Answered step by step

Verified Expert Solution

Question

1 Approved Answer

quick answer plz it is complete case study in 3 images plz quick answer. plz aleast just solve part A 1996 $95.627 1.146 04.773 74,505

quick answer plz

it is complete case study in 3 images

plz quick answer.

plz aleast just solve part A

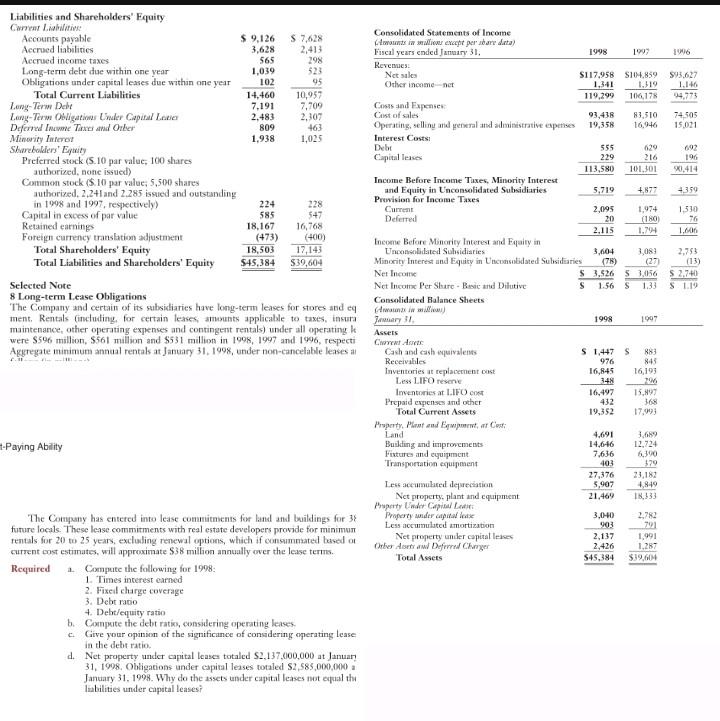

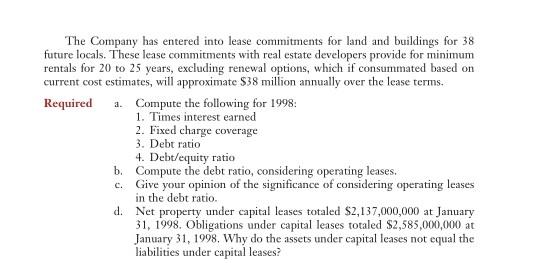

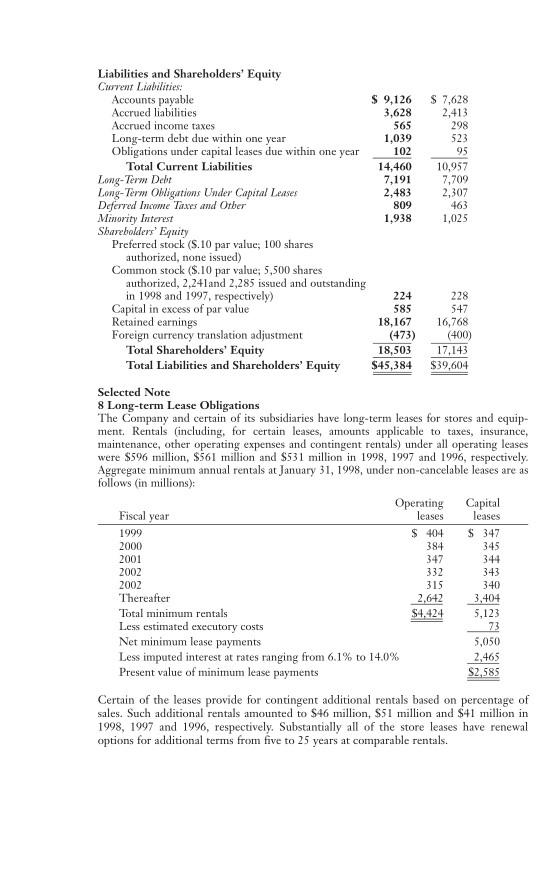

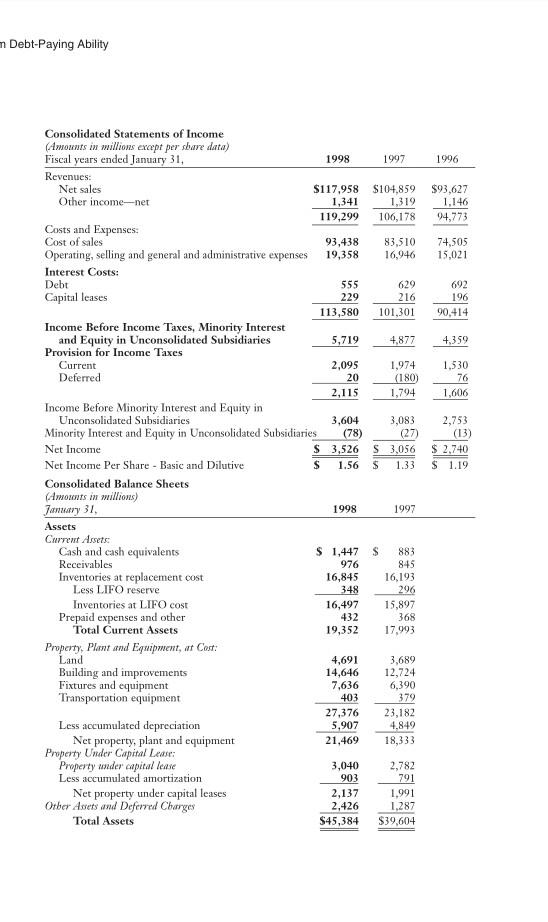

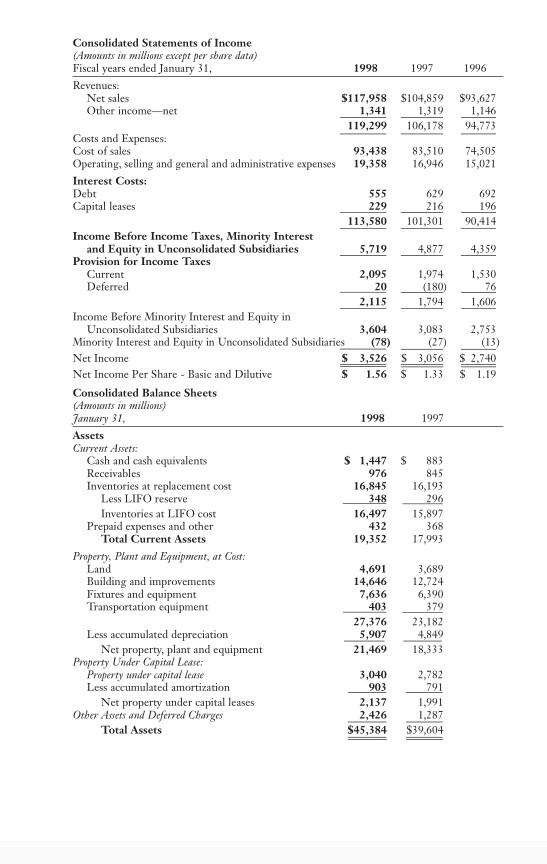

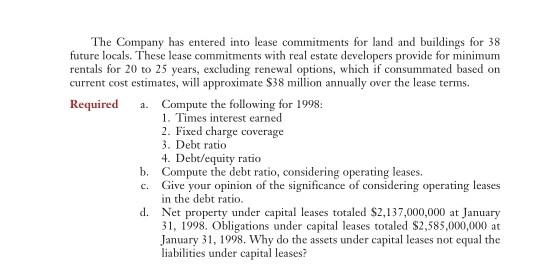

1996 $95.627 1.146 04.773 74,505 15.021 16946 196 X1,414 Liabilities and Shareholders' Equity Current Liabile Accounts payable $ 9,126 $ 7.628 Accrued liabilities 3,628 2,413 Accrued income taxes 565 298 Long-term debt due within one year 1,039 523 Obligations under capital leases due within one year 102 95 Total Current Liabilities 14,460 10,957 Long-Terw Delt 7.191 7,709 Lan - Terw Wigation Under Capital Louie 2.483 2,307 Deferred Inme Tax and Other 809 463 Minority Inter 1.938 1,025 Shurebollers' Equity Preferred stock (5.10 par valuc, 100 shares authorized, none issued) Common stock (5. 10 par value, 5,500 shares authorized 2,24 and 2.285 issued and outstanding in 1998 and 1997, respectively) 224 228 Capital in excess of par value 585 547 Retained earnings 18.167 16,768 Foreign currency translation adjustment (473) (400) Total Shareholders' Equity 18,503 17,143 Total Liabilities and Shareholders' Equity $45,384 539,604 Selected Note 8 Long-term Lease Obligations The Company and certain of its subsidiaries have long-term leases for stores and eq ment Rentals (including, for certain leases amants applicable to taxes, insura maintenance, other operating expenses and contingent rentals) under all operating k were $596 million, 5561 million and $531 million in 1998, 1997 and 1996, respecti Aggregate minimum annual rentals at January 31, 1998, under non-cancelable leases ar +359 1.510 76 1.04 2,753 (13) $ 2.740 S 1.19 Consolidated Statements of Income monts i except per bare data) Fiscal years ended January 31, 1998 1997 Revenues: Net sules $117.958 S104.859 Other income-net 1,341 1.119 119,299 11,178 Cost and Expenses Cost of sales 93,438 83,510 Operating, selline anal general til andeninistrative expenses 19,358 Interest Costs Debt 555 Capital lexes 229 216 113.580 101.301 Income Before Income Taxes. Minority Interest and Equity in Unconsolidated Subsidiaries 5,719 +,874 Provision for Income Taxes Current 2,095 1,974 Deferred 20 (180) 2,115 1.74 Income Before Minority Interest and Equity in Unconsolidated Subsidiaries 3,604 3,081 Minority Interest and Equity in Unconsolidated Subsidiaries (78) (27) Net Income $ 3,526 5 3,056 Net Income Per Share Besic and Dilutive S 1.56 S 1.33 Consolidated Balance Sheets ( Aww. Juary 31 1998 1997 Assets Corrent drets