Question

READ THE BELOW CASE AND ANSWER THE QUESTIONS GIVEN IN THE END OF THE CASE STUDY FALABELLA: GROWTH OPTIONS IN UNCERTAIN TIMES By the beginning

READ THE BELOW CASE ANDANSWER THE QUESTIONS GIVEN IN THE END OF THE CASE STUDY

FALABELLA: GROWTH OPTIONS IN UNCERTAIN TIMES

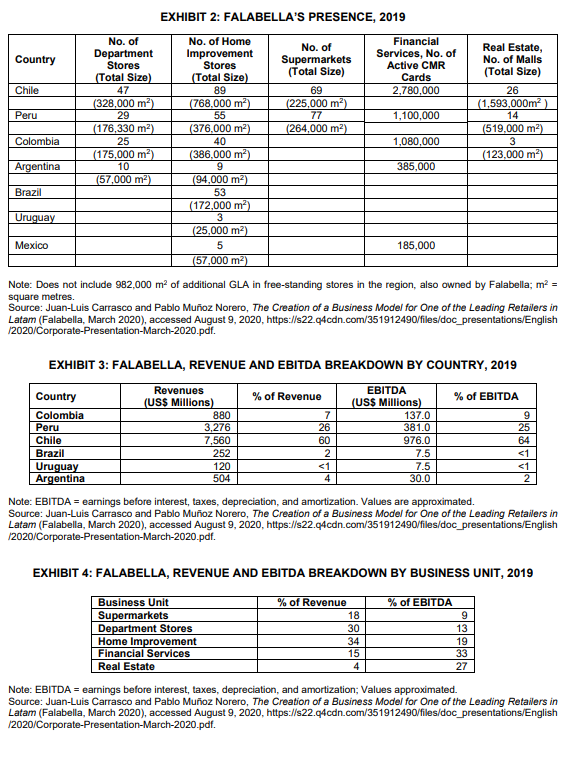

By the beginning of 2020, Falabella was one of the main Latin American retailers in terms of annualrevenues and earnings before interest, taxes, depreciation, and amortization (EBITDA) (see Exhibit 1).2The company, headquartered in Santiago, Chile, had more than 110,000 employees and operateddepartment stores, supermarkets, home improvement stores, shopping malls, and a credit business in sevencountries, including Brazil and Mexico.3

The phenomenal growth of the Latin American online marketplace Mercado Libre, and the recentannouncement of the arrival of Amazon.com Inc. (Amazon), Alibaba.com (Alibaba), and other e-commerce vendors into Latin America, posed significant challenges for Falabella.4While its main businesses remaineddriven by sales in physical stores, Falabella had initiated a more aggressive expansion into online sales, which made up almost 10 per cent of total revenues in 2019 and grew at a yearly rate of 124 per cent in the

second quarter of 2020.5Carlo Solari Donaggio, chairman of Falabella's board, noted,

The emergence of new technologies such as e-commerce, widespread cell phone adoption, communications and logistic innovations and big data processing, among others, have all changed

the entire retail map. This has required companies to strongly innovate, react more promptly, and clearly stand out from competition.6

In 2020, the COVID-19 pandemic brought additional challenges for Falabella's management team. Due to the pandemic, most shopping malls and stores were obliged to close for a rather long period of time, and it was unlikely that the expected increase in online sales would compensate for the decrease in physical sales.7

Partly as a result of the financial challenges brought by the closing of stores and shopping malls, by the end of April 2020, Fitch Ratings Inc. had decreased Falabella's credit rating from "BBB+" to "BBB," and rating agencies warned of the Falabella's increasing debt levels.8

In this scenario, there were different options for growth. For instance, Falabella could choose further growthin the brick-and-mortar stores, where there were still important opportunities (including its recently openedoperations in Brazil and Mexico), or it could promote growth in the online business. In its online activities,

Falabella could choose between organic growth (e.g., further investing in the marketplace business or its e commerce website),9joint ventures, or acquisitions. The question of how to approach the retail world in these turbulent times did not have an obvious answer, and there was also the question of whether the

historical strength of Falabella, fuelled by horizontal, vertical, and international expansion, would remainThis a source of value, or whether the company should focus on the online business, even at the cost of withdrawing or reducing its participation in some of the brick-and-mortar businesses.

