Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Range Resources stock sells for 120. The interest rate is 3 percent. The time to expiration is nine months on all call options. The standard

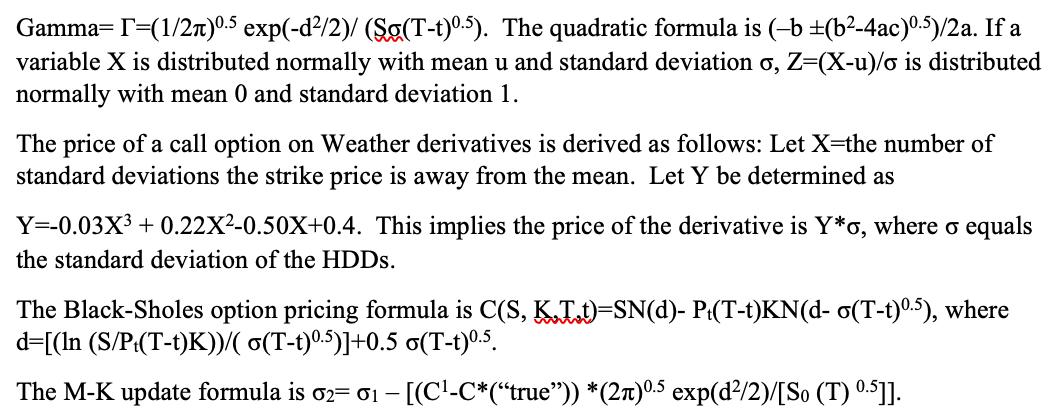

Range Resources stock sells for 120. The interest rate is 3 percent. The time to expiration is nine months on all call options. The standard deviation on Noble stock is 25 percent. The interest rate is 2 percent. You go short 140 call options at 125. A: (8 points): How do you delta hedge your portfolio? B: (12 points): You can also go long or short call options at 115. You will be happy to know that the delta on these options is 0.646, while the gamma is 0.01432. How do you delta- GAMMA hedge your position?

