Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Quiz 9 : 06:26:30 An investor has $50,000 to invest and is considering the following four alternatives: 1. S&P 500 ETF - an ETF that

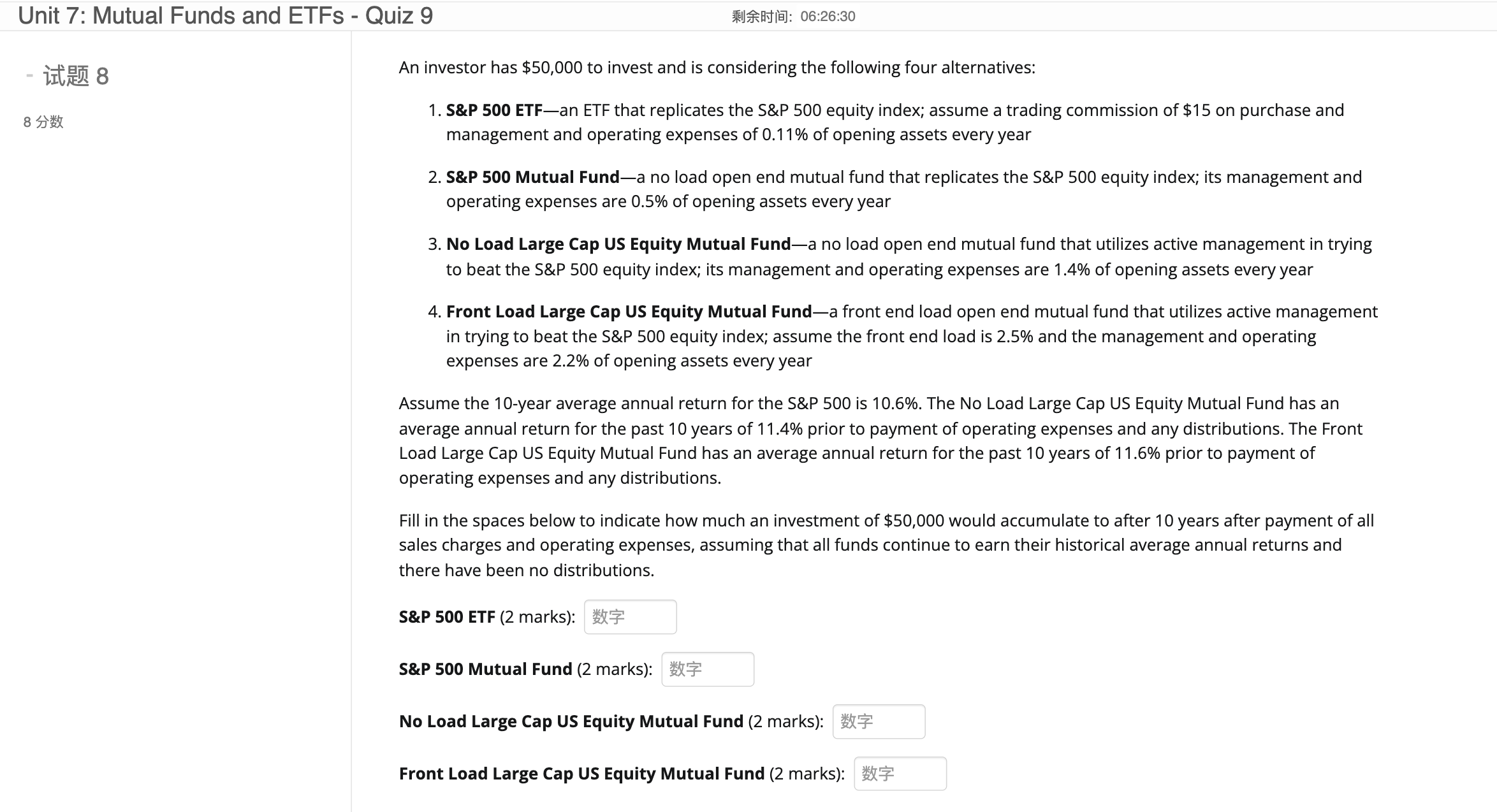

Quiz 9 : 06:26:30 An investor has $50,000 to invest and is considering the following four alternatives: 1. S\&P 500 ETF - an ETF that replicates the S\&P 500 equity index; assume a trading commission of $15 on purchase and management and operating expenses of 0.11% of opening assets every year 2. S\&P 500 Mutual Fund-a no load open end mutual fund that replicates the S\&P 500 equity index; its management and operating expenses are 0.5% of opening assets every year 3. No Load Large Cap US Equity Mutual Fund-a no load open end mutual fund that utilizes active management in trying to beat the S\&P 500 equity index; its management and operating expenses are 1.4% of opening assets every year 4. Front Load Large Cap US Equity Mutual Fund-a front end load open end mutual fund that utilizes active management in trying to beat the S\&P 500 equity index; assume the front end load is 2.5% and the management and operating expenses are 2.2% of opening assets every year Assume the 10-year average annual return for the S\&P 500 is 10.6\%. The No Load Large Cap US Equity Mutual Fund has an average annual return for the past 10 years of 11.4% prior to payment of operating expenses and any distributions. The Front Load Large Cap US Equity Mutual Fund has an average annual return for the past 10 years of 11.6% prior to payment of operating expenses and any distributions. Fill in the spaces below to indicate how much an investment of $50,000 would accumulate to after 10 years after payment of all sales charges and operating expenses, assuming that all funds continue to earn their historical average annual returns and there have been no distributions. S\&P 500 ETF ( 2 marks): S\&P 500 Mutual Fund (2 marks): No Load Large Cap US Equity Mutual Fund (2 marks): Front Load Large Cap US Equity Mutual Fund (2 marks)

Quiz 9 : 06:26:30 An investor has $50,000 to invest and is considering the following four alternatives: 1. S\&P 500 ETF - an ETF that replicates the S\&P 500 equity index; assume a trading commission of $15 on purchase and management and operating expenses of 0.11% of opening assets every year 2. S\&P 500 Mutual Fund-a no load open end mutual fund that replicates the S\&P 500 equity index; its management and operating expenses are 0.5% of opening assets every year 3. No Load Large Cap US Equity Mutual Fund-a no load open end mutual fund that utilizes active management in trying to beat the S\&P 500 equity index; its management and operating expenses are 1.4% of opening assets every year 4. Front Load Large Cap US Equity Mutual Fund-a front end load open end mutual fund that utilizes active management in trying to beat the S\&P 500 equity index; assume the front end load is 2.5% and the management and operating expenses are 2.2% of opening assets every year Assume the 10-year average annual return for the S\&P 500 is 10.6\%. The No Load Large Cap US Equity Mutual Fund has an average annual return for the past 10 years of 11.4% prior to payment of operating expenses and any distributions. The Front Load Large Cap US Equity Mutual Fund has an average annual return for the past 10 years of 11.6% prior to payment of operating expenses and any distributions. Fill in the spaces below to indicate how much an investment of $50,000 would accumulate to after 10 years after payment of all sales charges and operating expenses, assuming that all funds continue to earn their historical average annual returns and there have been no distributions. S\&P 500 ETF ( 2 marks): S\&P 500 Mutual Fund (2 marks): No Load Large Cap US Equity Mutual Fund (2 marks): Front Load Large Cap US Equity Mutual Fund (2 marks) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started