BUSINESS UNITS AND INTERNATIONALIZATION

Falabella was a corporation based in Chile that offered a wide range of products and services in five business

divisions and seven countries (see Exhibits 2, 3, and 4). The integrated retail format sought to achieve costand revenue synergies.10

Department Stores

Falabella was founded in 1889, when Salvatore Falabella, an Italian immigrant, opened the first tailor shopin northern Chile.11In 1958, the shop evolved into a department store through the introduction of a wide

array of home products. Fuelled by organic growth and acquisitions, by January 2020, Falabella operated

111 department stores (a total of 730,000 square metres), which were located throughout Chile, Peru,Colombia, and Argentina, and brought in more than US$3.6 billion in annual revenues.12Falabella's

business strategy in department stores was characterized by offering a wide variety of products and establishing strong relationships with its suppliers. The company had introduced an increasing selection of its own brand name products. Though the company operated stand-alone stores and stores in third-party shopping centres, Falabella's department stores were also located in Falabella-owned shopping malls.13

The internationalization of the department store business began in 1993, when the company opened a store in Argentina. Two years later, Falabella entered Peru by acquiring 70 per cent of the local department store chain Saga. In 2006, Falabella entered Colombia, where it opened three stores in two years, while in 2008 acquired Casa Estrella, a Colombian department store chain consisting of five stores. The growth of Falabella's department stores continued in all four countries, and in 2020, Falabella had the largest market share in department stores in each of the markets it participated in.14

Shopping Malls

In 1990, the company entered the shopping mall business with a controlling stake in the Mall Plaza group.

It launched Mall Plaza Vespucio, the first of several shopping centres opened in Chile, targeted mainly at middle-income consumers. At that time, there was only one mall in Chile: Parque Arauco, launched in 1982 by an independent mall developer.15

The shopping mall industry had seen growth in Latin America. One of the main reasons behind this growth was an increasing preference for purchasing different goods and services in the same place (i.e., one-stop shopping). Mall Plaza shopping malls also offered medical centres, gymnasiums, game zones, education centres, and public libraries.16

By the beginning of 2020, Mall Plaza (a publicly traded company with a market capitalization of about $3 billion) had 26 shopping malls in Chile, 14 in Peru, and three in Colombia and was the largest player in Chile and Peru. By the beginning of 2020, Falabella owned approximately 59 per cent of the Mall Plaza group.17

Home Improvement

Falabella entered the home improvement market in 1998 with the announcement of a joint venture with

Home Depot Inc. (Home Depot), the largest home improvement chain in the United States, which was about to start operations in Chile.18Home Depot held a controlling interest in the partnership by owning two thirds of the shares. It brought to Chile the concept of do-it-yourself (DIY). DIY customers were generally people who repaired and renovated their homes. The DIY concept was less developed in Chile than in the United States, and this was reflected in a lower level of consumer involvement in DIY activities in Chile, where consumers gave more importance to the attractiveness of the store, service quality, and product assortment than to DIY or low prices.19Despite opening five stores, after three years of operations andmounting financial losses, Home Depot announced its intention to exit Chile.20

In December 2001, Home Depot sold its shares to Falabella, which, operating under Home Depot's brand name and management, quickly recovered losses. Despite its success, in 2003, Falabella had only a small share of Chile's $4 billion home improvement market. With 51 stores in Chile and six in Colombia,

Falabella's competitor Sodimac dominated the market. Sodimac had introduced a new style of store, combining home products (such as furniture and appliances) with home improvement and construction goods. After extended negotiations, in 2003, Falabella acquired and merged with Sodimac.21

Falabella increased its internationalization with the opening of its first home improvement stores in Peru, in

2004, and in Argentina, in 2008. In 2014, it acquired the main Peruvian competitor, Maestro, and reached about 20 per cent market share in a highly fragmented market. In 2013, Falabella acquired a home improvement chain named Dicico, which had a strong presence in the state of So Paulo, Brazil, with 56 stores. The home improvement market in Brazil was very fragmented, with the top five players accounting for less than 10 per cent of the market.22In 2017, Falabella announced a partnership with Organizacin Soriana

