Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Qurstion 1 (34 marks) Income Tax and Capital Gains Tax Shaun is a fortyaolxynar.old computer analyst who is employed by Smart Solutions pic. He has

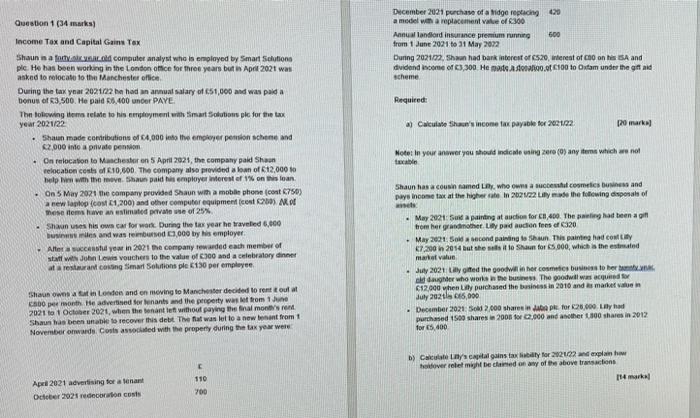

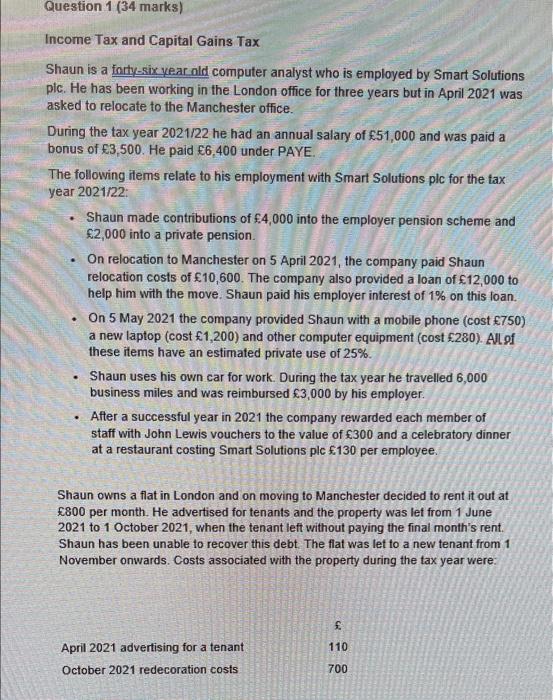

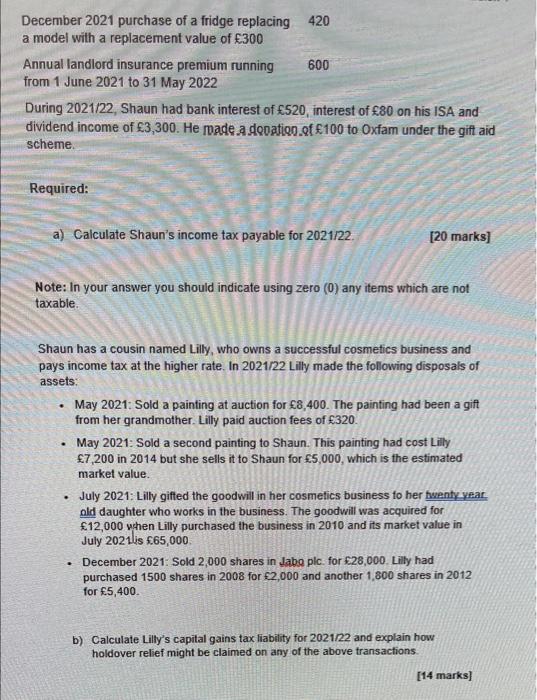

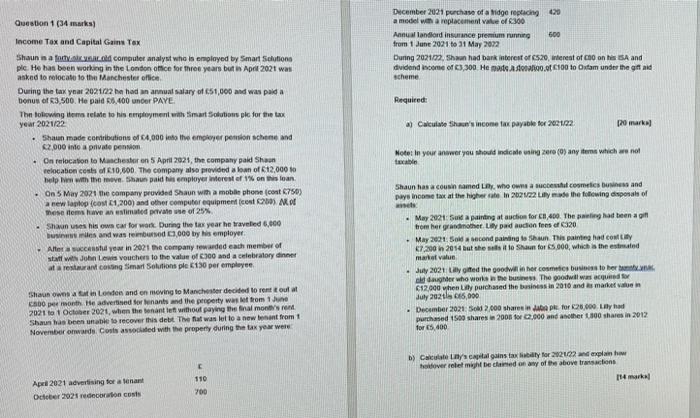

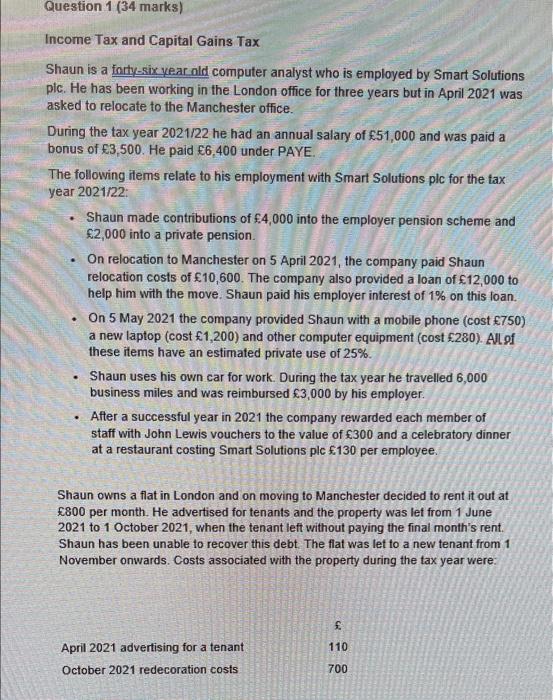

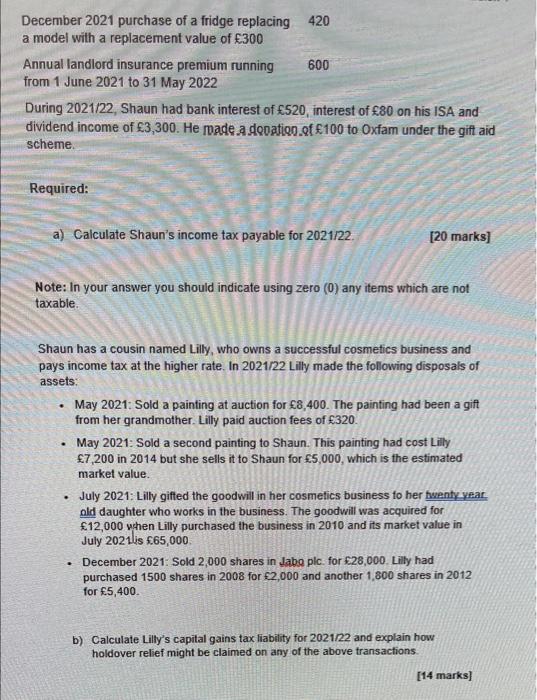

Qurstion 1 (34 marks) Income Tax and Capital Gains Tax Shaun is a fortyaolxynar.old computer analyst who is employed by Smart Solutions pic. He has been working in the London office for three years but in April 2021 was asked to relocate to the Manchester office. During the tax year 2021/22 he had an annual salary of 51,000 and was paid a bonus of 3,500. He paid 55,400 under PAYE The following items relate to his employment with Smart Solutions pic for the tax year 2021/22 . Shaun made contributions of 4,000 into the employer pension scheme and 2,000 into a private pension On relocation to Manchester on 5 April 2021, the company paid Shan relocation costs of 10,600. The company also provided a loan of 12,000 to help him with the move. Shaun paid his employer interest of 1% on this loan. On 5 May 2021 the company provided Shaun with a mobile phone (cost (750) a new laptop (cost 1,200) and other computer equipment (cost 200) Mot these items have an estimated private use of 25% Shaun uses his own car for work. During the tax year he traveled 6,000 business miles and was reimbursed E3,000 by his employer. After a successful year in 2021 the company rewarded each member of staff with John Lewis vouchers to the value of 300 and a celebratory dinner at a restaurant cossing Smart Solutions plc 130 per employee Shaun owns a fat in London and on moving to Manchester decided to rent it out at C500 per month. He advertised for tenants and the property was let from 1 June 2021 to 1 October 2021, when the tenant left without paying the final month's rent Shaun has been unable to recover this debt. The flat was let to a new tenant from 1 November onwards. Costs associated with the property during the tax year were April 2021 advertising for a tenant October 2021 redecoration costs 110 700 December 2021 purchase of a tridge replacing 429 a model with a replacement value of 300 600 Annual landlord insurance premium running from 1 June 2021 to 31 May 2022 During 2021/22, Shaun had bank interest of C520, interest of C00 on his SA and dividend income of 3,300. He made a dosahoo.ot 100 to Oxfam under the gift id scheme Required: a) Calculate Shaun's income tax payable for 2021/22 [20 marks) Note: In your answer you should indicate using zero (0) any items which are not taxable Shaun has a cousin named Lily, who owns a successful cosmetics business and pays income at the higher rate In 2021/22 Lilly made the following disposals of assch May 2021: Sund a painting at auction for CB,400. The painting had been a gift from her grandmother. Lily paid auction fees of C320 May 2021: Sold a second painting to Shaun. This painting had cont Lity 7,200 in 2014 but she sells it to Shaun for 5,000, which is the stated market value. July 2021: Lilly gifted the goodwill in her cosmetics business to her banna old daughter who works in the business. The goodwill was acquired for C12,000 when Lity