Question

Rajesh Vyas, a financial advisor at a brokerage firm in Mumbai, is tasked with assessing the financial performance and future of Amtek Auto, an integrated

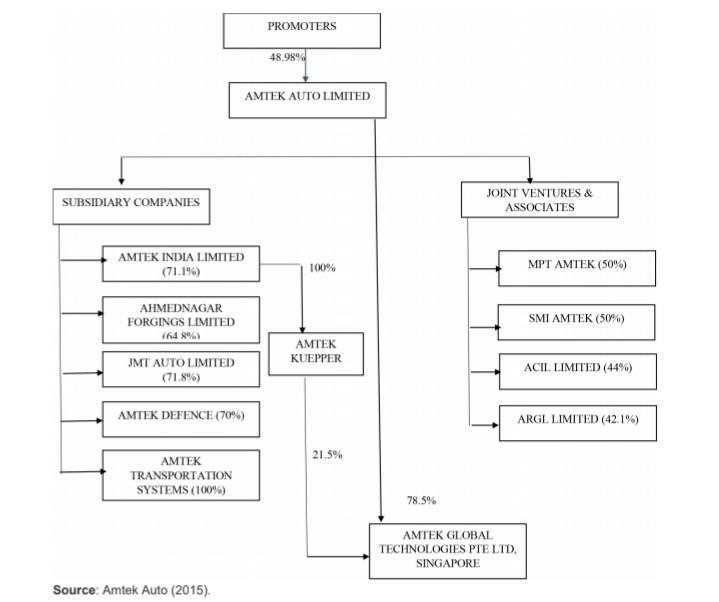

Rajesh Vyas, a financial advisor at a brokerage firm in Mumbai, is tasked with assessing the financial performance and future of Amtek Auto, an integrated automotive component manufacturer headquartered in New Delhi, India. Recently, Amtek Auto had defaulted on its INR 800 crore worth of bond payment to its lenders on account of its inability to refinance maturity obligations. As instructed by his reporting manager, Rajesh was required to evaluate the financial position of the firm on the basis of information embedded in current financial statements (income statement, balance sheet, and cash flows) so as to enable his firms clients to devise a rationale for their investment decisions with regards to their existing holdings in Amtek Auto. The case assesses the usefulness of financial ratio analysis in assessing various aspects of a firms performance, including liquidity, profitability, working capital, capital structure, efficiency, and return on investment, to inform investor options. By the end of this case study, students should be able to: understand the significance of various types of financial ratios used to assess financial risk profiles; discuss and calculate liquidity and working capital ratios, profitability ratios, capital structure ratios, and return on investment ratios; evaluate the overall financial position of a firm using trend analysis to devise a rationale for future investment decision making. Introduction December 30, 2015 was a late evening for Rajesh Vyas, a financial advisor at one of the prominent brokerage firms operating out of the Bandra Kurla Complex, Mumbai. Rajesh was examining the latest financial information from Amtek Auto Limited (Amtek Auto), an integrated automotive component manufacturer headquartered in New Delhi, India. Some of his firms clients held equity shares in Amtek Auto and had approached Rajeshs reporting manager for future investment advice on the company. Rajesh was instructed by his manager to evaluate the financial position of the firm to enable his firms clients to make rational investment decisions with regards to their holdings in Amtek Auto. On September 20, 2015, Amtek Auto had defaulted on the INR 800 crore worth of bond payment to its lenders on account of its inability to refinance maturity obligations (Nair & Adajania, 2015). This incident represented one of the biggest corporate bond defaults in years wherein debt and equity lenders were caught completely unaware that the company faced significant deterioration in its financial position. For a company like Amtek, which was one of the largest integrated automotive component manufacturers in India with a strong global presence, bond payment default had come as a rude jolt. From a high of INR 156 per share in July 2015, Amteks stock declined to INR 45 per share in October 2015, resulting in an equity market value of just under INR 10,000 million. To enable his firms clients to decide whether their investments in Amtek were justified, Rajesh decided to conduct duct a close scrutiny of the financial statements (income statement, balance sheet and cash flow). He knew that equity investors used the information contained in financial statements (profit and loss account, balance sheet, and cash flow) to assess the future earnings and cash flows generation ability of a firm, while lenders used it to assess the creditworthiness or debt paying capacity. In either case, Rajesh knew it was important to understand and interpret the large amount of data that these financial statements contained. He planned to assess the underlying weakness in profitability and status of Amteks various financial parameters for the preceding years to develop a rationale for investors. However, such an analysis required an understanding of various aspects of the firms performance, including its liquidity, profitability, working capital, capital structure, and financial risk. Before Rajesh could move on to conduct the financial evaluation of Amtek Auto, he needed to find the best way to carry out a financial risk assessment of Amtek Auto in light of the companys current financial statements. What would be the basis for calculating and deciphering various financial ratios including trend and impact analysis? Would this financial assessment provide useful insights for his clients to develop rationales for their investment decisions? Indian Automotive Component Industry The Indian automotive component industry, estimated to be around USD 38 billion (ACMA, 201516) in terms of turnover (includes sales to original equipment manufacturers, aftermarket sales, and exports), has grown tremendously over the past decade on the back of increased indigenization/localization and attractiveness of India as a preferable designing and manufacturing base. According to the Auto Components Manufacturing Association of India (ACMA), Indias auto component industry was expected to see a compounded annual growth rate (CAGR) of 14% over 20132021 (ACMA, 201516). With the growing demand and scale of automotive components in India, manufacturers had been able to keep the costs 1025% lower relative to operations in Europe and Latin America. This cost savings and annual growth had been possible because of the availability of a large pool of skilled and semi-skilled workers and low input costs (India being the third largest steel producer globally) (Mazumdar, 2016). According to ACMA (201516a), the Indian automotive component industry can be primarily divided into six major segments: a. engine parts; b. driver transmission and steering parts; c. electrical parts; d. equipment; e. suspension and braking parts; and f. body and chassis. Of the above segments, engine and driver transmission parts constituted almost 50% of the total auto component industry production followed by suspension and braking parts (12%), body and chassis (12%), equipment (10%), and electrical parts (9%) In terms of performance, in the financial year 20142015, the Indian automotive component industry registered a growth of 11% in turnover compared to the previous year. A major contributor to this growth had been the export of auto components to various countries, such as Europe, North America, Africa, and Latin America. As a result of low-cost manufacturing advantages, technologically advanced products, and the substantial depreciation of the rupee over the last few years, Indias export of auto components had witnessed an impressive growth. According to the IBEF (India Brand Equity Foundation), the Indian automotive components industry was expected to record a turnover of US$ 115 billion by the financial year 2021, at which time exports would comprise approximately US$30 billion (IBEF, 2015). Amtek Auto Amtek Auto, incorporated in 1985, rose to become one of the largest integrated automotive component manufacturers in India with a strong global presence across Europe and North America. With significant expertise in forging, grey and ductile iron casting, gravity and high-pressure aluminum die casting, and machining and sub-assembly, the company manufactured products such as connecting rod assemblies, flywheel ring gears and assembly, steering knuckles, crankshaft assemblies, and torque links (NDTV profit, n.d.). Besides this, Amtek Auto also catered to the demand (domestic and exports) for non-auto sectors such as the railways, specialty vehicles, aerospace, agricultural, and heavy earth moving equipment (Business Standard, n.d.). Amtek Auto had been a key beneficiary of expansion of global OEMs (original equipment manufacturers) in India on account of its significant investment in capacity and acquisitions over the last few years to achieve scale. In terms of group structure, Amtek Autos promoters hold a stake of 48.98% in Amtek Auto, the flagship company. Within domestic subsidiaries, the company holds a 71.2% stake in Amtek India, 64.8% in Ahmednagar Forgings, and 71.7% in JMT Auto. In terms of overseas subsidiaries, the company holds 100% in Tekfor (as a part of Amtek global technologies) and Kuepper (engaged in iron castings for turbocharger housings) (see Figure 1). Figure 1: Amtek Auto Group structure.

