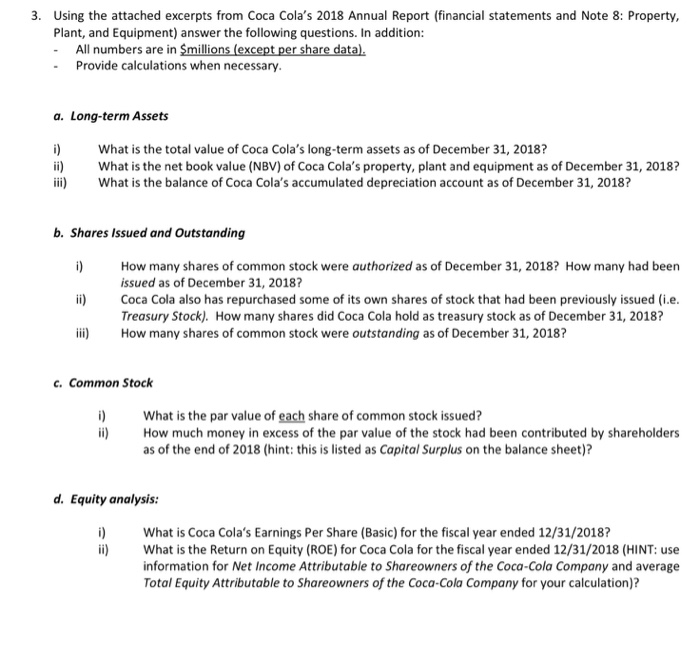

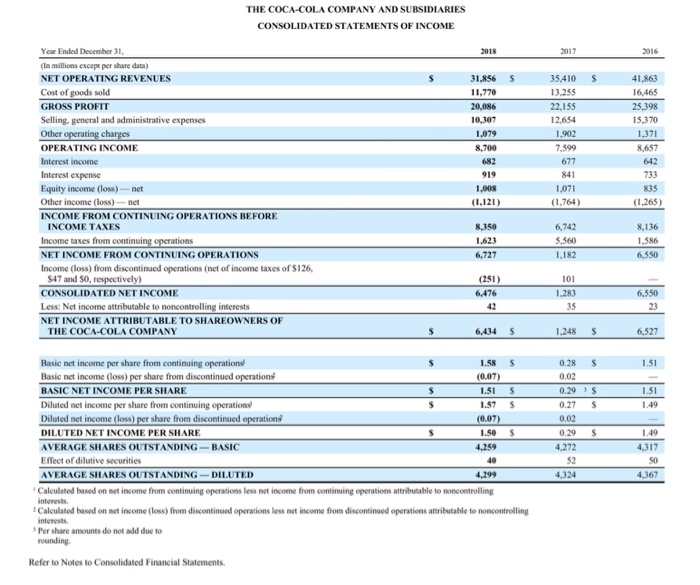

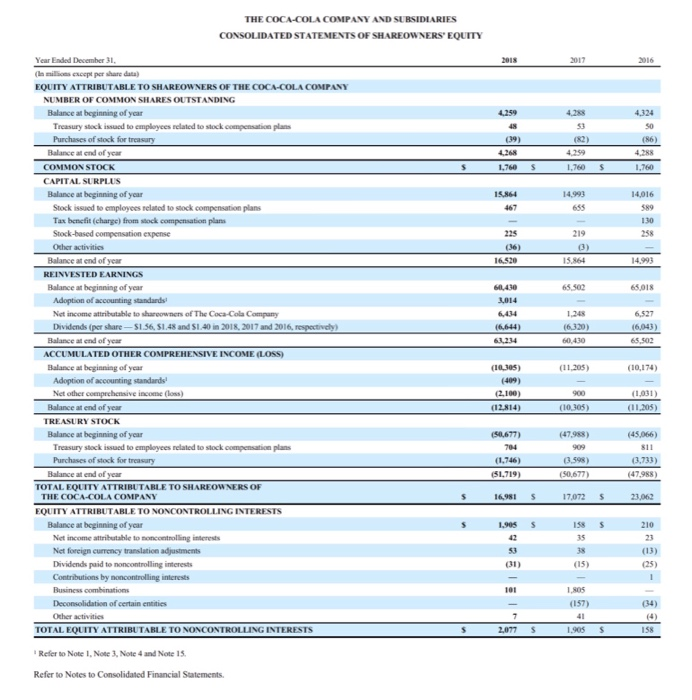

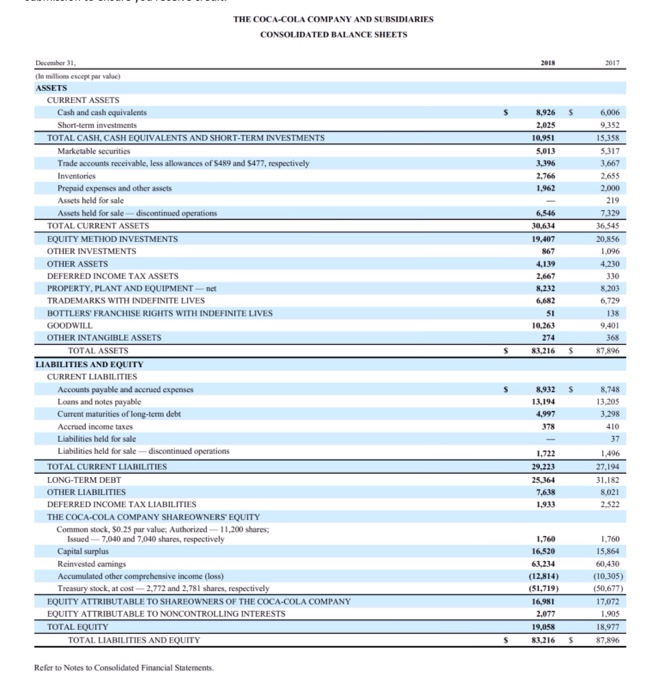

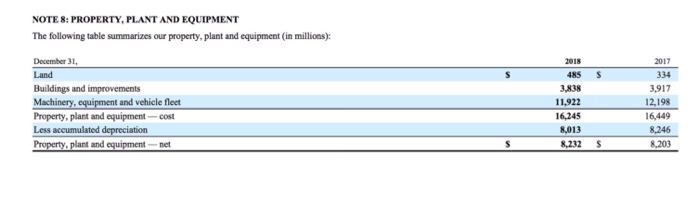

3. Using the attached excerpts from Coca Cola's 2018 Annual Report (financial statements and Note 8: Property, Plant, and Equipment) answer the following questions. In addition: - All numbers are in Smillions (except per share data). - Provide calculations when necessary. a. Long-term Assets i) ii) iii) What is the total value of Coca Cola's long-term assets as of December 31, 2018? What is the net book value (NBV) of Coca Cola's property, plant and equipment as of December 31, 2018? What is the balance of Coca Cola's accumulated depreciation account as of December 31, 2018? b. Shares Issued and Outstanding How many shares of common stock were authorized as of December 31, 2018? How many had been issued as of December 31, 2018? Coca Cola also has repurchased some of its own shares of stock that had been previously issued (i.e. Treasury Stock). How many shares did Coca Cola hold as treasury stock as of December 31, 2018? How many shares of common stock were outstanding as of December 31, 2018? c. Common Stock ii) What is the par value of each share of common stock issued? How much money in excess of the par value of the stock had been contributed by shareholders as of the end of 2018 (hint: this is listed as Capital Surplus on the balance sheet)? d. Equity analysis: What is Coca Cola's Earnings Per Share (Basic) for the fiscal year ended 12/31/2018? What is the Return on Equity (ROE) for Coca Cola for the fiscal year ended 12/31/2018 (HINT: use information for Net Income Attributable to Shareowners of the Coca-Cola Company and average Total Equity Attributable to Shareowners of the Coca-Cola Company for your calculation)? THE COCA-COLA COMPANY AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF INCOME 2017 S S 31.856 11,770 20,086 10,307 1.079 8,700 682 919 1.008 (1.121) 35.410 13.255 22.155 12.654 1.902 7.599 41.863 16,465 25.398 15.370 1,371 