purchased the business in 2010 and as market value in July 2021 065,000 December 2021: Sold 2,000 shares in Jaba pk for 26,000 had purchased 1500 shares in 2008 for 2,000 and another 1,300 shares in 2012 for 5,400 b) Calculate Ly's capital gains tax liability for 2021/22 and explain how hoidover rebel might be claimed on any of the above transactions [1 mark] Question 1 (34 marks) Income Tax and Capital Gains Tax Shaun is a forty-six year old computer analyst who is employed by Smart Solutions pic. He has been working in the London office for three years but in April 2021 was asked to relocate to the Manchester office. During the tax year 2021/22 he had an annual salary of 51,000 and was paid a bonus of 3,500. He paid 6,400 under PAYE. The following items relate to his employment with Smart Solutions plc for the tax year 2021/22: Shaun made contributions of 4,000 into the employer pension scheme and 2,000 into a private pension. . On relocation to Manchester on 5 April 2021, the company paid Shaun relocation costs of 10,600. The company also provided a loan of 12,000 to help him with the move. Shaun paid his employer interest of 1% on this loan. . On 5 May 2021 the company provided Shaun with a mobile phone (cost 750) a new laptop (cost 1,200) and other computer equipment (cost 280). All of these items have an estimated private use of 25%. . Shaun uses his own car for work. During the tax year he travelled 6,000 business miles and was reimbursed 3,000 by his employer. . After a successful year in 2021 the company rewarded each member of staff with John Lewis vouchers to the value of 300 and a celebratory dinner at a restaurant costing Smart Solutions plc 130 per employee. Shaun owns a flat in London and on moving to Manchester decided to rent it out at 800 per month. He advertised for tenants and the property was let from 1 June 2021 to 1 October 2021, when the tenant left without paying the final month's rent. Shaun has been unable to recover this debt. The flat was let to a new tenant from 1 November onwards. Costs associated with the property during the tax year were: 110 April 2021 advertising for a tenant October 2021 redecoration costs 700 December 2021 purchase of a fridge replacing 420 a model with a replacement value of 300 Annual landlord insurance premium running 600 from 1 June 2021 to 31 May 2022 During 2021/22, Shaun had bank interest of 520, interest of 80 on his ISA and dividend income of 3,300. He made a donation of 100 to Oxfam under the gift aid scheme. Required: a) Calculate Shaun's income tax payable for 2021/22 [20 marks] Note: In your answer you should indicate using zero (0) any items which are not taxable. Shaun has a cousin named Lilly, who owns a successful cosmetics business and pays income tax at the higher rate. In 2021/22 Lilly made the following disposals of assets: . May 2021: Sold a painting at auction for 8,400. The painting had been a gift from her grandmother. Lilly paid auction fees of 320. :. May 2021: Sold a second painting to Shaun. This painting had cost Lilly 7,200 in 2014 but she sells it to Shaun for 5,000, which is the estimated market value. July 2021: Lilly gifted the goodwill in her cosmetics business to her twenty year. old daughter who works in the business. The goodwill was acquired for 12,000 when Lilly purchased the business in 2010 and its market value in