Answered step by step

Verified Expert Solution

Question

1 Approved Answer

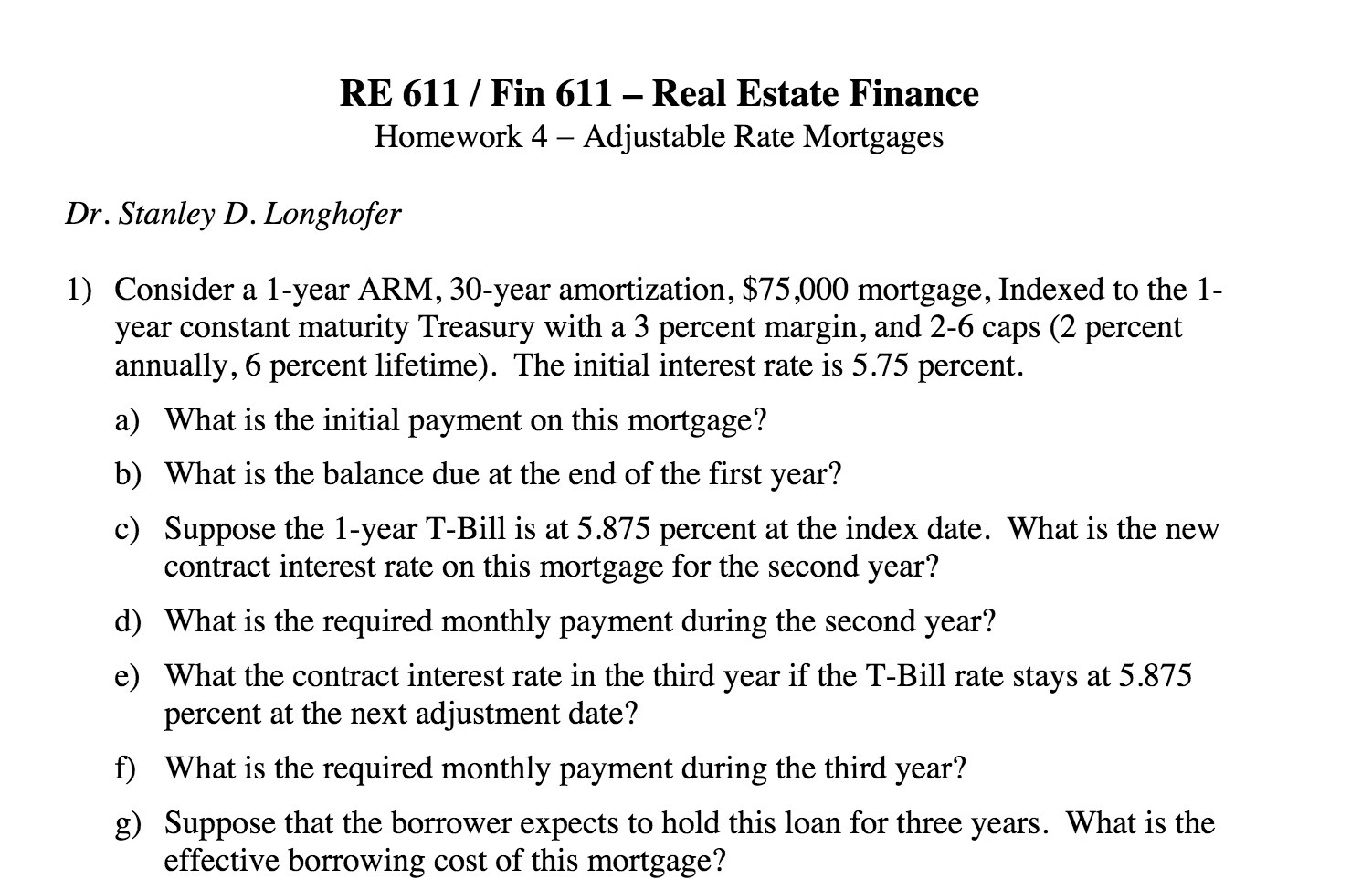

RE 611 / Fin 611 Real Estate Finance Homework 4- Adjustable Rate Mortgages Dr. Stanley D. Longhofer 1) Consider a 1-year ARM, 30-year amortization,

RE 611 / Fin 611 Real Estate Finance Homework 4- Adjustable Rate Mortgages Dr. Stanley D. Longhofer 1) Consider a 1-year ARM, 30-year amortization, $75,000 mortgage, Indexed to the 1- year constant maturity Treasury with a 3 percent margin, and 2-6 caps (2 percent annually, 6 percent lifetime). The initial interest rate is 5.75 percent. a) What is the initial payment on this mortgage? b) What is the balance due at the end of the first year? c) Suppose the 1-year T-Bill is at 5.875 percent at the index date. What is the new contract interest rate on this mortgage for the second year? d) What is the required monthly payment during the second year? e) What the contract interest rate in the third year if the T-Bill rate stays at 5.875 percent at the next adjustment date? f) What is the required monthly payment during the third year? g) Suppose that the borrower expects to hold this loan for three years. What is the effective borrowing cost of this mortgage?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets break down each part of the problem a Initial Payment To calculate the initial payment we use t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started