Answered step by step

Verified Expert Solution

Question

1 Approved Answer

questionsn in yellow is what i need help on 1. Calculate the projected annual demand volume in cases and dollars, average daily volume in cases

questionsn in yellow is what i need help on

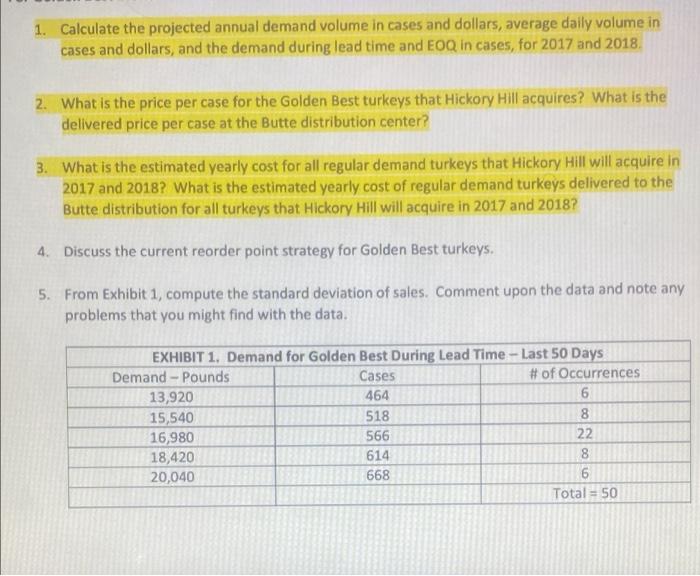

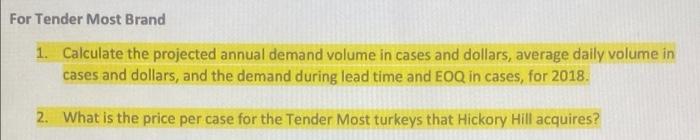

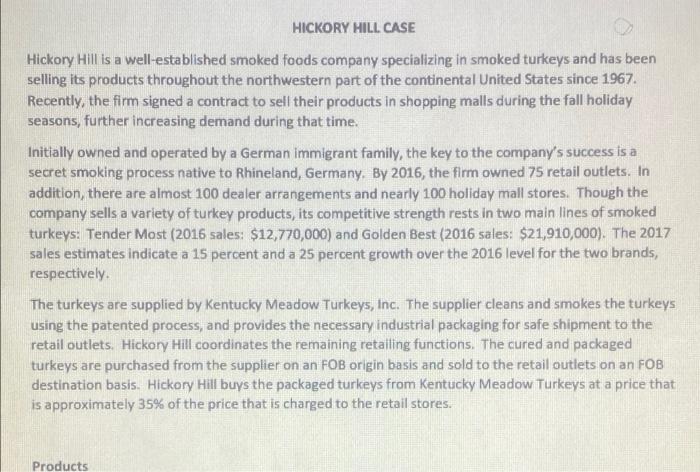

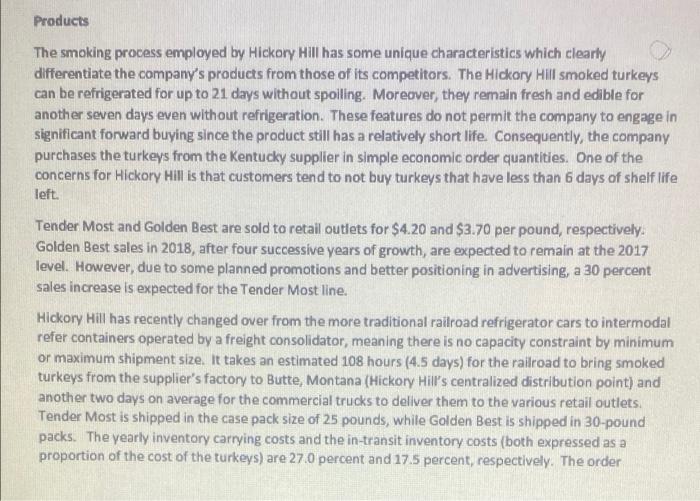

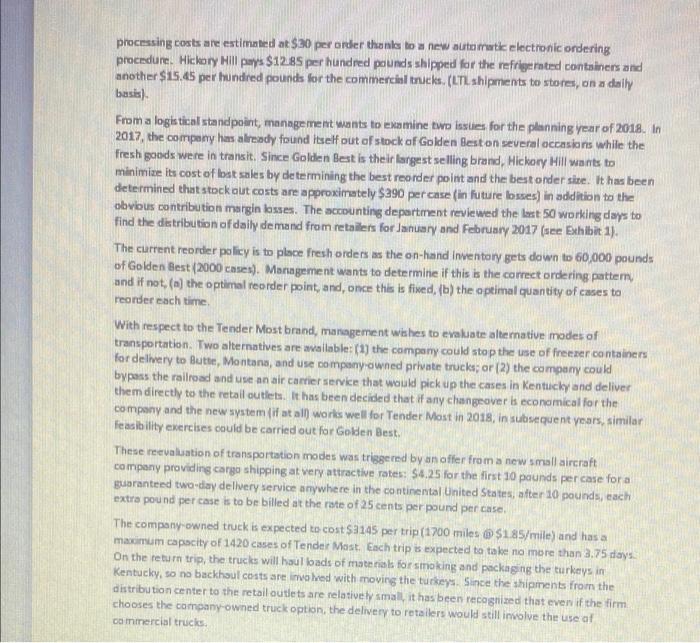

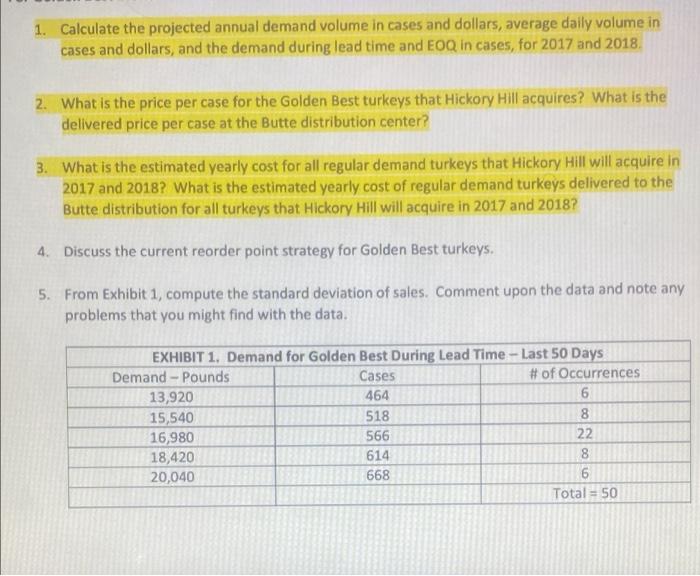

1. Calculate the projected annual demand volume in cases and dollars, average daily volume in cases and dollars, and the demand during lead time and EOQ in cases, for 2017 and 2018 2. What is the price per case for the Golden Best turkeys that Hickory Hill acquires? What is the delivered price per case at the Butte distribution center? 3. What is the estimated yearly cost for all regular demand turkeys that Hickory Hill will acquire in 2017 and 2018? What is the estimated yearly cost of regular demand turkeys delivered to the Butte distribution for all turkeys that Hickory Hill will acquire in 2017 and 2018? 4. Discuss the current reorder point strategy for Golden Best turkeys, 5. From Exhibit 1, compute the standard deviation of sales. Comment upon the data and note any problems that you might find with the data. EXHIBIT 1. Demand for Golden Best During Lead Time - Last 50 Days Demand - Pounds Cases # of Occurrences 13,920 464 6 15,540 518 8 16,980 566 22 18,420 614 8 20,040 668 6 Total = 50 For Tender Most Brand 1. Calculate the projected annual demand volume in cases and dollars, average daily volume in cases and dollars, and the demand during lead time and EOQ in cases, for 2018. 2. What is the price per case for the Tender Most turkeys that Hickory Hill acquires? HICKORY HILL CASE Hickory Hill is a well-established smoked foods company specializing in smoked turkeys and has been selling its products throughout the northwestern part of the continental United States since 1967. Recently, the firm signed a contract to sell their products in shopping malls during the fall holiday seasons, further increasing demand during that time. Initially owned and operated by a German immigrant family, the key to the company's success is a secret smoking process native to Rhineland, Germany. By 2016, the firm owned 75 retail outlets. In addition, there are almost 100 dealer arrangements and nearly 100 holiday mall stores. Though the company sells a variety of turkey products, its competitive strength rests in two main lines of smoked turkeys. Tender Most (2016 sales: $12,770,000) and Golden Best (2016 sales: $21,910,000). The 2017 sales estimates indicate a 15 percent and a 25 percent growth over the 2016 level for the two brands, respectively. The turkeys are supplied by Kentucky Meadow Turkeys, Inc. The supplier cleans and smokes the turkeys using the patented process, and provides the necessary industrial packaging for safe shipment to the retail outlets. Hickory Hill coordinates the remaining retailing functions. The cured and packaged turkeys are purchased from the supplier on an FOB origin basis and sold to the retail outlets on an FOB destination