July 2021 is 65,000 . December 2021: Sold 2,000 shares in Jabo plc. for 28,000. Lilly had purchased 1500 shares in 2008 for 2,000 and another 1,800 shares in 2012 for 5,400. b) Calculate Lilly's capital gains tax liability for 2021/22 and explain how holdover relief might be claimed on any of the above transactions. [14 marks] Qurstion 1 (34 marks) Income Tax and Capital Gains Tax Shaun is a fortyaolxynar.old computer analyst who is employed by Smart Solutions pic. He has been working in the London office for three years but in April 2021 was asked to relocate to the Manchester office. During the tax year 2021/22 he had an annual salary of 51,000 and was paid a bonus of 3,500. He paid 55,400 under PAYE The following items relate to his employment with Smart Solutions pic for the tax year 2021/22 . Shaun made contributions of 4,000 into the employer pension scheme and 2,000 into a private pension On relocation to Manchester on 5 April 2021, the company paid Shan relocation costs of 10,600. The company also provided a loan of 12,000 to help him with the move. Shaun paid his employer interest of 1% on this loan. On 5 May 2021 the company provided Shaun with a mobile phone (cost (750) a new laptop (cost 1,200) and other computer equipment (cost 200) Mot these items have an estimated private use of 25% Shaun uses his own car for work. During the tax year he traveled 6,000 business miles and was reimbursed E3,000 by his employer. After a successful year in 2021 the company rewarded each member of staff with John Lewis vouchers to the value of 300 and a celebratory dinner at a restaurant cossing Smart Solutions plc 130 per employee Shaun owns a fat in London and on moving to Manchester decided to rent it out at C500 per month. He advertised for tenants and the property was let from 1 June 2021 to 1 October 2021, when the tenant left without paying the final month's rent Shaun has been unable to recover this debt. The flat was let to a new tenant from 1 November onwards. Costs associated with the property during the tax year were April 2021 advertising for a tenant October 2021 redecoration costs 110 700 December 2021 purchase of a tridge replacing 429 a model with a replacement value of 300 600 Annual landlord insurance premium running from 1 June 2021 to 31 May 2022 During 2021/22, Shaun had bank interest of C520, interest of C00 on his SA and dividend income of 3,300. He made a dosahoo.ot 100 to Oxfam under the gift id scheme Required: a) Calculate Shaun's income tax payable for 2021/22 [20 marks) Note: In your answer you should indicate using zero (0) any items which are not taxable Shaun has a cousin named Lily, who owns a successful cosmetics business and pays income at the higher rate In 2021/22 Lilly made the following disposals of assch May 2021: Sund a painting at auction for CB,400. The painting had been a gift from her grandmother. Lily paid auction fees of C320 May 2021: Sold a second painting to Shaun. This painting had cont Lity 7,200 in 2014 but she sells it to Shaun for 5,000, which is the stated market value. July 2021: Lilly gifted the goodwill in her cosmetics business to her banna old daughter who works in the business. The goodwill was acquired for C12,000 when Lity purchased the business in 2010 and as market value in July 2021 065,000 December 2021: Sold 2,000 shares in Jaba pk for 26,000 had