Cash and cash wuivalents S 1,447 S 883 Receivables 976 845 Inventaries it replacement est 16,845 16,193 Less LIFO resene 348 2 Inventories at LIFO 16,497 15,197 Prepard expenses and other 368 Total Current Assets 19,352 17,90 Property w portar Coats Land 4.691 Building and improvements 14,646 12,724 Fixtures and equipment 7,636 600 Transportation equipment 403 529 27,376 23,182 Les accumulated depreciation 5,907 4,849 Net property, plant and equipment 21,469 Property Under Copia La Propery surfier arpital has 3.040 Less accumulated amortization 903 Net property under capital laces 2.117 1,901 Orber dorty w Deformed Churn 2,426 1.287 Total Assets 545,384 $39,604 432 -Paying Ability The Company has entered into lease commitments for land and buildings for 38 future locals. These lease commitments with real estate developers provide for minimum Tentals for 20 to 25 years, excluding renewal options, which if consummated based on current cost estimates will approximate $38 million annually over the lease terms. Required Compute the following for 1998: 1. Times interest earned 2. Fixeil charge coverage 3. Debt ratio 4. Debt/equity ratio b. Compute the debt ratio, cunsidering operating leases c. Give your opinion of the significance of considering operating lease in the debt ratio. d. Net property under capital leuses totaled $2.137.000.000 at January 31, 1998. Obligations under capital leases totaled S2.585,000,000 January 31. 1998. Why do the assets under capital leases not equal thu Isabilities under capital leases The Company has entered into lease commitments for land and buildings for 38 future locals. These lease commitments with real estate developers provide for minimum rentals for 20 to 25 years, excluding renewal options, which if consummated based on current cost estimates, will approximate $38 million annually over the lease terms. Required 1. Compute the following for 1998: 1. Times interest earned 2. Fixed charge coverage 3. Debt ratio 4. Debt/equity ratio b. Compute the debt ratio, considering operating leases. c. Give your opinion of the significance of considering operating leases in the debt ratio. d. Net property under capital leases totaled $2,137,000,000 at January 31, 1998. Obligations under capital leases totaled $2,585,000,000 at January 31, 1998. Why do the assets under capital leases not equal the liabilities under capital leases? Liabilities and Shareholders' Equity Current Liabilities: Accounts payable $9,126 $ 7,628 Accrued liabilities 3,628 2,413 Accrued income taxes 565 298 Long-term debt due within one year 1,039 523 Obligations under capital leases due within one year 102 95 Total Current Liabilities 14,460 10,957 Long-Term Delt 7,191 7,709 Long-Term Owigations Under Capital Leases 2,483 2,307 Deferred Income Taxes and Other 809 463 Minority Interest 1,938 1,025 Shareholders' Equity