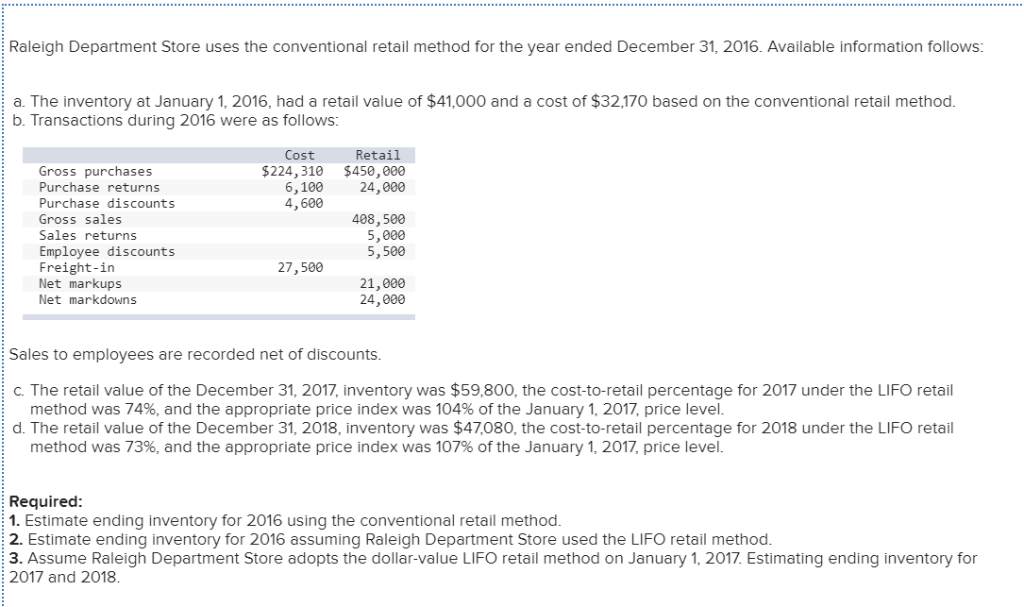

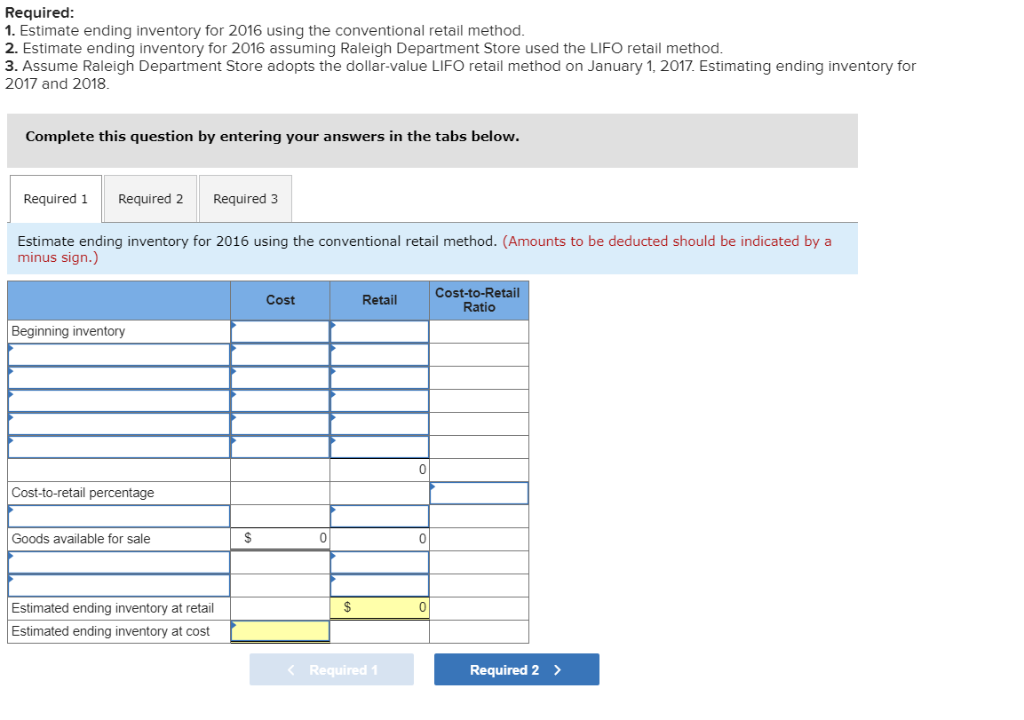

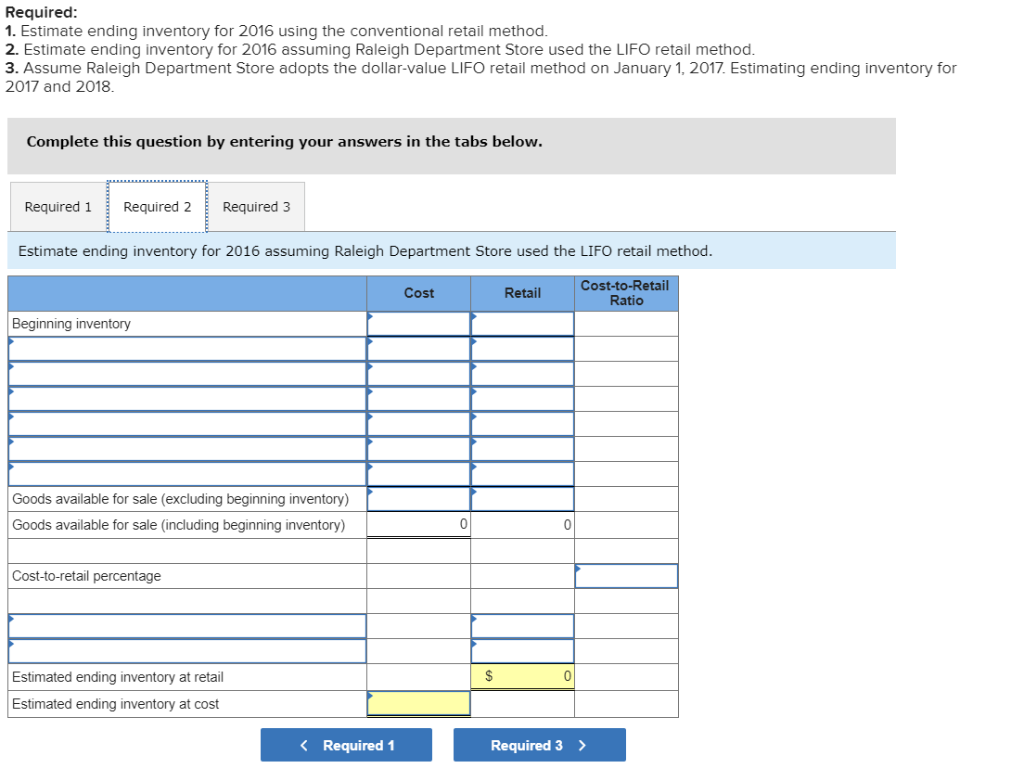

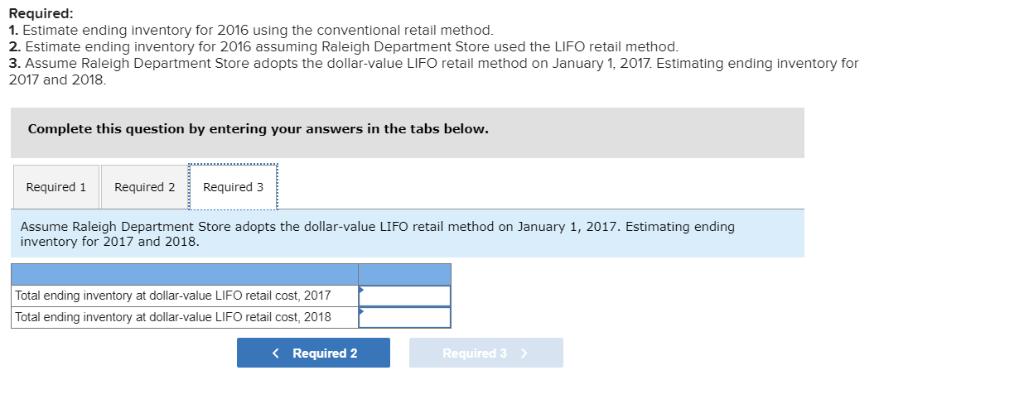

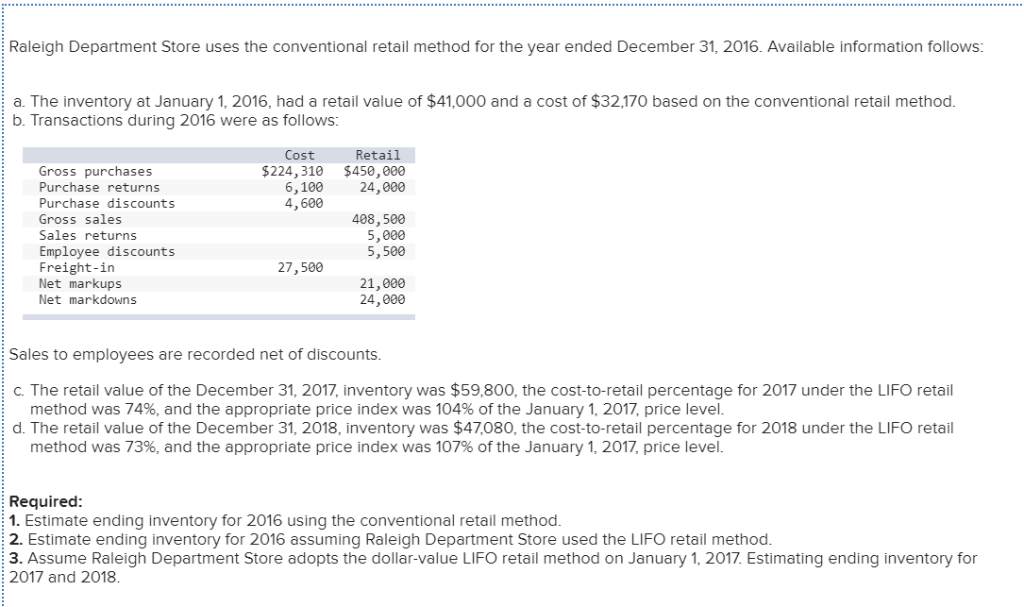

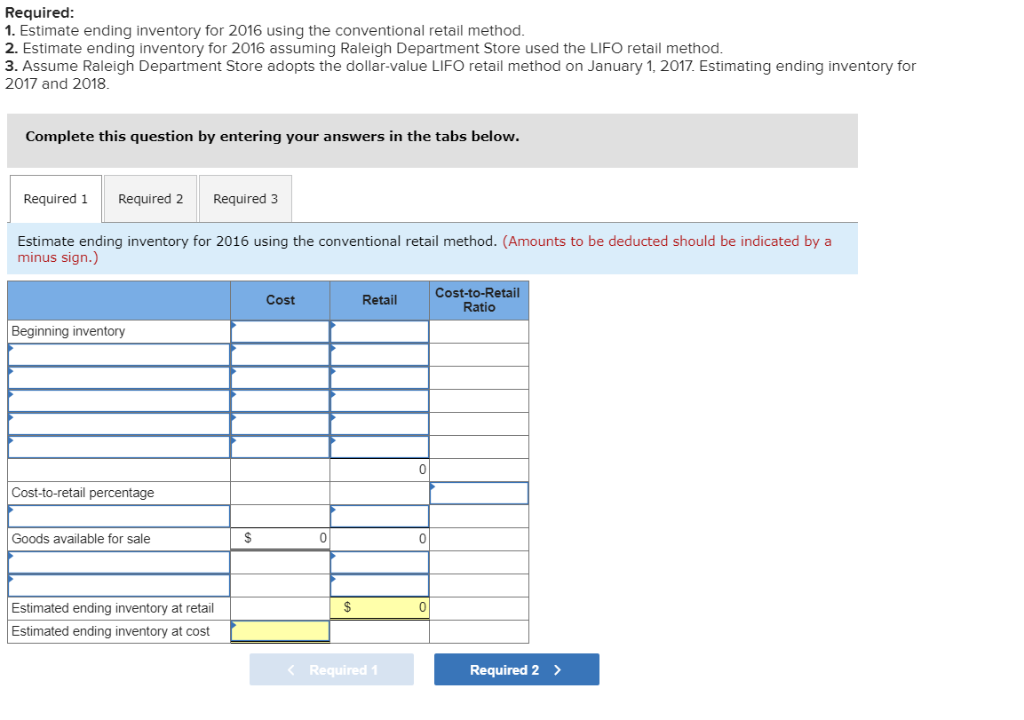

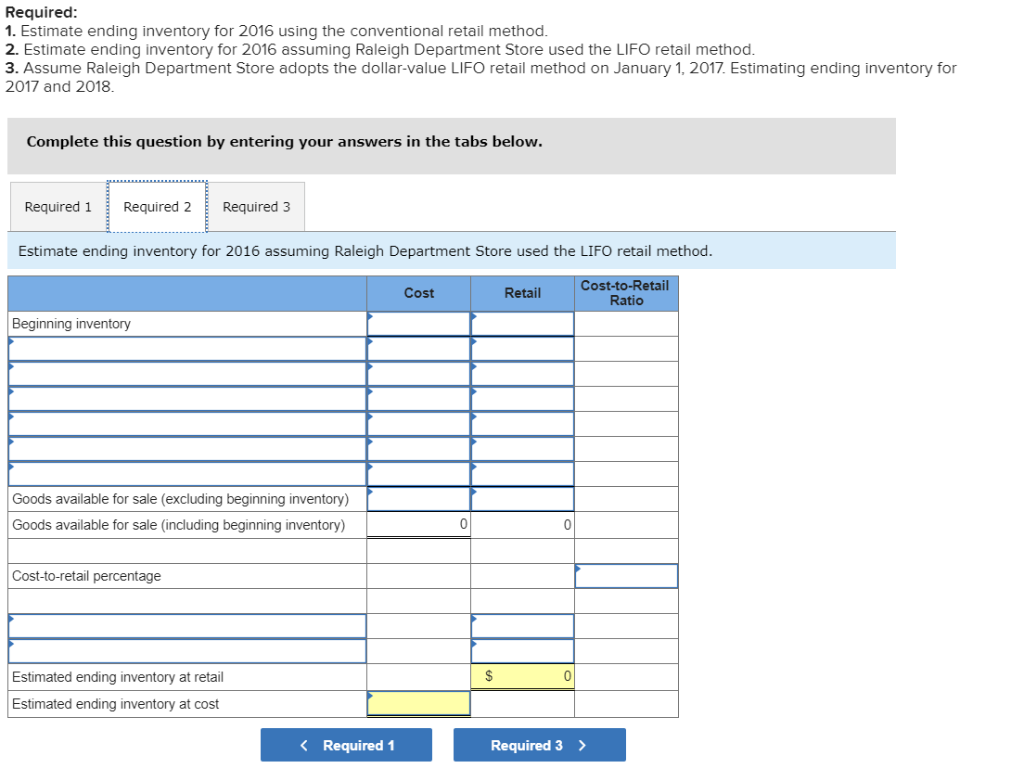

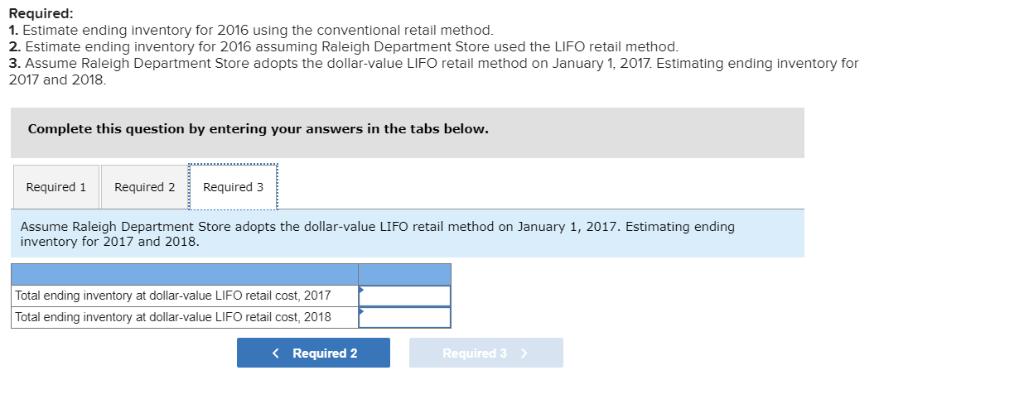

Raleigh Department Store uses the conventional retail method for the year ended December 31, 2016. Available information follows: a. The inventory at January 1, 2016, had a retail value of $41,000 and a cost of $32,170 based on the conventional retail method. b. Transactions