8.657 677 642 Year Ended December 31, (In millions except per share data) NET OPERATING REVENUES Cost of goods sold GROSS PROFIT Selling, general and administrative expenses Other operating charges OPERATING INCOME Interest income Interest expense Equity income (loss)-net Other income (loss) -- net INCOME FROM CONTINUING OPERATIONS BEFORE INCOME TAXES Income taxes from continuing operations NET INCOME FROM CONTINUING OPERATIONS Income (loss) from discontinued operations (net of income taxes of $126, S47 and SO, respectively) CONSOLIDATED NET INCOME Less: Net income attributable to noncontrolling interests NET INCOME ATTRIBUTABLE TO SHAREOWNERS OF THE COCA-COLA COMPANY 733 841 1,071 (1.764) 835 (1.265) 6,742 8,350 1.623 6,727 5.560 1,182 8,136 1.586 6.550 (251) 6,476 42 101 1.283 35 6.550 23 6,434 S 1.248 $ 6,527 $ 1.51 0.28 0.02 0.29S 0.27 0.02 0.29 4.272 $ 1.49 $ 1.49 Basic net income per share from continuing operations $ 1.58 Basic net income (loss) per share from discontinued operations (0.07) BASIC NET INCOME PER SHARE 1.51 S Diluted net income per share from continuing operations 1.57 $ Diluted net income (loss) per share from discontinued operations (0.07) DILUTED NET INCOME PER SHARE 1.50 $ AVERAGE SHARES OUTSTANDING - BASIC 4,259 Effect of dilutive securities 40 AVERAGE SHARES OUTSTANDING DILUTED 4,299 Calculated based on net income from continuing operations less net income from continuing operations attributable to noncontrolling interest Calculated based on net income (loss) from discontinued operations less net income from discontinued operations attributable to noncontrolling interests Per share amounts do not add due to rounding 4.324 4,367 Refer to Notes to Consolidated Financial Statements. THE COCA-COLA COMPANY AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF SHAREOWNERS' EQUITY 2017 4.259 50 (16) (39) 4.268 1,760 48 4.259 1,760 $ $ $ 1.760 15.864 14,016 14993 655 130 258 3) (36) 16.620 15.164 14.99 65 502 65,018 1410 3,014 Year Ended Desember 31. (les millies except per share data) EQUITY ATTRIBUTABLE TO SHAREOWNERS OF THE COCA-COLA COMPANY NUMBER OF COMMON SHARES OUTSTANDING Balance at beginning of year Treasury stock issued to employees related to stock compensation plans Purchases of stock for treasury Balance at end of your COMMON STOCK CAPITAL SURPLUS Balance at beginning of year Stock issued to employees related to stock compensation plans Tax benefit (charge) from wock compensation plans Stock-based compensation expense Oxher activities Balance end of year REINVESTED EARNINGS Balance at beginning of year Adoption of accounting standards! Net income attributable to shareowners of The Coca-Cola Company Dividends (per share --S1.56, 51.48 and 1.40 in 2018, 2017 and 2016, respectively) Balance and of year ACCUMULATED OTHER COMPREHENSIVE INCOME LOSS) Balance at beginning of year Adoption of accounting standardel Net other comprehensive income (less) Balance end of year TREASURY STOCK Balance at beginning of year Treasury stock issued to employees related to stock compensation plans Purchases of stock for treasury Balance at end of year TOTAL EQUITY ATTRIBUTARLE TO SHAREOWNERS OF THE COCA-COLA COMPANY EQUITY ATTRIBUTABLE TO NONCONTROLLING INTERESTS Balance at beginning of year Net income attributable to controlling interest Net foreign currency translation adjustments Dividends paid to noncontrolling interests Contributions by noncontrolling interests Business combinations Deconsolidation of certain entities Other activities TOTAL EQUITY ATTRIBUTARLE TO NONCONTROLLING INTERESTS (6,043) 1.248 (6320) 60.410 (6.644) 61214 65 SOZ (11.205) (10,174) (10_305) (409) 2.100) 900 (10 305) (1.031) (11,205) (12.814) (45,066) 704 (3.598) (50.677) (3.733) (47,988) $1,719) S 169815170725 23.062 1.9055 158 35 210 (13) (25) (15) 1.805 (157) $ 2077 $ 1.95 $ 158 Refer to Note 1. Note 3 Note 4 and Note 15 Refer to Notes to Consolidated Financial Statements. THE COCA-COLA COMPANY AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS $ 8,926 2,025 10,951 5,013 6.006 9152 15.158 5317 3.667 2655 2.000 196 2,766 1.962 219 6,546 61 19,407 867 4,139 2.667 8.232 6,682 SI 10,263 7.329 36,545 20.356 1.096 