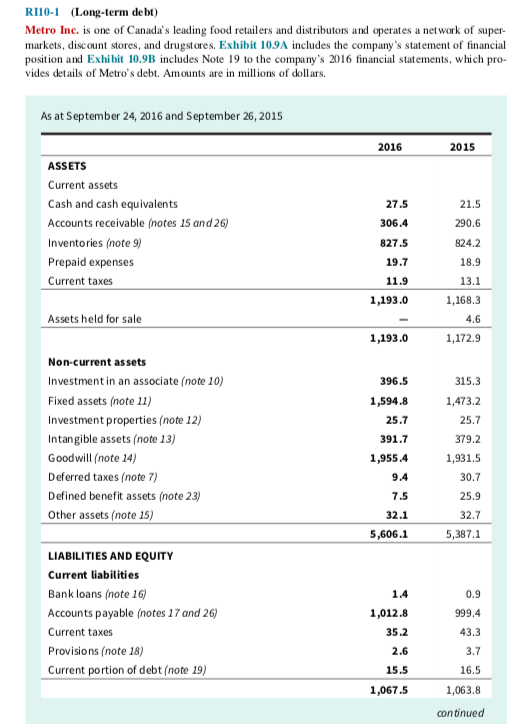

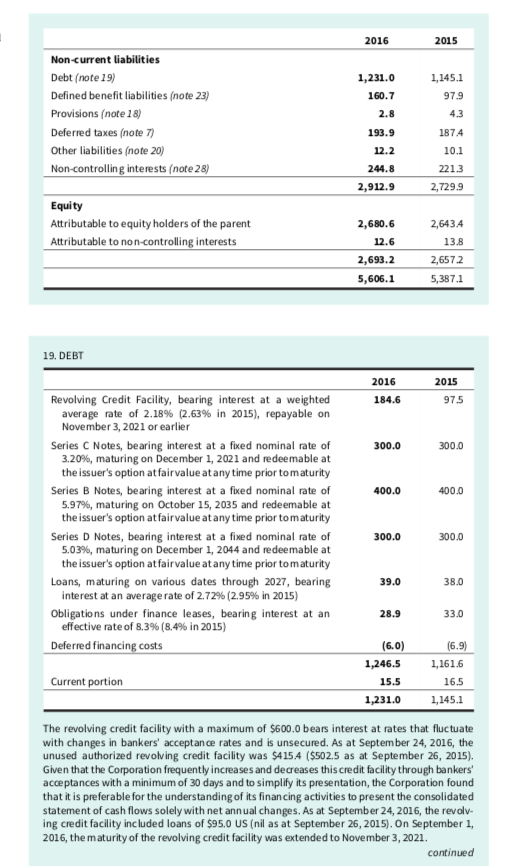

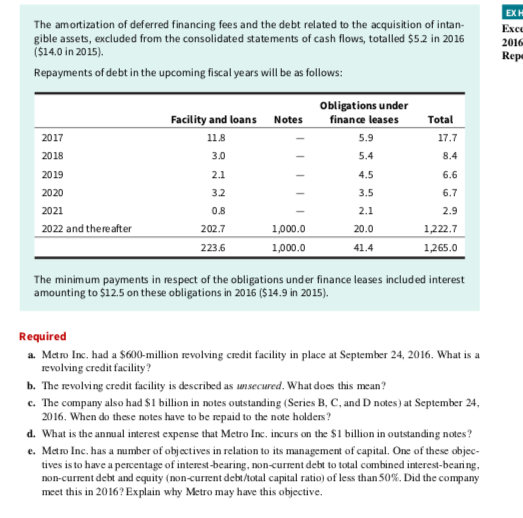

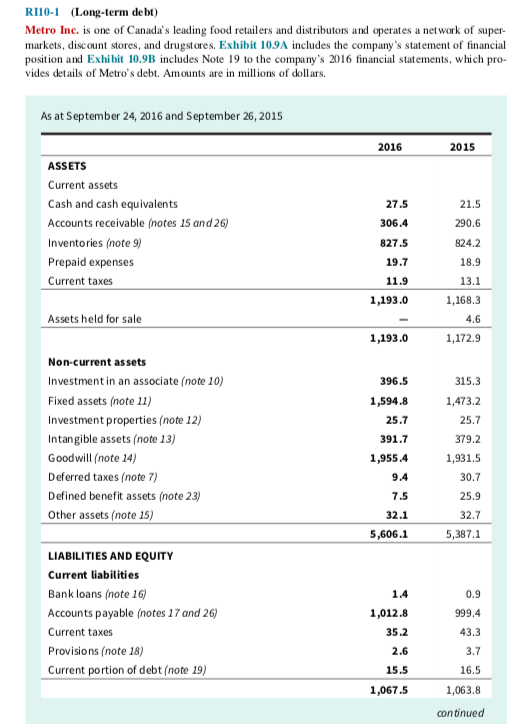

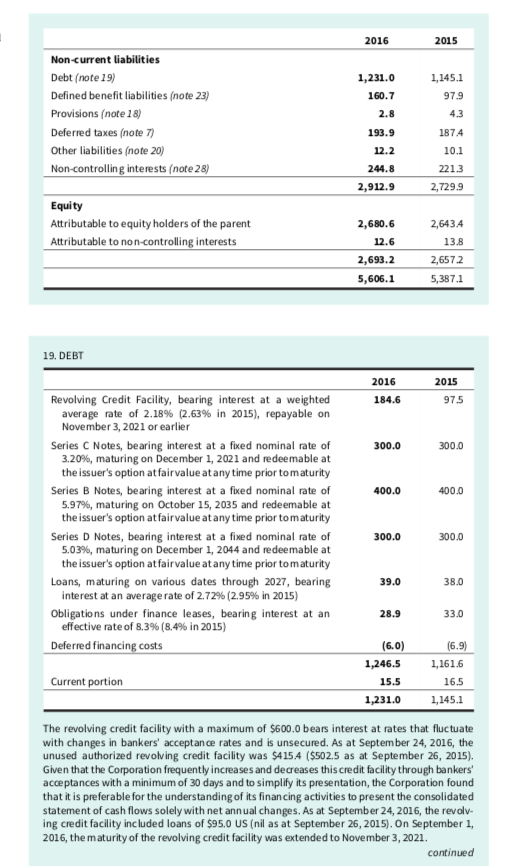

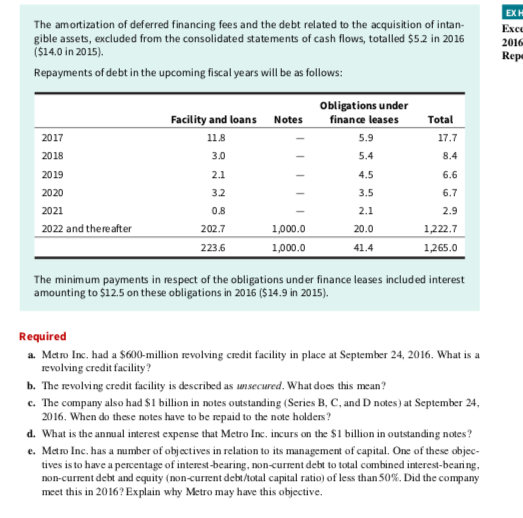

R110-1 (Long-term de bt) Metro Inc. is one of Canada's leading food retailers and distributors and operates a network of super markets, discount stores, and drugstores. Exhibit 109A includes the company's statement of financial position and Exhibit 10.9B includes Note 19 to the company's 2016 financial statements, which pro- vides details of Metro's debt. Amounts are in millions of dollars. As at September 24, 2016 and September 26, 2015 2016 2015 ASSETS Current assets Cash and cash equivalents Accounts receivable (notes 15 and 26) Inventories (note 9) Prepaid expenses Current taxes 27.5 306.4 827.5 19.7 11.9 1,193.0 21.5 290.6 824.2 18.9 13.1 1,168.3 4.6 1,172.9 Assets held for sale 1,193.0 Non-current assets Investment in an associate (note 10) Fixed assets (note 11) Investment properties (note 12) Intangible assets (note 13) Goodwill (note 24) Deferred taxes (note 7) Defined benefit assets (note 23) Other assets (note 15) 396.5 1,594.8 25.7 391.7 1,955.4 9.4 7.5 32.1 5,606. 1 315.3 1,473.2 25.7 379.2 1,931.5 30.7 25.9 32.7 ,387.1 5 LIABILITIES AND EQUITY Current liabilities Bank loans (note 16) Accounts payable (notes 17 and 26) Current taxes Provisions (note 18) Current portion of debt (note 19) 1.4 1,012.8 35.2 0.9 999.4 43.3 3.7 16.5 1,063.8 2.6 15.5 1,067.5 continued 2016 2015 1,231.0 160.7 1,145.1 979 Non-current liabilities Debt (note 19) Defined benefit liabilities (note 23) Provisions (note 18) Deferred taxes (note 77 Other liabilities (note 20) Non-controlling interests (note 28) 193.9 12.2 244.8 2,912.9 1874 10.1 2213 2,729.9 Equity Attributable to equity holders of the parent Attributable to non-controlling interests 2,680.6 12.6 2,693.2 5,606. 