Answered step by step

Verified Expert Solution

Question

1 Approved Answer

R=16 Q3. A well diversified corporation(with current beta of 1.2 and current D/E of 0.2) is entering in to a new venture which is likely

R=16

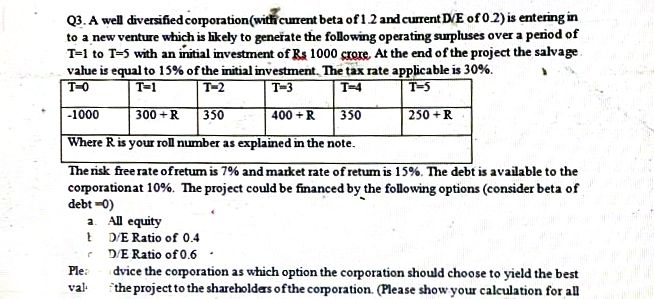

Q3. A well diversified corporation(with current beta of 1.2 and current D/E of 0.2) is entering in to a new venture which is likely to generate the following operating surpluses over a period of T=1 to T-5 with an initial investment of Rs 1000 crore. At the end of the project the salvage value is equal to 15% of the initial investment. The tax rate applicable is 30%. T=1 T-2 T-3 T-4 T-0 T=5 -1000 300+R 350 400+R 350 250+R Where R is your roll number as explained in the note. The risk free rate of retum is 7% and market rate of retum is 15%. The debt is available to the corporation at 10%. The project could be financed by the following options (consider beta of debt-0) All equity 1 D/E Ratio of 0.4 DE Ratio of 0.6 dvice the corporation as which option the corporation should choose to yield the best the project to the shareholders of the corporation. (Please show your calculation for all a Ple: valStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started