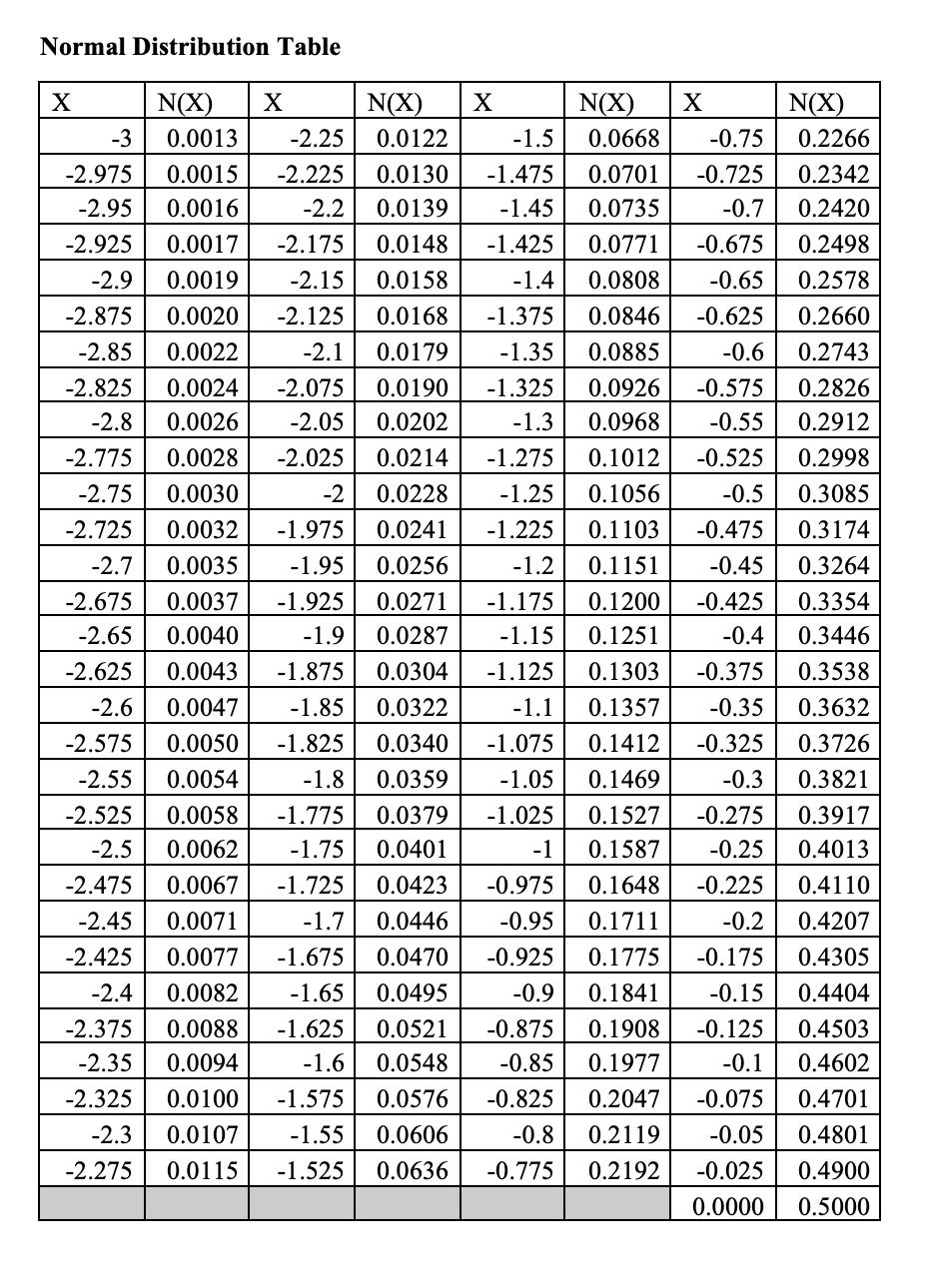

Normal Distribution Table N(X) 0.0122 -3 -1.5 -2.975 0.0015 -2.225 0.0130 -1.475 -2.95 0.0016 0.0139 -2.2 -2.925 0.0017 -2.175 0.0148 0.0019 -2.15 0.0158 -2.9 -2.875 0.0020 -2.125 0.0168 -2.85 0.0022 -2.1 0.0179 -2.825 0.0024 -2.075 0.0190 -2.8 0.0026 -2.05 0.0202 -2.775 0.0028 -2.025 0.0214 -2.75 0.0030 -2 0.0228 -2.725 0.0032 -1.975 0.0241 -2.7 0.0035 -1.95 0.0256 -2.675 0.0037 -1.925 0.0271 -2.65 0.0040 0.0287 -2.625 0.0043 -1.9 -1.875 0.0304 -1.125 -2.6 0.0047 -1.85 0.0322 -2.575 0.0050 -1.825 0.0340 -1.075 -1.1 -2.55 0.0054 0.0359 -1.05 -1.8 -2.525 0.0058 -1.775 0.0379 -1.025 -1.75 0.0401 -1 -2.5 0.0062 -2.475 0.0067 -1.725 0.0423 -0.975 -2.45 0.0071 -1.7 0.0446 -2.425 0.0077 -1.675 0.0470 -2.4 0.0082 -1.65 0.0495 -0.9 -2.375 0.0088 -1.625 0.0521 -0.875 -2.35 0.0094 -1.6 0.0548 -0.85 -2.325 0.0100 -1.575 0.0576 -0.825 -2.3 0.0107 -1.55 0.0606 -2.275 0.0115 -1.525 0.0636 X N(X) X 0.0013 -2.25 N(X) X 0.0668 -0.75 0.0701 -0.725 0.2342 -1.45 0.0735 -0.7 0.2420 -1.425 0.0771 -0.675 0.2498 -1.4 0.0808 -0.65 0.2578 -1.375 0.0846 -0.625 0.2660 -1.35 0.0885 -0.6 0.2743 -1.325 0.0926 -0.575 0.2826 -1.3 0.0968 -0.55 0.2912 -1.275 0.1012 -0.525 0.2998 -1.25 0.1056 -0.5 0.3085 -1.225 0.1103 -0.475 0.3174 -1.2 0.1151 -0.45 0.3264 -1.175 0.1200 -0.425 0.3354 -1.15 0.1251 -0.4 0.3446 0.1303 -0.375 0.3538 0.1357 -0.35 0.3632 0.1412 -0.325 0.3726 0.1469 -0.3 0.3821 0.1527 -0.275 0.3917 0.1587 -0.25 0.4013 0.1648 -0.225 0.4110 0.4207 0.4305 0.4404 0.4503 0.4602 0.4701 0.4801 0.4900 0.5000 X -0.2 -0.95 0.1711 -0.925 0.1775 -0.175 0.1841 -0.15 0.1908 -0.125 0.1977 -0.1 0.2047 -0.075 -0.8 0.2119 -0.05 -0.775 0.2192 -0.025 0.0000 N(X) 0.2266

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

To delta hedge your portfolio in this scenario you need to calculate the delta value of the short call options and take an offsetting position in the underlying stock The delta of an option represents ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started