during 2016 were as follows Retail $224, 310 $450,000 24,000 Cost Gross purchases Purchase returns Purchase discounts Gross sales Sales returns Employee discounts Freight-in Net markups Net markdowns 6,100 4,600 408, 500 5,000 5,500 27,500 21,000 24,000 Sales to employees are recorded net of discounts. C. The retail value of the December 31, 2017, inventory was $59,800, the cost-to-retail percentage for 2017 under the LIFO retail method was 74%, and the appropriate price index was 104% of the January 1, 2017, price level d. The retail value of the December 31, 2018, inventory was $47080, the cost-to-retail percentage for 2018 under the LIFO retail method was 73%, and the appropriate price index was 107% of the January 1, 2017, price level. Required 1. Estimate ending inventory for 2016 using the conventional retail method 2. Estimate ending inventory for 2016 assuming Raleigh Department Store used the LIFO retail method 3. Assume Raleigh Department Store adopts the dollar-value LIFO retail method on January 1, 2017 Estimating ending inventory for 2017 and 2018 Raleigh Department Store uses the conventional retail method for the year ended December 31, 2016. Available information follows: a. The inventory at January 1, 2016, had a retail value of $41,000 and a cost of $32,170 based on the conventional retail method. b. Transactions during 2016 were as follows Retail $224, 310 $450,000 24,000 Cost Gross purchases Purchase returns Purchase discounts Gross sales Sales returns Employee discounts Freight-in Net markups Net markdowns 6,100 4,600 408, 500 5,000 5,500 27,500 21,000 24,000 Sales to employees are recorded net of discounts. C. The retail value of the December 31, 2017, inventory was $59,800, the cost-to-retail percentage for 2017 under the LIFO retail method was 74%, and the appropriate price index was 104% of the January 1, 2017, price level d. The retail value of the December 31, 2018, inventory was $47080, the cost-to-retail percentage for 2018 under the LIFO retail method was 73%, and the appropriate price index was 107% of the January 1, 2017, price level. Required 1. Estimate ending inventory for 2016 using the conventional retail method 2. Estimate ending inventory for 2016 assuming Raleigh Department Store used the LIFO retail method 3. Assume Raleigh Department Store adopts the dollar-value LIFO retail method on January 1, 2017 Estimating ending inventory for 2017 and 2018