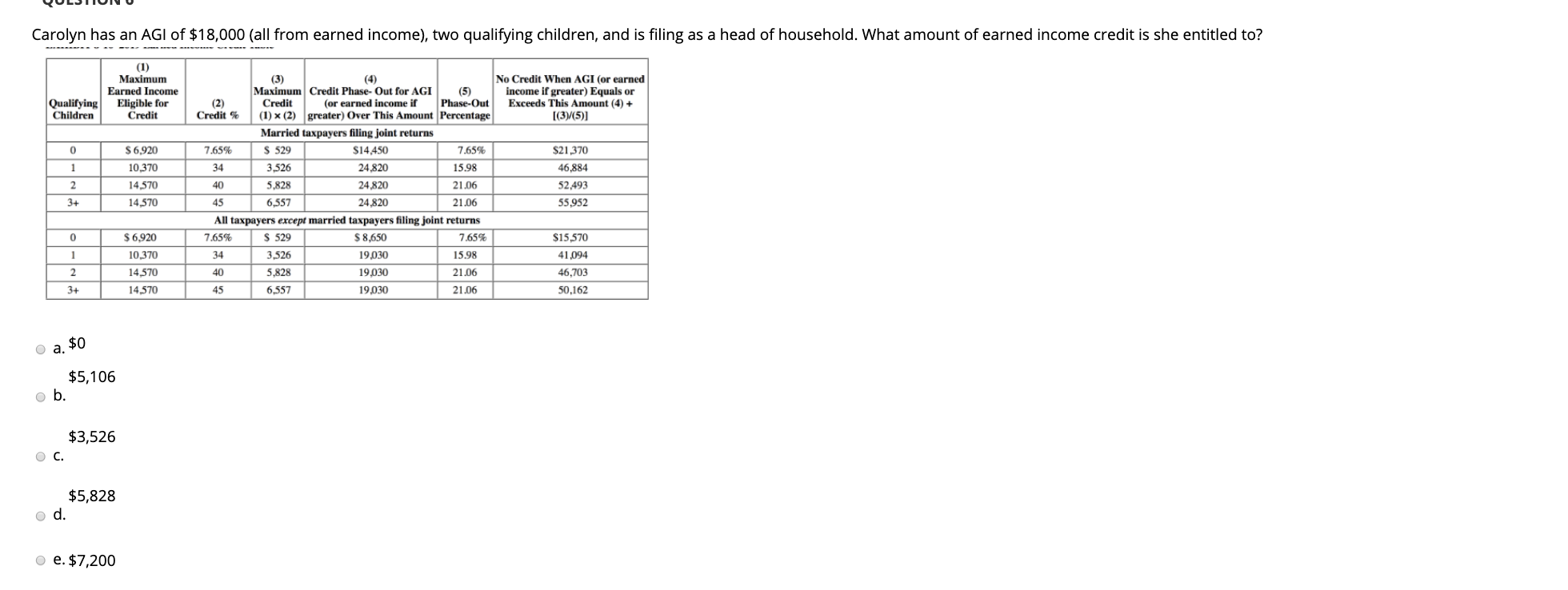

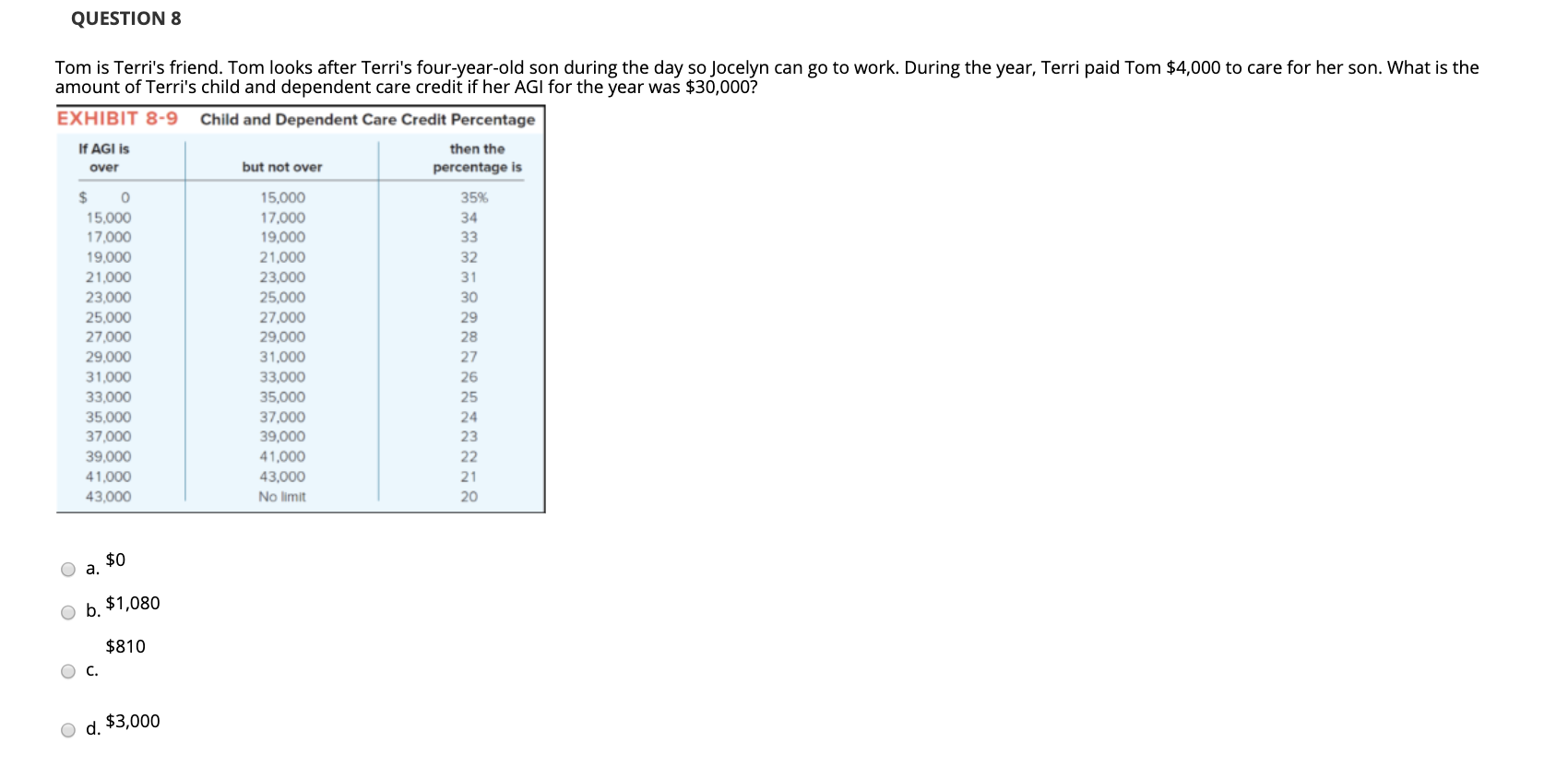

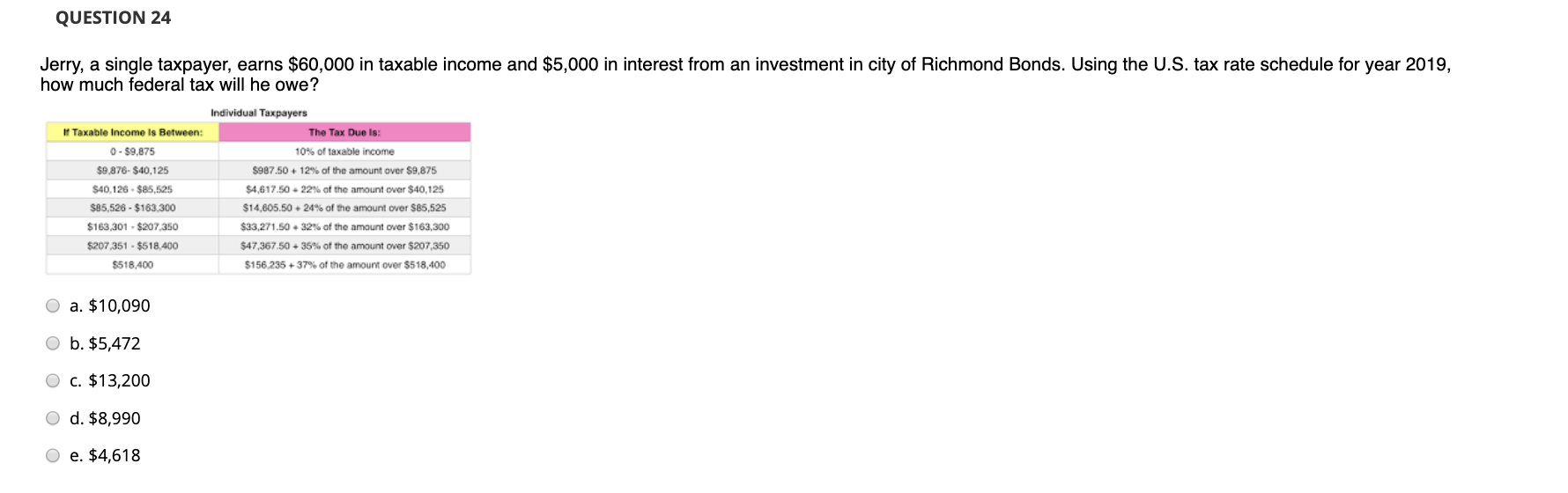

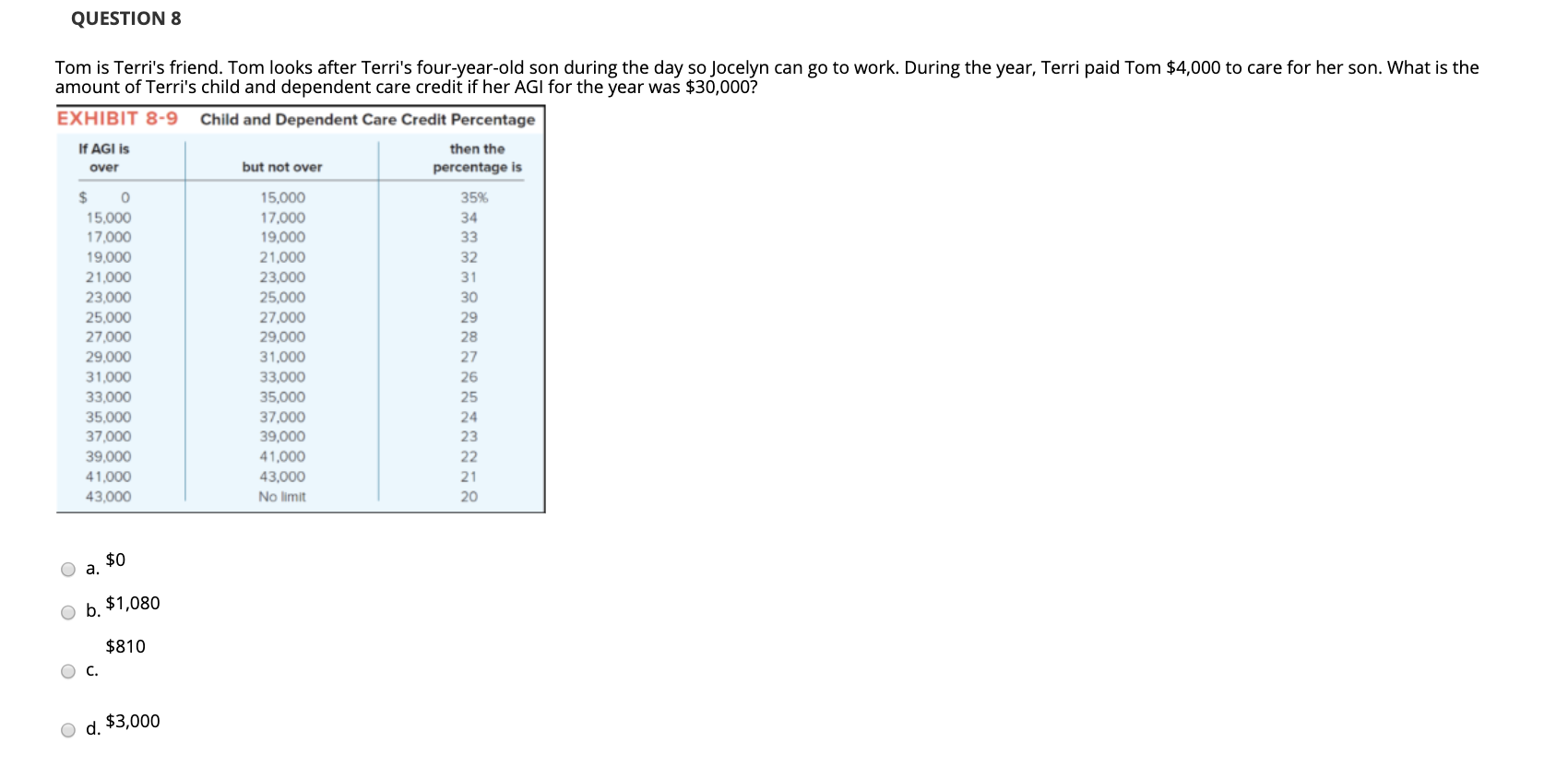

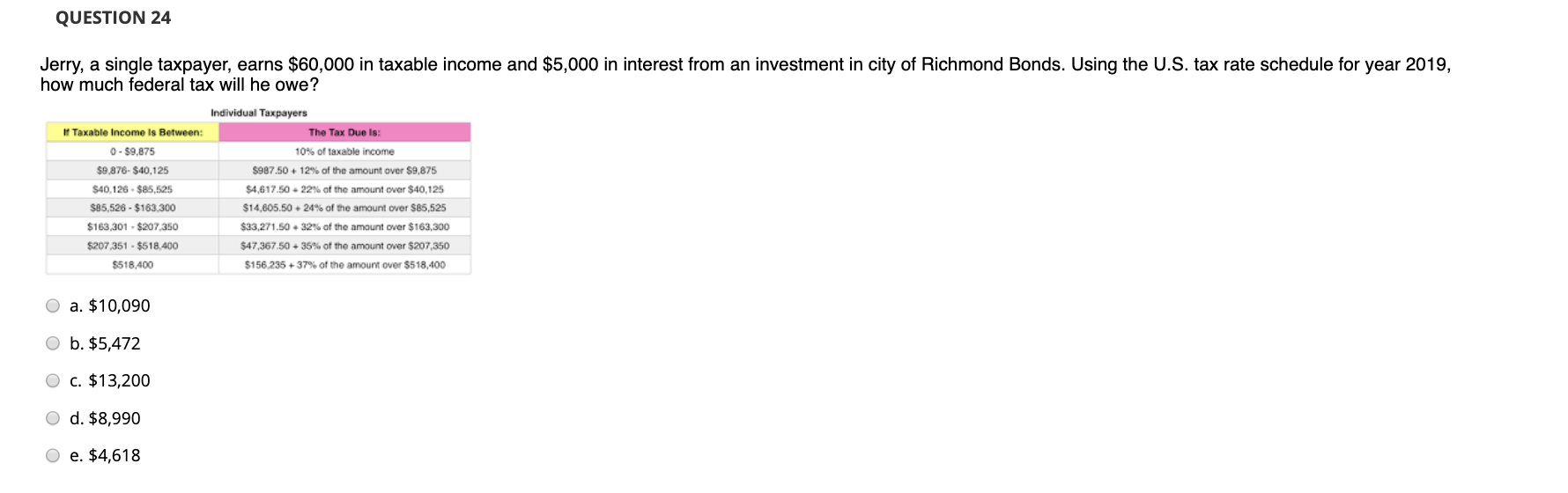

QULJTIUIVU Carolyn has an AGI of $18,000 (all from earned income), two qualifying children, and is filing as a head of household. What amount of earned income credit is she entitled to? (1) Maximum Earned Income Eligible for Credit Qualifying Children No Credit When AGI (or earned income if greater) Equals or Exceeds This Amount (4) + [(3)/(5)] 0 1 $6,920 10,370 14,570 14.570 (3) (4) Maximum Credit Phase-Out for AGI (5) (2) Credit (or earned income if Phase-Out Credit % (1) x (2) greater) Over This Amount Percentage Married taxpayers filing joint returns 7.65% S 529 | $14,450 7.65% 34 3,526 24,820 15.98 40 5,828 24,820 21.06 6,557 24,820 21.06 All taxpayers except married taxpayers filing joint returns 7.65% S 529 $ 8,650 7.65% 34 3,526 19.030 15.98 40 5,828 19.030 21.06 45 6,557 19.030 21.06 $21,370 46,884 52,493 55,952 2 3+ L 45 0 i $6920 $ 6,920 10,370 14,570 14,570 $15,570 41,094 46,703 50.162 2 3+ a. $0 $5,106 ob. $3,526 OC. $5,828 od. e. $7,200 QUESTION 8 Tom is Terri's friend. Tom looks after Terri's four-year-old son during the day so Jocelyn can go to work. During the year, Terri paid Tom $4,000 to care for her son. What is the amount of Terri's child and dependent care credit if her AGI for the year was $30,000? EXHIBIT 8-9 Child and Dependent Care Credit Percentage If AGI is then the over but not over percentage is $ 0 15,000 35% 15,000 17.000 17,000 19,000 19.000 21,000 21,000 23,000 23,000 25,000 25,000 27,000 27,000 29,000 29.000 31.000 31,000 33,000 33.000 35.000 35.000 37,000 37,000 39,000 39.000 41,000 41,000 43,000 43.000 No limit | a $0 O 0 5.080 $810 0 O d. $3,000 QUESTION 24 Jerry, a single taxpayer, earns $60,000 in taxable income and $5,000 in interest from an investment in city of Richmond Bonds. Using the U.S. tax rate schedule for year 2019, how much federal tax will he owe? I Taxable income Is Between: - 59.875 $9.876-$40,125 $40,126 - $85,525 $85,526 - $163.300 $163,301 - $207,350 Individual Taxpayers The Tax Due is: 10% of taxable income S987.50 +12% of the amount over $9,875 $4,617.50 -22% of the amount over $40,125 $14,605.50.24% of the amount over $85,525 $33,271.50 +32% of the amount over $163,300 $47,367.50 +35% of the amount over $207,350 $156 235 +37% of the amount over $518,400 $518,400 O a. $10,090 O b. $5,472 O c. $13,200 O d. $8,990 O e. $4,618