(Soriana) to jointly develop the home improvement market in Mexico. Soriana was Mexico's second-largestretailer based on sales, behind the Mexican arm of Walmart Inc. (Walmart). Valued at $30 billion annually,the Mexican home improvement market was the second largest in Latin America, after Brazil.23By the beginning of 2020, Falabella had 254 home improvement stores; the largest market share in Chile, Peru, andColombia; the second-largest market share in Argentina; and the fourth-largest market share in Brazil.24

Regarding Sodimac's strategy in the home improvement market, Solari Donaggio said,

We realized that the increase in per capita income in Latin America, which translates into higherspending by households, was not being well addressed by the few competitors in the home improvement category. So, we took advantage of the opportunity and entered Brazil, Uruguay, and

Mexico. We are strengthening our presence in countries where we have operations, and we are bettingheavily in Brazil and Mexico.25

In 2018, Falabella signed an agreement with IKEA to build and operate at least nine IKEA stores in Chile,Peru, and Colombia in the next 10 years. The first store was expected to open by 2021.IKEA was a world

class Swedish company that designed and sold ready-to-assemble furniture and home accessories.26

Supermarkets

Falabella entered the supermarket business in 2002, when it launched a supermarket chain in Peru namedTottus. After opening several Tottus stores in Peru, Falabella entered the Chilean supermarket business byacquiring a supermarket chain with 4 per cent market share. Although customers' average purchase amount per visit to a supermarket was lower than their average purchase amount per visit to a department or home

improvement store, customers visited supermarkets more often.27Solari Donaggio reasoned that "Formal market penetration in Peru is less than 30 per cent, whereas in Chile, given the much higher penetration of the supermarket industry, our strategy has been differentiation."28

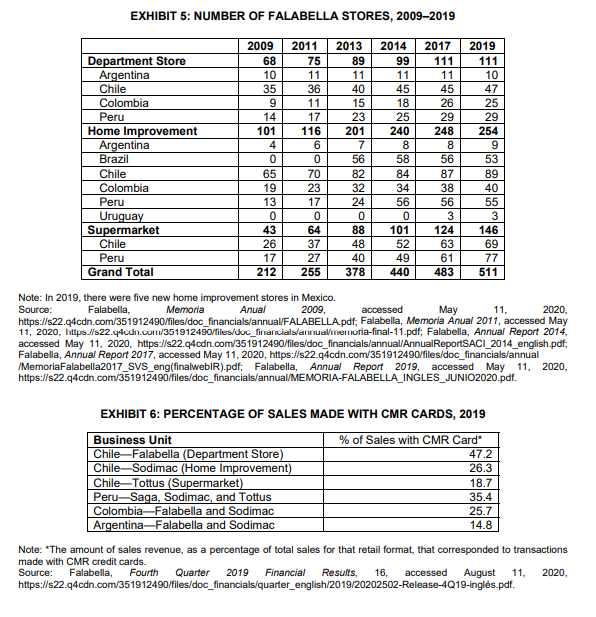

By the beginning of 2020, Falabella had 69 stores in Chile and 77 stores in Peru totalling 490,000 squaremetres, with total annual revenues of $2.8 billion (see Exhibit 5).29The main players in the Chilean supermarket industry were Walmart and Cencosud, with market shares in the vicinity of 30 per cent each.

Falabella was in fourth place, far from the market leaders. In Peru, the leaders were Supermercados Peruanos, Cencosud, and Falabella, with similar market shares.30

Financial Business

From its beginnings, Falabella had extended credit to its customers. In 1980, the company became the first store to introduce its own credit card, CMR Falabella (CMR), which customers could use to make purchases in

Falabella stores. To start a relationship with a client without a financial history, Falabella offered clients a credit

card with a small credit line, which was dynamically modified according to the consumer's behaviour. As a

result, Falabella acquired valuable information from its customers and increased its client base. In 2010, CMRestablished alliances with Visa Inc. and Mastercard Incorporated (Mastercard), which allowed the credit card to

be used in third-party stores. By the end of 2019, Falabella was partnered only with Mastercard.31

CMR was the largest credit card issuer in Chile and Peru and the fourth-largest in Colombia. CMR'sstrategy was to offer a large set of products and discounts to consumers if they paid with CMR in any Falabella store (see Exhibit 6).32Wherever a new Falabella business was opened (e.g., a department store,

home improvement store, or supermarket), CMR was introduced and offered to customers.

