Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Rai, Sai and Tai are former school mates who were doing business together. The business is not registered but they QUESTION FOUR registered themselves as

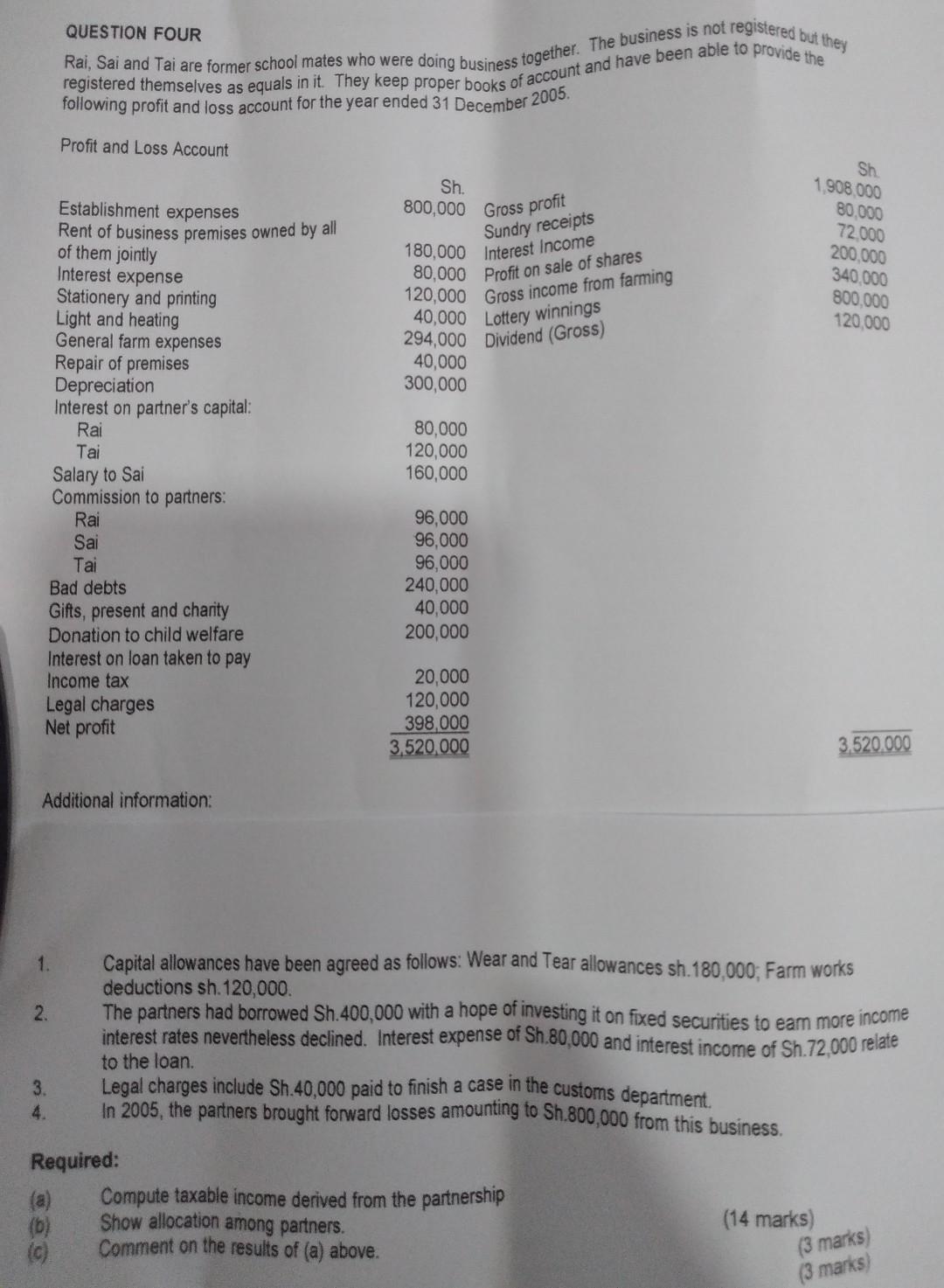

Rai, Sai and Tai are former school mates who were doing business together. The business is not registered but they QUESTION FOUR registered themselves as equals in it. They keep proper books of account and have been able to provide the following profit and loss account for the year ended 31 December 2005. Profit and I nce annumt 1. Capital allowances have been agreed as follows: Wear and Tear allowances sh. 180,000; Farm works deductions sh. 120,000 . 2. The partners had borrowed Sh. 400,000 with a hope of investing it on fixed securities to eam more income interest rates nevertheless declined. Interest expense of Sh. 80,000 and interest income of Sh. 72,000 relate to the loan. 3. Legal charges include Sh. 40,000 paid to finish a case in the customs department. 4. In 2005, the partners brought forward losses amounting to Sh.800,000 from this business

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started