1 2,6434 135 2,6572 ,387.1 5 19. DEBT 2016 184.6 2015 97.5 300.0 300.0 400.0 400.0 Revolving Credit Facility, bearing interest at a weighted average rate of 2.18% (2.63% in 2015), repayable on November 3, 2021 or earlier Series C Notes, bearing interest at a fixed nominal rate of 3.20%, maturing on December 1, 2021 and redeemable at the issuer's option at fairvalue at any time prior to maturity Series B Notes, bearing interest at a fixed nominal rate of 5.97%, maturing on October 15, 2035 and redeemable at the issuer's option at fairvalue at any time prior to maturity Series D Notes, bearing interest at a fixed nominal rate of 5.03%, maturing on December 1, 2044 and redeemable at the issuer's option at fairvalue at any time prior to maturity Loans, maturing on various dates through 2027, bearing interest at an average rate of 2.72% (2.95% in 2015) Obligations under finance leases, bearing interest at an effective rate of 8.3% (8.4% in 2015) Deferred financing costs 300.0 300.0 39.0 38.0 28.9 33.0 (6.0) 1,246.5 15.5 1,231.0 (6.9) 1,161.6 16.5 1.145.1 Current portion The revolving credit facility with a maximum of $600.0 bears interest at rates that fluctuate with changes in bankers' acceptance rates and is unsecured. As at September 24, 2016, the unused authorized revolving credit facility was $415.4 ($502.5 as at September 26, 2015). Given that the Corporation frequently increases and decreases this credit facility through bankers' acceptances with a minimum of 30 days and to simplify its presentation, the Corporation found that it is preferable for the understanding of its financing activities to present the