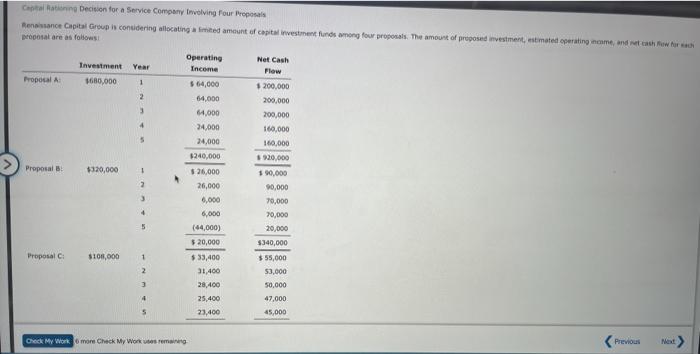

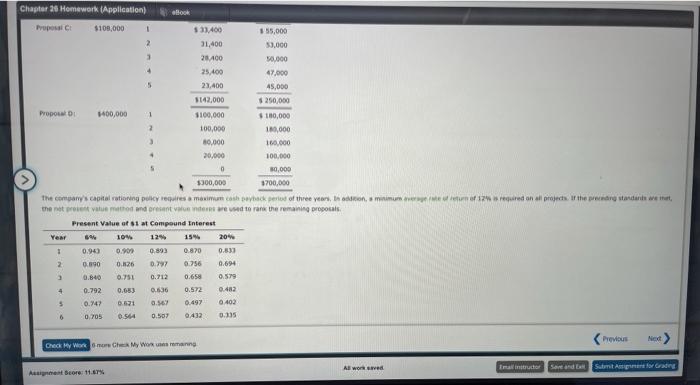

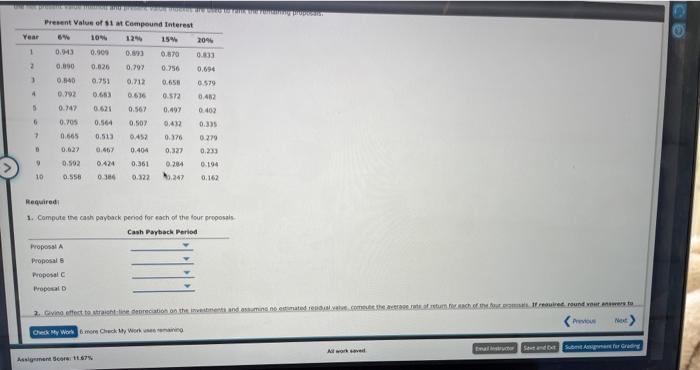

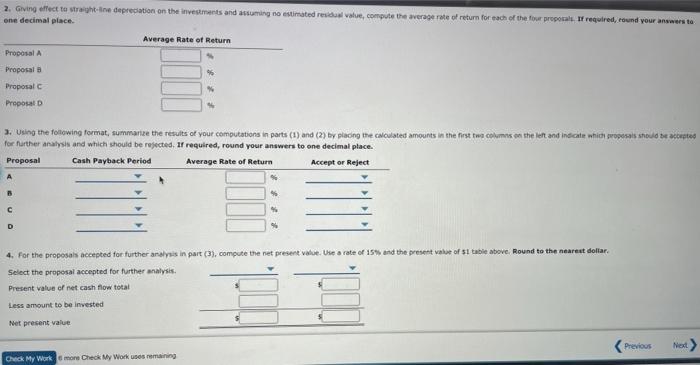

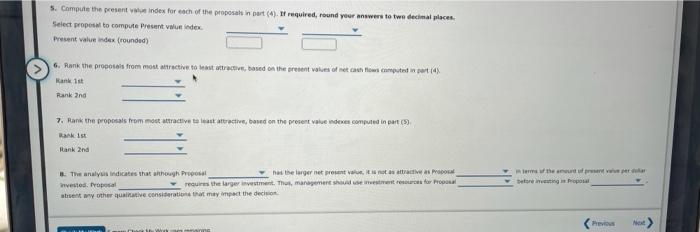

Ratione Decision for a Service Company Inolving Four Proposals Renaissance Capital Group is considering allocating a limited amount of capital investment funds among four proposals. The amount of proposed investment, estimated operating name, and each work posal are as follows Operating Net Cash Investment Year Income Flow Proposal 1680,000 1 $ 64,000 $200,000 2 64,000 200,000 3 64.000 200,000 4 24,000 160,000 5 24,000 160,000 $240,000 8920,000 Proposal B $320,000 1 $26.000 $ 90,000 2 26,000 90,000 3 6,000 70,000 6,000 70,000 (44,000) 20,000 $ 20,000 $340,000 Proposal ci $100,000 1 $ 33,400 $ 55,000 2 31,400 53,000 3 28,400 50,000 4 25,400 47,000 5 23,400 45,000 4 5 Check My work more Check My Work we remaining Previous Next Chapter 26 Homework (Application) eBook Proposal $109,000 1 533400 155,000 2 31,400 50.000 3 28400 50.000 4 25.400 47.000 5 23,400 45,000 1142,000 $ 250,000 Proposal 1400,000 1 $100,000 $180,000 2 100,000 140,000 10.000 10.000 4 20,000 100.000 0 30,000 $300,000 1700,000 The company's capital voting policy requires a maximum cashback period of three years, Indon, minimum of 124 required an all projects. If the prestandard wit the net rent value method anderen als we to rank the remaining proposals Present Value of 81 at Compound Interest Year 10V 12 15% 2017 1 0.96 0.900 0.893 0.870 0.630 2 0.090 0.126 0.797 0.756 0.694 0.840 0.751 0.712 0.658 0.579 4 0.792 0.65) 0.636 0.572 0.482 5 0.747 0621 0.56 0.497 6.402 0.705 0.544 0.507 9432 0.335 Previous CHECK MY WOOC My Wong Al woved Ima tutto Save and ta Sumt for Grade Accent core 11.6% Present Value of Sit Compound Interest Year 10% 15% 20% 1 0.943 0.570 2 0.000 0.020 0.79 0.756 0.694 1 0.540 0.751 0.712 0.65 0579 4 0.792 0.60 0.572 5 0.747 0.625 0.567 0.497 0.402 5 0.705 0,564 0.507 0.432 0.335 7 0.665 0,513 0452 0.376 0279 0.667 0.404 0,327 0.233 0.592 0.424 0.361 