In terms of revenue segmentation by process, the company operated a highly diversified business model with machined components accounting for 53% of the consolidated revenues, followed by forging (34%), iron casting (9.7%), and aluminum casting (3%). In terms of end market segmentation, the company was present across all vehicle segments with the auto segment comprising almost 83% of the total revenues. Within the auto segment, the passenger vehicle segment was the key revenue driver for Amtek. It accounted for nearly 60% of the total revenues, while the commercial vehicle segment contributed only 14% of overall revenues. To grow inorganically, the company had made a host of acquisitions in either related businesses or related products or processesincluding the acquisitions of JMT Auto (auto and non-auto gears), Amtek Tekfor (engine parts), and Amtek Kuepper (turbocharger housings). With the recent acquisitions of Tekfor and Kuepper Group, the overseas businesses accounted for almost ~42% of the consolidated revenues. Financial Performance and Management Outlook To understand the current state of financial affairs at Amtek Auto and the management outlook for the future, Rajesh examined excerpts from the Directors Report and Management Discussion and Analysis sections of the Amtek Auto annual report 201415 (Amtek Auto, 2015). For the 20142015 financial year, aggregate sales of Amtek Auto registered a decline of 5.6% compared to 27% growth in the previous financial year of 20132014. On account of declining revenues (due to subdued performance of global economy) and rising expenditures (due to increase in raw material cost), the company recorded a loss of INR 1,157 million in the 20142015 year, compared to a profit of INR 3,234 million in the previous 20132014 year. Due to losses incurred, the company did not recommend any dividend on the equity shares for the 20142015 financial year. During 20142015, the company acquired German-based Scholz Edelstahl GmbH through its 100% Singapore-based subsidiary Amtek Precision Engineering Pte. Ltd. The acquisition of Scholza company that also engaged in the special steel trading businessenabled backward integration with all of Amtek Groups international business. Through its overseas subsidiary, Amtek also acquired various companies engaged in iron casting, forging, and machining from Japan-based Asahi Tec Corporation. The acquired companies had various manufacturing facilities located in Japan, Thailand, and China that had long standing relationships with the blue chip OEM. The objective of the above acquisitions were to increase access to state of the art technologies, growth markets, new customers, and several strategic cross selling opportunities. Besides this, the expansion through acquisitions was supposed to bring backward integration and realise key financial synergies benefits. Looking ahead, the management forecasted an increasing demand from overseas subsidiaries for products that were manufactured only at Amteks India-based facilities, including for camshafts, crankshafts, cylinder and cast turbo charger housing. The management believed that the cross selling opportunities were substantial and expected to yield benefits in the near term. Further, the acquisitions overseas provided Amtek Auto with access to state of the art technologies, growth markets, new customers, and several strategic cross selling opportunities. Data for Financial Analysis Rajesh decided to conduct the financial ratio analysis of Amtek Auto by using the audited financial statements (profit and loss statement and balance sheet) of the company for the previous four years (see Tables 1 and 2). Table 1 : Amtek Auto Balance Sheet Amtek Auto Ltd. Balance Sheet (in INR-Million) FY 2012 FY 2013 FY 2014 FY 2015 Equity and liabilities Share capital 441 437 441 450 Reserves and surplus 43,392 47,540 50,895 50,437 Shareholders funds 43,833 47,985 51,336 50,887

