Answered step by step

Verified Expert Solution

Question

1 Approved Answer

RadCo International is a U . S . firm with a wholly owned subsidiary in France that uses the euro as its functional currency. The

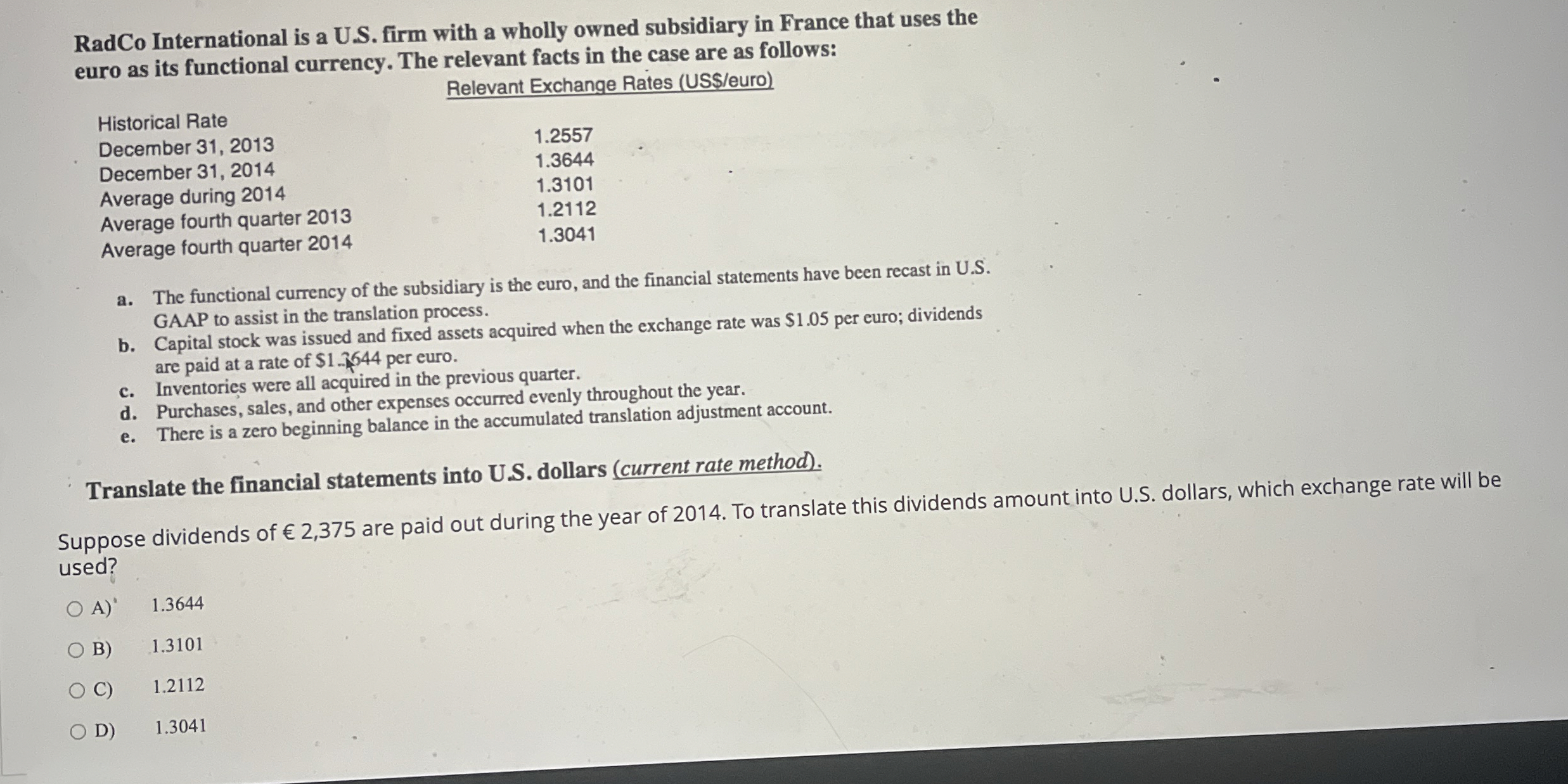

RadCo International is a US firm with a wholly owned subsidiary in France that uses the euro as its functional currency. The relevant facts in the case are as follows: Relevant Exchange Rates US$euro tableHistorical Rate,December December Average during Average fourth quarter Average fourth quarter a The functional currency of the subsidiary is the curo, and the financial statements have been recast in US GAAP to assist in the translation process. b Capital stock was issued and fixed assets acquired when the exchange rate was $ per euro; dividends are paid at a rate of $ $ per euro. c Inventories were all acquired in the previous quarter. d Purchases, sales, and other expenses occurred evenly throughout the year. e There is a zero beginning balance in the accumulated translation adjustment account. Translate the financial statements into US dollars current rate method Suppose dividends of are paid out during the year of To translate this dividends amount into US dollars, which exchange rate will be used? A B C D

RadCo International is a US firm with a wholly owned subsidiary in France that uses the euro as its functional currency. The relevant facts in the case are as follows:

Relevant Exchange Rates US$euro

tableHistorical Rate,December December Average during Average fourth quarter Average fourth quarter

a The functional currency of the subsidiary is the curo, and the financial statements have been recast in US GAAP to assist in the translation process.

b Capital stock was issued and fixed assets acquired when the exchange rate was $ per euro; dividends are paid at a rate of $ $ per euro.

c Inventories were all acquired in the previous quarter.

d Purchases, sales, and other expenses occurred evenly throughout the year.

e There is a zero beginning balance in the accumulated translation adjustment account.

Translate the financial statements into US dollars current rate method

Suppose dividends of are paid out during the year of To translate this dividends amount into US dollars, which exchange rate will be used?

A

B

C

D

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started