basis. Hickory Hill buys the packaged turkeys from Kentucky Meadow Turkeys at a price that is approximately 35% of the price that is charged to the retail stores. Products Products The smoking process employed by Hickory Hill has some unique characteristics which clearly differentiate the company's products from those of its competitors. The Hickory Hill smoked turkeys can be refrigerated for up to 21 days without spoiling. Moreover, they remain fresh and edible for another seven days even without refrigeration. These features do not permit the company to engage in significant forward buying since the product still has a relatively short life. Consequently, the company purchases the turkeys from the Kentucky supplier in simple economic order quantities. One of the concerns for Hickory Hill is that customers tend to not buy turkeys that have less than 6 days of shelf life left. Tender Most and Golden Best are sold to retail outlets for $4.20 and $3.70 per pound, respectively. Golden Best sales in 2018, after four successive years of growth, are expected to remain at the 2017 level. However, due to some planned promotions and better positioning in advertising, a 30 percent sales increase is expected for the Tender Most line. Hickory Hill has recently changed over from the more traditional railroad refrigerator cars to intermodal refer containers operated by a freight consolidator, meaning there is no capacity constraint by minimum or maximum shipment size. It takes an estimated 108 hours (4.5 days) for the railroad to bring smoked turkeys from the supplier's factory to Butte, Montana (Hickory Hill's centralized distribution point) and another two days on average for the commercial trucks to deliver them to the various retail outlets. Tender Most is shipped in the case pack size of 25 pounds, while Golden Best is shipped in 30-pound packs. The yearly inventory carrying costs and the in-transit inventory costs (both expressed as a proportion of the cost of the turkeys) are 27.0 percent and 17.5 percent, respectively. The order processing costs are estimated at $30 per order thanks to a new automatic electronic ordering procedure. Hickory Hill pays $12.85 per hundred pounds shipped for the refrigerated containers and another $15.45 per hundred pounds for the commercial trucks (LTL shipments to stores, on a daily basis). From a logistical standpoint, management wants to examine two issues for the planning year of 2018. In 2017, the company has already found itself out of stock of Golden Best on several occasions while the fresh goods were in transit. Since Golden Best is their largest selling brand, Hickory Hill wants to minimize its cost of lost sales by determining the best reorder point and the best order site. It has been determined that stock aut costs are approximately $290 percase (in future losses) in addition to the obvious contribution margin losses. The accounting department reviewed the last 50 working days to find the distribution of daily demand from retailers for January and February 2017 (see Exhibit 1). The current reorder policy is to place fresh orders as the on-hand Inventory gets down to 60,000 pounds of Golden Best (2000 cases). Management