0.284 0.194 10 0380 0.322 0.162 0.482 0.558 Required 1. Compute the cash payback period for each of the four proposals. Cash Payback Period Proposal Proposal Proposal Proposal 2. Giving effect to the detection on the end mine nostre comes the return chefret round out to Oleck My Worlomon Chucky Wong Al word Ewa Standard Assignment 1.67% 2. Giving effect to straht-line depreciation on the investments and autuming no estimated resident value, compute te werage rate of return for each of the four propetals required, round your answers to one decimal place. Average Rate of Return Proposal Proposal Proposal Proposal p 3. Using the following format, summarize the results of your computations in parts (1) and (2) by placing the coulated amounts in the first two columes on the left and indicate which proposals should be accepted for further analysis and which should be rejected. If required, round your answers to one decimal place. Proposal Cash Payback Period Average Rate of Return Accept or Reject B % % D % 4. For the proposals accepted for further analysis in part (3), compute the net present value. Use a rate of 15 and the present value of 51 table above. Round to the nearest dollar Select the proposal accepted for further analysis. Present value of net cash flow total Less amount to be invested Net present value Previous Ned Check My Workmore Check My Work uses remaining 5. Compute the present the index for each of the proposals in part (4). It required, round your answers to two decimal placer Select proposal to compute Present value Index Present value index (rounded) 6. Rank the propotains from most atractive to test attractive, based on the present values of het aan How compte porta Rank and 7. Rank the proposals from moet tractive to eat attractive band on the present value dever computed in parte Bakis Rank 2nd 3. The analysindicates that although Proposal thes the larger net presentat personal wedPool requires the larger investment. Thus, management shoulders for Proposal te ww other que consideration that may impact the deciso Nied