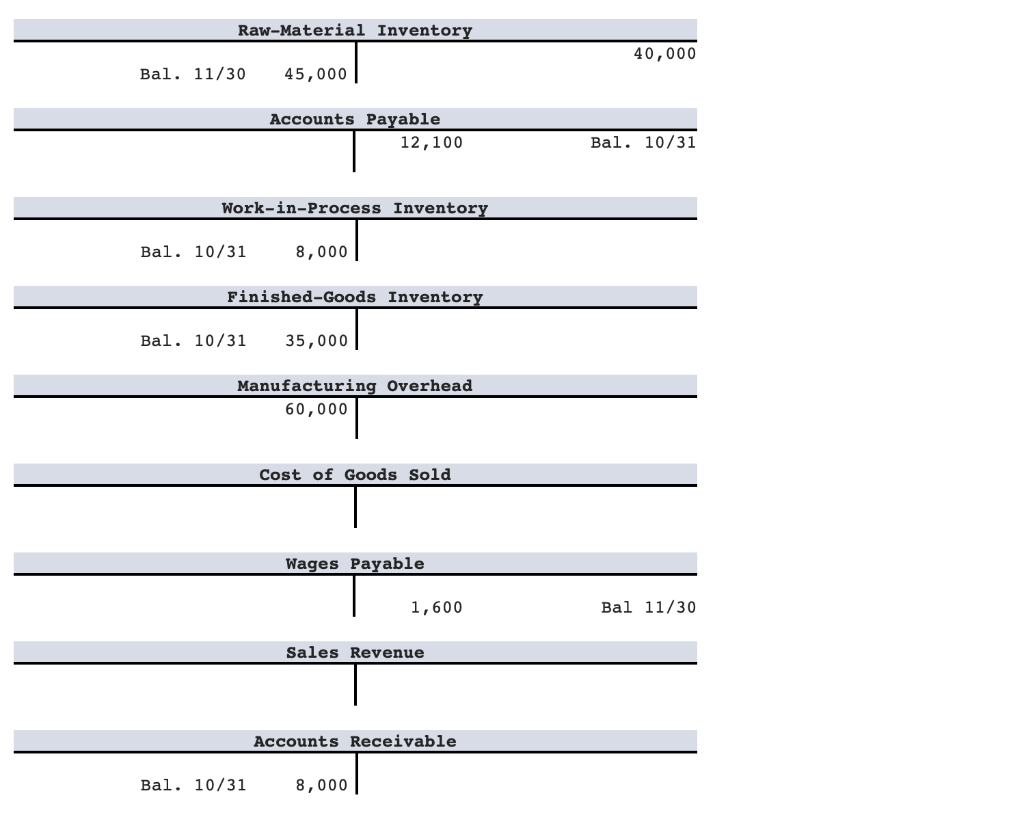

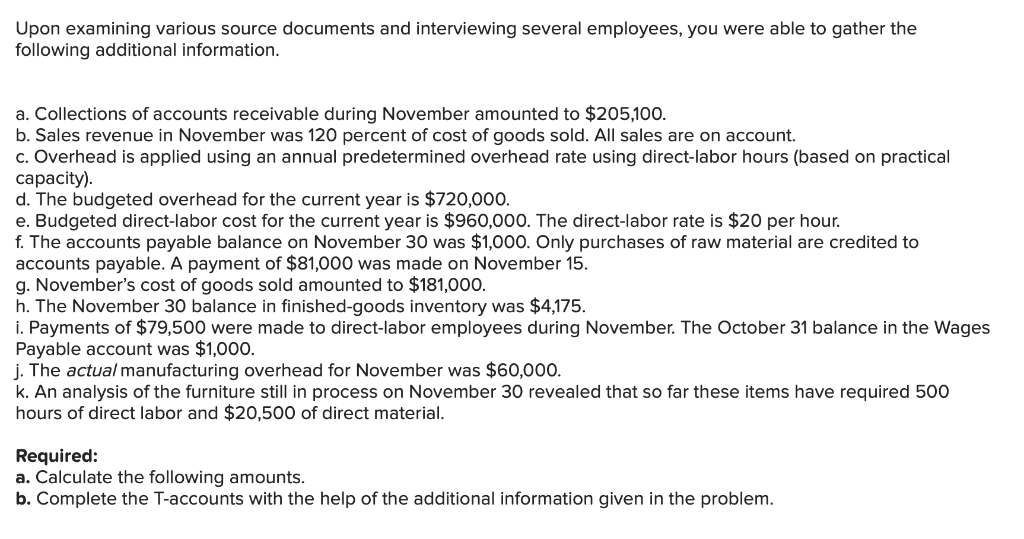

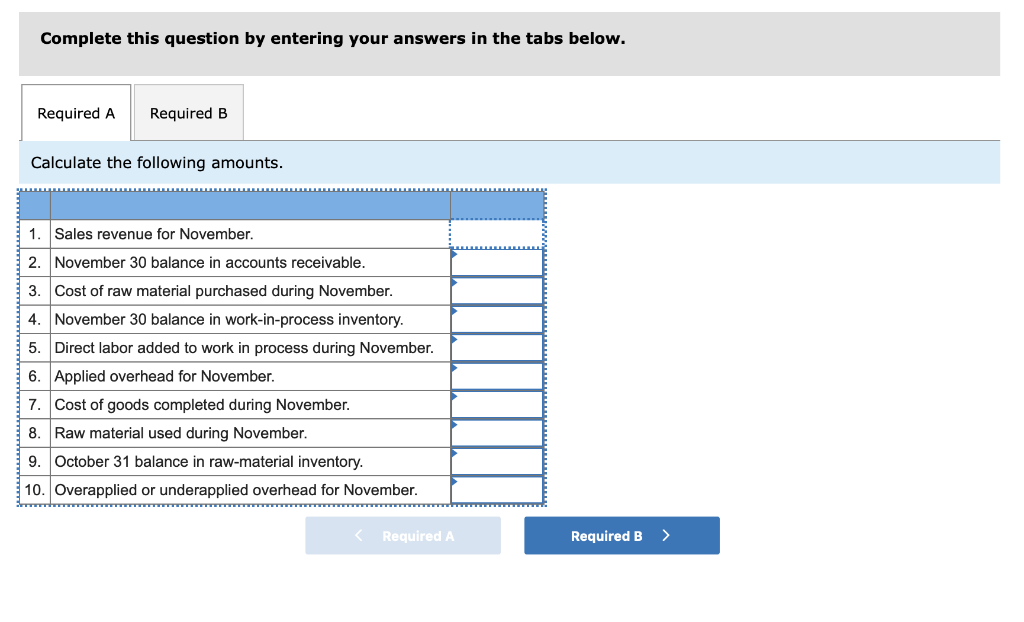

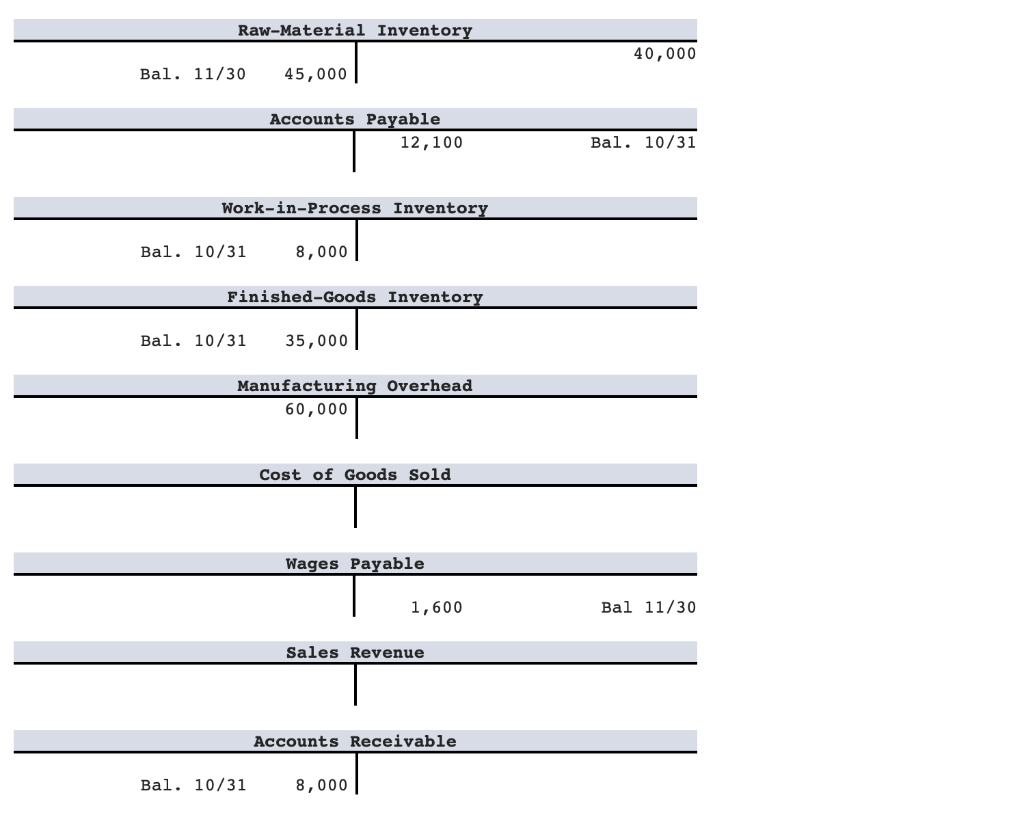

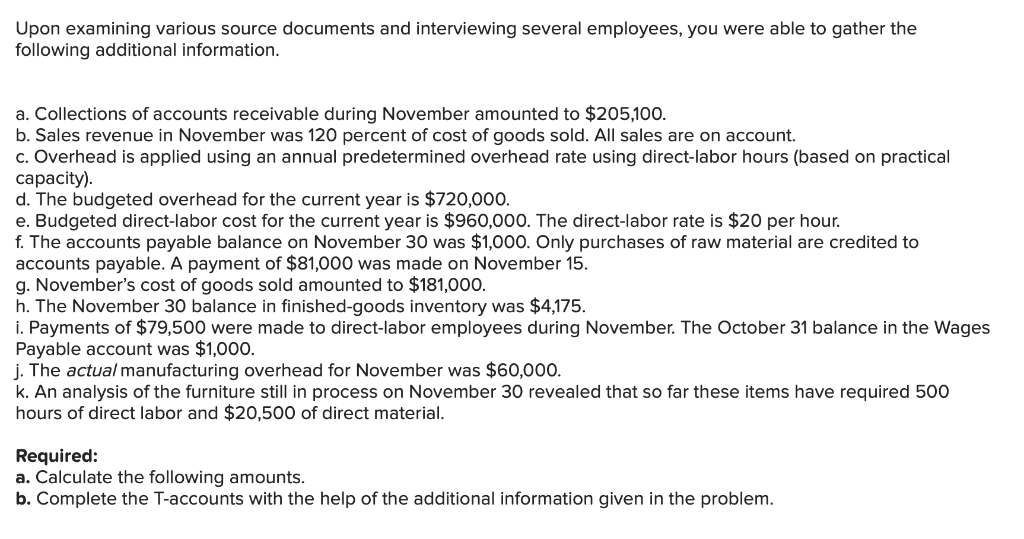

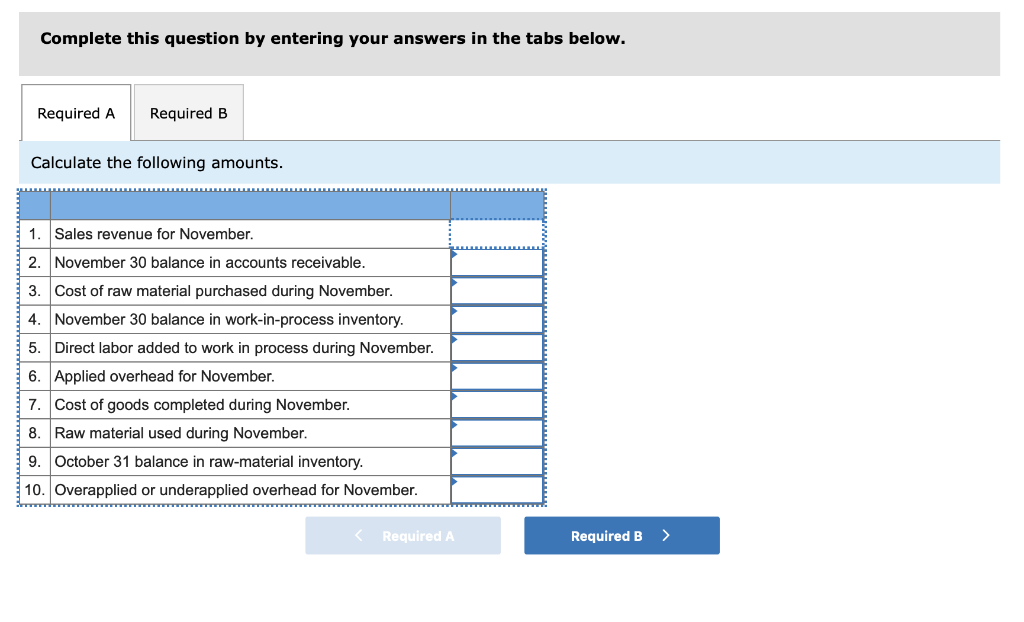

Raw-Material Inventory 40,000 Bal. 11/30 45,000 Accounts Payable 12,100 Bal. 10/31 Work-in-Process Inventory Bal. 10/31 8,000o Finished-Goods Inventory Bal. 10/31 35,000 Manufacturing Overhead 60,000 Cost of Goods Sold Wages Payable Bal 11/30 1,600 Sales Revenue Accounts Receivable .10/31 8,000 Upon examining various source documents and interviewing several employees, you were