4.230 330 8.203 6,729 214 December 31 In millions par value) ASSETS CURRENT ASSETS Cash and cash equivalents Short-term investments TOTAL CASH, CASH EQUIVALENTS AND SHORT-TERM INVESTMENTS Marketable securities Trade accounts receivable, less allowances of $489 and 5477, respectively Inventones Prepaid expenses and other assets Assets held for sale Assets held for sale discontinued stations TOTAL CURRENT ASSETS EQUITY METHOD INVESTMENTS OTHER INVESTMENTS OTHER ASSETS DEFERRED INCOME TAX ASSETS PROPERTY, PLANT AND EQUIPMENT-net TRADEMARKS WITH INDEFINITE LIVES BOTTLERS' FRANCHISE RIGHTS WITH INDEFINITE LIVES GOODWILL OTHER INTANGIBLE ASSETS TOTAL ASSETS LIABILITIES AND EQUITY CURRENT LIABILITIES Accounts payable and accrued expenses Loans and notes payable Current maturities of long-term debt Accrued income taxes Liabilities held for sale Liabilities held for sale-discontinued operations TOTAL CURRENT LIABILITIES LONG-TERM DEBT OTHER LIABILITIES DEFERRED INCOME TAX LIABILITIES THE COCA-COLA COMPANY SHAREOWNERS' EQUITY Common stock, S0.25 par value: Authorized - 11.200 shares, Issud 7040 and 7010 shares, respectively Capital surplus Renewed cng Accumulated other comprehensive income (loss) Treasury stock, at cost-2.772 and 2,781 shares, respectively EQUITY ATTRIBUTABLE TO SHAREOWNERS OF THE COCA-COLA COMPANY EQUITY ATTRIBUTABLE TO NONCONTROLLING INTERESTS TOTAL EQUITY TOTAL LIABILITIES AND EQUITY 9401 368 87,896 S 1216 $ $ 8,932 12194 4.997 378 8,748 11.05 3.298 410 1,722 25364 1,496 27,194 31,182 8,021 2.522 1.933 1,760 16.520 (12,814) (51.719) 16,981 2.077 1.760 15.864 60430 (10,305) (50.677) 17,072 1.905 18977 87,896 S 83,216 $ Refer to Notes to Consolidated Financial Statements. NOTE 8: PROPERTY, PLANT AND EQUIPMENT The following table summarizes our property, plant and equipment (in millions): 2017 S December 31. Land Buildings and improvements Machinery, equipment and vehicle fleet Property, plant and equipment-cost Less accumulated depreciation Property, plant and equipment-net 2015 4NS 3,838 11,922 16,245 2013 ,232 3,917 12.198 16,449 8.246 8,203 S 8 $