Answered step by step

Verified Expert Solution

Question

1 Approved Answer

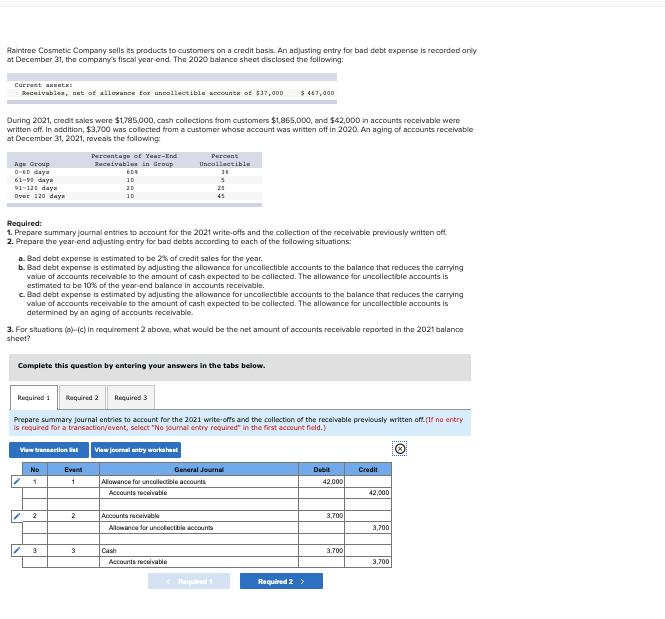

Raintree Cosmetic Company sells its products to customers on a credit basis. An adjusting entry for bad debt expense is recorded only at December

Raintree Cosmetic Company sells its products to customers on a credit basis. An adjusting entry for bad debt expense is recorded only at December 31, the company's fiscal year end. The 2020 balance sheet disclosed the following: Currest annata: Receivahlea, nat of allowance tor uncollectible acounts of $37,000 447,000 During 2021, credit sales were $1,785,000, cash collections from customers $1,865,000, and $42,000 in accounts receivable were written aff. In addition, $3,700 was collected from a customer whase account was written off in 2020. An aging of accounts receivable at December 31, 2021, reveals the following: Percentage of Year-End Percent Receivables in Group Uncallectible Age Group O-ED daya EDE 61-9 daya 91-120 dayw 10 21 Over 120 daya 1D 45 Required: 1. Prepare summary journal entries to account for the 2021 write-offs and the collection of the receivable previously written off 2. Prepare the year-end adjusting entry for bad detts according to each of the following situations: a. Bad debt expense is estimated to be 2% of credit sales for the year. b. Bad debt expense is estimated by adjusting the allowance for uncolectible accounts to the balance that reduces the carrying value of accounts receivable to the amaunt of cash expected to be collected. The allowance for uncollectible accounts is estimated to be 10% of the year-end balance in accounts receivable. c. Bad debt expense is estimated by adjusting the alowance for uncoliectible accounts to the balance that reduces the carrying value of accounts recelvable to the amaunt of cash expected to be collected. The allowance for uncollectible accounts is determined by an aging of accounts receivable. 3. For situations (a)-(c) in requirement 2 above, what would be the net amount of accounts receivable reported in the 2021 balance sheet? Complete this question by entering your answers in the tabs below. Raquired 1 Required 2 Raquired 3 Prepare summary journal entries to account for the 2021 write-offs and the collection of the receivable previously written off.(If no entry Is required for a transaction/event, select "No joumal entry required" in the fiest account reld.) Visw transaction t View journal antry warkahest No Event General Journal Debit Credit 1 Alowance for uncollectible accounts 42,000 Accounts recelvable 42,000 2 Accounts recaivable 3,700 Allowanoe for unoolectible accounts 3,700 3 3 Cash 3,700 Accounts receivatie 3,700 a Required 2 >

Step by Step Solution

★★★★★

3.39 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Req 1 Journal entries Sno Accounts title and explanations Debit Credit a Allowance for Uncollectible ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started