Answered step by step

Verified Expert Solution

Question

1 Approved Answer

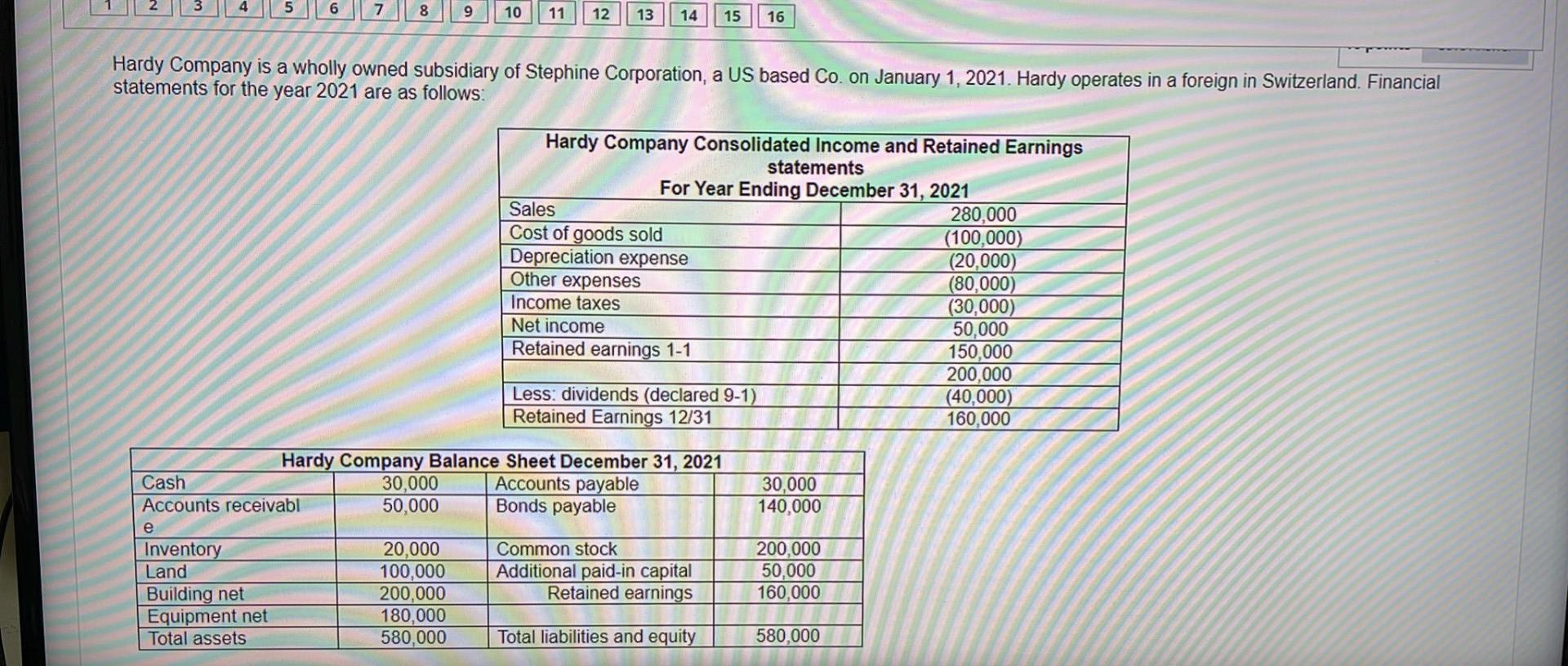

quick please 5 6 7 8 9 10 11 12 13 14 15 16 Hardy Company is a wholly owned subsidiary of Stephine Corporation, a

quick please

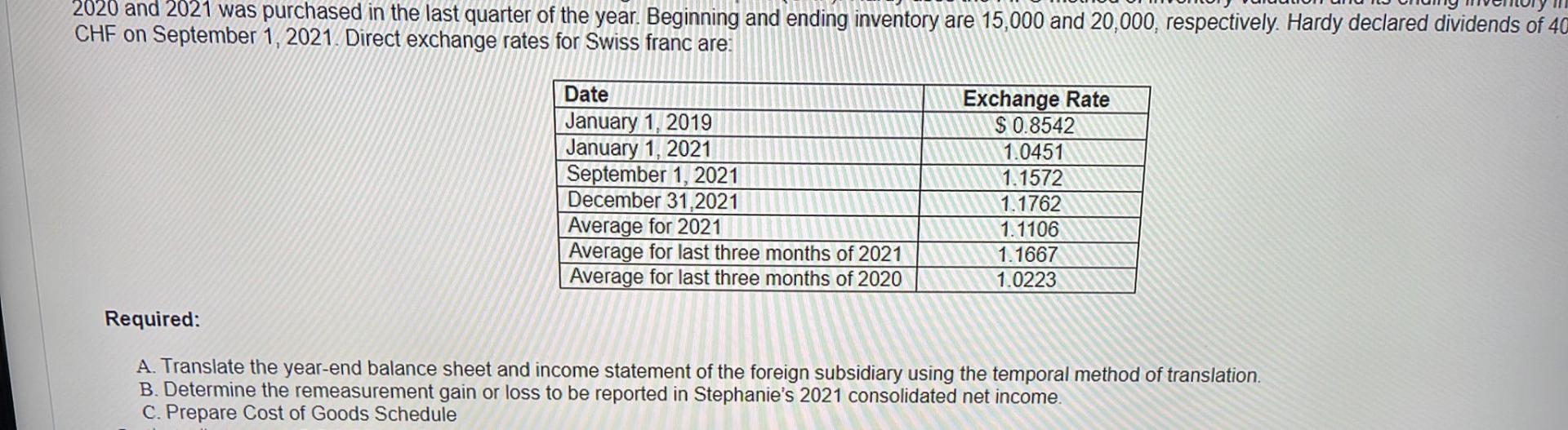

5 6 7 8 9 10 11 12 13 14 15 16 Hardy Company is a wholly owned subsidiary of Stephine Corporation, a US based Co. on January 1, 2021. Hardy operates in a foreign in Switzerland. Financial statements for the year 2021 are as follows: Hardy Company Consolidated Income and Retained Earnings statements For Year Ending December 31, 2021 Sales 280,000 Cost of goods sold (100,000) Depreciation expense (20,000) Other expenses (80,000) Income taxes (30,000) Net income 50,000 Retained earnings 1-1 150,000 200,000 Less: dividends (declared 9-1) (40,000) Retained Earnings 12/31 160,000 30,000 140,000 Hardy Company Balance Sheet December 31, 2021 Cash 30,000 Accounts payable Accounts receivabl 50,000 Bonds payable e Inventory 20,000 Common stock Land 100,000 Additional paid-in capital Building net 200,000 Retained earnings Equipment net 180,000 Total assets 580,000 Total liabilities and equity 200,000 50,000 160,000 580,000 2020 and 2021 was purchased in the last quarter of the year. Beginning and ending inventory are 15,000 and 20,000, respectively. Hardy declared dividends of 40 CHF on September 1, 2021. Direct exchange rates for Swiss franc are: Date January 1, 2019 January 1, 2021 September 1, 2021 December 31, 2021 Average for 2021 Average for last three months of 2021 Average for last three months of 2020 Exchange Rate $ 0.8542 1.0451 1.1572 1.1762 1.1106 1.1667 1.0223 Required: A. Translate the year-end balance sheet and income statement of the foreign subsidiary using the temporal method of translation B. Determine the remeasurement gain or loss to be reported in Stephanie's 2021 consolidated net income. C. Prepare Cost of Goods ScheduleStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started