Answered step by step

Verified Expert Solution

Question

1 Approved Answer

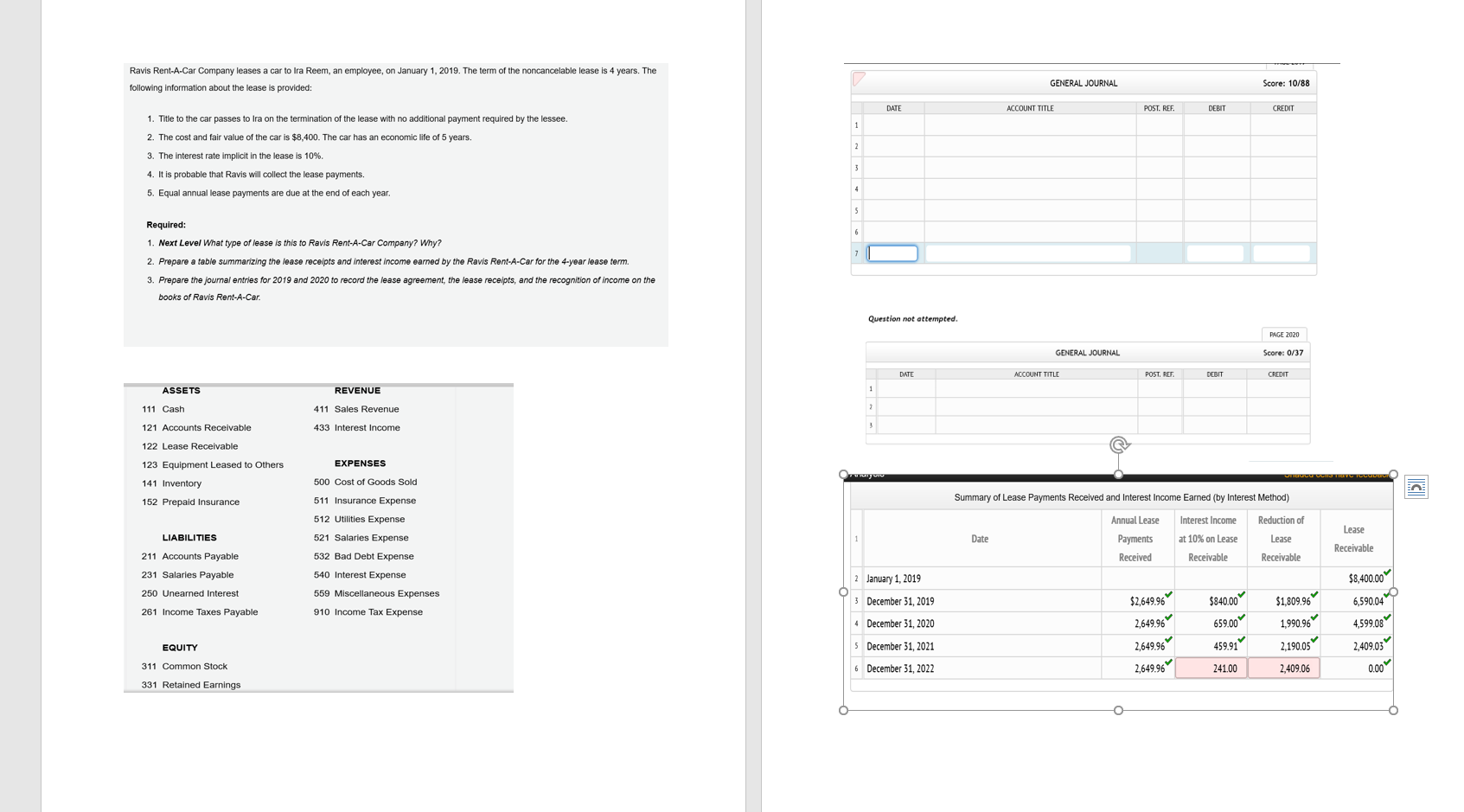

Ravis Rent-A-Car Company leases a car to Ira Reem, an employee, on January 1, 2019. The term of the noncancelable lease is 4 years. The