Preferred stock (S. 10 par value, 100 shares authorized, none issued) Common stock (S. 10 par value; 5,500 shares authorized, 2,241 and 2,285 issued and outstanding in 1998 and 1997, respectively) 224 228 Capital in excess of par value 585 547 Retained earnings 18,167 16,768 Foreign currency translation adjustment (473) (400) Total Shareholders' Equity 18,503 17,143 Total Liabilities and Shareholders' Equity $45,384 $39,604 Selected Note 8 Long-term Lease Obligations The Company and certain of its subsidiaries have long-term leases for stores and equip- ment. Rentals (including, for certain leases, amounts applicable to taxes, insurance, maintenance, other operating expenses and contingent rentals) under all operating leases were $596 million, S561 million and $531 million in 1998, 1997 and 1996, respectively. Aggregate minimum annual rentals at January 31, 1998, under non-cancelable leases are as follows (in millions): Operating Capital Fiscal year leases leases 1999 $ 404 $ 347 2000 384 345 2001 347 344 2002 332 343 2002 315 340 Thereafter 2,642 3,404 Total minimum rentals $4.424 5,123 Less estimated executory costs 73 Net minimum lease payments 5,050 Less imputed interest at rates ranging from 6,1% to 14.0% 2,465 Present value of minimum lease payments S2,585 Certain of the leases provide for contingent additional rentals based on percentage of sales. Such additional rentals amounted to $46 million, 51 million and $41 million in 1998, 1997 and 1996, respectively. Substantially all of the store leases have renewal options for additional terms from five to 25 years at comparable rentals. n Debt-Paying Ability 1996 $93,627 1,146 94,773 74,505 15,021 692 196 90,414 4.359 1.530 76 1,606 2,753 (13) $ 2,740 $ 1.19 Consolidated Statements of Income (Amounts in millions except per sbare data) Fiscal years ended January 31, 1998 1997 Revenues: Net sales $117.958 $104,859 Other income--net 1,341 1,319 119,299 106,178 Costs and Expenses: Cost of sales 93,438 83,510 Operating, selling and general and administrative expenses 19,358 16,946 Interest Costs: Debt 555 629 Capital cases 229 216 113,580 101,301 Income Before Income Taxes, Minority Interest and Equity in Unconsolidated Subsidiaries 5,719 4,877 Provision for Income Taxes Current 2,095 1,974 Deferred 20 (180) 2,115 1,794 Income Before Minority Interest and Equity in Unconsolidated Subsidiaries 3,604 3,083 Minority Interest and Equity in Unconsolidated Subsidiaries (78) (27) Net Income $ 3,526 S 3,056 Net Income Per Share - Basic and Dilutive $ 1.56 $ 1.33 Consolidated Balance Sheets (Amounts in millions) January 31, 1998 1997 Assets Current Assets Cash and cash equivalents $ 1,447 $ 883 Receivables 976 845 Inventories at replacement cost 16,845 16,193 Less LIFO reserve 348 296 Inventories at LIFO cost 16,497 15,897 Prepaid expenses and other 432 368 Total Current