Answered step by step

Verified Expert Solution

Question

1 Approved Answer

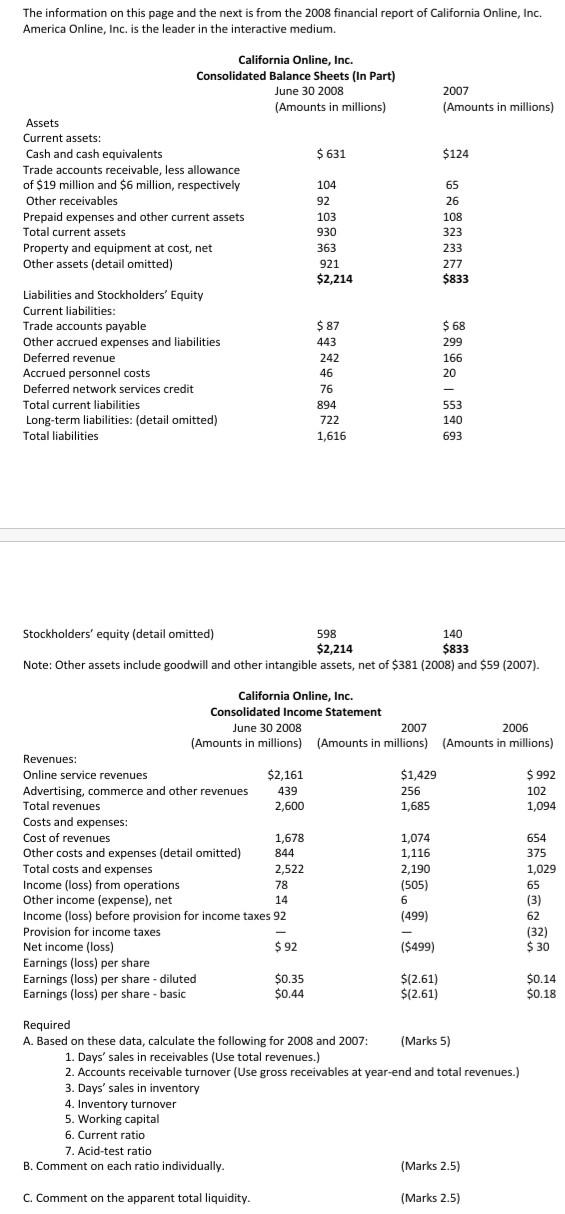

quick answer plz The information on this page and the next is from the 2008 financial report of California Online, Inc. America Online, Inc. is

quick answer plz

The information on this page and the next is from the 2008 financial report of California Online, Inc. America Online, Inc. is the leader in the interactive medium. 2007 (Amounts in millions) $124 California Online, Inc. Consolidated Balance Sheets (In Part) June 30 2008 (Amounts in millions) Assets Current assets: Cash and cash equivalents $631 Trade accounts receivable, less allowance of $19 million and $6 million, respectively 104 Other receivables 92 Prepaid expenses and other current assets 103 Total current assets 930 Property and equipment at cost, net 363 Other assets (detail omitted) 921 $2,214 Liabilities and Stockholders' Equity Current liabilities: Trade accounts payable $ 87 Other accrued expenses and liabilities Deferred revenue 242 Accrued personnel costs 46 Deferred network services credit 76 Total current liabilities 894 Long-term liabilities: (detail omitted) 722 Total liabilities 1,616 65 26 108 323 233 277 $833 443 $ 68 299 166 20 553 140 693 Stockholders' equity (detail omitted) 598 140 $2,214 $833 Note: Other assets include goodwill and other intangible assets, net of $381 (2008) and $59 (2007). Total revenues California Online, Inc. Consolidated Income Statement June 30 2008 2007 2006 (Amounts in millions) (Amounts in millions) (Amounts in millions) Revenues: Online service revenues $2,161 $1,429 $ 992 Advertising, commerce and other revenues 439 256 102 2,600 1,685 1,094 Costs and expenses: Cost of revenues 1,678 1,074 654 Other costs and expenses (detail omitted) 844 1,116 375 Total costs and expenses 2,522 2,190 1,029 Income (loss) from operations 78 (505) 65 Other income (expense), net 14 6 (3) (3 Income (loss) before provision for income taxes 92 (499) 62 Provision for income taxes (32) Net income (loss) $92 ($499) $ 30 Earnings (loss) per share Earnings (loss) per share - diluted $0.35 $(2.61) $0.14 Earnings (loss) per share-basic $0.44 $(2.61) $0.18 Required A. Based on these data, calculate the following for 2008 and 2007: (Marks 5) 1. Days' sales in receivables (Use total revenues.) 2. Accounts receivable turnover (Use gross receivables at year-end and total revenues.) 3. Days' sales in inventory 4. Inventory turnover 5. Working capital 6. Current ratio 7. Acid-test ratio - B. Comment on each ratio individually. (Marks 2.5) C. Comment on the apparent total liquidity. (Marks 2.5)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started