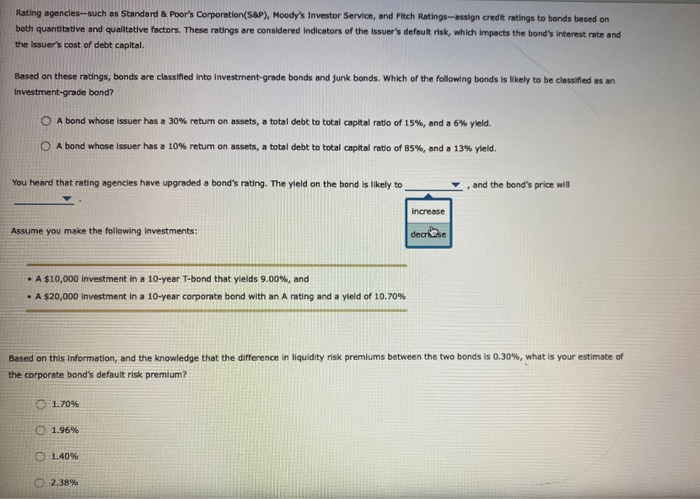

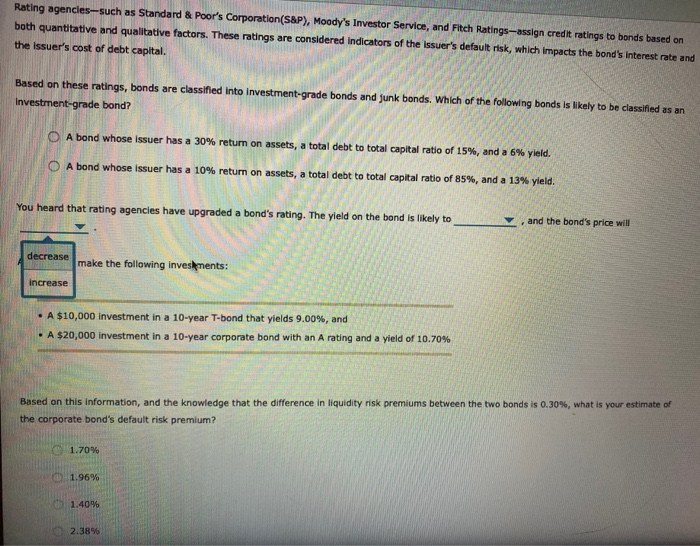

Rating agencies such as Standard & Poor's Corporation(S&P), Moody's Investor Service, and Fitch Ratings-assign credit ratings to bonds based on both quantitative and qualitative factors. These ratings are considered Indicators of the issuer's defauk risk, which impacts the band's interest rate and the issuer's cost of debt capital. Based on these ratings, bonds are classified into Investment-grade bonds and junk bonds. Which of the following bonds is likely to be classified as an Investment-grade bond? A bond whose issuer has a 30return on assets, a total debt to total capital ratio of 15%, and a 6% yield. A bond whose issuer has a 10% return on assets, a total debt to total capital ratio of 85%, and a 13% yield. You heard that rating agencies have upgraded a bond's rating. The yield on the bond is likely to , and the bond's price will increase decrease Assume you make the following investments: A $10,000 Investment in a 10-year T-bond that yields 9.00%, and A $20,000 investment in a 10-year corporate bond with an A rating and a yield of 10.70% Based on this information, and the knowledge that the difference in liquidity risk premiums between the two bonds is 0.30%, what is your estimate of the corporate bond's default risk premium? 1.70% 1.96% 140% @ 2.38% Rating agencies-such as Standard & Poor's Corporation(S&P), Moody's Investor Service, and Fitch Ratings-assign credit ratings to bonds based on both quantitative and qualitative factors. These ratings are considered indicators of the issuer's default risk, which impacts the bond's interest rate and the issuer's cost of debt capital. Based on these ratings, bonds are classified into Investment-grade bonds and junk bonds. Which of the following bonds is likely to be classified as an Investment-grade bond? O A bond whose issuer has a 30% return on assets, a total debt to total capital ratio of 15%, and a 6% yield. O A bond whose issuer has a 10% return on assets, a total debt to total capital ratio of 85%, and a 13% yield. You heard that rating agencies have upgraded a bond's rating. The yield on the bond is likely to - , and the bond's price will decrease make the following investments: increase A $10,000 investment in a 10-year T-bond that yields 9.00%, and A $20,000 investment in a 10-year corporate bond with an A rating and a yield of 10.70% Based on this information, and the knowledge that the difference in liquidity risk premiums between the two bonds is 0.30%, what is your estimate of the corporate bond's default risk premium? 1.70% 1.96% 1.40% 2.38%