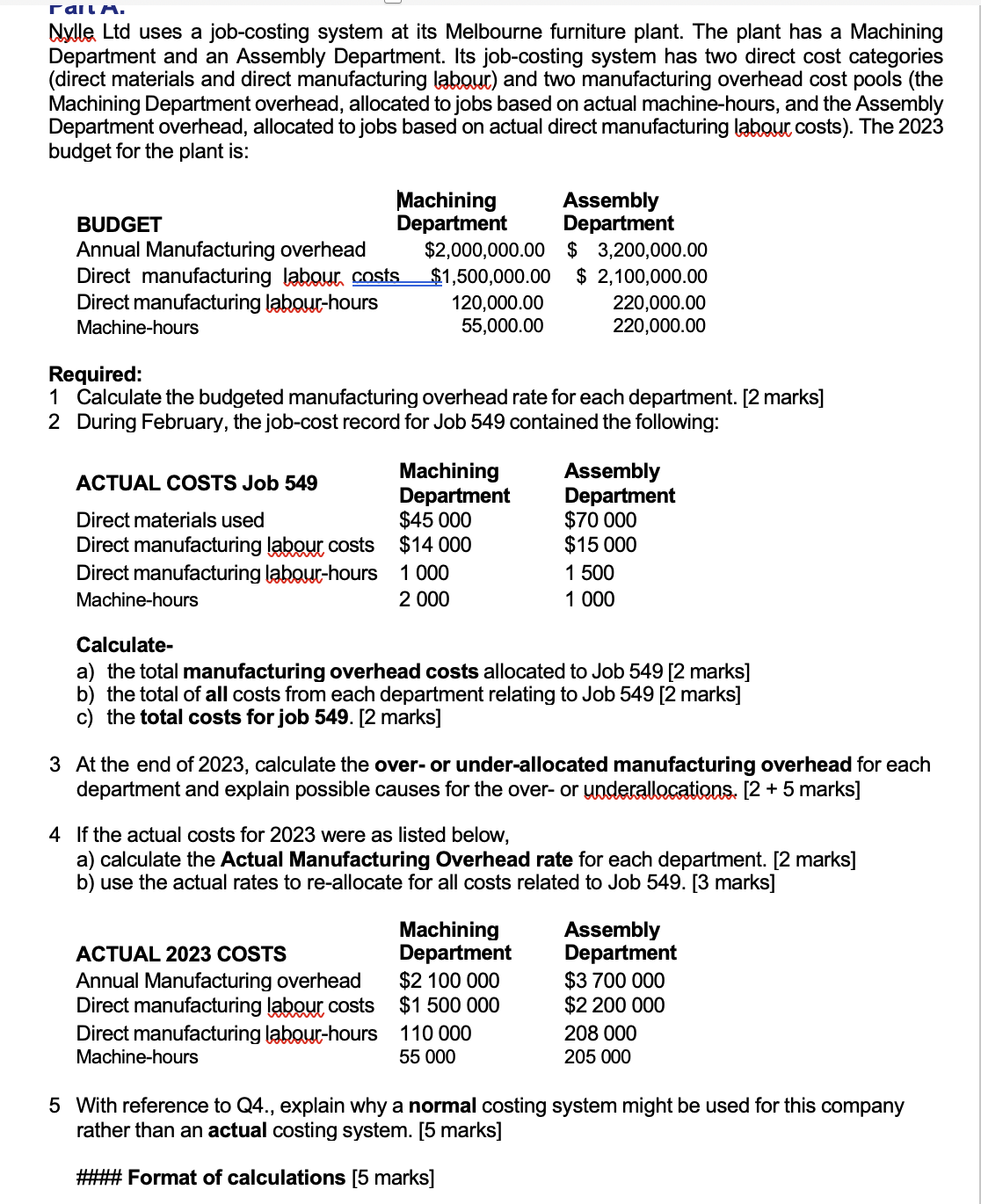

railA. Nylle Lid uses a job-costing system at its Melbourne furniture plant. The plant has a Machining Department and an Assembly Department. Its job-costing system has two direct cost categories (direct materials and direct manufacturing labour) and two manufacturing overhead cost pools (the Machining Department overhead, allocated to jobs based on actual machine-hours, and the Assembly Department overhead, allocated to jobs based on actual direct manufacturing labour costs). The 2023 budget for the plant is: Machining Assembly BUDGET Department Department Annual Manufacturing overhead $2,000,000.00 $ 3,200,000.00 Direct manufacturing labour costs $1,500,000.00 $ 2, 100,000.00 Direct manufacturing labour-hours 120,000.00 220,000.00 Machine-hours 55,000.00 220,000.00 Required: 1 Calculate the budgeted manufacturing overhead rate for each department. [2 marks] 2 During February, the job-cost record for Job 549 contained the following: ACTUAL COSTS Job 549 Machining Assembly Department Department Direct materials used $45 000 $70 000 Direct manufacturing labour costs $14 000 $15 000 Direct manufacturing labour-hours 1 000 1 500 Machine-hours 2 000 1 000 Calculate- a) the total manufacturing overhead costs allocated to Job 549 [2 marks] b) the total of all costs from each department relating to Job 549 [2 marks] c) the total costs for job 549. [2 marks] 3 At the end of 2023, calculate the over- or under-allocated manufacturing overhead for each department and explain possible causes for the over- or underallocations. [2 + 5 marks] 4 If the actual costs for 2023 were as listed below, a) calculate the Actual Manufacturing Overhead rate for each department. [2 marks] b) use the actual rates to re-allocate for all costs related to Job 549. [3 marks] Machining Assembly ACTUAL 2023 COSTS Department Department Annual Manufacturing overhead $2 100 000 $3 700 000 Direct manufacturing labour costs $1 500 000 $2 200 000 Direct manufacturing labour-hours 110 000 208 000 Machine-hours 55 000 205 000 5 With reference to Q4., explain why a normal costing system might be used for this company rather than an actual costing system. [5 marks] #### Format of calculations [5 marks]