purchased 1500 shares in 2008 for 2,000 and another 1,300 shares in 2012 for 5,400 b) Calculate Ly's capital gains tax liability for 2021/22 and explain how hoidover rebel might be claimed on any of the above transactions [1 mark] Question 1 (34 marks) Income Tax and Capital Gains Tax Shaun is a forty-six year old computer analyst who is employed by Smart Solutions pic. He has been working in the London office for three years but in April 2021 was asked to relocate to the Manchester office. During the tax year 2021/22 he had an annual salary of 51,000 and was paid a bonus of 3,500. He paid 6,400 under PAYE. The following items relate to his employment with Smart Solutions plc for the tax year 2021/22: Shaun made contributions of 4,000 into the employer pension scheme and 2,000 into a private pension. . On relocation to Manchester on 5 April 2021, the company paid Shaun relocation costs of 10,600. The company also provided a loan of 12,000 to help him with the move. Shaun paid his employer interest of 1% on this loan. . On 5 May 2021 the company provided Shaun with a mobile phone (cost 750) a new laptop (cost 1,200) and other computer equipment (cost 280). All of these items have an estimated private use of 25%. . Shaun uses his own car for work. During the tax year he travelled 6,000 business miles and was reimbursed 3,000 by his employer. . After a successful year in 2021 the company rewarded each member of staff with John Lewis vouchers to the value of 300 and a celebratory dinner at a restaurant costing Smart Solutions plc 130 per employee. Shaun owns a flat in London and on moving to Manchester decided to rent it out at 800 per month. He advertised for tenants and the property was let from 1 June 2021 to 1 October 2021, when the tenant left without paying the final month's rent. Shaun has been unable to recover this debt. The flat was let to a new tenant from 1 November onwards. Costs associated with the property during the tax year were: 110 April 2021 advertising for a tenant October 2021 redecoration costs 700 December 2021 purchase of a fridge replacing 420 a model with a replacement value of 300 Annual landlord insurance premium running 600 from 1 June 2021 to 31 May 2022 During 2021/22, Shaun had bank interest of 520, interest of 80 on his ISA and dividend income of 3,300. He made a donation of 100 to Oxfam under the gift aid scheme. Required: a) Calculate Shaun's income tax payable for 2021/22 [20 marks] Note: In your answer you should indicate using zero (0) any items which are not taxable. Shaun has a cousin named Lilly, who owns a successful cosmetics business and pays income tax at the higher rate. In 2021/22 Lilly made the following disposals of assets: . May 2021: Sold a painting at auction for 8,400. The painting had been a gift from her grandmother. Lilly paid auction fees of 320. :. May 2021: Sold a second painting to Shaun. This painting had cost Lilly 7,200 in 2014 but she sells it to Shaun for 5,000, which is the estimated market value. July 2021: Lilly gifted the goodwill in her cosmetics business to her twenty year. old daughter who works in the business. The goodwill was acquired for 12,000 when Lilly purchased the business in 2010 and its market value in July 2021 is 65,000 . December 2021: Sold 2,000 shares in Jabo plc. for 28,000. Lilly had purchased 1500 shares in 2008 for 2,000 and another 1,800 shares in 2012 for 5,400. b) Calculate Lilly's capital gains tax liability for 2021/22 and explain how holdover relief might be claimed on any of the above transactions. [14 marks]