able to gather the following additional information. a. Collections of accounts receivable during November amounted to $205,100. b. Sales revenue in November was 120 percent of cost of goods sold. All sales are on account. c. Overhead is applied using an annual predetermined overhead rate using direct-labor hours (based on practical capacity) d. The budgeted overhead for the current year is $720,000 e. Budgeted direct-labor cost for the current year is $960,000. The direct-labor rate is $20 per hour f. The accounts payable balance on November 30 was $1,000. Only purchases of raw material are credited to accounts payable. A payment of $81,000 was made on November 15 g. November's cost of goods sold amounted to $181,000. h. The November 30 balance in finished-goods inventory was $4,175 i. Payments of $79,500 were made to direct-labor employees during November. The October 31 balance in the Wages Payable account was $1,000. j. The actual manufacturing overhead for November was $60,000 k. An analysis of the furniture still in process on November 30 revealed that so far these items have required 500 hours of direct labor and $20,500 of direct material. Required: a. Calculate the following amounts. b. Complete the T-accounts with the help of the additional information given in the problem. Complete this question by entering your answers in the tabs below. Required A Required B Calculate the following amounts. 1. Sales revenue for November. 2. November 30 balance in accounts receivable. 3. Cost of raw material purchased during November. 4.November 30 balance in work-in-process inventory. process during November 5. Direct labor added to work i 6. Applied overhead for November. 7. Cost of goods completed during November. 8. Raw material used during November. 9. October 31 balance in raw-material inventory 10. Overapplied or underapplied overhead for November. Required A Required B>