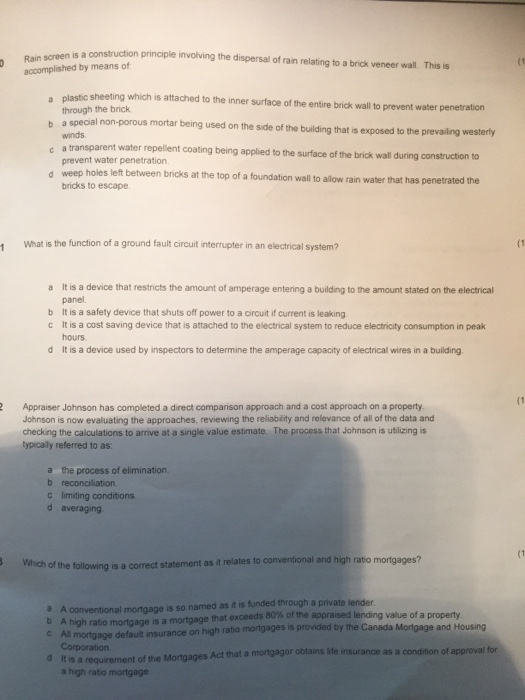

Rain screen is a construction principle involving the dispersal of rain relating to a brick veneer wall. This is accomplished by means of a. plastic sheeting which is attached to the inner surface of the entire brick wall to prevent water penetration through the brick. b. a special non-porous mortar being used on the side of the building that is exposed to the prevailing westerly winds. c. a transparent water repellent coating being applied to the surface of the brick wall during construction to prevent water penetration. d. weep holes lessthanorequalto holes left between bricks at the top of a foundation wall to allow rain water that has penetrated the bricks to escape What is the function of a ground fault circuit interrupter in an electrical system? a. It is a device that restricts the amount of amperage entering a building to the amount stated on the electrical panel. b. It is a safety device that shuts off power to a circuit if current is leaking. c. It is a cost saving device that is attached to the electrical system to reduce electricity consumption in peak hours. d. It is a device used by inspectors to determine the amperage capacity of electrical wires in a building. Appraiser Johnson has completed a direct comparison approach and a cost approach on a property. Johnson is now evaluating the approaches, reviewing the reliability and relevance of all of the data and checking the calculations to arrive at a single value estimate. The process that Johnson is utilizing is typically referred to as: a. the process of elimination. b. reconciliation. c. limiting conditions d. averaging. Which of the following is a correct statement as it relates to c conventional and high ratio mortgages? a. A conventional mortgage is so named as it is funded through a private lender. b. A high ratio mortgage is a mortgage that exceeds 80% of the appraised lending value of a property. c. All mortgage default insurance on high ratio mortgages is provided by the Canada Mortgage and Housing Corporation. d. It is a requirement of the Mortgage Act that a mortgagor obtains life insurance as a condition of approval for a high rate mortgage