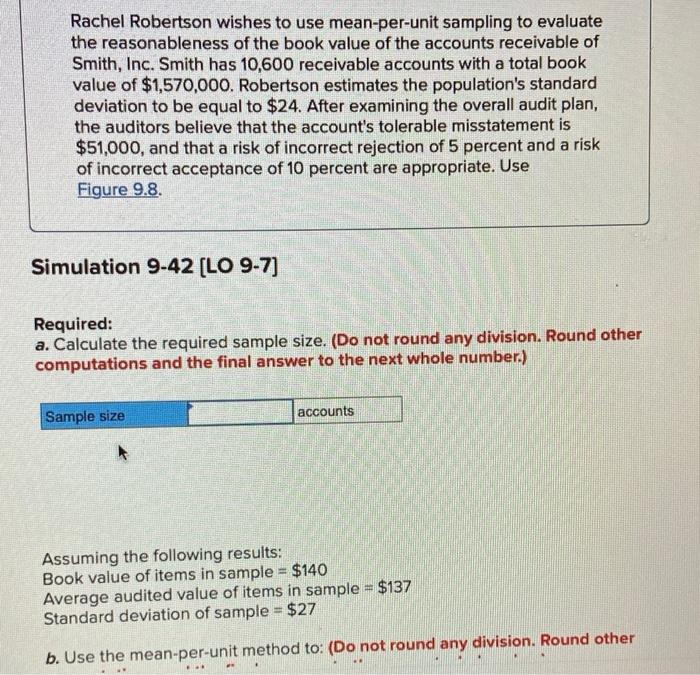

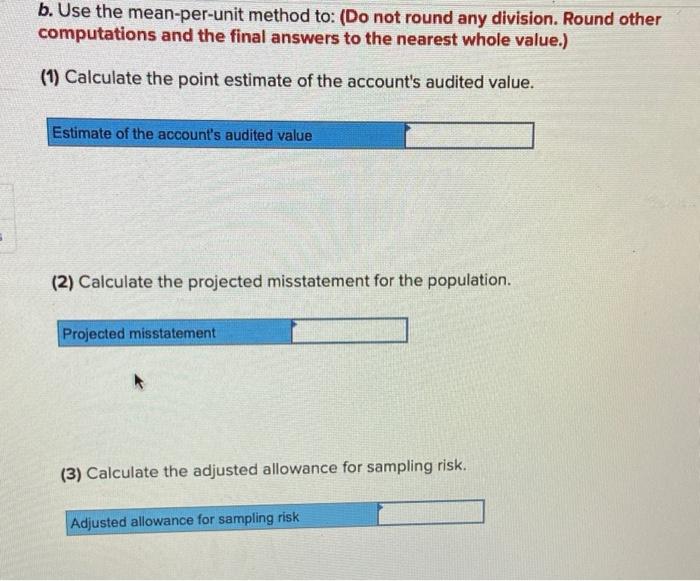

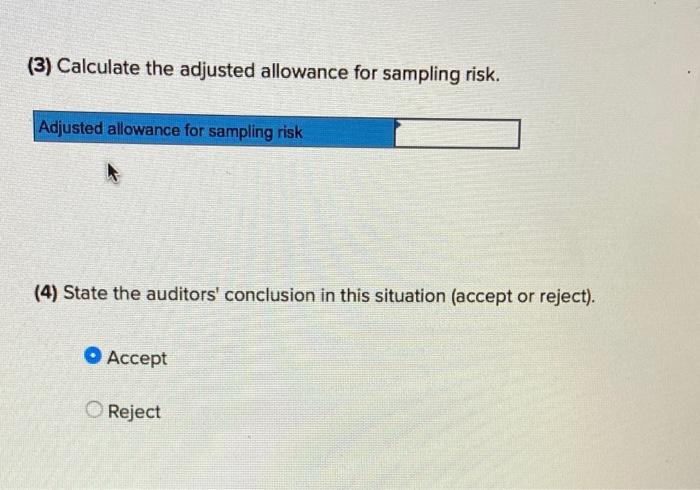

Rachel Robertson wishes to use mean-per-unit sampling to evaluate the reasonableness of the book value of the accounts receivable of Smith, Inc. Smith has 10,600 receivable accounts with a total book value of $1,570,000. Robertson estimates the population's standard deviation to be equal to $24. After examining the overall audit plan, the auditors believe that the account's tolerable misstatement is $51,000, and that a risk of incorrect rejection of 5 percent and a risk of incorrect acceptance of 10 percent are appropriate. Use Figure 9.8. Simulation 9-42 [LO 9-7] Required: a. Calculate the required sample size. (Do not round any division. Round other computations and the final answer to the next whole number.) Assuming the following results: Book value of items in sample =$140 Average audited value of items in sample =$137 Standard deviation of sample =$27 b. Use the mean-per-unit method to: (Do not round any division. Round other b. Use the mean-per-unit method to: (Do not round any division. Round other computations and the final answers to the nearest whole value.) (1) Calculate the point estimate of the account's audited value. (2) Calculate the projected misstatement for the population. (3) Calculate the adjusted allowance for sampling risk. (3) Calculate the adjusted allowance for sampling risk. (4) State the auditors' conclusion in this situation (accept or reject). Accept Reject Rachel Robertson wishes to use mean-per-unit sampling to evaluate the reasonableness of the book value of the accounts receivable of Smith, Inc. Smith has 10,600 receivable accounts with a total book value of $1,570,000. Robertson estimates the population's standard deviation to be equal to $24. After examining the overall audit plan, the auditors believe that the account's tolerable misstatement is $51,000, and that a risk of incorrect rejection of 5 percent and a risk of incorrect acceptance of 10 percent are appropriate. Use Figure 9.8. Simulation 9-42 [LO 9-7] Required: a. Calculate the required sample size. (Do not round any division. Round other computations and the final answer to the next whole number.) Assuming the following results: Book value of items in sample =$140 Average audited value of items in sample =$137 Standard deviation of sample =$27 b. Use the mean-per-unit method to: (Do not round any division. Round other b. Use the mean-per-unit method to: (Do not round any division. Round other computations and the final answers to the nearest whole value.) (1) Calculate the point estimate of the account's audited value. (2) Calculate the projected misstatement for the population. (3) Calculate the adjusted allowance for sampling risk. (3) Calculate the adjusted allowance for sampling risk. (4) State the auditors' conclusion in this situation (accept or reject). Accept Reject