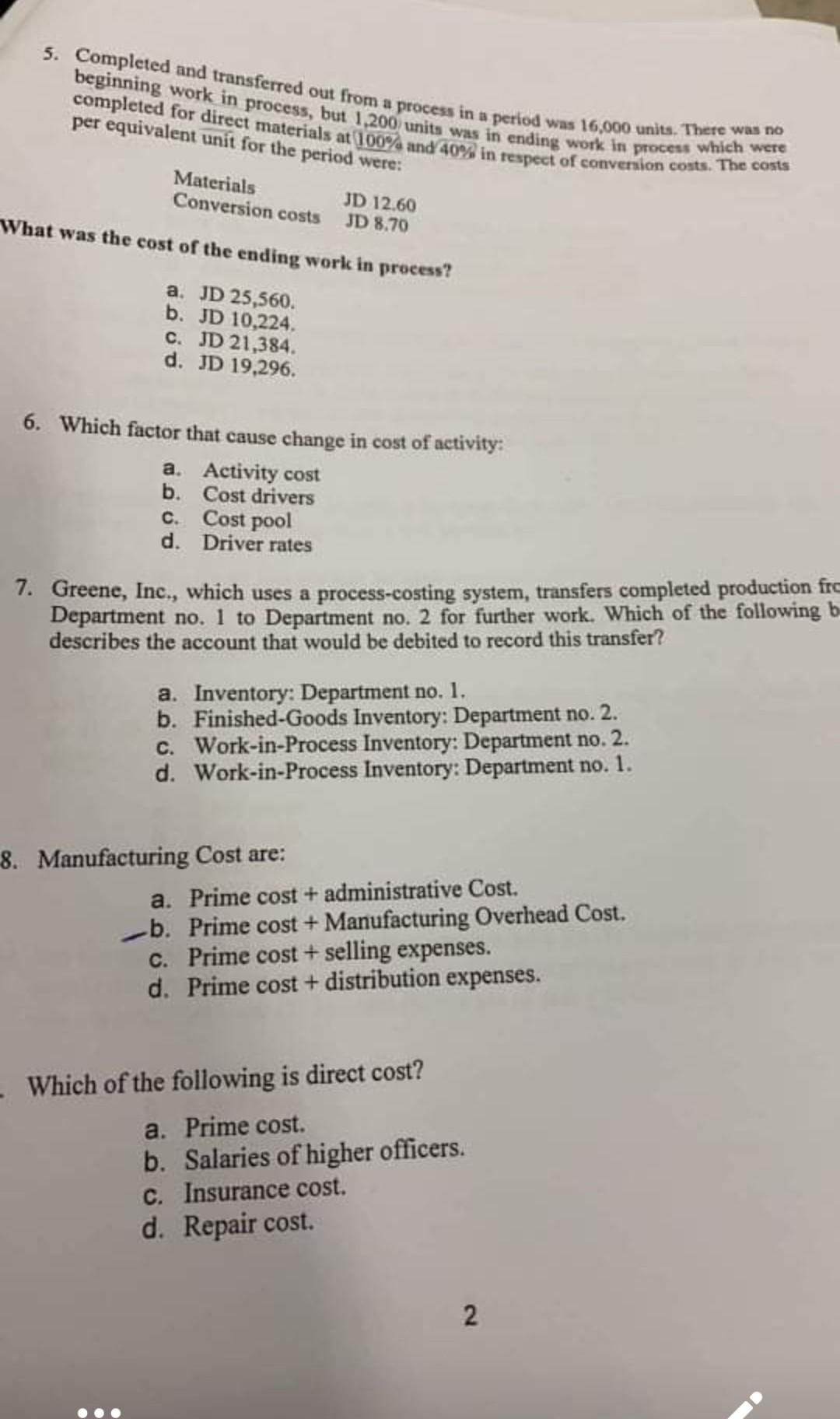

questions: Use the following information to answer questions 1 through 3: In the month of June, department X had 10,000 units in beginning work in

questions: Use the following information to answer questions 1 through 3: In the month of June, department X had 10,000 units in beginning work in 40,000 units were completed and transferred out. At the end of June, there ending work in process that were 40% complete. Materials are added at process, while conversion costs are added evenly during production. Th materials was JD 450,000 and conversion was JD 400,000. If weighted ave 1. What was the unit materials cost in June? a. JD 8.18 b. JD 9.00 C. JD 10.71 d. JD 10.00 2. What was the unit conversion cost in June? a. JD 9.52 b. JD 7.69 C. JD 8.88 d. JD 7.27 3. What was the total manufacturing cost per unit? a. JD 17.97 b. JD 17.69 C. JD 19.52 d. JD 18.88 4. The section of the process costing in which the details for th units completed and transferred out and the cost of ending w and conversion costs are shown is the: a. Assignment of costs. b. Costs charged to the department. c. Equivalent unit processing costs. d. Total costs to be accounted for. 5. Completed and transferred out from a process in a period was 16,000 units. There was no beginning work in process, but 1.200 units was in ending work in process which were per equivalent unit for the period were: completed for direct materials at 100% and 40% in respect of conversion costs. The costs Materials JD 12.60 Conversion costs JD 8.70 What was the cost of the ending work in process? a. JD 25,560. b. JD 10,224. c. JD 21,384. d. JD 19,296. 6. Which factor that cause change in cost of activity: a. Activity cost b. Cost drivers c. Cost pool d. Driver rates 7. Greene, Inc., which uses a process-costing system, transfers completed production fr Department no. 1 to Department no. 2 for further work. Which of the following b describes the account that would be debited to record this transfer? a. Inventory: Department no. 1. b. Finished-Goods Inventory: Department no. 2. C. Work-in-Process Inventory: Department no. 2. d. Work-in-Process Inventory: Department no. 1. 