Qurstion 1 (34 marks) Income Tax and Capital Gains Tax Shaun is a fortyaolxynar.old computer analyst who is employed by Smart Solutions pic. He has been working in the London office for three years but in April 2021 was asked to relocate to the Manchester office. During the tax year 2021/22 he had an annual salary of 51,000 and was paid a bonus of 3,500. He paid 55,400 under PAYE The following items relate to his employment with Smart Solutions pic for the tax year 2021/22 . Shaun made contributions of 4,000 into the employer pension scheme and 2,000 into a private pension On relocation to Manchester on 5 April 2021, the company paid Shan relocation costs of 10,600. The company also provided a loan of 12,000 to help him with the move. Shaun paid his employer interest of 1% on this loan. On 5 May 2021 the company provided Shaun with a mobile phone (cost (750) a new laptop (cost 1,200) and other computer equipment (cost 200) Mot these items have an estimated private use of 25% Shaun uses his own car for work. During the tax year he traveled 6,000 business miles and was reimbursed E3,000 by his employer. After a successful year in 2021 the company rewarded each member of staff with John Lewis vouchers to the value of 300 and a celebratory dinner at a restaurant cossing Smart Solutions plc 130 per employee Shaun owns a fat in London and on moving to Manchester decided to rent it out at C500 per month. He advertised for tenants and the property was let from 1 June 2021 to 1 October 2021, when the tenant left without paying the final month's rent Shaun has been unable to recover this debt. The flat was let to a new tenant from 1 November onwards. Costs associated with the property during the tax year were April 2021 advertising for a tenant October 2021 redecoration costs 110 700 December 2021 purchase of a tridge replacing 429 a model with a replacement value of 300 600 Annual landlord insurance premium running from 1 June 2021 to 31 May 2022 During 2021/22, Shaun had bank interest of C520, interest of C00 on his SA and dividend income of 3,300. He made a dosahoo.ot 100 to Oxfam under the gift id scheme Required: a) Calculate Shaun's income tax payable for 2021/22 [20 marks) Note: In your answer you should indicate using zero (0) any items which are not taxable Shaun has a cousin named Lily, who owns a successful cosmetics business and pays income at the higher rate In 2021/22 Lilly made the following disposals of assch May 2021: Sund a painting at auction for CB,400. The painting had been a gift from her grandmother. Lily paid auction fees of C320 May 2021: Sold a second painting to Shaun. This painting had cont Lity 7,200 in 2014 but she sells it to Shaun for 5,000, which is the stated market value. July 2021: Lilly gifted the goodwill in her cosmetics business to her banna old daughter who works in the business. The goodwill was acquired for C12,000 when Lity purchased the business in 2010 and as market value in July 2021 065,000 December 2021: Sold 2,000 shares in Jaba pk for 26,000 had purchased 1500 shares in 2008 for 2,000 and another 1,300 shares in 2012 for 5,400 b) Calculate Ly's capital gains tax liability