Assets 19,352 17,993 Property. Plant and Equipment, at Cast: Land 4,691 3,689 Building and improvements 14,646 12,724 Fixtures and equipment 7.636 6,390 Transportation equipment 403 379 27,376 23,182 Less accumulated depreciation 5,907 4,849 Net property, plant and equipment 21,469 18,333 Property Under Capital Lease: Property under capital loete 3,040 2,782 Less accumulated amortization 903 791 Net property under capital leases 2,137 1,991 Other Assets and Deferred Charges 2,426 1,287 Total Assets $45,384 $39,604 1996 $93,627 1,146 94.773 74,505 15,021 692 196 90,414 4,359 20 1,530 76 1,606 (78) 2,753 (13) $ 2.740 S 1.19 S Consolidated Statements of Income (Amounts in millions except per sbare data) Fiscal years ended January 31, 1998 1997 Revenues: Net sales $117,958 $104,859 Other income-net 1,341 1,319 119,299 106,178 Costs and Expenses: Cost of sales 93,438 83,510 Operating, selling and general and administrative expenses 19,358 16,946 Interest Costs: Debt 555 629 Capital leases 229 216 113,580 101,301 Income Before Income Taxes, Minority Interest and Equity in Unconsolidated Subsidiaries 5,719 4,877 Provision for Income Taxes Current 2,095 1,974 Deferred (180) 2,115 1,794 Income Before Minority Interest and Equity in Unconsolidated Subsidiaries 3,604 3,083 Minority Interest and Equity in Unconsolidated Subsidiaries (27) Net Income $ 3,526 S 3,056 Net Income Per Share - Basic and Dilutive $ 1.56 1.33 Consolidated Balance Sheets (Amounts in millions) January 31, 1998 1997 Assets Current Asset: Cash and cash equivalents $ 1,447 $ 883 Receivables 976 845 Inventories at replacement cost 16,845 16,193 Less LIFO reserve 348 296 Inventories at LIFO cost 16,497 15,897 Prepaid expenses and other 432 368 Total Current Assets 19,352 17,993 Property, Plant and Equipment, at Cost: Land 4,691 3,689 Building and improvements 14,646 12,724 Fixtures and equipment 7,636 6,390 Transportation equipment 403 379 27,376 23,182 Less accumulated depreciation 5,907 4,849 Net property, plant and equipment 21,469 18,333 Property Under Capital Lease: Property under capital lease 3,040 2,782 Less accumulated amortization 903 791 Net property under capital leases 2,137 1,991 Other Agets and Deferred Charges 2,426 1,287 Total Assets $45,384 $39,604 The Company has entered into lease commitments for land and buildings for 38 future locals. These lease commitments with real estate developers provide for minimum rentals for 20 to 25 years, excluding renewal options, which if consummated based on current cost estimates, will approximate $38 million annually over the lease terms. Required a. Compute the following for 1998: 1. Times interest earned 2. Fixed charge coverage 3. Debt ratio 4. Debt/equity ratio b. Compute the debt ratio, considering operating leases. c. Give your opinion of the significance of considering operating leases in the