Answered step by step

Verified Expert Solution

Question

1 Approved Answer

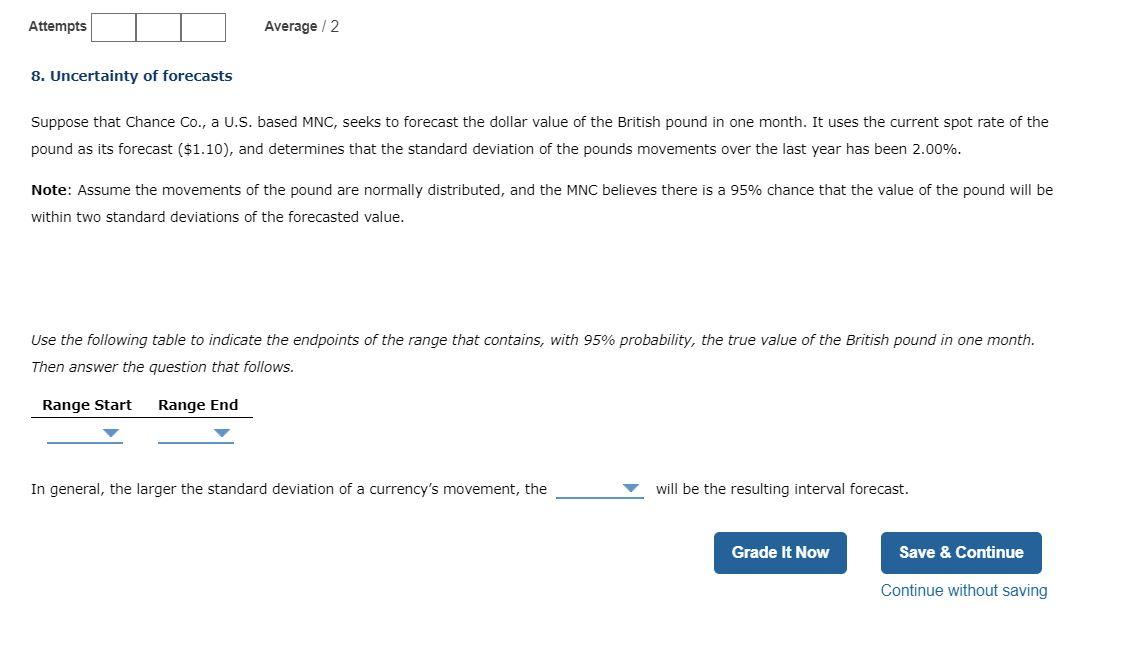

Range Start options:1.056/1.078/1.089/1.034 Range End Options:1.166/1.111/1.144/1.122 Last question: Larger/ Smaller Attempts Average/2 8. Uncertainty of forecasts Suppose that Chance Co., a U.S. based MNC, seeks

Range Start options:1.056/1.078/1.089/1.034

Range Start options:1.056/1.078/1.089/1.034

Range End Options:1.166/1.111/1.144/1.122

Last question: Larger/ Smaller

Attempts Average/2 8. Uncertainty of forecasts Suppose that Chance Co., a U.S. based MNC, seeks to forecast the dollar value of the British pound in one month. It uses the current spot rate of the pound as its forecast ($1.10), and determines that the standard deviation of the pounds movements over the last year has been 2.00%. Note: Assume the movements of the pound are normally distributed, and the MNC believes there is a 95% chance that the value of the pound will be within two standard deviations of the forecasted value. Use the following table to indicate the endpoints of the range that contains, with 95% probability, the true value of the British pound in one month. Then answer the question that follows. Range Start Range End In general, the larger the standard deviation of a currency's movement, the will be the resulting interval forecast. Grade It Now Save & Continue Continue without savingStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started