Non-current liabilities Long term borrowings 27,349 53,361 52,166 60,322 Deferred tax liabilities (net) 3,044 3,802 5,289 4,550 Other long term liabilities 0 0 0 1,225 Long term provisions 120 94 139 184 Total non-current liabilities 30,513 57,257 57,594 66,282 Current liabilities Short term borrowings 7,650 6,960 11,529 20,832 Trade payables 1,893 1,310 1,617 1,016 Other current liabilities 12,052 8,227 16,313 22,673 Current maturities of long term debt 5,068 7,249 14,098 9,192 Short term provisions 225 129 143 10 Total liabilities 96,167 121,869 138,532 161,700

Assets Non-current assets Fixed assets 43,642 71,724 82,660 98,431 Non-current investments 11,252 17,595 16,656 17,300 Long term loans and advances 18,143 10,361 14,833 15,284 0 0 0 0 Current assets 0 0 0 0 Currents investments 38 513 221 283 Inventories 5,806 7,036 10,572 16,061 Trade receivables 5,837 6,294 8,756 9,045 Cash and cash equivalents 3,147 6,424 2,233 781 Short term loans and advances 8,270 1,896 2,594 4,506 Other current assets 32 18 7 10 Total Assets 96,167 121,862 138,532 161,700 Table 2 : Amtek Auto Income Statement Amtek Auto Ltd. Income Statement (In INR-millions) FY 2012 FY 2013 FY 2014 FY 2015 Revenue Revenue from operations 24,539 31,260 39,507 37,408 Other income 0 0 490 330 Total revenue 24,539 31,260 39,997 37,738 Cost of materials consumed 14,020 18,928 23,682 29,619 Purchase of stock-in-trade 0 0 0 0 Changes in inventories of finished goods, work-in-progress and Stock-in-Trade 260 318 331 5,839 Employee benefits expense 930 1,166 1,468 1,383 Finance costs 1,855 2,753 4,291 7,745 Depreciation and amortization of expenses 2,119 2,837 3,290 5,251 Other expenses 1,778 2,075 2,876 3,019 Total expenses 20,441 27,441 35,277 41,178 Profit/(loss) before exceptional and extraordinary items and tax 4,098 3,819 4,720 3,440 Exceptional items 0 1,898 0 1,567 Profit/(loss) before tax 4,098 5,717 4,720 1,873 Provision for tax 1,183 1,210 1,487 716 Profit/(loss) for the year 2,916 4,508 3,234 1,157 Specifically, Rajesh decided to conduct his financial analysis using the following six categories of ratios in order to explore various aspects of Amtek Autos performance including liquidity, working capital, profitability, efficiency, and financial risk: liquidity ratios; working capital ratios; profitability ratios; capital structure ratios; turnover ratios; return on investment ratios. With all this financial information in hand, Rajesh set out to assess the financial statements of Amtek Auto on the basis of various financial parameters highlighted above. He decided to calculate and decipher these financial ratios to offer a trend and impact analysis. Investors needed to understand why Amtek had been unable to refinance maturity obligations and assess the future earnings and cash flow generation abilities of the company. Rajesh trusted that his financial statement analysis would provide an evaluation of the overall financial health and risk profile of the company. He also trusted that this analysis would help investors assess the necessary aspects of Amteks performance and develop a rationale for their holdings in Amtek going forward

questions. 1. Estimate the various financial ratios (liquidity ratios, working capital ratios, profitability ratios, turnover ratios, capital structure ratios, and return on investment ratios) for Amtek Auto using publicly available audited financial statements. 2. Compare those ratios with Amtek Autos various competitors and industry averages. 3. Based on your trend and competition analysis of financial ratios, what would be your suggestion to Rajeshs client with regards to their current holdings in Amtek Auto and future investment decisions? First question example liquidity ratio= current assets/current liabilities

Source: Amtek Auto (2015)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started