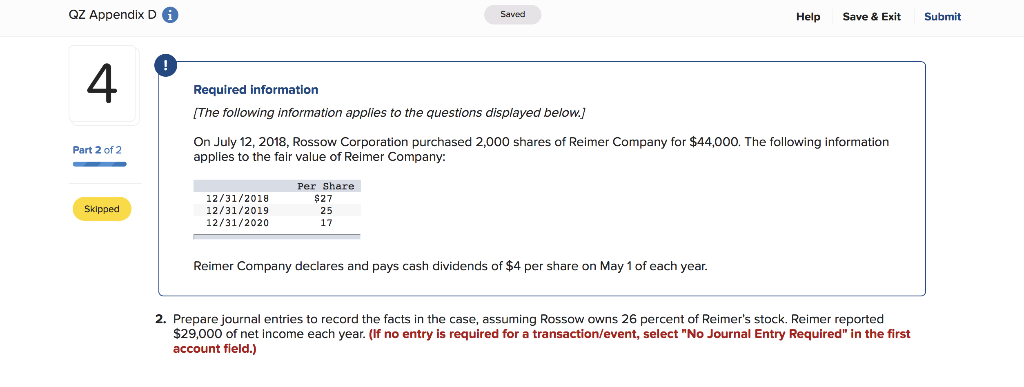

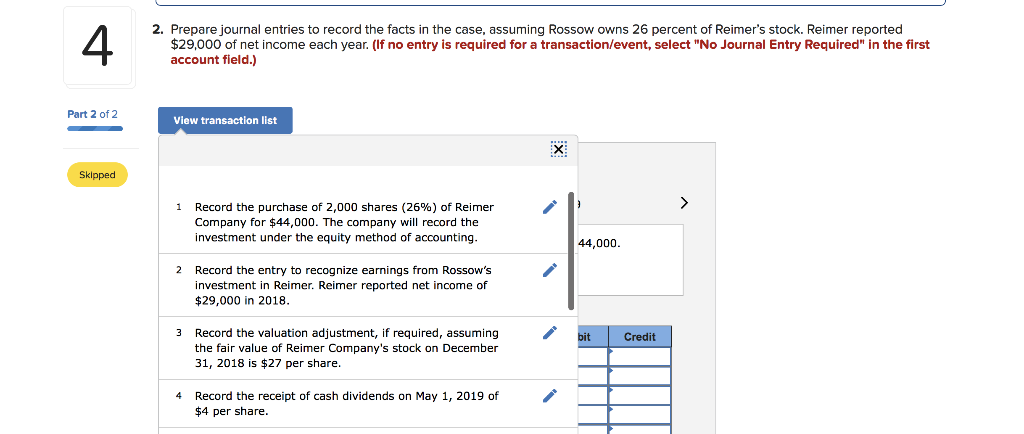

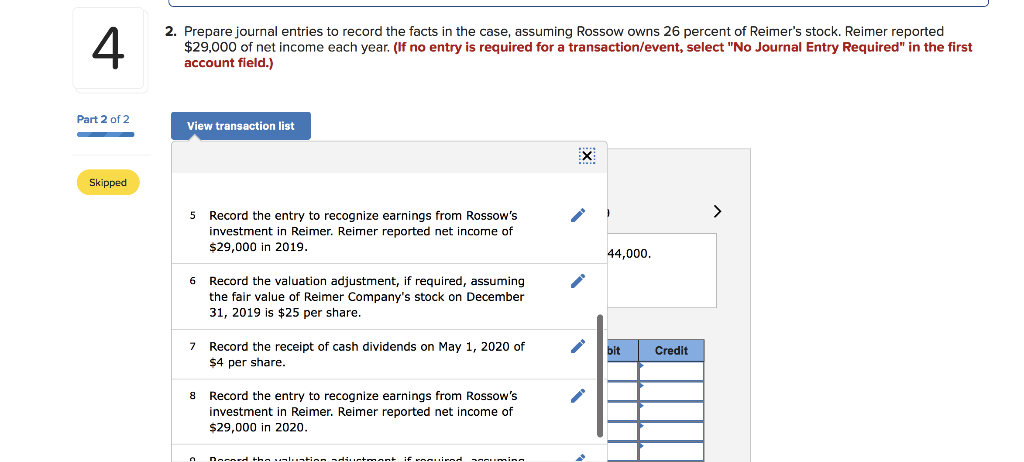

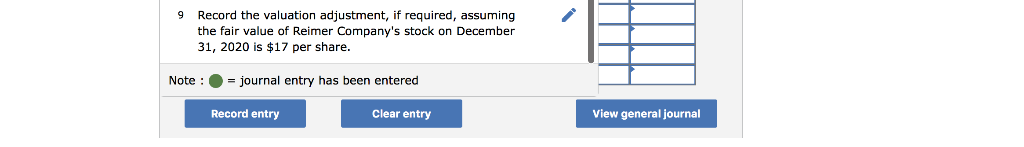

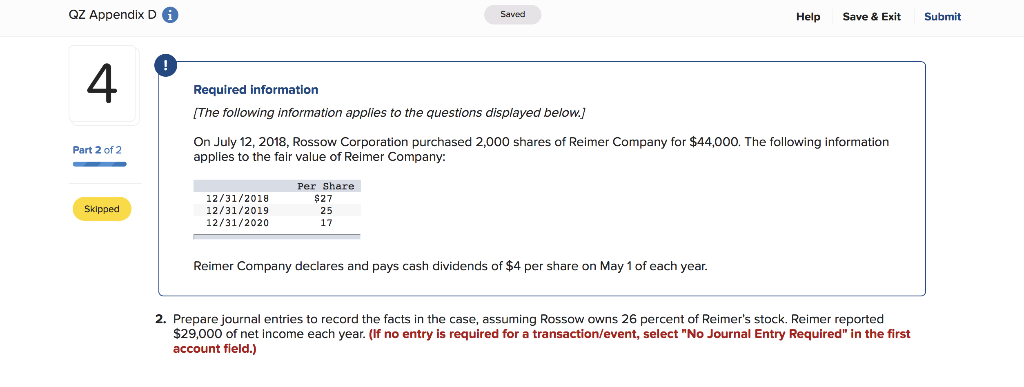

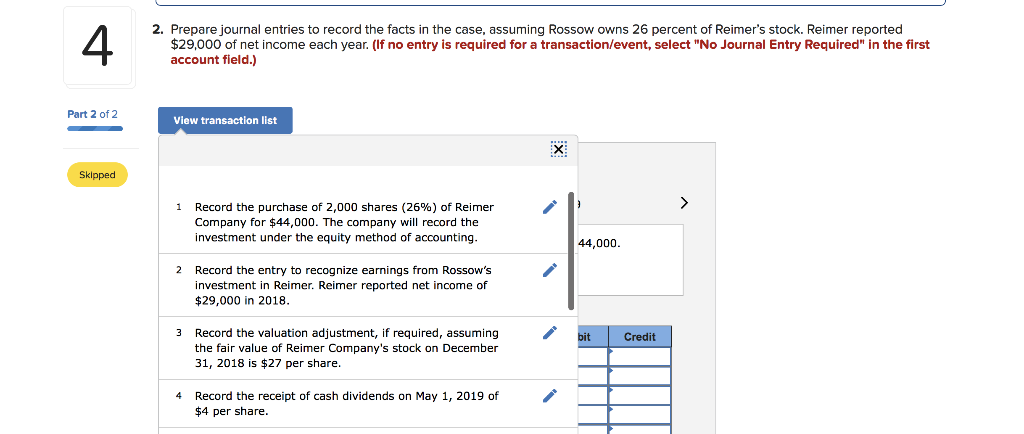

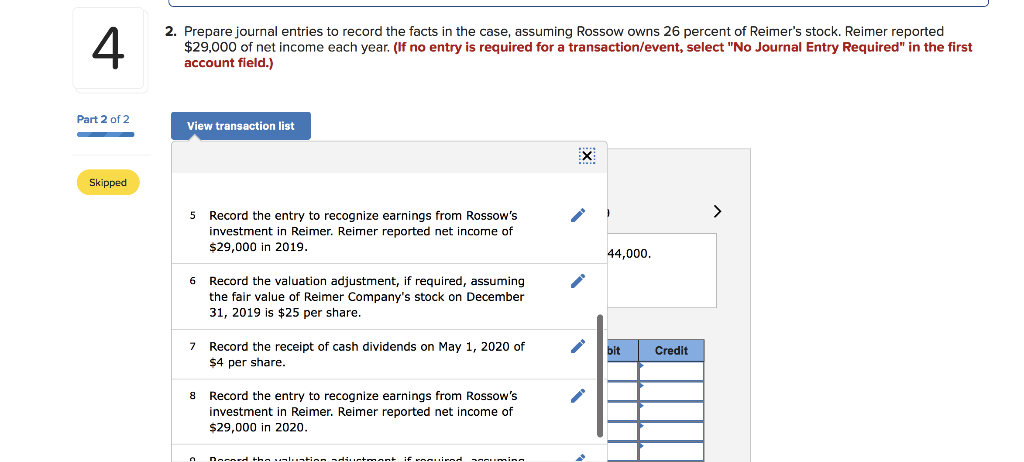

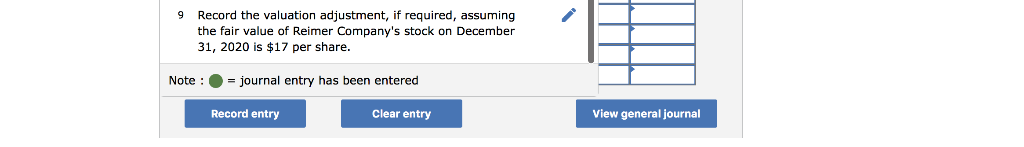

QZ Appendix D Saved Help Save & Exit Submit Required information [The following information applies to the questions displayed below.) Part 2 of 2 On July 12, 2018, Rossow Corporation purchased 2,000 shares of Reimer Company for $44,000. The following information applies to the fair value of Reimer Company: Skipped 12/31/2018 12/31/2019 12/31/2020 Per Share $ 27 25 17 Reimer Company declares and pays cash dividends of $4 per share on May 1 of each year. 2. Prepare journal entries to record the facts in the case, assuming Rossow owns 26 percent of Reimer's stock. Reimer reported $29,000 of net income each year. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) 2. Prepare journal entries to record the facts in the case, assuming Rossow owns 26 percent of Reimer's stock. Reimer reported $29,000 of net income each year. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Part 2 of 2 View transaction list Skipped 1 Record the purchase of 2,000 shares (26%) of Reimer Company for $44,000. The company will record the investment under the equity method of accounting. 44,000. 2 Record the entry to recognize earnings from Rossow's investment in Reimer. Reimer reported net income of $29,000 in 2018. bit Credit 3 Record the valuation adjustment, if required, assuming the fair value of Reimer Company's stock on December 31, 2018 is $27 per share. 4 Record the receipt of cash dividends on May 1, 2019 of $4 per share. 2. Prepare journal entries to record the facts in the case, assuming Rossow owns 26 percent of Reimer's stock. Reimer reported $29,000 of net income each year. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Part 2 of 2 View transaction list Skipped 5 Record the entry to recognize earnings from Rossow's investment in Reimer. Reimer reported net income of $29,000 in 2019. 44,000. 6 Record the valuation adjustment, if required, assuming the fair value of Reimer Company's stock on December 31, 2019 is $25 per share. 7 Record the receipt of cash dividends on May 1, 2020 of $4 per share. bit Credit 8 Record the entry to recognize earnings from Rossow's investment in Reimer. Reimer reported net income of $29,000 in 2020. Dacard that man IF ARIlinad Amina 9 Record the valuation adjustment, if required, assuming the fair value of Reimer Company's stock on December 31, 2020 is $17 per share. Note : = journal entry has been entered Record entry Clear entry View general journal