wants to determine if this is the correct ordering pattem, and if not, (a) the optimal reorder point, and, once this is fixed. (b) the optimal quantity of cases to reorder each time With respect to the Tender Most brand, management wishes to evaluate alternative modes of transportation. Two alternatives are available: (1) the company could stop the use of freezer containers for delivery to Butte, Montana, and use company-owned private truck; or (2) the company could bypass the railroad and use an air carrier service that would pick up the cases in Kentucky and deliver them directly to the retail outlets. It has been decided that if any changeover is economical for the company and the new system (if at all) works well for Tender Most in 2018, in subsequent years, similar feasibility exercises could be carried out for Golden Best. These reevaluation of transportation modes was triggered by an offer from a new small aircraft company providing cargo shipping at very attractive rates: $4,25 for the first 10 pounds per case for a guaranteed two-day delivery service anywhere in the continental United States, after 10 pounds, each extra pound per case is to be billed at the rate of 25 cents per pound percase The company-owned truck is expected to cost $3145 per trip (1700 miles @$185/mile) and has a maximum capacity of 1420 cases of Tender Mast. Each trip is expected to take no more than 3.75 days On the return trip, the trucks will haul loads of material for smoking and packaging the turkeys in Kentucky, so no backhoul costs are involved with moving the turkeys. Since the shipments from the distribution center to the retail outlets are relatively small, it has been recognized that even if the firm chooses the company-owned truck option, the delivery to retailers would still involve the use of commercial trucks 1. Calculate the projected annual demand volume in cases and dollars, average daily volume in cases and dollars, and the demand during lead time and EOQ in cases, for 2017 and 2018 2. What is the price per case for the Golden Best turkeys that Hickory Hill acquires? What is the delivered price per case at the Butte distribution center? 3. What is the estimated yearly cost for all regular demand turkeys that Hickory Hill will acquire in 2017 and 2018? What is the estimated yearly cost of regular demand turkeys delivered to the Butte distribution for all turkeys that Hickory Hill will acquire in 2017 and 2018? 4. Discuss the current reorder point strategy for Golden Best turkeys, 5. From Exhibit 1, compute the standard deviation of sales. Comment upon the data and note any problems that you might find with the data. EXHIBIT 1. Demand for Golden Best During Lead Time - Last 50 Days Demand - Pounds Cases # of Occurrences 13,920 464 6 15,540 518 8 16,980 566 22 18,420 614 8 20,040 668 6 Total = 50 For Tender Most Brand 1. Calculate the projected annual demand volume in cases and dollars, average daily volume in cases and dollars, and the demand during lead time and EOQ in cases, for 2018. 