for 2021/22 and explain how hoidover rebel might be claimed on any of the above transactions [1 mark] Question 1 (34 marks) Income Tax and Capital Gains Tax Shaun is a forty-six year old computer analyst who is employed by Smart Solutions pic. He has been working in the London office for three years but in April 2021 was asked to relocate to the Manchester office. During the tax year 2021/22 he had an annual salary of 51,000 and was paid a bonus of 3,500. He paid 6,400 under PAYE. The following items relate to his employment with Smart Solutions plc for the tax year 2021/22: Shaun made contributions of 4,000 into the employer pension scheme and 2,000 into a private pension. . On relocation to Manchester on 5 April 2021, the company paid Shaun relocation costs of 10,600. The company also provided a loan of 12,000 to help him with the move. Shaun paid his employer interest of 1% on this loan. . On 5 May 2021 the company provided Shaun with a mobile phone (cost 750) a new laptop (cost 1,200) and other computer equipment (cost 280). All of these items have an estimated private use of 25%. . Shaun uses his own car for work. During the tax year he travelled 6,000 business miles and was reimbursed 3,000 by his employer. . After a successful year in 2021 the company rewarded each member of staff with John Lewis vouchers to the value of 300 and a celebratory dinner at a restaurant costing Smart Solutions plc 130 per employee. Shaun owns a flat in London and on moving to Manchester decided to rent it out at 800 per month. He advertised for tenants and the property was let from 1 June 2021 to 1 October 2021, when the tenant left without paying the final month's rent. Shaun has been unable to recover this debt. The flat was let to a new tenant from 1 November onwards. Costs associated with the property during the tax year were: 110 April 2021 advertising for a tenant October 2021 redecoration costs 700 December 2021 purchase of a fridge replacing 420 a model with a replacement value of 300 Annual landlord insurance premium running 600 from 1 June 2021 to 31 May 2022 During 2021/22, Shaun had bank interest of 520, interest of 80 on his ISA and dividend income of 3,300. He made a donation of 100 to Oxfam under the gift aid scheme. Required: a) Calculate Shaun's income tax payable for 2021/22 [20 marks] Note: In your answer you should indicate using zero (0) any items which are not taxable. Shaun has a cousin named Lilly, who owns a successful cosmetics business and pays income tax at the higher rate. In 2021/22 Lilly made the following disposals of assets: . May 2021: Sold a painting at auction for 8,400. The painting had been a gift from her grandmother. Lilly paid auction fees of 320. :. May 2021: Sold a second painting to Shaun. This painting had cost Lilly 7,200 in 2014 but she sells it to Shaun for 5,000, which is the estimated market value. July 2021: Lilly gifted the goodwill in her cosmetics business to her twenty year. old daughter who works in the business. The goodwill was acquired for 12,000 when Lilly purchased the business in 2010 and its market value in July 2021 is 65,000 . December 2021: Sold 2,000 shares in Jabo plc. for 28,000. Lilly had purchased 1500 shares in 2008 for 2,000 and another 1,800 shares in 2012 for 5,400. b) Calculate Lilly's capital gains tax liability for 2021/22 and explain how