debt ratio. d. Net property under capital leases totaled $2,137,000,000 at January 31, 1998. Obligations under capital leases totaled $2,585,000,000 at January 31, 1998. Why do the assets under capital leases not equal the liabilities under capital leasest 1996 $95.627 1.146 04.773 74,505 15.021 16946 196 X1,414 Liabilities and Shareholders' Equity Current Liabile Accounts payable $ 9,126 $ 7.628 Accrued liabilities 3,628 2,413 Accrued income taxes 565 298 Long-term debt due within one year 1,039 523 Obligations under capital leases due within one year 102 95 Total Current Liabilities 14,460 10,957 Long-Terw Delt 7.191 7,709 Lan - Terw Wigation Under Capital Louie 2.483 2,307 Deferred Inme Tax and Other 809 463 Minority Inter 1.938 1,025 Shurebollers' Equity Preferred stock (5.10 par valuc, 100 shares authorized, none issued) Common stock (5. 10 par value, 5,500 shares authorized 2,24 and 2.285 issued and outstanding in 1998 and 1997, respectively) 224 228 Capital in excess of par value 585 547 Retained earnings 18.167 16,768 Foreign currency translation adjustment (473) (400) Total Shareholders' Equity 18,503 17,143 Total Liabilities and Shareholders' Equity $45,384 539,604 Selected Note 8 Long-term Lease Obligations The Company and certain of its subsidiaries have long-term leases for stores and eq ment Rentals (including, for certain leases amants applicable to taxes, insura maintenance, other operating expenses and contingent rentals) under all operating k were $596 million, 5561 million and $531 million in 1998, 1997 and 1996, respecti Aggregate minimum annual rentals at January 31, 1998, under non-cancelable leases ar +359 1.510 76 1.04 2,753 (13) $ 2.740 S 1.19 Consolidated Statements of Income monts i except per bare data) Fiscal years ended January 31, 1998 1997 Revenues: Net sules $117.958 S104.859 Other income-net 1,341 1.119 119,299 11,178 Cost and Expenses Cost of sales 93,438 83,510 Operating, selline anal general til andeninistrative expenses 19,358 Interest Costs Debt 555 Capital lexes 229 216 113.580 101.301 Income Before Income Taxes. Minority Interest and Equity in Unconsolidated Subsidiaries 5,719 +,874 Provision for Income Taxes Current 2,095 1,974 Deferred 20 (180) 2,115 1.74 Income Before Minority Interest and Equity in Unconsolidated Subsidiaries 3,604 3,081 Minority Interest and Equity in Unconsolidated Subsidiaries (78) (27) Net Income $ 3,526 5 3,056 Net Income Per Share Besic and Dilutive S 1.56 S 1.33 Consolidated Balance Sheets ( Aww. Juary 31 1998 1997 Assets Corrent drets Cash and cash wuivalents S 1,447 S 883 Receivables 976 845 Inventaries it replacement est 16,845 16,193 Less LIFO resene 348 2 Inventories at LIFO 16,497 15,197 Prepard expenses and other 368 Total Current Assets 19,352 17,90 Property w portar Coats Land 4.691 Building and improvements 14,646 12,724 Fixtures and