Answered step by step

Verified Expert Solution

Question

1 Approved Answer

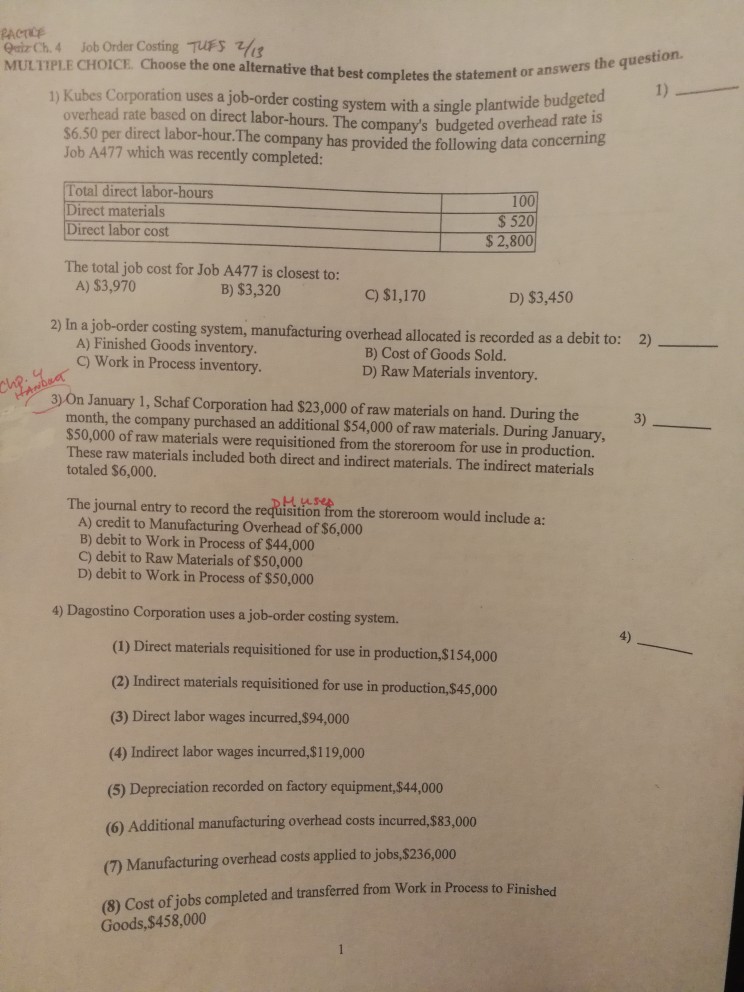

RAer Quir Ch. 4 Job Order Costing TuFs We MULTIPLE CHOICE. Choose the one alternative that best completes the statemen or answers the question. 1)

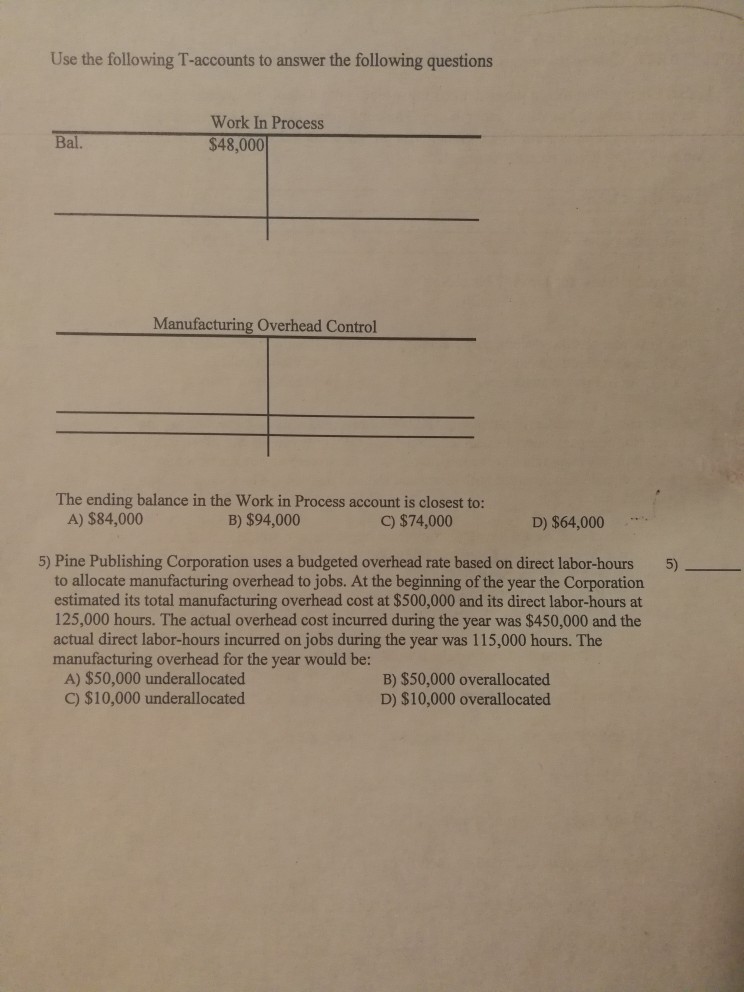

RAer Quir Ch. 4 Job Order Costing TuFs We MULTIPLE CHOICE. Choose the one alternative that best completes the statemen or answers the question. 1) Kubes Corporation uses a job-order costing system with a single plantwide bu overhead rate based on direct labor-hours. The company's budgeted o S6.50 per direct labor-hour.The company has provided the Job A477 which was recently completed: overhead rate is following data concerning Total direct labor-hours Direct materials Direct labor cost 100 $ 520 $ 2,800 The total job cost for Job A477 is closest to: A) $3,970 B) $3,320 C) $1,170 D) $3,450 2) In a job-order costing system, manufacturing overhead allocated is recorded as a debit to:2)_ A) Finished Goods inventory. B) Cost of Goods Sold. D) Raw Materials inventory. C) Work in Process inventory. 3)0n January 1, Schaf Corporation had $23,000 of raw materials on hand. During the month, the company purchased an additional $54,000 of raw materials. During January, $50,000 of raw materials were requisitioned from the storeroom for use in production. These raw materials included both direct and indirect materials. The indirect materials totaled $6,000. 3) The journal entry to record the requisition from the storeroom would include a: A) credit to Manufacturing Overhead of $6,000 B) debit to Work in Process of $44,000 C) debit to Raw Materials of $50,000 D) debit to Work in Process of $50,000 4) Dagostino Corporation uses a job-order costing system. 4) (1) Direct materials requisitioned for use in production,$154,000 (2) Indirect materials requisitioned for use in production,$45,000 (3) Direct labor wages incurred,$94,000 (4) Indirect labor wages incurred,$119,000 (5) Depreciation recorded on factory equipment, $44,000 (6) Additional manufacturing overhead costs incurred, $83,000 (7) Manufacturing overhead costs applied to jobs,$236,000 (8) Cost of jobs completed and transferred from Work in Process to Finished Goods,$458,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started