Falabella's expansion into new business sectors included the launch of Banco Falabella in 1998. As Solari

Donaggio explained, "The financial area has always been very relevant within the group. We realized that to maintain a relationship with customers, we had to go from being a credit card company to being a bank for people (personal banking)."33

Insurance services, a travel agency, and virtual mobile operators were integrated with the financial services business unit, "combining the stability of a traditional financial business with the proximity to customers that characterizes a retail company."34

CMR expanded to Peru in 1998 and then to Colombia and Argentina in 2006. By the end of 2019, CMR

had five and a half million active accounts, and Banco Falabella had 256 branches across Chile, Peru, Colombia, Mexico, and Argentina.35Falabella pursued strong growth in Mexico by offering integrated

services and credit products within more than 800 Soriana stores.36

The Online Business

In 1999, Falabella launched its first e-commerce platform for its department stores in Chile, expanding toArgentina in 2005 and Colombia in 2010. Later, in 2012, it updated its online platform and launched "click and collect," which enabled customers to purchase online and pick up orders at the store, as part of an omni channel and digitalization strategy.37In 2014, Falabella started rolling out e-commerce-enabled tablets to its salespeople. With these tablets, the salespeople were able to offer a wider range of products than was physically available on the sales floor.38Sodimac and Tottus profited from the online development of

Falabella's department store. Sodimac's e-commerce was launched on 2001, while Tottus's e-commerce was launched in 2010.39

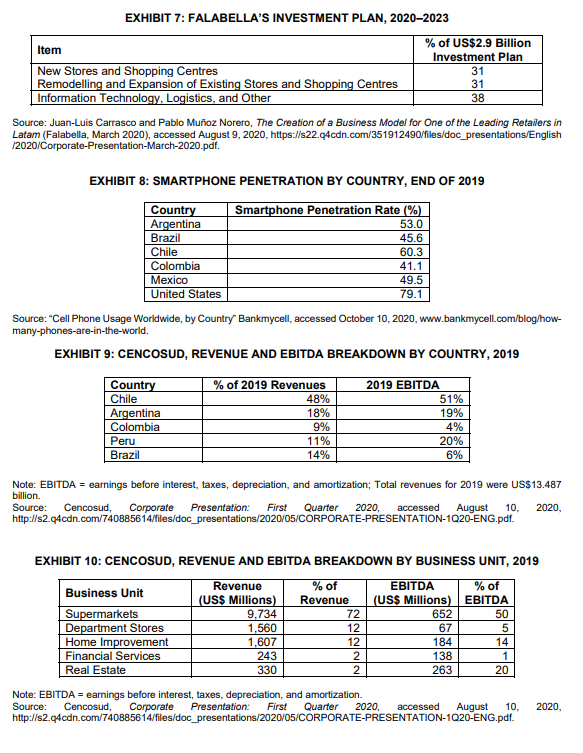

Out of the $2.9 billion of Falabella's expected investments for the period 2020-2023, 38 per cent was fortechnology and logistics associated with online sales (see Exhibit 7).40Falabella built a new distribution

centre in Chile?one of the most modern distribution centres in South America?mainly to handle the logistics of the home delivery of online sales. However, as a result of the COVID-19 pandemic, in April 2020, Falabella announced the freezing of investments in both the remodelling and expansion of shopping malls and stores, though it kept investing in online activities.41

The rapid penetration of smartphones with high-speed Internet facilitated the growth of online commerce(see Exhibit 8). In 2019, Falabella sold more than $1.2 billion in products via online sales and more than $1.33 billion in financial products through digital channels.42By 2019, over 60 per cent of the products sold

on Falabella's website (www.fallabella.com) in Chile were picked up in stores. By the end of 2019,