equipment 7,636 600 Transportation equipment 403 529 27,376 23,182 Les accumulated depreciation 5,907 4,849 Net property, plant and equipment 21,469 Property Under Copia La Propery surfier arpital has 3.040 Less accumulated amortization 903 Net property under capital laces 2.117 1,901 Orber dorty w Deformed Churn 2,426 1.287 Total Assets 545,384 $39,604 432 -Paying Ability The Company has entered into lease commitments for land and buildings for 38 future locals. These lease commitments with real estate developers provide for minimum Tentals for 20 to 25 years, excluding renewal options, which if consummated based on current cost estimates will approximate $38 million annually over the lease terms. Required Compute the following for 1998: 1. Times interest earned 2. Fixeil charge coverage 3. Debt ratio 4. Debt/equity ratio b. Compute the debt ratio, cunsidering operating leases c. Give your opinion of the significance of considering operating lease in the debt ratio. d. Net property under capital leuses totaled $2.137.000.000 at January 31, 1998. Obligations under capital leases totaled S2.585,000,000 January 31. 1998. Why do the assets under capital leases not equal thu Isabilities under capital leases The Company has entered into lease commitments for land and buildings for 38 future locals. These lease commitments with real estate developers provide for minimum rentals for 20 to 25 years, excluding renewal options, which if consummated based on current cost estimates, will approximate $38 million annually over the lease terms. Required 1. Compute the following for 1998: 1. Times interest earned 2. Fixed charge coverage 3. Debt ratio 4. Debt/equity ratio b. Compute the debt ratio, considering operating leases. c. Give your opinion of the significance of considering operating leases in the debt ratio. d. Net property under capital leases totaled $2,137,000,000 at January 31, 1998. Obligations under capital leases totaled $2,585,000,000 at January 31, 1998. Why do the assets under capital leases not equal the liabilities under capital leases? Liabilities and Shareholders' Equity Current Liabilities: Accounts payable $9,126 $ 7,628 Accrued liabilities 3,628 2,413 Accrued income taxes 565 298 Long-term debt due within one year 1,039 523 Obligations under capital leases due within one year 102 95 Total Current Liabilities 14,460 10,957 Long-Term Delt 7,191 7,709 Long-Term Owigations Under Capital Leases 2,483 2,307 Deferred Income Taxes and Other 809 463 Minority Interest 1,938 1,025 Shareholders' Equity Preferred stock (S. 10 par value, 100 shares authorized, none issued) Common stock (S. 10 par value; 5,500 shares authorized, 2,241 and 2,285 issued and outstanding in 1998 and 1997, respectively) 224 228 Capital in excess of par value 585 547 Retained earnings 18,167 16,768 Foreign currency translation adjustment (473) (400) Total Shareholders' Equity 18,503 17,143 Total Liabilities and Shareholders' Equity $45,384 $39,604 Selected Note 8 Long-term Lease Obligations The Company and certain of its subsidiaries have long-term leases for stores and equip- ment. Rentals (including, for certain leases, amounts applicable to taxes, insurance, maintenance, other operating expenses and contingent rentals) under all operating leases were $596 million, S561 million and $531 million in 1998, 1997 and 1996, respectively. Aggregate minimum annual rentals at January 31, 1998, under non-cancelable leases are as follows (in millions): Operating Capital Fiscal year leases leases 1999 $ 404 $ 347 2000 384 345 2001 347 344 2002 332 343 2002 315 340 Thereafter 2,642 3,404 Total minimum rentals $4.424 5,123 Less estimated executory costs 73 Net minimum lease payments 5,050 Less imputed interest at rates ranging from 6,1% to 14.0% 2,465 Present value of minimum lease payments S2,585 Certain of the leases provide for contingent additional rentals based on percentage of sales. Such additional rentals amounted to $46 million, 51 million and $41 million in 1998, 1997 and 1996, respectively. Substantially all of the store leases have renewal options for additional terms from five to 25 years at comparable rentals. n Debt-Paying Ability 1996 $93,627 1,146 94,773 74,505 15,021 692 196 90,414 4.359 1.530 76 1,606 2,753 (13) $ 2,740 $ 1.19 Consolidated Statements of Income (Amounts in millions except per sbare data) Fiscal years ended January 31, 1998 1997 Revenues: Net sales $117.958 $104,859 Other income--net 1,341 1,319 119,299 106,178 Costs and Expenses: Cost of sales 93,438 83,510 Operating, selling and general and administrative expenses 19,358 16,946 Interest Costs: Debt 555 629 Capital cases 229 216 113,580 101,301 Income Before Income Taxes, Minority Interest and Equity in Unconsolidated Subsidiaries 5,719 4,877 Provision for Income Taxes Current 2,095 1,974 Deferred 20 (180) 2,115 1,794 Income Before Minority Interest and Equity in Unconsolidated Subsidiaries 3,604 3,083 Minority Interest and Equity in Unconsolidated Subsidiaries (78) (27) Net Income $ 3,526 S 3,056 Net Income Per Share - Basic and Dilutive $ 1.56 $ 1.33 Consolidated Balance Sheets (Amounts in millions) January 31, 1998 1997 Assets Current Assets Cash and cash equivalents $ 1,447 $ 883 Receivables 976 845 Inventories at replacement cost 16,845 16,193 Less LIFO reserve 348 296 Inventories at LIFO cost 16,497 15,897 Prepaid expenses and other 432 368 Total Current Assets 19,352 17,993 Property. Plant and Equipment, at Cast: Land 4,691 3,689 Building and improvements 14,646 12,724 Fixtures and equipment 7.636 6,390 Transportation equipment 403 379 27,376 23,182 Less accumulated depreciation 5,907 4,849 Net property, plant and equipment 21,469 18,333 Property Under Capital Lease: Property under capital loete 3,040 2,782 Less accumulated amortization 903 791 Net property under capital leases 2,137 1,991 Other Assets and Deferred Charges 2,426 1,287 Total Assets $45,384 $39,604 1996 $93,627 1,146 94.773 74,505 15,021 692 196 90,414 4,359 20 1,530 76 1,606 (78) 2,753 (13) $ 2.740 S 1.19 S Consolidated Statements of Income (Amounts in millions except per sbare data) Fiscal years ended January 31, 1998 1997 Revenues: Net sales $117,958 $104,859 Other income-net 1,341 1,319 119,299 106,178 Costs and Expenses: Cost of sales 93,438 83,510 Operating, selling and general and administrative expenses 19,358 16,946 Interest Costs: Debt 555 629 Capital leases 229 216 113,580 101,301 Income Before Income Taxes, Minority Interest and Equity in Unconsolidated Subsidiaries 5,719 4,877 Provision for Income Taxes Current 2,095 1,974 Deferred (180) 2,115 1,794 Income Before Minority Interest and Equity in Unconsolidated Subsidiaries 3,604 3,083 Minority Interest and Equity in Unconsolidated Subsidiaries (27) Net Income $ 3,526 S 3,056 Net Income Per Share - Basic and Dilutive $ 1.56 1.33 Consolidated Balance Sheets (Amounts in millions) January 31, 1998 1997 Assets Current Asset: Cash and cash equivalents $ 1,447 $ 883 Receivables 976 845 Inventories at replacement cost 16,845 16,193 Less LIFO reserve 348 296 Inventories at LIFO cost 16,497 15,897 Prepaid expenses and other 432 368 Total Current Assets 19,352 17,993 Property, Plant and Equipment, at Cost: Land 4,691 3,689 Building and improvements 14,646 12,724 Fixtures and equipment 7,636 6,390 Transportation equipment 403 379 27,376 23,182 Less accumulated depreciation 5,907 4,849 Net property, plant and equipment 21,469 18,333 Property Under Capital Lease: Property under capital lease 3,040 2,782 Less accumulated amortization 903 791 Net property under capital leases 2,137 1,991 Other Agets and Deferred Charges 2,426 1,287 Total Assets $45,384 $39,604 The Company has entered into lease commitments for land and buildings for 38 future locals. These lease commitments with real estate developers provide for minimum rentals for 20 to 25 years, excluding renewal options, which if consummated based on current cost estimates, will approximate $38 million annually over the lease terms. Required a. Compute the following for 1998: 1. Times interest earned 2. Fixed charge coverage 3. Debt ratio 4. Debt/equity ratio b. Compute the debt ratio, considering operating leases. c. Give your opinion of the significance of considering operating leases in the debt ratio. d. Net property under capital leases totaled $2,137,000,000 at January 31, 1998. Obligations under capital leases totaled $2,585,000,000 at January 31, 1998. Why do the assets under capital leases not equal the liabilities under capital leasest

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started