Question

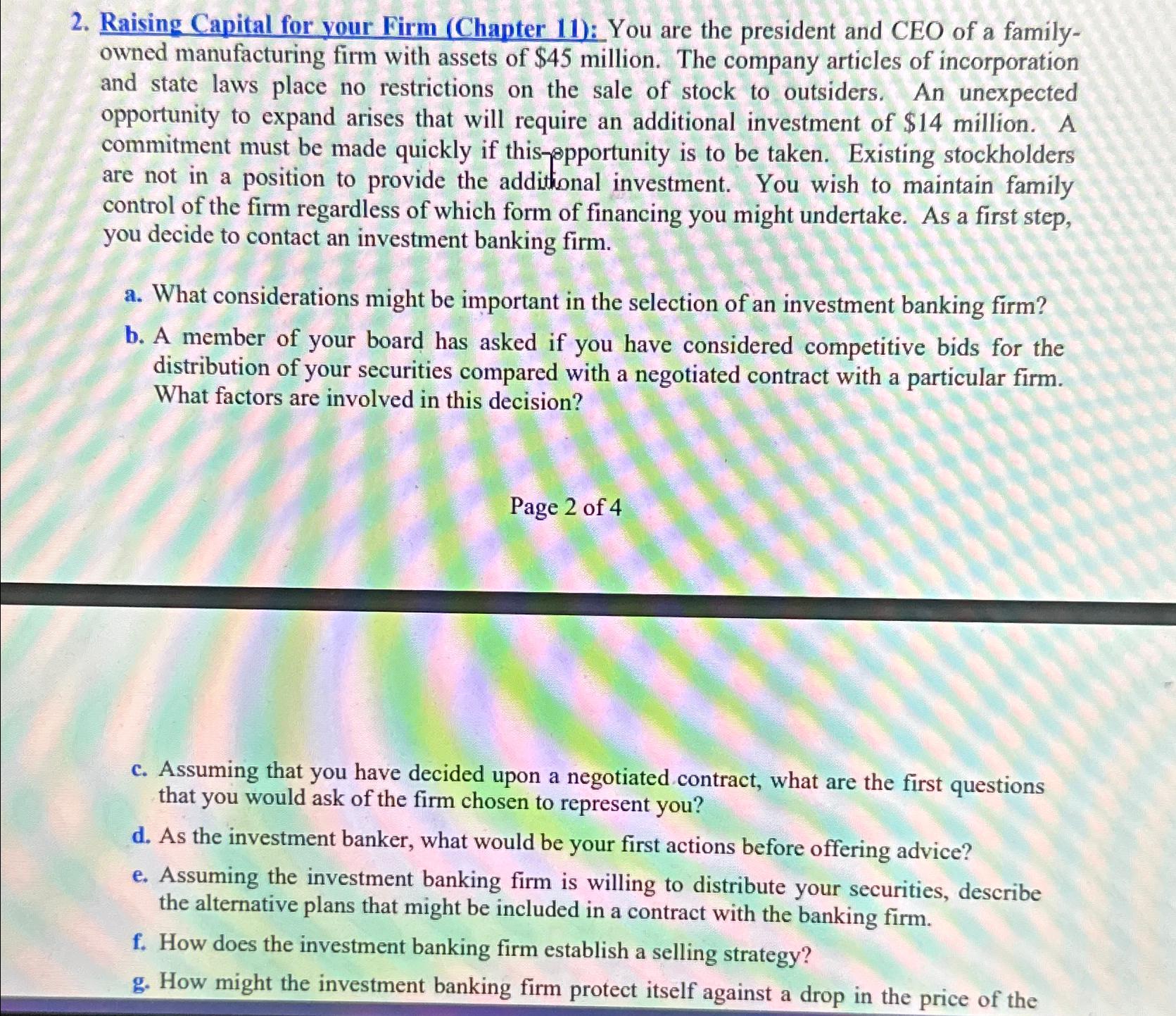

Raising Capital for your Firm (Chapter 11): You are the president and CEO of a familyowned manufacturing firm with assets of $45 million. The company

Raising Capital for your Firm (Chapter 11): You are the president and CEO of a familyowned manufacturing firm with assets of

$45million. The company articles of incorporation and state laws place no restrictions on the sale of stock to outsiders. An unexpected opportunity to expand arises that will require an additional investment of

$14million. A commitment must be made quickly if this-apportunity is to be taken. Existing stockholders are not in a position to provide the additional investment. You wish to maintain family control of the firm regardless of which form of financing you might undertake. As a first step, you decide to contact an investment banking firm.\ a. What considerations might be important in the selection of an investment banking firm?\ b. A member of your board has asked if you have considered competitive bids for the distribution of your securities compared with a negotiated contract with a particular firm. What factors are involved in this decision?\ Page 2 of 4\ c. Assuming that you have decided upon a negotiated contract, what are the first questions that you would ask of the firm chosen to represent you?\ d. As the investment banker, what would be your first actions before offering advice?\ e. Assuming the investment banking firm is willing to distribute your securities, describe the alternative plans that might be included in a contract with the banking firm.\ f. How does the investment banking firm establish a selling strategy?\ g. How might the investment banking firm protect itself against a drop in the price of the

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started