Question: Ralph Bellamy it considering borrowing $20,000 for a year from a bank that has offered the following alternatives: An interest payment of $1, 800 at

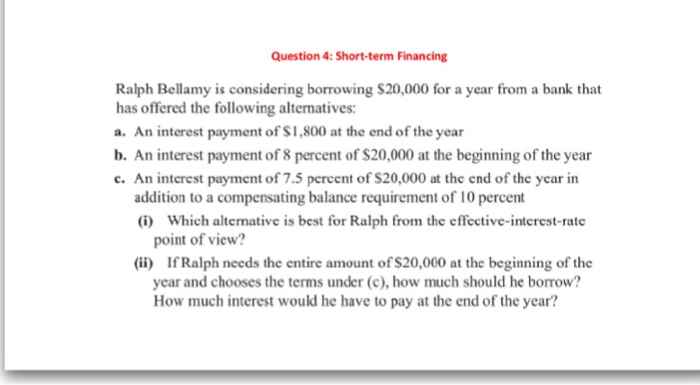

Ralph Bellamy it considering borrowing $20,000 for a year from a bank that has offered the following alternatives: An interest payment of $1, 800 at the end of the year. An interest payment of 8 percent of $520,000 at the beginning of the year An interest payment of 7.5 percent of $20,000 at the end of the year in addition to a compensating balance requirement of 10 percent Which alternative is best for Ralph from the effective-interest-rate point of view? If Ralph needs the entire amount of $20,000 at the beginning of the year and chooses the terms under (c), how much should he borrow? How much interest would he have to pay at the end of the year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts