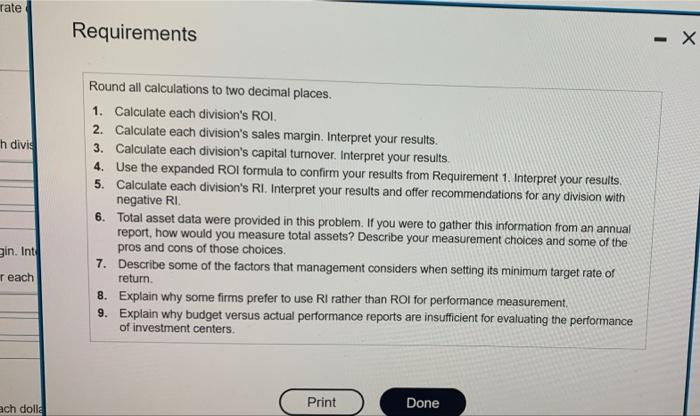

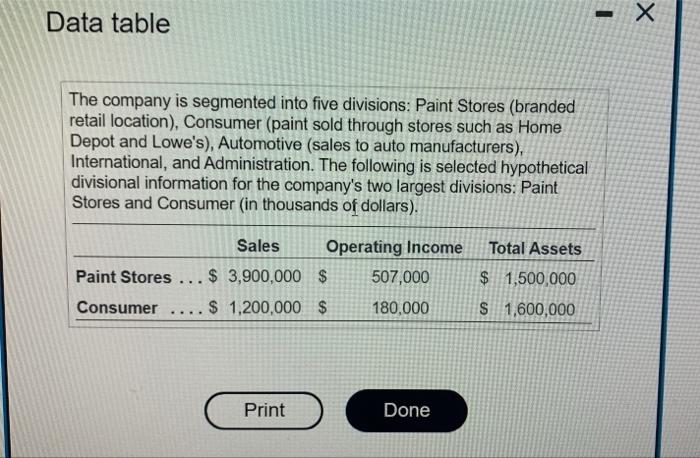

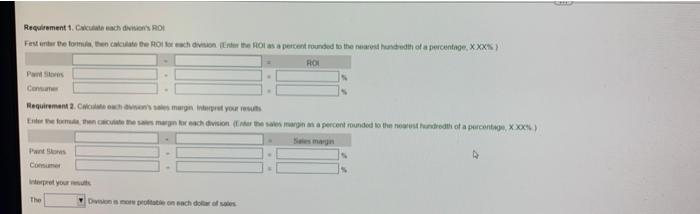

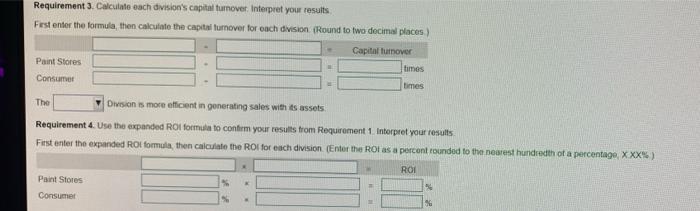

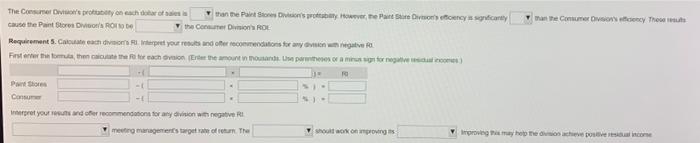

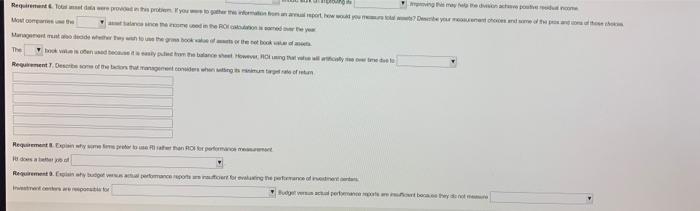

rate Requirements - X h divis Round all calculations to two decimal places. 1. Calculate each division's ROI. 2. Calculate each division's sales margin. Interpret your results. 3. Calculate each division's capital turnover. Interpret your results 4. Use the expanded ROI formula to confirm your results from Requirement 1. Interpret your results, 5. Calculate each division's Ri. Interpret your results and offer recommendations for any division with negative RI 6. Total asset data were provided in this problem. If you were to gather this information from an annual report, how would you measure total assets? Describe your measurement choices and some of the pros and cons of those choices. 7. Describe some of the factors that management considers when setting its minimum target rate of return 8. Explain why some firms prefer to use Rl rather than ROI for performance measurement, 9. Explain why budget versus actual performance reports are insufficient for evaluating the performance of investment centers gin. Int reach Print Done ach dolls Data table - The company is segmented into five divisions: Paint Stores (branded retail location), Consumer (paint sold through stores such as Home Depot and Lowe's), Automotive (sales to auto manufacturers), International, and Administration. The following is selected hypothetical divisional information for the company's two largest divisions: Paint Stores and Consumer (in thousands of dollars). Total Assets Paint Stores Sales Operating Income $ 3,900,000 $ 507,000 $ 1,200,000 $ 180,000 --- $ 1,500,000 Consumer $ 1,600,000 Print Done Requirement 1. Calculate ch's ROI Festher the tomaten the chain the Rosa percent rounded to the hundredth of a percentage XXX) ROS PS Can Requirement Coach's margine your resu Elementoresch divisione percent rounded to the most hundredth of a percentage Xxx Pants Commer The Date on each of Requirement 3. Calculate each division's capital turnover. Interpret your results Fast enter the formula, then calculate the capital turnover for each division (Round to two decimal places) Capitalurnover Paint Stores times Consumer times The Division is more efficient in generating sales with its assets. Requirement 4. Use the expanded ROI formulato confirm your results from Requirement 1. Interpret your results First enter the expanded ROI formula, then calculate the ROI for each division (Enter the ROI as a percent rounded to the nearest hundredth of a percentago, XXX) ROI Paint Stores Consumer ma e Comune Divin' on These meth The consumers prototy on each of than the Palet Store Danske Powever, the Pure Sure Diversenyuscany cause the Pant Stores Divi' ROOD the core Di ROE Requirements. Clean Compeet your res and other recommendations for anyone First to the charach in the amount in mod normative Pet Shoes Con - merret your needs for any do wnegativ RI meeting managerienstarget of The Showing Improving the chance Request to the Weston now you would in dhe me Mango wywanowe them where becko The nedenly the balance sheet How the whole Retrators who wiling to fem Represent performance Remment. En browser tugas pemborom rate Requirements - X h divis Round all calculations to two decimal places. 1. Calculate each division's ROI. 2. Calculate each division's sales margin. Interpret your results. 3. Calculate each division's capital turnover. Interpret your results 4. Use the expanded ROI formula to confirm your results from Requirement 1. Interpret your results, 5. Calculate each division's Ri. Interpret your results and offer recommendations for any division with negative RI 6. Total asset data were provided in this problem. If you were to gather this information from an annual report, how would you measure total assets? Describe your measurement choices and some of the pros and cons of those choices. 7. Describe some of the factors that management considers when setting its minimum target rate of return 8. Explain why some firms prefer to use Rl rather than ROI for performance measurement, 9. Explain why budget versus actual performance reports are insufficient for evaluating the performance of investment centers gin. Int reach Print Done ach dolls Data table - The company is segmented into five divisions: Paint Stores (branded retail location), Consumer (paint sold through stores such as Home Depot and Lowe's), Automotive (sales to auto manufacturers), International, and Administration. The following is selected hypothetical divisional information for the company's two largest divisions: Paint Stores and Consumer (in thousands of dollars). Total Assets Paint Stores Sales Operating Income $ 3,900,000 $ 507,000 $ 1,200,000 $ 180,000 --- $ 1,500,000 Consumer $ 1,600,000 Print Done Requirement 1. Calculate ch's ROI Festher the tomaten the chain the Rosa percent rounded to the hundredth of a percentage XXX) ROS PS Can Requirement Coach's margine your resu Elementoresch divisione percent rounded to the most hundredth of a percentage Xxx Pants Commer The Date on each of Requirement 3. Calculate each division's capital turnover. Interpret your results Fast enter the formula, then calculate the capital turnover for each division (Round to two decimal places) Capitalurnover Paint Stores times Consumer times The Division is more efficient in generating sales with its assets. Requirement 4. Use the expanded ROI formulato confirm your results from Requirement 1. Interpret your results First enter the expanded ROI formula, then calculate the ROI for each division (Enter the ROI as a percent rounded to the nearest hundredth of a percentago, XXX) ROI Paint Stores Consumer ma e Comune Divin' on These meth The consumers prototy on each of than the Palet Store Danske Powever, the Pure Sure Diversenyuscany cause the Pant Stores Divi' ROOD the core Di ROE Requirements. Clean Compeet your res and other recommendations for anyone First to the charach in the amount in mod normative Pet Shoes Con - merret your needs for any do wnegativ RI meeting managerienstarget of The Showing Improving the chance Request to the Weston now you would in dhe me Mango wywanowe them where becko The nedenly the balance sheet How the whole Retrators who wiling to fem Represent performance Remment. En browser tugas pemborom