2. What is the price per case for the Tender Most turkeys that Hickory Hill acquires? HICKORY HILL CASE Hickory Hill is a well-established smoked foods company specializing in smoked turkeys and has been selling its products throughout the northwestern part of the continental United States since 1967. Recently, the firm signed a contract to sell their products in shopping malls during the fall holiday seasons, further increasing demand during that time. Initially owned and operated by a German immigrant family, the key to the company's success is a secret smoking process native to Rhineland, Germany. By 2016, the firm owned 75 retail outlets. In addition, there are almost 100 dealer arrangements and nearly 100 holiday mall stores. Though the company sells a variety of turkey products, its competitive strength rests in two main lines of smoked turkeys. Tender Most (2016 sales: $12,770,000) and Golden Best (2016 sales: $21,910,000). The 2017 sales estimates indicate a 15 percent and a 25 percent growth over the 2016 level for the two brands, respectively. The turkeys are supplied by Kentucky Meadow Turkeys, Inc. The supplier cleans and smokes the turkeys using the patented process, and provides the necessary industrial packaging for safe shipment to the retail outlets. Hickory Hill coordinates the remaining retailing functions. The cured and packaged turkeys are purchased from the supplier on an FOB origin basis and sold to the retail outlets on an FOB destination basis. Hickory Hill buys the packaged turkeys from Kentucky Meadow Turkeys at a price that is approximately 35% of the price that is charged to the retail stores. Products Products The smoking process employed by Hickory Hill has some unique characteristics which clearly differentiate the company's products from those of its competitors. The Hickory Hill smoked turkeys can be refrigerated for up to 21 days without spoiling. Moreover, they remain fresh and edible for another seven days even without refrigeration. These features do not permit the company to engage in significant forward buying since the product still has a relatively short life. Consequently, the company purchases the turkeys from the Kentucky supplier in simple economic order quantities. One of the concerns for Hickory Hill is that customers tend to not buy turkeys that have less than 6 days of shelf life left. Tender Most and Golden Best are sold to retail outlets for $4.20 and $3.70 per pound, respectively. Golden Best sales in 2018, after four successive years of growth, are expected to remain at the 2017 level. However, due to some planned promotions and better positioning in advertising, a 30 percent sales increase is expected for the Tender Most line. Hickory Hill has recently changed over from the more traditional railroad refrigerator cars to intermodal refer containers operated by a freight consolidator, meaning there is no capacity constraint by minimum or maximum shipment size. It takes an estimated 108 hours (4.5 days) for the railroad to bring smoked turkeys from the supplier's factory to Butte, Montana (Hickory Hill's centralized distribution point) and another two days on average for the commercial trucks to deliver them to the various retail outlets. Tender Most is shipped in the case pack size of 25 pounds, while Golden Best is shipped in 30-pound packs. The yearly inventory carrying