Falabella was an important online player in Chile, Peru, and Colombia.43

To increase its online presence, in 2018, Falabella acquired Linio, a marketplace application (app) with operations in Mexico, Colombia, Peru, and Chile, for $138 million. Immediately after the announcement, Falabella's stock price fell 4.5 per cent.44Linio expanded its offering by integrating the Falabella, Sodimac,

and Tottus catalogues and by including many products from domestic and international sellers. In 2019,Linio had more than 8,600 active sellers, 290 million annual visits, $188 million in sales, and a 49 per centincrease in traffic compared with the previous year.45

In the second quarter of 2020, Gaston Bottazzini, chief executive officer of Falabella, announced two new apps to complement Falabella's offerings and expand online sales: Fazil, a last-mile app that offered products from

Tottus, Falabella, and Sodimac, and Fpay, a new digital payment app.46Fazil allowed users to access the

assortment of products available in stores from their mobile phones as well as schedule deliveries at theirconvenience, monitor the status of their orders in real time, and interact with the person in charge of preparing

and delivering their order. With Fpay, users could use QR codes to make purchases in Falabella's stores and

affiliated businesses, using credit cards from any bank. Fpay users could also transfer money to their contacts

through the Fpay app. According to Bottazzini, "Fazil and Fpay are part of the solutions we want to deliver to

our customers to help them simplify their lives, strengthening their supply alternatives, making available all our product offerings while delivering digital payment solutions."47

With regard to Falabella's online strategy, Solari Donaggio said,

We believe in the increasing relevance of digital channels. However, we also believe these will notreplace the store experience. The e-commerce is complemented by and integrated with physical

commerce. In countries more digitized than those in Latin America, physical stores help attract new customers, increase brand awareness and therefore brand choosing, facilitate product deliveries, and especially product returns.48

MAIN COMPETITORS

Falabella faced competition domestically and internationally from large companies at the integrated retaillevel (i.e., retailers that managed a set of businesses), focused competitors within each of its business units,and online players. The main competitors at the integrated level were Cencosud and Ripley Corp. SA (Ripley), whereas the main competitor at the focused business level in Chile and Mexico was Walmart.

Cencosud

In 2012, Cencosud ended a period of major acquisitions that saw it spend more than $2.2 billion and reachsales of over $19 billion.49In that year alone, Cencosud acquired a supermarket chain in Brazil andCarrefour SA (Carrefour) operations in Colombia, opened the biggest shopping mall in Chile, and built the

tallest building in South America (also located in Chile), reaching substantial operations in all countries where it had presence: Chile, Argentina, Peru, Brazil, and Colombia.50In the credit card business, Cencosud developed joint ventures with local banksin Chile (Scotiabank), Brazil (Banco Bradesco SA), and Colombia

(Colpatria by Banco Colpatria SA), dissolving its own credit card subsidiaries in these countries.51

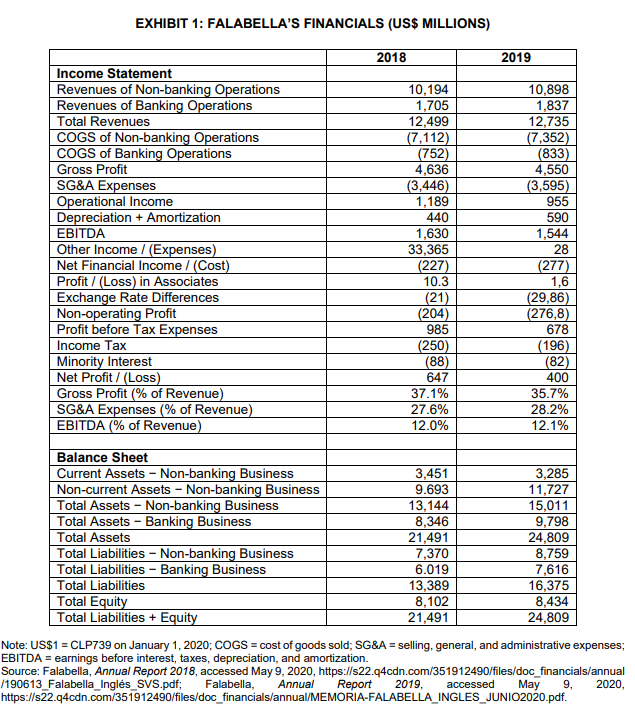

Cencosud's EBITDA was concentrated in the supermarket sector, followed by home improvement stores,

department stores, shopping malls, and financial services (see Exhibits 9 and 10). At the end of 2019,