Ravis Rent-A-Car Company leases a car to Ira Reem, an employee, on January 1, 2019. The term of the noncancelable lease is 4 years. The following information about the lease is provided: GENERAL JOURNAL Score: 10/88 DATE ACCOUNT TITLE POST. REF. DEBIT CREDIT 1. Title to the car passes to Ira on the termination of the lease with no additional payment required by the lessee. 2. The cost and fair value of the car is $8,400. The car has an economic life of 5 years. 3. The interest rate implicit in the lease is 10%. 4. It is probable that Ravis will collect the lease payments. 5. Equal annual lease payments are due at the end of each year. Required: 2. Prepare a table summarizing the lease receipts and interest Income earned by the Ravis Rent-A-Car for the 4-year lease term. 3. Prepare the journal entries for 2019 and 2020 to record the lease agreement, the lease receipts, and the recognition of income on the books of Ravis Rent-A-Car. Question not attempted. PAGE 2020 GENERAL JOURNAL Score: 0/37 DATE ACCOUNT TITLE CREDIT ASSETS REVENUE 111 Cash 411 Sales Revenue 121 Accounts Receivable 433 Interest Income 122 Lease Receivable 123 Equipment Leased to Others 141 Inventory 152 Prepaid Insurance EXPENSES 500 Cost of Goods Sold 511 Insurance Expense 512 Utilities Expense Summary of Lease Payments Received and Interest Income Earned (by Interest Method) Annual Lease Reduction of Lease LIABILITIES 521 Salaries Expense Date Payments Interest Income at 10% on Lease Receivable Lease Receivable 211 Accounts Payable 532 Bad Debt Expense Receivable 540 Interest Expense 2 January 1, 2019 231 Salaries Payable 250 Unearned Interest 261 Income Taxes Payable 559 Miscellaneous Expenses 910 Income Tax Expense 3 December 31, 2019 $2,649.96 $840.00 $8,400.00 6,590.04 4,599.08 2,409.03 December 31, 2020 659.00 $1,809.96 1,990.969 2,190.05 2,649.96 2,649.96 EQUITY December 31, 2021 459.91 311 Common Stock 331 Retained Earnings December 31, 2022 2,649.96 241.00 2,409.06 0.00 Ravis Rent-A-Car Company leases a car to Ira Reem, an employee, on January 1, 2019. The term of the noncancelable lease is 4 years. The following information about the lease is provided: GENERAL JOURNAL Score: 10/88 DATE ACCOUNT TITLE POST. REF. DEBIT CREDIT 1. Title to the car passes to Ira on the termination of the lease with no additional payment required by the lessee. 2. The cost and fair value of the car is $8,400. The car has an economic life of 5 years. 3. The interest rate implicit in the lease is 10%. 4. It is probable that Ravis will collect the lease payments. 5. Equal annual lease payments are due at the end of each year. Required: 2. Prepare a table summarizing the lease receipts and interest Income earned by the Ravis Rent-A-Car for the 4-year lease term. 3. Prepare the journal entries for 2019 and 2020 to record the lease agreement, the lease receipts, and the recognition of income on the books of Ravis Rent-A-Car. Question not attempted. PAGE 2020 GENERAL JOURNAL Score: 0/37 DATE ACCOUNT TITLE CREDIT ASSETS REVENUE 111 Cash 411 Sales Revenue 121 Accounts Receivable 433 Interest Income 122 Lease Receivable 123 Equipment Leased to Others 141 Inventory 152 Prepaid Insurance EXPENSES 500 Cost of Goods Sold 511 Insurance Expense 512 Utilities Expense Summary of Lease Payments Received and Interest Income Earned (by Interest Method) Annual Lease Reduction of Lease LIABILITIES 521 Salaries Expense Date Payments Interest Income at 10% on Lease Receivable Lease Receivable 211 Accounts Payable 532 Bad Debt Expense Receivable 540 Interest Expense 2 January 1, 2019 231 Salaries Payable 250 Unearned Interest 261 Income Taxes Payable 559 Miscellaneous Expenses 910 Income Tax Expense 3 December 31, 2019 $2,649.96 $840.00 $8,400.00 6,590.04 4,599.08 2,409.03 December 31, 2020 659.00 $1,809.96 1,990.969 2,190.05 2,649.96 2,649.96 EQUITY December 31, 2021 459.91 311 Common Stock 331 Retained Earnings December 31, 2022 2,649.96 241.00 2,409.06 0.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started