consolidated statement of cash flows solely with net annual changes. As at September 24, 2016, the revolv. ing credit facility included loans of $95.0 US (nil as at September 26, 2015). On September 1, 2016, the maturity of the revolving credit facility was extended to November 3, 2021. continued EXH FC The amortization of deferred financing fees and the debt related to the acquisition of intan gible assets, excluded from the consolidated statements of cash flows, totalled $52 in 2016 ($14.0 in 2015). Repayments of debt in the upcoming fiscal years will be as follows: 2016 Rep Facility and loans Notes Obligations under finance leases 5.9 Total 17.7 8.4 5.4 2017 2018 2019 2020 2021 2022 and thereafter 32 3.5 6.7 0.8 202.7 2.9 1,222.7 20.0 1,000.0 1,000.0 223.6 41.4 1,265.0 The minimum payments in respect of the obligations under finance leases included interest amounting to $12.5 on these obligations in 2016 ($14.9 in 2015). Required a. Metro Inc, had a $600-million revolving credit facility in place at September 24, 2016. What is a revolving credit facility? b. The revolving credit facility is described as unsecured. What does this mean? c. The company also had $1 billion in notes outstanding Series B, C, and D notes) at September 24, 2016. When do these notes have to be repaid to the note holders? d. What is the annual interest expense that Metro Inc. incurs on the $1 billion in outstanding notes? e. Metro Inc. has a number of objectives in relation to its management of capital. One of these objec- tives is to have a percentage of interest-bearing, non-current debt to total combined interest-bearing. non-current debt and equity (non-current debt/total capital ratio) of less than 50%. Did the company meet this in 2016? Explain why Metro may have this objective