Cencosud had 1,108 retail stores.52

In 2016, Cencosud launched its omni-channel strategy and innovated on delivery possibilities. Customers could

buy online, by telephone, or in store. Delivery could happen at the destination, through a click-and-collect

service, or at a specific parking lot outside the store. In 2019, Cencosud's online supermarket sales were 2.1 per

cent of Cencosud's total supermarket sales; online department store sales were 22.4 per cent of total department store sales; and online home improvement sales were 6.6 per cent ofCencosud'stotal home improvement sales.53

In June 2019, Cencosud successfully launched an initial public offering (IPO) for its shopping mallbusiness, Cencosud Shopping. It was the largest-ever IPO in Santiago's stock exchange, netting the company $1.06 billion for 474 million shares (27.7 per cent ownership in the newly created company).54The main buyers of Cencosud Shopping shares were pension funds, financial institutions, and foreign investors. The remaining 72 per cent of Cencosud Shopping shares remained in the hands of Cencosud. Cencosud Shopping was the largest owner and operator of shopping malls in Chile and the second largest in South America. Cencosud Shopping had said that the capital raised by the IPO would be used to pay off debt to Cencosud.55

Ripley

Ripley had three main businesses: department stores, banking, and shopping centres. In 2019, almost halfof the company's EBITDA originated from its financial services division (1.8 million active cards),

followed by the retail division (76 stores) and real estate (13 shopping malls).56Ripley had a leading

position in Peru, and it was the third-largest retailer in Chile. The firm's online sales had grown more than20 per cent annually in Chile and Peru between 1990 and 2019. On April 2017, Ripley launched a new

platform to allow third parties to sell their products through its website, Mercado Ripley. By the end of2019, Ripley's online sales accounted for 20 per cent of its total retail sales.57

Parque Arauco and VivoCorp Shopping Malls

Two additional competitors in the shopping mall business were Parque Arauco and VivoCorp. By June

2020, Parque Arauco had 48 shopping malls and strip malls in Chile, Peru, and Colombia. Between 2014 and 2020, it had almost doubled its gross leasable area.58VivoCorp had 23 shopping malls and strip malls

in Chile and was the fourth-largest shopping mall player in the country.59

Falabella's Main Competitors in Other Latin American Countries

In Peru, Falabella's main competitor was Supermercados Peruanos, which held grocery store leadership. Other relevant competitors were Cencosud and Makro. Department store competitors included Ripley, Cencosud, and Oechsle SA. In the home improvement sector, the leaders were Cencosud and Falabella.60

In Colombia, Falabella was the main department store. In the home improvement sector, Falabella's main

competitor was Cencosud. Some of the country's most relevant supermarket chains were Almacenes xito

SA, a leading Colombian food retailer with presence also in Brazil and Argentina, and Olmpica SA, a

Colombian supermarket and drugstore retailer with geographical coverage in Central America.61

In Argentina, Carrefour was a leading player in supermarkets, competing with Cencosud and Walmart,among others. In the home improvement sector, Falabella's main competitor was Cencosud.62However, in Argentina, retail was a highly fragmented channel featuring numerous independent players with one or two branches.63In May 2020, Walmart announced its intention to sell its operations in Argentina.64

In Brazil, the home improvement market was highly atomized, and the main players were Leroy Merlin and C&C Casa e Construo. The biggest retailers were the supermarket chains Po de Aucar and Carrefour.65In Mexico, the leading home improvement player was Home Depot. In supermarkets, theMexican branch of Walmart was the leader, holding a strong position against the second-largest player, FEMSA (which owned OXXO, the largest convenience store chain in Latin America). Another major retailer in Mexico was El Puerto de Liverpool SAB de CV (El Puerto), which participated in department stores, consumer finance, and shopping centres. More than 45 per cent of El Puerto's total sales was done through its own credit cards.66