holdover relief might be claimed on any of the above transactions. [14 marks] Qurstion 1 (34 marks) Income Tax and Capital Gains Tax Shaun is a fortyaolxynar.old computer analyst who is employed by Smart Solutions pic. He has been working in the London office for three years but in April 2021 was asked to relocate to the Manchester office. During the tax year 2021/22 he had an annual salary of 51,000 and was paid a bonus of 3,500. He paid 55,400 under PAYE The following items relate to his employment with Smart Solutions pic for the tax year 2021/22 . Shaun made contributions of 4,000 into the employer pension scheme and 2,000 into a private pension On relocation to Manchester on 5 April 2021, the company paid Shan relocation costs of 10,600. The company also provided a loan of 12,000 to help him with the move. Shaun paid his employer interest of 1% on this loan. On 5 May 2021 the company provided Shaun with a mobile phone (cost (750) a new laptop (cost 1,200) and other computer equipment (cost 200) Mot these items have an estimated private use of 25% Shaun uses his own car for work. During the tax year he traveled 6,000 business miles and was reimbursed E3,000 by his employer. After a successful year in 2021 the company rewarded each member of staff with John Lewis vouchers to the value of 300 and a celebratory dinner at a restaurant cossing Smart Solutions plc 130 per employee Shaun owns a fat in London and on moving to Manchester decided to rent it out at C500 per month. He advertised for tenants and the property was let from 1 June 2021 to 1 October 2021, when the tenant left without paying the final month's rent Shaun has been unable to recover this debt. The flat was let to a new tenant from 1 November onwards. Costs associated with the property during the tax year were April 2021 advertising for a tenant October 2021 redecoration costs 110 700 December 2021 purchase of a tridge replacing 429 a model with a replacement value of 300 600 Annual landlord insurance premium running from 1 June 2021 to 31 May 2022 During 2021/22, Shaun had bank interest of C520, interest of C00 on his SA and dividend income of 3,300. He made a dosahoo.ot 100 to Oxfam under the gift id scheme Required: a) Calculate Shaun's income tax payable for 2021/22 [20 marks) Note: In your answer you should indicate using zero (0) any items which are not taxable Shaun has a cousin named Lily, who owns a successful cosmetics business and pays income at the higher rate In 2021/22 Lilly made the following disposals of assch May 2021: Sund a painting at auction for CB,400. The painting had been a gift from her grandmother. Lily paid auction fees of C320 May 2021: Sold a second painting to Shaun. This painting had cont Lity 7,200 in 2014 but she sells it to Shaun for 5,000, which is the stated market value. July 2021: Lilly gifted the goodwill in her cosmetics business to her banna old daughter who works in the business. The goodwill was acquired for C12,000 when Lity purchased the business in 2010 and as market value in July 2021 065,000 December 2021: Sold 2,000 shares in Jaba pk for 26,000 had purchased 1500 shares in 2008 for 2,000 and another 1,300 shares in 2012 for 5,400 b) Calculate Ly's capital gains tax liability for 2021/22 and explain how hoidover rebel might be claimed on any of the above transactions [1 mark] Question 1 (34 marks) Income