Question

Ray Ray made the following contributions in 2023. Charity Property Cost Athens Academy School Cash $ 5,200 FMV $ 5,200 United Way Cash 5,250

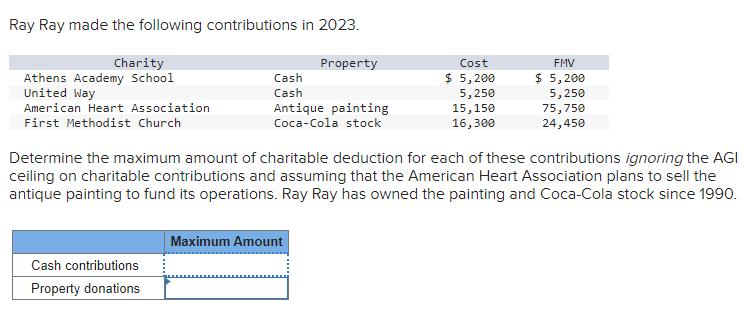

Ray Ray made the following contributions in 2023. Charity Property Cost Athens Academy School Cash $ 5,200 FMV $ 5,200 United Way Cash 5,250 5,250 American Heart Association First Methodist Church Antique painting Coca-Cola stock 15,150 75,750 16,300 24,450 Determine the maximum amount of charitable deduction for each of these contributions ignoring the AGI ceiling on charitable contributions and assuming that the American Heart Association plans to sell the antique painting to fund its operations. Ray Ray has owned the painting and Coca-Cola stock since 1990. Cash contributions Property donations Maximum Amount

Step by Step Solution

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Cash Contributions Athens Academy School 5200 Cash contributions are deductible up to their fa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Taxation Of Individuals And Business Entities 2015

Authors: Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

6th Edition

978-1259206955, 1259206955, 77862368, 978-0077862367

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App