Main Online Competitors

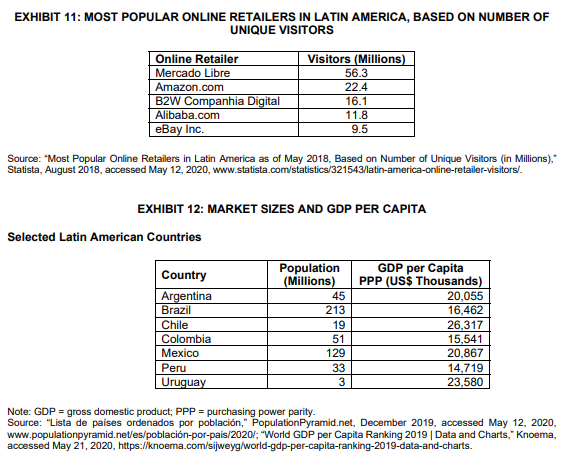

The retail industry had been influenced by several technological changes. The emergence of new technologies, such as e-commerce; widespread mobile phone adoption; communications and logistic innovations; and big data processing had changed the entire retail map.67Solari Donaggio stated, "For many years we [Falabella] have been talking about competing with the main players in the world. We no longer compete with local players."68Among the most popular online retailers in Latin America were MercadoLibre, Amazon, and Alibaba (see Exhibit 11).

Mercado Libre

Mercado Libre hosted the largest online commerce and payment ecosystems in Latin America, with operations in 18 countries, including Argentina, Brazil, Mexico, Colombia, Chile, Venezuela, and Peru. Mercado Libre was a marketplace that allowed both businesses and individuals to offer any item for online

purchase, including payment services. Mercado Libre also served users by making capital more accessible through different credit products and by offering optional advertising and logistic support for sellers. Mercado Libre did not have brick-and-mortar stores.69

One Mercado Libre business with growing potential was an integrated online payments solution, MercadoPago, which offered payment solutions designed to facilitate transactions both on and off the marketplace.70As such, Mercado Pago complemented the Mercado Libre marketplace. With more than 800 million payment transactions in 2019,71Mercado Libre had more than $1.3 billion in revenues from marketplace (commerce) activities and $1 billion in revenues from non-marketplace activities (mainly financial

services). Launched in 1999, by August 2020, Mercado Libre had a market capitalization of over $54 billion(more than seven times Falabella's market capitalization), was among the top-10 online retail sites in the world, and was the top online vendor in Latin America.72

Amazon

With $280 billion revenues in 2019 ($75 billion in the international segment, outside North America),Amazon was the largest and most valuable retail company in the world (with a market cap of about $1.5

trillion by August 2020).73Amazon was primarily an online retail store, offering a wide range of product categories as well as software, cloud storage services, and online video and streaming. In a surprising move, Amazon bought the organic supermarket chain Whole Foods Market Inc. (Whole Foods) in 2017, in a deal valued at $13.7 billion. Whole Foods had more than 450 stores.74

Amazon, which not only sold its own products but also maintained a significant third-party marketplace, offered

services such as warehousing, shipping, customer service, payment processing, and return services. In 2015,Amazon launched Amazon Business, a marketplace tailored to business customers. Amazon charged third parties a percentage of sales as well as additional fees for warehousing, shipment, and logistics.75More than

eight million sellers had sold through Amazon's marketplace, accounting for approximately 50 per cent of the

total items sold by Amazon in 2019.76Every year, more than a million new sellers join Amazon; however,less than 10 per cent of active sellers were able to achieve $100,000 in yearly sales, and only 1 per cent

achieved $1 million in sales. This was consistent with the general behaviour observed in onlinemarketplaces: a large portion of sales was usually generated by a small fraction of sellers.77