costs and the in-transit inventory costs (both expressed as a proportion of the cost of the turkeys) are 27.0 percent and 17.5 percent, respectively. The order processing costs are estimated at $30 per order thanks to a new automatic electronic ordering procedure. Hickory Hill pays $12.85 per hundred pounds shipped for the refrigerated containers and another $15.45 per hundred pounds for the commercial trucks (LTL shipments to stores, on a daily basis). From a logistical standpoint, management wants to examine two issues for the planning year of 2018. In 2017, the company has already found itself out of stock of Golden Best on several occasions while the fresh goods were in transit. Since Golden Best is their largest selling brand, Hickory Hill wants to minimize its cost of lost sales by determining the best reorder point and the best order site. It has been determined that stock aut costs are approximately $290 percase (in future losses) in addition to the obvious contribution margin losses. The accounting department reviewed the last 50 working days to find the distribution of daily demand from retailers for January and February 2017 (see Exhibit 1). The current reorder policy is to place fresh orders as the on-hand Inventory gets down to 60,000 pounds of Golden Best (2000 cases). Management wants to determine if this is the correct ordering pattem, and if not, (a) the optimal reorder point, and, once this is fixed. (b) the optimal quantity of cases to reorder each time With respect to the Tender Most brand, management wishes to evaluate alternative modes of transportation. Two alternatives are available: (1) the company could stop the use of freezer containers for delivery to Butte, Montana, and use company-owned private truck; or (2) the company could bypass the railroad and use an air carrier service that would pick up the cases in Kentucky and deliver them directly to the retail outlets. It has been decided that if any changeover is economical for the company and the new system (if at all) works well for Tender Most in 2018, in subsequent years, similar feasibility exercises could be carried out for Golden Best. These reevaluation of transportation modes was triggered by an offer from a new small aircraft company providing cargo shipping at very attractive rates: $4,25 for the first 10 pounds per case for a guaranteed two-day delivery service anywhere in the continental United States, after 10 pounds, each extra pound per case is to be billed at the rate of 25 cents per pound percase The company-owned truck is expected to cost $3145 per trip (1700 miles @$185/mile) and has a maximum capacity of 1420 cases of Tender Mast. Each trip is expected to take no more than 3.75 days On the return trip, the trucks will haul loads of material for smoking and packaging the turkeys in Kentucky, so no backhoul costs are involved with moving the turkeys. Since the shipments from the distribution center to the retail outlets are relatively small, it has been recognized that even if the firm chooses the company-owned truck option, the delivery to retailers would still involve the use of commercial trucks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started