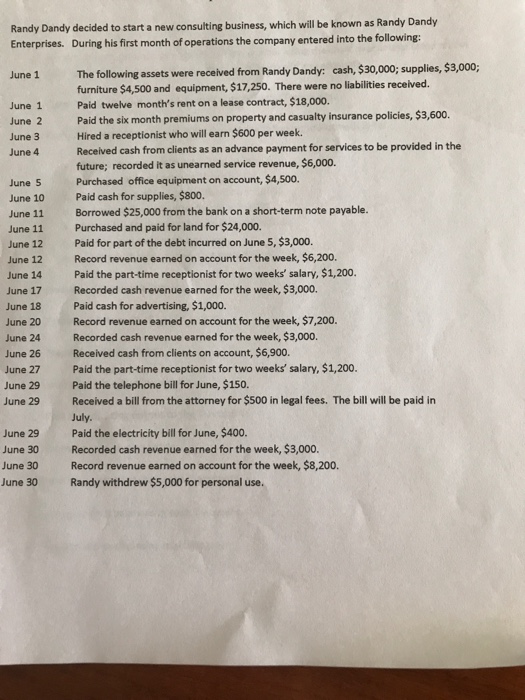

Randy Dandy decided to start a new consulting business, which will be known as Randy Dandy Enterprises. During his first month ofoperations the company entered into the following: The following assets were received from Randy Dandy: cash $30,000; supplies, $3,000; June 1 furniture $4,500 and equipment, $17,250. There were no liabilities received. Paid twelve month's rent on a lease contract, $18,000. June June 2 Paid the six month premiums on property and casualty insurance policies, $3,600. Hired a receptionist who will earn $600 per week. June 3 Received cash from clients as an advance payment for servicesto be provided in the June 4 future; recorded it as unearned service revenue, $6,000. June 5 Purchased office equipment on account, $4,500. June 10 Paid cash for supplies, $800. June 11 Borrowed $25,000 from the bank on a short-term note payable. June 11 Purchased and paid for land for $24,000. June 12 Paid for part of the debt incurred on June 5, $3,000. June 12 Record revenue earned on account for the week, $6,200 June 14 Paid the part-time receptionist for two weeks' salary, $1,200. June 17 Recorded cash revenue earned for the week, $3,000. June 18 Paid cash for advertising, $1,000. June 20 Record revenue earned on account for the week, $7,200. June 24 Recorded cash revenue earned for the week, $3,000. June 26 Received cash from clients on account, $6,900. June 27 Paid the part-time receptionist for two weeks' salary, $1.200. June 29 Paid the telephone bill for June, $150 June 29 Received a bill from the attorney for $500 in legal fees. The bill will be paid in July. June 29 Paid the electricity bill for June, $400. June 30 Recorded cash revenue earned for the week, $3,000. June 30 Record revenue earned on account for the week, $8,200. June 30 Randy withdrew $5,000 for personal use. Randy Dandy decided to start a new consulting business, which will be known as Randy Dandy Enterprises. During his first month ofoperations the company entered into the following: The following assets were received from Randy Dandy: cash $30,000; supplies, $3,000; June 1 furniture $4,500 and equipment, $17,250. There were no liabilities received. Paid twelve month's rent on a lease contract, $18,000. June June 2 Paid the six month premiums on property and casualty insurance policies, $3,600. Hired a receptionist who will earn $600 per week. June 3 Received cash from clients as an advance payment for servicesto be provided in the June 4 future; recorded it as unearned service revenue, $6,000. June 5 Purchased office equipment on account, $4,500. June 10 Paid cash for supplies, $800. June 11 Borrowed $25,000 from the bank on a short-term note payable. June 11 Purchased and paid for land for $24,000. June 12 Paid for part of the debt incurred on June 5, $3,000. June 12 Record revenue earned on account for the week, $6,200 June 14 Paid the part-time receptionist for two weeks' salary, $1,200. June 17 Recorded cash revenue earned for the week, $3,000. June 18 Paid cash for advertising, $1,000. June 20 Record revenue earned on account for the week, $7,200. June 24 Recorded cash revenue earned for the week, $3,000. June 26 Received cash from clients on account, $6,900. June 27 Paid the part-time receptionist for two weeks' salary, $1.200. June 29 Paid the telephone bill for June, $150 June 29 Received a bill from the attorney for $500 in legal fees. The bill will be paid in July. June 29 Paid the electricity bill for June, $400. June 30 Recorded cash revenue earned for the week, $3,000. June 30 Record revenue earned on account for the week, $8,200. June 30 Randy withdrew $5,000 for personal use