Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider the following three independent situations relating to the issuance of shares: (i) The board of directors of Pigeon Limited, an unlisted company, entered

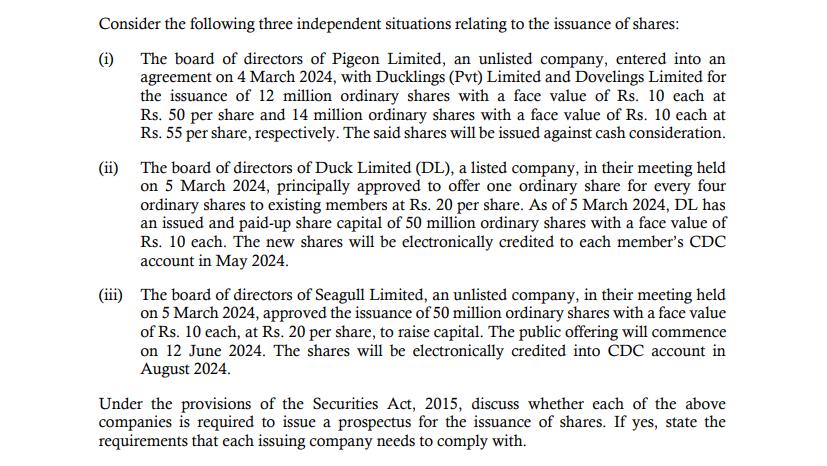

Consider the following three independent situations relating to the issuance of shares: (i) The board of directors of Pigeon Limited, an unlisted company, entered into an agreement on 4 March 2024, with Ducklings (Pvt) Limited and Dovelings Limited for the issuance of 12 million ordinary shares with a face value of Rs. 10 each at Rs. 50 per share and 14 million ordinary shares with a face value of Rs. 10 each at Rs. 55 per share, respectively. The said shares will be issued against cash consideration. (ii) The board of directors of Duck Limited (DL), a listed company, in their meeting held on 5 March 2024, principally approved to offer one ordinary share for every four ordinary shares to existing members at Rs. 20 per share. As of 5 March 2024, DL has an issued and paid-up share capital of 50 million ordinary shares with a face value of Rs. 10 each. The new shares will be electronically credited to each member's CDC account in May 2024. (iii) The board of directors of Seagull Limited, an unlisted company, in their meeting held on 5 March 2024, approved the issuance of 50 million ordinary shares with a face value of Rs. 10 each, at Rs. 20 per share, to raise capital. The public offering will commence on 12 June 2024. The shares will be electronically credited into CDC account in August 2024. Under the provisions of the Securities Act, 2015, discuss whether each of the above companies is required to issue a prospectus for the issuance of shares. If yes, state the requirements that each issuing company needs to comply with.

Step by Step Solution

★★★★★

3.45 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

i Pigeon Limited is required to issue a prospectus for issuing 12 million and 14 million shares resp...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started