8. Manufacturing Cost are: a. Prime cost + administrative Cost. b. Prime cost + Manufacturing Overhead Cost. c. Prime cost + selling expenses. d. Prime cost + distribution expenses. Which of the following is direct cost? a. Prime cost. b. Salaries of higher officers. C. Insurance cost. d. Repair cost. 2 questions: Use the following information to answer questions 1 through 3: In the month of June, department X had 10,000 units in beginning work in 40,000 units were completed and transferred out. At the end of June, there ending work in process that were 40% complete. Materials are added at process, while conversion costs are added evenly during production. Th materials was JD 450,000 and conversion was JD 400,000. If weighted ave 1. What was the unit materials cost in June? a. JD 8.18 b. JD 9.00 C. JD 10.71 d. JD 10.00 2. What was the unit conversion cost in June? a. JD 9.52 b. JD 7.69 C. JD 8.88 d. JD 7.27 3. What was the total manufacturing cost per unit? a. JD 17.97 b. JD 17.69 C. JD 19.52 d. JD 18.88 4. The section of the process costing in which the details for th units completed and transferred out and the cost of ending w and conversion costs are shown is the: a. Assignment of costs. b. Costs charged to the department. c. Equivalent unit processing costs. d. Total costs to be accounted for. 5. Completed and transferred out from a process in a period was 16,000 units. There was no beginning work in process, but 1.200 units was in ending work in process which were per equivalent unit for the period were: completed for direct materials at 100% and 40% in respect of conversion costs. The costs Materials JD 12.60 Conversion costs JD 8.70 What was the cost of the ending work in process? a. JD 25,560. b. JD 10,224. c. JD 21,384. d. JD 19,296. 6. Which factor that cause change in cost of activity: a. Activity cost b. Cost drivers c. Cost pool d. Driver rates 7. Greene, Inc., which uses a process-costing system, transfers completed production fr Department no. 1 to Department no. 2 for further work. Which of the following b describes the account that would be debited to record this transfer? a. Inventory: Department no. 1. b. Finished-Goods Inventory: Department no. 2. C. Work-in-Process Inventory: Department no. 2. d. Work-in-Process Inventory: Department no. 1. 8. Manufacturing Cost are: a. Prime cost + administrative Cost. b. Prime cost + Manufacturing Overhead Cost. c. Prime cost + selling expenses. d. Prime cost + distribution expenses. Which of the following is direct cost? a. Prime cost. b. Salaries of higher officers. C. Insurance cost. d. Repair cost. 2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started