Amazon had been building warehouses closer to major consumption centres to offer same-day delivery in

some product categories and two-day delivery in others. Amazon had also been investing heavily infulfillment facilities (including handling, warehousing, logistics, and shipment) in Europe, Asia, and theAmericas.78In January 2017, Amazon arrived in Chile with Amazon Web Services, a business line that

grouped the firm's computing and technology businesses.79Amazon rented locations and hired executives to increase its presence in Chile and Latin America, announcing the possible implementation of its service Prime Now and analysis of further expansions in the region.80

Alibaba

Founded in 1999, Alibaba was a Chinese multinational marketplace and Internet and technology conglomerate.It provided consumer-to-consumer(C2C), business to consumer (B2C), and business-to-business (B2B) services in web portals.81It also offered electronic payment services, cloud computing services, and and shopping search

engines. Alibaba's market capitalization in August 2020 was about $666 billion.82

Alibaba's business had grown in Latin America, where it had operations in Argentina, Brazil, Colombia,

Chile, Mexico, and Peru; Alibaba used a multilanguage portal to reach clients from different countries.

Alibaba's first experience in Latin America was its entry into Brazil in 2010, followed by its establishment of cross-border B2B and B2C e-commerce platforms, which developed well in that country.83Alibaba had conducted a number of studies and worked with extensive databases to identify countries to expand to, and

Chile was one of them?mainly because it had political stability, positive growth prospects, and a highInternet penetration rate.84Regarding competition from online vendors, Solari Donaggio said that "the Internet lowers entry barriers and makes these great foreign actors compete through the Internet in Chile, Peru, or Colombia. It is not a question about whether they will arrive; we are already competing with them.

In this game, our competitors will be all the actors in the world."85

SOME INSTITUTIONAL INFORMATION

Chile had opened its economy to international trade and deregulated its markets, as evidenced in its free trade agreements with the United States, China, and the European Union.86As a result, exports and imports strongly increased. The openness to international trade was correlated with a growing per capita income. As Solari Donaggio said, "We have benefited from the growth of the middle classes that has occurred in the Latin American region, and as the countries continue to grow, this trend will continue."87

InThe Global Competitiveness Report 2019, Chile was ranked as the 33rd most competitive country in the world and the first most competitive country in Latin America, above Brazil (71), Mexico (48), Peru (65), Colombia (57), and Argentina (83).88The 2019 per capita gross domestic product (purchasing power parity) was $26,317 in Chile, $20,055 in Argentina, $16,462 in Brazil, $15,541 in Colombia, $20,877 in Mexico,

and $14,719 in Peru. The 2019 per capita gross domestic product (purchasing power parity) was $65,112 for the United States and $19,503 for China (see Exhibit 12).89

Historically, the level of banking penetration in Latin America had been lower than in the United States.

However, the number of users of banking services had increased in the last decades, mainly due to higher

incomes, better technology and scoring systems, and higher market competitiveness. Alongside the higher use

of banking services, there was also an increase in the total number of active credit cards issued by banks.90

LOOKING AHEAD

By mid-2020, Falabella's senior management team had to outline key priorities for the growth expectations

of investors. The last few months had been especially challenging, as the COVID-19 pandemic obliged most shopping malls and stores to close. How to allocate future investments and approach growth were among the key priorities. As Solari Donaggio pointed out, "In order to have the scale that allows us to make investments in technology, in logistics, to attract the best talent, to be able to buy from all parts of the world at the best price, we need to grow."91

One debate concerned whether Falabella should prioritize the online business, a more aggressive international expansion, or a combination of both. A related debate was whether Falabella should sell part of its stake in the shopping mall business, or in any of the other businesses, to focus on the development of further capabilities in its online or international efforts or both.

In the online business, questions were associated with whether it would be a good idea to explore an alliancewith companies such as Amazon and Alibaba, or whether to invest more heavily in the marketplace business, where third-party suppliers could sell their own products to final consumers. A follow-up question was whether Falabella should allow its existing suppliers to sell in the marketplace, or whether it should focus on suppliers not currently sourcing Falabella.

The most intriguing question concerned whether the company should take advantage of its strengths to compete in the dual online and off-line retail world in these challenging times.

Below are exhibits for references :

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started