Tax and Capital Gains Tax Shaun is a forty-six year old computer analyst who is employed by Smart Solutions pic. He has been working in the London office for three years but in April 2021 was asked to relocate to the Manchester office. During the tax year 2021/22 he had an annual salary of 51,000 and was paid a bonus of 3,500. He paid 6,400 under PAYE. The following items relate to his employment with Smart Solutions plc for the tax year 2021/22: Shaun made contributions of 4,000 into the employer pension scheme and 2,000 into a private pension. . On relocation to Manchester on 5 April 2021, the company paid Shaun relocation costs of 10,600. The company also provided a loan of 12,000 to help him with the move. Shaun paid his employer interest of 1% on this loan. . On 5 May 2021 the company provided Shaun with a mobile phone (cost 750) a new laptop (cost 1,200) and other computer equipment (cost 280). All of these items have an estimated private use of 25%. . Shaun uses his own car for work. During the tax year he travelled 6,000 business miles and was reimbursed 3,000 by his employer. . After a successful year in 2021 the company rewarded each member of staff with John Lewis vouchers to the value of 300 and a celebratory dinner at a restaurant costing Smart Solutions plc 130 per employee. Shaun owns a flat in London and on moving to Manchester decided to rent it out at 800 per month. He advertised for tenants and the property was let from 1 June 2021 to 1 October 2021, when the tenant left without paying the final month's rent. Shaun has been unable to recover this debt. The flat was let to a new tenant from 1 November onwards. Costs associated with the property during the tax year were: 110 April 2021 advertising for a tenant October 2021 redecoration costs 700 December 2021 purchase of a fridge replacing 420 a model with a replacement value of 300 Annual landlord insurance premium running 600 from 1 June 2021 to 31 May 2022 During 2021/22, Shaun had bank interest of 520, interest of 80 on his ISA and dividend income of 3,300. He made a donation of 100 to Oxfam under the gift aid scheme. Required: a) Calculate Shaun's income tax payable for 2021/22 [20 marks] Note: In your answer you should indicate using zero (0) any items which are not taxable. Shaun has a cousin named Lilly, who owns a successful cosmetics business and pays income tax at the higher rate. In 2021/22 Lilly made the following disposals of assets: . May 2021: Sold a painting at auction for 8,400. The painting had been a gift from her grandmother. Lilly paid auction fees of 320. :. May 2021: Sold a second painting to Shaun. This painting had cost Lilly 7,200 in 2014 but she sells it to Shaun for 5,000, which is the estimated market value. July 2021: Lilly gifted the goodwill in her cosmetics business to her twenty year. old daughter who works in the business. The goodwill was acquired for 12,000 when Lilly purchased the business in 2010 and its market value in July 2021 is 65,000 . December 2021: Sold 2,000 shares in Jabo plc. for 28,000. Lilly had purchased 1500 shares in 2008 for 2,000 and another 1,800 shares in 2012 for 5,400. b) Calculate Lilly's capital gains tax liability for 2021/22 and explain how holdover relief might be claimed on any of the above transactions. [14 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started