Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Rabuan has been carrying on a sole proprietorship business known as Rabuan Sports for the past 15 years in Kuala Pilah. He has been

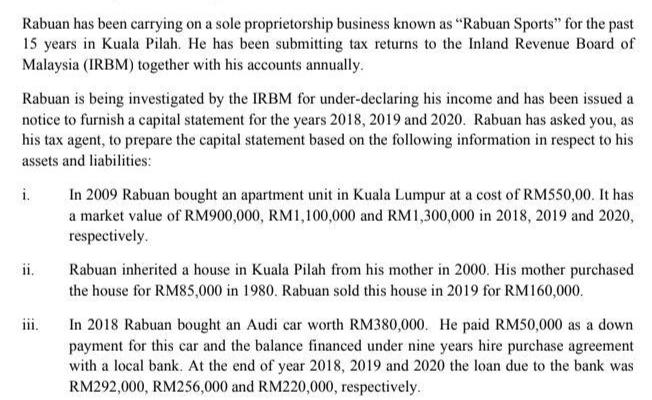

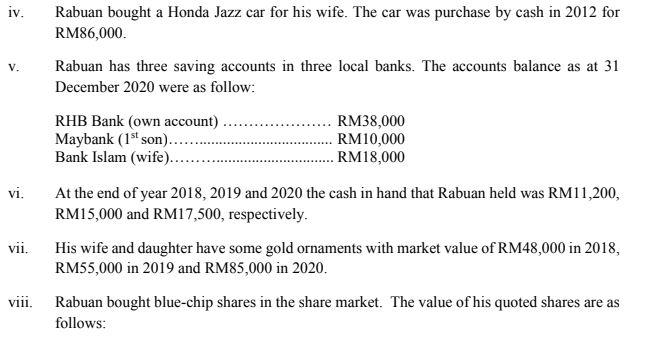

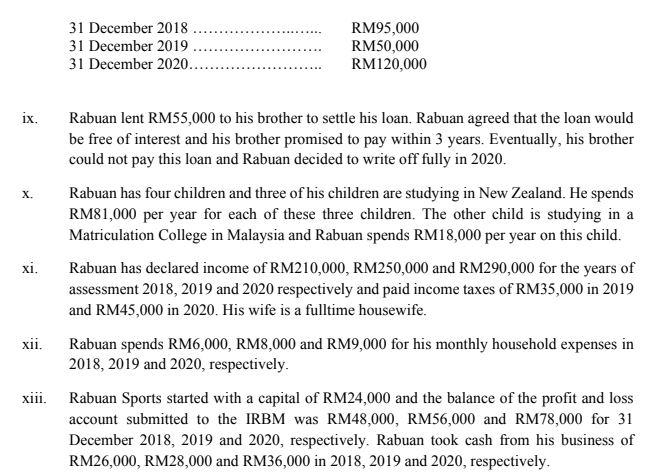

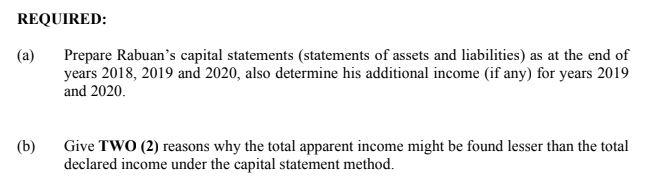

Rabuan has been carrying on a sole proprietorship business known as "Rabuan Sports" for the past 15 years in Kuala Pilah. He has been submitting tax returns to the Inland Revenue Board of Malaysia (IRBM) together with his accounts annually. Rabuan is being investigated by the IRBM for under-declaring his income and has been issued a notice to furnish a capital statement for the years 2018, 2019 and 2020. Rabuan has asked you, as his tax agent, to prepare the capital statement based on the following information in respect to his assets and liabilities: i. In 2009 Rabuan bought an apartment unit in Kuala Lumpur at a cost of RM550,00. It has a market value of RM900,000, RM1,100,000 and RM1,300,000 in 2018, 2019 and 2020, respectively. ii. Rabuan inherited a house in Kuala Pilah from his mother in 2000. His mother purchased the house for RM85,000 in 1980. Rabuan sold this house in 2019 for RM160,000. iii. In 2018 Rabuan bought an Audi car worth RM380,000. He paid RM50,000 as a down payment for this car and the balance financed under nine years hire purchase agreement with a local bank. At the end of year 2018, 2019 and 2020 the loan due to the bank was RM292,000, RM256,000 and RM220,000, respectively. iv. Rabuan bought a Honda Jazz car for his wife. The car was purchase by cash in 2012 for RM86,000. V. Rabuan has three saving accounts in three local banks. The accounts balance as at 31. December 2020 were as follow: RHB Bank (own account) Maybank (1st son)....... RM38,000 RM10,000 RM18,000 Bank Islam (wife)..... vi. At the end of year 2018, 2019 and 2020 the cash in hand that Rabuan held was RM11,200, RM15,000 and RM17,500, respectively. vii. His wife and daughter have some gold ornaments with market value of RM48,000 in 2018, RM55,000 in 2019 and RM85,000 in 2020. viii. Rabuan bought blue-chip shares in the share market. The value of his quoted shares are as follows: 31 December 2018 31 December 2019 31 December 2020.. RM95,000 RM50,000 RM120,000 ix. Rabuan lent RM55,000 to his brother to settle his loan. Rabuan agreed that the loan would be free of interest and his brother promised to pay within 3 years. Eventually, his brother could not pay this loan and Rabuan decided to write off fully in 2020. X. Rabuan has four children and three of his children are studying in New Zealand. He spends RM81,000 per year for each of these three children. The other child is studying in a Matriculation College in Malaysia and Rabuan spends RM18,000 per year on this child. xi. Rabuan has declared income of RM210,000, RM250,000 and RM290,000 for the years of assessment 2018, 2019 and 2020 respectively and paid income taxes of RM35,000 in 2019 and RM45,000 in 2020. His wife is a fulltime housewife. xii. Rabuan spends RM6,000, RM8,000 and RM9,000 for his monthly household expenses in 2018, 2019 and 2020, respectively. xiii. Rabuan Sports started with a capital of RM24,000 and the balance of the profit and loss account submitted to the IRBM was RM48,000, RM56,000 and RM78,000 for 31 December 2018, 2019 and 2020, respectively. Rabuan took cash from his business of RM26,000, RM28,000 and RM36,000 in 2018, 2019 and 2020, respectively. REQUIRED: (a) Prepare Rabuan's capital statements (statements of assets and liabilities) as at the end of years 2018, 2019 and 2020, also determine his additional income (if any) for years 2019 and 2020. (b) Give TWO (2) reasons why the total apparent income might be found lesser than the total declared income under the capital statement method.

Step by Step Solution

★★★★★

3.58 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

a Rabuans capital statement as at the end of year 2018 Assets Cash in hand RM11200 Savings accounts ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started